Have we been in a bear market for ten months already?

Crypto markets are quiet as bitcoin hovers between $88K-$94K. After a brutal drop from $126K to $80.5K that triggered $9.9B in realized losses, investors are catching their breath. But is this consolidation—or something more bearish?

It's quiet on the crypto market. Over the past week, bitcoin's price fluctuated between $88,000 and $94,000. Investors are catching their breath after a turbulent finale to the decline from $126,000 on October 6 to $80,500 on November 21.

For the first time since the 2022 bear market, we witnessed significant capitulation. Within two days, on-chain data showed $9.9 billion in realized losses. Investors who had bought spot bitcoin above $100,000 decided to sell when the price came uncomfortably close to $80,000.

That spike in loss-taking turned out to be the bottom. Since the $80,500 low on November 21, the price has been recovering by setting consecutively higher lows. The emerging pattern can be interpreted in two ways.

The pessimistic interpretation is that a continuation pattern is forming—a rising wedge or a bear flag, for example. This would be a brief counter-move within the downtrend, which then continues toward a lower low below $80,500.

A logical price target would then be $74,000—the April 2025 low and the top following the ETF launches in March 2024.

Above the current price lies substantial resistance: the horizontal level at $94,000, the VWAP accompanying the downtrend, and a whole array of moving averages. We expect these to be broken in a relief rally. That would likely happen later, after the bottom of this correction has been found.

The chart below shows the optimistic interpretation. The higher lows are accompanied by more or less equal highs in the zone just below $94,000. An ascending triangle may be forming—a pattern that tends to break out to the upside.

The price has now closed above the green short-term moving averages for three consecutive days. This suggests the trendless days are numbered, and a new short-term uptrend has begun.

Acceptance above $94,000 would be strong evidence for this bullish scenario. A logical destination for a relief rally is $110,000. We discussed this in the Alpha Markets edition of November 28 under 'How high can this rally go?'. If we get above that, the probability increases that we're not seeing a relief rally, but a continuation of the bull market.

We continue with the following topics for our Alpha Plus members:

- Have we been in a bear market for ten months already?

- Major division within the US Federal Reserve

- The return of QE?

- The emotions of the market cycle

1️⃣ Have we been in a bear market for ten months already?

Bert

The four-year cycle is dead. We've been in a bear market since February of this year. The all-time highs this summer weren't driven by organic demand in a bull market, but by the explosion of treasury companies.

That's roughly the thesis of Bitwise CEO Hunter Horsley. He wrote about it on X. His colleague Matt Hougan appeared on the Empire podcast and reached the same conclusion: "I just don't see 2026 being a down year."

4 year cycle is dead.

— Hunter Horsley (@HHorsley) December 10, 2025

The market has changed. Matured.

We will look back on 2025 and realize that it's been a bear market since February — masked by the relentless bid from DATs and Bitcoin Treasury Companies.

Everything is lining up for a massive 2026. It's stunning.

Is there merit to this, or is it nonsense—at best a shot of hopium?

Let's start by acknowledging that it doesn't fit the standard definition of a bear market: a regime where prices fall and investors expect further decline. That contradicts the higher highs in May, July, August, and October.

But a cyclical bear market has more characteristics than just price, such as:

- Existing investors take profits.

- Some investors lose interest and leave.

- Price stops responding to good news.

- Bull market narratives collapse and give way to new beliefs.

- Crypto company apps slide down the rankings.

We've seen all of this over the past six months. Sentiment hasn't become as gloomy and fearful as it was around the 2022 bottom, but that's easily explained by the (artificially) high prices.

These have given existing investors the opportunity to exit at a decent price. In previous bear markets, investors watched large portions of their paper gains evaporate. Now they've been able to sell to treasury companies, sovereign wealth funds, and new ETF investors. The mechanism is the same, the mood a bit brighter.

