Sow the Wind, Reap the Storm

Trump’s blunt tariff measures have jolted US markets. Surging bond yields and doubts over “risk‐free” US bonds signal a potential final chapter for American dominance. Amid mounting trade deficits and chaos, could bitcoin finally emerge as digital gold?

Deals are my art form. Other people paint beautifully or write poetry. I like making deals, preferably big deals. That's how I get my kicks. — Donald Trump (2014)

One might assume that Trump had already secured the best possible deal. In many countries, the US government can order anything it wants—oil, steel, cars, electronics, or medicine—by simply using an IOU that can be printed without limit. Instead of using that IOU to purchase goods, the seller tucks it away as a reserve. It’s a truly unique arrangement.

Back in the ’60s, these benefits were referred to as an “exorbitant privilege” because the dollar was the world’s reserve currency. Even then, economists recognized that these perks came with significant downsides.

Years of trade deficits, budget deficits, and an overvalued currency have led to the hollowing out of domestic industry and a huge national debt. It’s no wonder that the Trump administration is now searching for a solution.

The plan was to restore trade balance by imposing trade barriers. Ideally, this could be done with surgical precision by crafting tariffs wrapped in diplomacy and courtesy. Instead, it turned into a blunt instrument.

The immediate effects were quite noticeable, but the initial analysis quickly became outdated. Consumers, entrepreneurs, investors, and government leaders began to react—some opting to wait it out, others to act quickly, and still others to fight back.

A Dutch proverb warns, “He who sows the wind will reap the storm.” On Wednesday morning, an acute problem surfaced in the US bond market, prompting Trump to ease the pressure. China was identified as the main culprit, and the rest of the world was given 90 days to negotiate.

Stock prices rebounded, but the underlying structural issues remained unresolved. Yields on longer-term bonds continued to climb, placing massive pressure on the market. More details on this will follow shortly.

Besides these immediate issues in the bond market, rising yields pose a strategic setback. Lower interest rates were intended to allow the government, businesses, and households to refinance their debts, and that goal is now in jeopardy.

In a complex system, changes rarely progress in a simple, straight line. Instead, they come in bursts—accelerations, shocks, and phase transitions. We touched on this on March 7:

This is the heart of the risk with Team Trump’s aggressive approach: that economies, trade relationships, or financial markets will transform in ways that cannot be undone. Like a kernel of corn turning into popcorn when heated.

We’re now very close to that tipping point. What if other countries stop considering America a dependable trading partner and ally? And what if US government bonds are no longer viewed as risk free?

Then we may be witnessing the final chapter of the American era. Of course, the US will continue to play an important role, but not as the hegemon—the captain of the world stage.

Countries will have to seek alternatives to the dollar system: other reserve currencies, new infrastructures for settling transactions, and alternative mechanisms to provide liquidity.

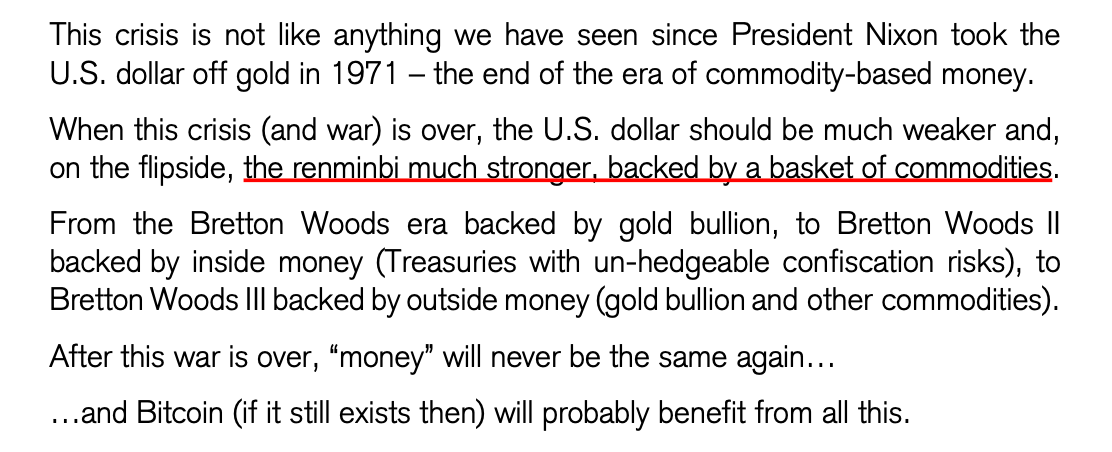

No obvious alternative presents itself. Both the euro and the yuan seem unsuitable. So what about shifting from “inside money” to “outside money”? You might think of “external money” as money that stands on its own, not as a claim on someone else. Gold—and perhaps bitcoin?

Bitcoin was designed for this era. It has passed countless tests, and now faces its final exam. This isn’t primarily about the price—it’s about how institutions and countries assess it. If bitcoin truly is digital gold, now is the time to treat it as such.

Eventually, that recognition should be reflected in its price. For the moment, however, we’re seeing only limited evidence of this. The chart below shows bitcoin holding its own between gold and stocks during this period.

Technically speaking, bitcoin’s price—as with major stock indices—has underperformed over the past six weeks. In the short run, we are in a downtrend, characterized by lower highs and lower lows, with the price remaining below its moving average and the downward trend line.

Before we can declare an uptrend, a few hurdles must be overcome:

- The downward trend line and the 50-day moving average must converge at $86,000.

- A higher peak than the one on March 24 must form at $89,000.

- The price must re-enter the range we experienced from November through February at $91,200.

It’s up to the bulls to prove that the tide has turned. Until then, we’ll assume the downtrend continues and expect further declines. That’s intriguing too, as we’ve hit a crossroads around the $75,000 low. More on that in the premium section.

We continue with the following topics for our Alpha Plus members:

- At a crossroads

- Bearish – defensive – bullish

- The bond market

- An extra daily cycle?

- The poison cup runs deeper than expected