Bitcoin on Standby

Bitcoin stalls near $96.5K as ETF outflows signal waning excitement at $100K. Investors now pause—will a breakout surge or a hidden bearish twist emerge? Meanwhile, split views at the Fed hint at a possible QT pause, stirring more questions.

Bitcoin’s price has settled around $96,500, right in the middle of the range we’ve held since November 20. For the past 17 days, every daily close has been between $95,500 and $98,500.

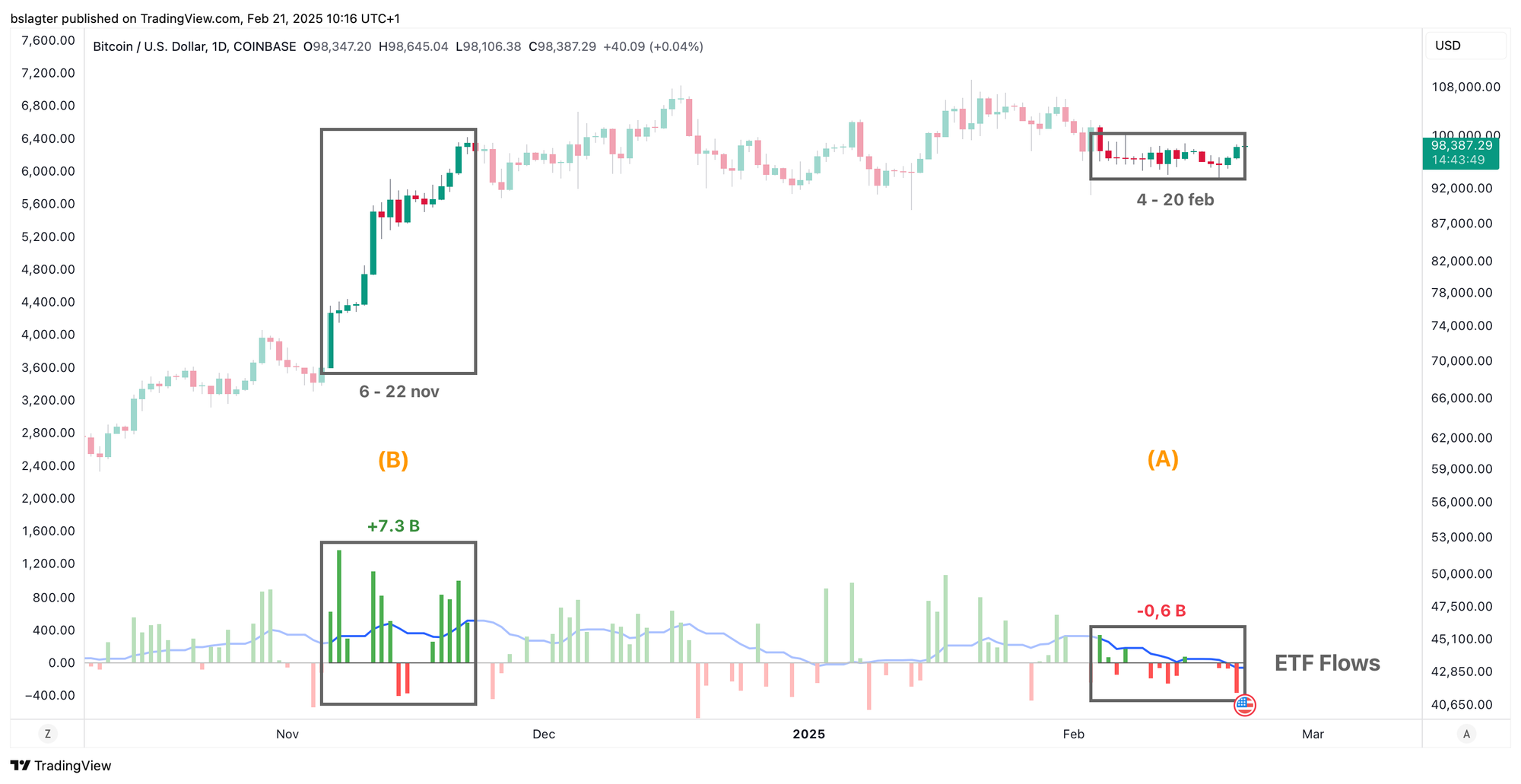

During these 17 days—from February 4 to February 20—US spot bitcoin ETFs experienced a combined outflow of $632 million. In contrast, in the 17 days following the election results, $7.3 billion flowed into the ETFs.

In the chart below, we’ve marked the recent calm period with (A) and the period immediately following the elections with (B).

The reduced flow of money into ETFs is just one of many signals showing that price levels around $100,000 no longer excite investors. They need to see significantly higher—or lower—prices to get moving again.