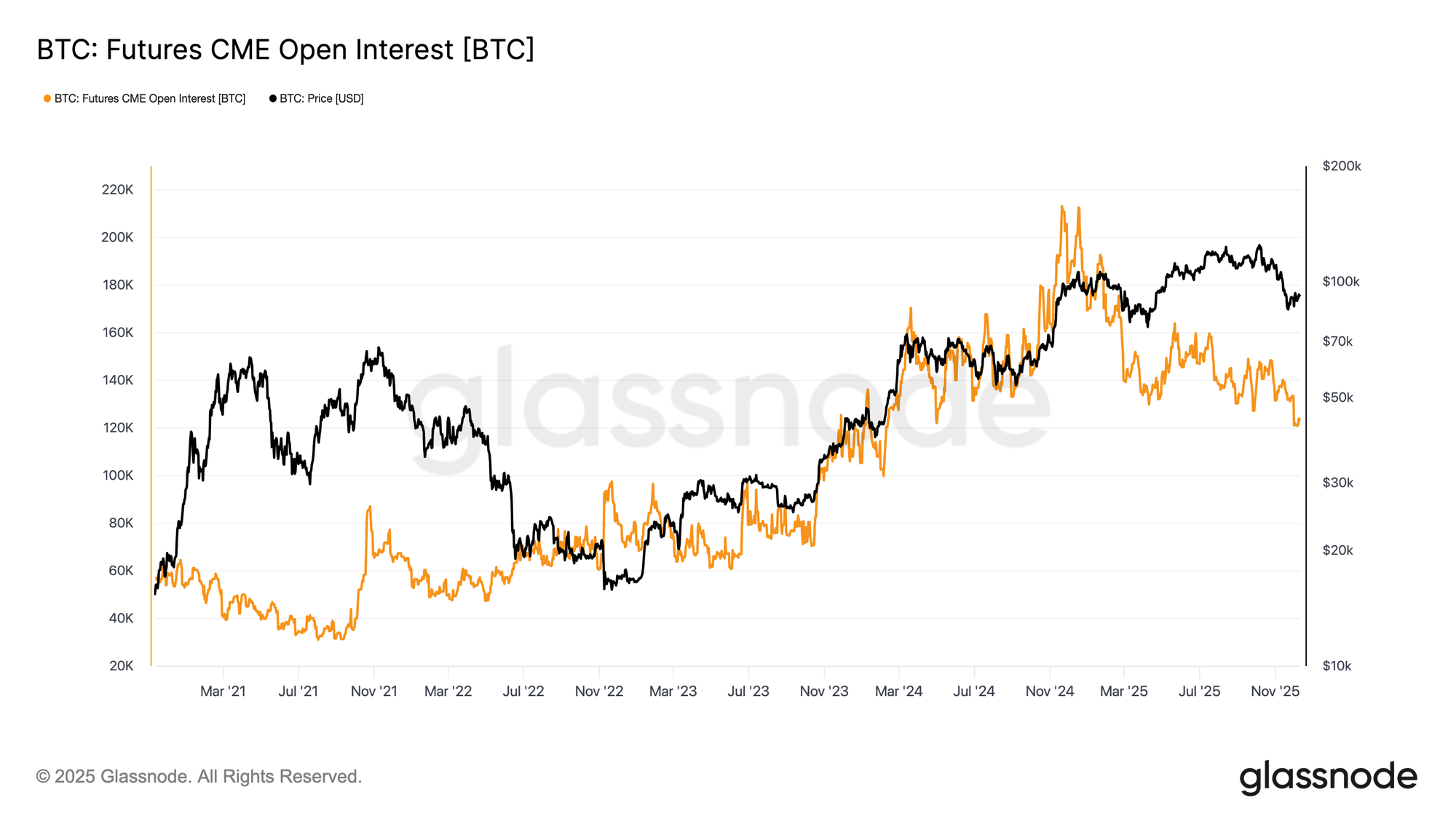

On the chart, that would look something like this. The two most important moments of the bull market were the rally following the ETF launches in March 2024 and the rally after Trump's election victory in December 2024. Those saw peaks in trading volume and momentum.

At the higher prices this past summer, we saw lower readings on momentum indicators, and trading volume was nothing to write home about either. The next spike in trading volume wasn't at the top but during the capitulation to $80,500 in late November.

On-chain data and derivatives market data also show that the bull market peak was in March or December 2024. But 2025 hasn't really been a typical bear market year either. It's been muddling along.

The question arises whether we've been watching a really bad bull market or a really good bear market. Bitwise clearly opts for the latter.

A bear market is a reset in many ways. Price and momentum. Positioning and leverage. Sentiment and valuation. We're seeing declining values across many of these metrics, but nowhere near the levels we saw in previous bear markets.

But maybe that won't happen either. Just as we didn't have a scorching bull market and only got a whiff of hype and euphoria, perhaps the bear market will also be mild.

If the Bitwise scenario plays out, we'd find a bottom somewhere this winter. Maybe November 21, maybe later in January or February. We're curious!

2️⃣ Major division within the US Federal Reserve

Thom

The US Federal Reserve cut the policy rate by 25 basis points this week. It was also confirmed that balance sheet expansion will resume. Yet the outlook for the coming period hasn't become any clearer. There's considerable division within the central bank.

On one hand, inflation remains higher than desired, which argues against rate cuts. On the other hand, we're seeing weakness in the labor market, which does call for rate cuts.

