Donald Trump's Popcorn

US Sets Up a Strategic Bitcoin Reserve: Is the Correction Over, Will the Bull Market Continue, and What's Trump's Plan for the Financial Markets?

A digital Fort Knox for digital gold

Bitcoin is the original cryptocurrency. The protocol permanently limits the total supply of bitcoin (BTC) to 21 million coins, and it has never been hacked. Because of its scarcity and security, Bitcoin is often called “digital gold.”

This introduction leads into the decree where Trump set up a Strategic Bitcoin Reserve last night. Just before signing, David Sacks stressed bitcoin’s status as digital gold in his explanation: “This is like a digital Fort Knox for digital gold.”

The introduction goes on to argue that there is a strategic edge to being early, precisely because the total bitcoin supply is fixed:

Because the supply of BTC is fixed, there is a strategic advantage to being among the first nations to create a strategic bitcoin reserve.

The purpose of this executive order becomes clear with the following line: “[Implement] a policy to maximize BTC’s strategic standing as a unique store of value in the global financial system.”

The plan is to retain all bitcoin already owned by the US government and refrain from selling it.

Additionally, Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick have been instructed to purchase more bitcoin. However, this must be done without raising additional funds from taxpayers.

The Secretary of the Treasury and the Secretary of Commerce shall develop strategies for acquiring additional Government BTC provided that such strategies are budget neutral and do not impose incremental costs on United States taxpayers.

The executive order also makes a clear distinction between bitcoin and other digital assets:

- Bitcoin is part of the Strategic Bitcoin Reserve. The US intends to hold it as a “reserve asset” and, if possible, buy more.

- Other digital assets are allocated to the Digital Asset Stockpile. These will be managed prudently and may be sold.

This order puts to rest the doubts and concerns that have recently dominated the discussion. No shitcoins will be included in the strategic reserve, no taxpayer money will be used to make purchases, and the implementation won’t take years.

On top of all that, the US government is clearly bullish on bitcoin. After all, you wouldn’t emphasize the strategic advantage of being early unless you anticipated higher prices in the future!

And yet, the price remains at $88,000—unchanged from yesterday, right before the announcement. No sudden spike, no deep crash. Isn’t that bullish?

The most straightforward explanation is that this type of strategic reserve had already been priced in. Any further uptick in price must come from actual purchases prompted by the decree or from other countries deciding to get in on the action early.

With its digital Fort Knox, bitcoin checks off another box. The launch of ETFs won approval from BlackRock and Fidelity. And now, the President of the United States is recognizing bitcoin as a legitimate component of an investment portfolio.

Investors are free to buy bitcoin, but do they really want to?