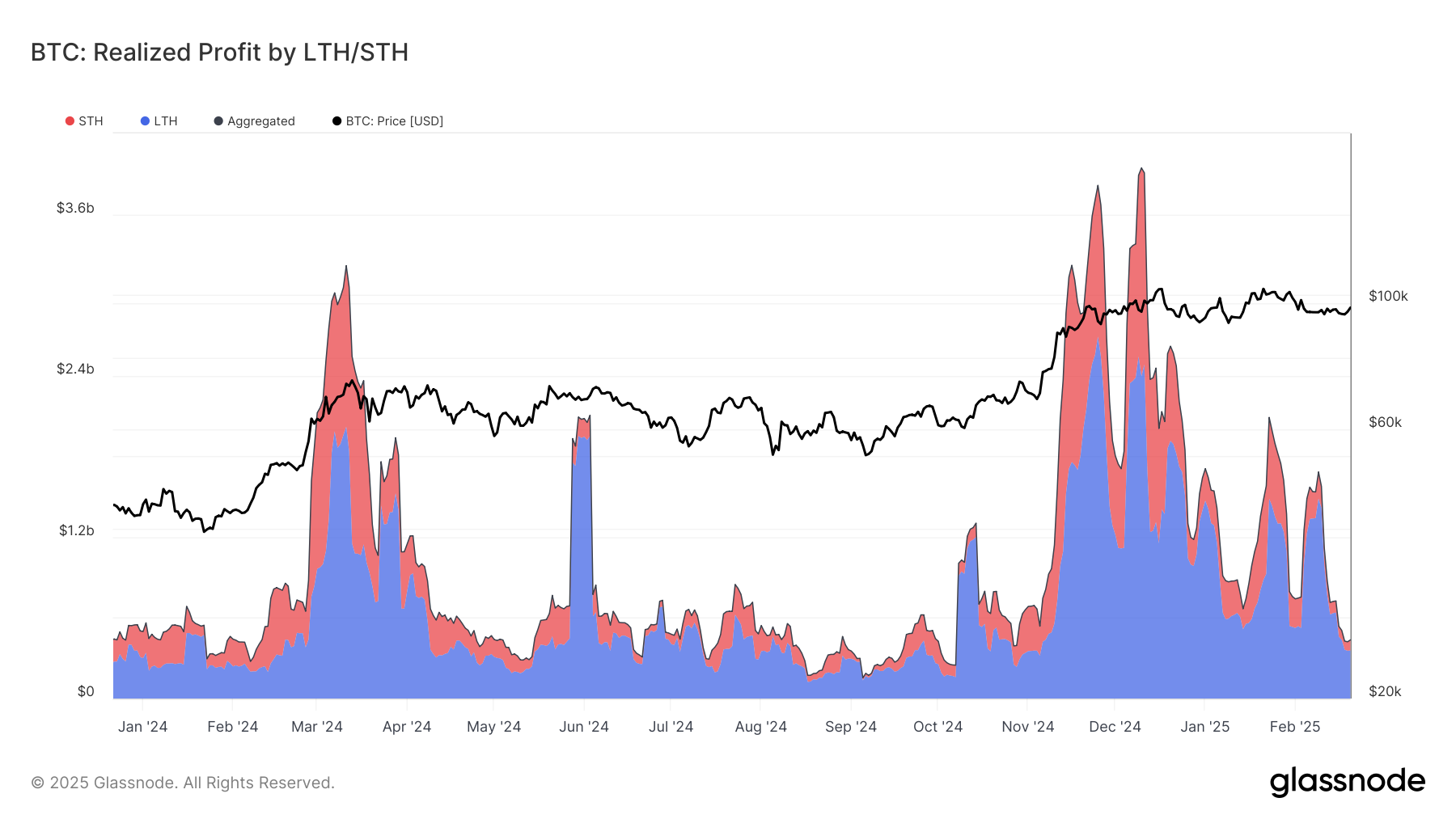

Everyone eager to take profits in the current trading range has done so, and those looking to jump in have also acted. The chart below shows realized profits, distinguishing between investors who entered recently (red) and those who have held their bitcoin for more than five months (blue). We’re back to last summer’s levels!

The Accumulation Trend Score displayed in the chart below shows how existing investors are acting. A dark dot indicates that a large portion of them increased their positions in the past month. At the moment, that isn’t the case.

Existing investors have stopped taking profits, but they aren’t adding to their positions either. The market is waiting for direction.

In a bull market, the expectation is that a new upward trend will follow a period of consolidation. The idea is that investors in a bull market aren’t willing to sell at a loss. If prices fall, fresh demand and limited supply can trigger a rapid recovery.

It’s only when we enter a bear market that things change—when fearful investors start taking losses and exit their positions. We saw that happen, for example, in parts of 2018 and 2022. In such cases, falling prices release additional supply, giving prices an extra downward push.

The data does not suggest a shift toward a bear market regime. However, what isn’t happening now can emerge suddenly—a war outbreak, an acute crisis in the banking or bond markets, or a rapid deterioration in economic conditions, for example.

Luckily, we have the parachute for that!

We’re moving on to the following topics for our Alpha Plus members:

- Outlook for the Coming Weeks

- Division within the US Central Bank

- Is the End of QT in Sight?

- “Only the patient survives to see the good stuff”