Division within the US Federal Reserve

Although a majority supported this rate cut, we saw three official votes against the decision—the highest number since 2019. Two policymakers wanted to keep rates unchanged, while Donald Trump appointee Stephen Miran proposed a larger 50 basis point cut.

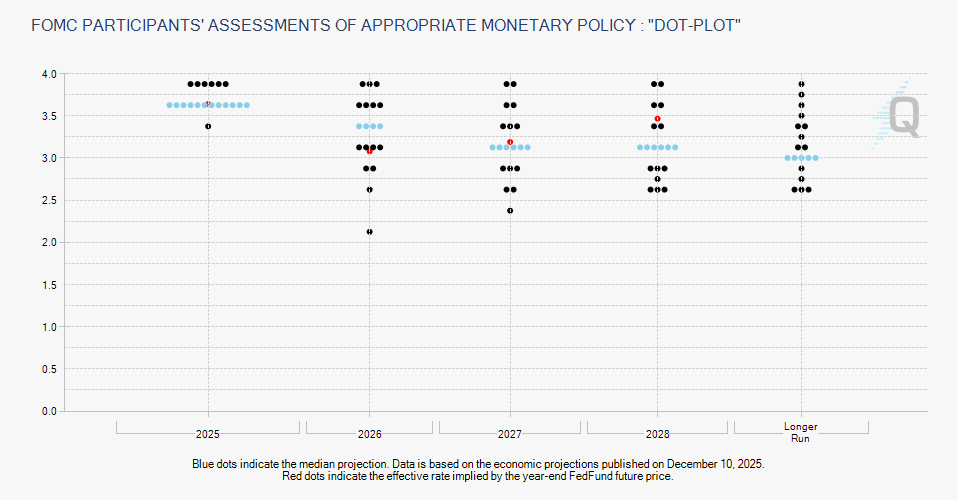

That was the official vote. In the "dot plot"—a chart showing where each committee member thinks rates should go—we see that six members of the rate committee believed no rate cut was needed this week. Four of them ultimately voted for the cut anyway.

During the press conference, Powell addressed the difficult balancing act his central bank faces. "A large majority of participants agree that risks are elevated for both unemployment and inflation. So what do you do? You have one tool and can't do two things at once. It's a very challenging situation."

Much uncertainty about 2026

Although Donald Trump may nominate a new Federal Reserve chair by May 2026, additional rate cuts are not guaranteed. Ultimately, a majority of votes within the rate committee is required.

Currently, that's far from guaranteed. The "dot plot" shows the median expects just one 25 basis point rate cut for 2026. Furthermore, seven committee members expect no rate cuts next year, and three members even envision a scenario with one rate hike.

The market disagrees, currently pricing in about two 25 basis point rate cuts.

Overall, however, the emphasis appears to be on rate cuts. During the press conference, Powell mentioned that job growth, currently at +40,000 jobs per month, is probably overstated and should actually be closer to -20,000 jobs per month.

Regarding inflation, he said it would be heading toward 2 percent if not for Trump's tariffs. Putting these statements together, the central bank seems primarily concerned about the labor market.

It wouldn't surprise me if the Federal Reserve delivers more rate cuts in 2026 than the market currently expects. My expectation is that from here they'll become a positive force for global liquidity, and that the Fed will provide a tailwind for bitcoin.

3️⃣ The return of QE?

Thom

Alongside the rate decision, the Federal Reserve announced the launch of "Reserve Management Purchases" (RMPs). The idea behind this program is to purchase $40 billion in short-term government bonds monthly, starting December 12.

Through these purchases, the Federal Reserve's balance sheet will gradually expand. According to Powell, it will amount to an expansion of $20 to $25 billion per month.

You could call this Quantitative Easing (QE)—balance sheet expansion. However, in terms of scale, these plans aren't comparable to what we saw in 2020. Between March and June 2020, the Federal Reserve purchased $800 billion in financial assets per month.

Additionally, the Fed is primarily buying short-term government bonds through RMPs. This means demand for longer-dated bonds won't directly increase, so this probably won't put much—if any—pressure on longer-term rates. In this respect too, the current round of QE differs from past episodes.

Still, there's no denying this represents a positive development for bitcoin. These Federal Reserve actions reduce the chances of problems at the core of the financial system, which in my view has increased the probability of the bullish scenario of an extended bull market.

So it's not spectacular, but certainly not irrelevant for bitcoin either.