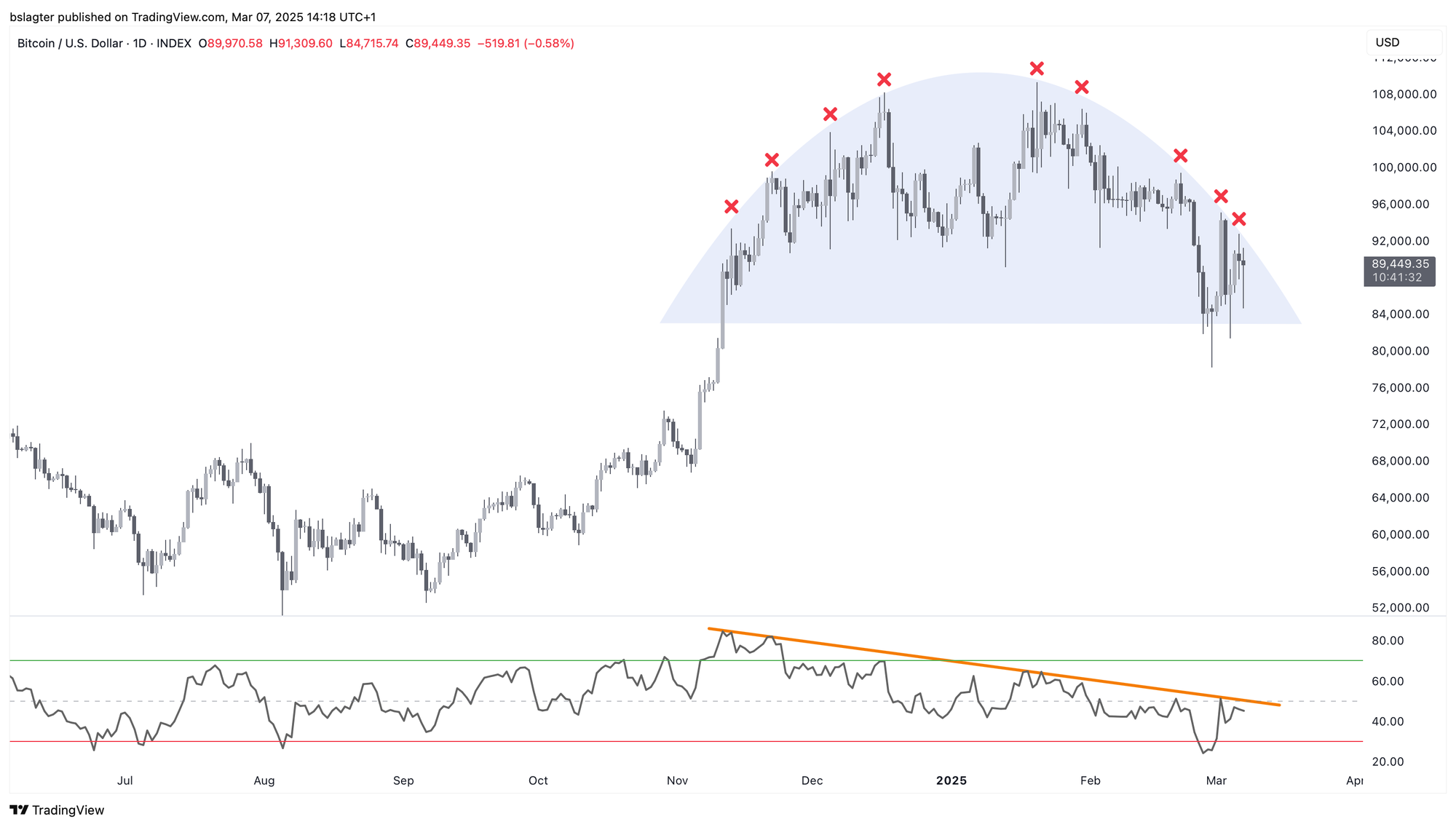

This question brings us to the turbulent headwinds facing both the crypto and the stock markets. After several months of gains in the fall of 2024, prices stalled in December. In recent weeks, we even saw a sharp decline, with both stocks and bitcoin dropping to their lowest levels since early November.

The past two weeks have been especially volatile. The chart below shows a roller coaster ride that left many investors feeling queasy.

Amid all the noise, the price gradually climbed from $83,000 to $88,000 over the past week. On its own, that’s a decent performance in a week when stocks took a hit. However, that’s “necessary but not sufficient.”

We’ll truly be out of the correction that has deepened over recent weeks only when we break through the $94,000 to $100,000 zone. Until then, the bears hold sway, and the burden of proof is on the bulls.

We expect more clarity in the coming week. Will the market overcome the disruptions caused by import tariffs as stocks and crypto bounce back? Or are we headed for an extended period of weakness?

The daily chart for bitcoin appears to be approaching a crucial turning point. Will the price break out with a bang, or will it retreat back toward last summer’s range, below $72,000? We’re eager to see!

We continue with the following topics for our Alpha Plus members:

- Donald Trump’s Popcorn

- Germany Breaks with Frugality

- Concerns Over the U.S. Economy Are (Somewhat) Overstated

- Has a New Weekly Cycle Begun?