4️⃣ The emotions of the market cycle

Bert

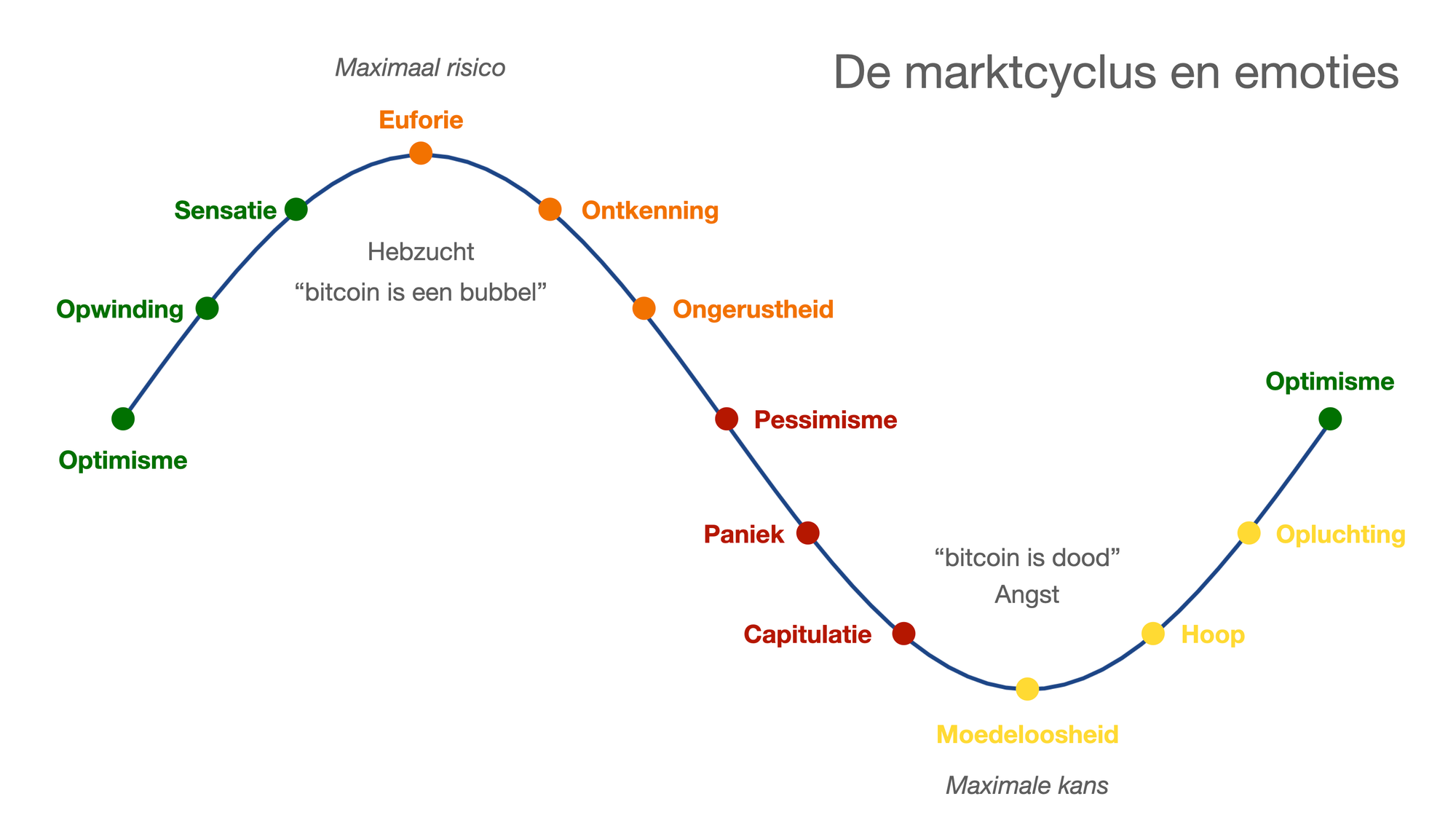

What characterizes bull and bear markets? Yes, in a bull market prices rise, and in a bear market they fall. But equally characteristic are the contrasting emotions. Greed and fear. Euphoria and despair. Hype and oblivion.

When you study the alternation between bull and bear markets, you'll discover the same sequence of emotions, feelings, and sentiment across vastly different markets. They follow each other in a logical manner. They flow from one another. One causes the other.

Many have studied this and created diagrams noting these emotions alongside an abstract market cycle. We made this version a few years ago.

It gets even more interesting when you plot the emotions on the actual chart. We've done this several times before, first in the Alpha Markets edition of November 17, 2023.

It was high time for an update, and here's the result.

But it only really comes alive when we walk through it completely, starting with the 2018 bear market. You'll go through two bull markets and start recognizing the similarities.

We did exactly that on Thursday, December 4, in Discord. More than a hundred Plus members joined live and could ask questions. We recorded the main segment and uploaded it to YouTube. Have fun!

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!