Bears Run the Show: Bitcoin Dives to 112k

Bitcoin tumbled 10% last week—dropping from $124,500 to $112,000—amid Fed uncertainty and cautious investors. All eyes now turn to Powell at Jackson Hole. Will he spark a rally or deepen the downturn?

Last week, the bears were in charge. Between August 14 and 21, Bitcoin’s price dropped 10%, falling from $124,500 to $112,000. With every decline, a support level turned into resistance.

That was a setback. After a series of slightly lower highs (LH) and lower lows (LL) in July, August began with a promising recovery above $120,000. We noted this in the Alpha Markets on August 8:

The bulls haven’t secured victory yet, but things are looking promising. […] The drop to $112,000 has hardly shaken existing investors. […] The on-chain activity suggests that investors remain confident and expect higher prices in the near future.

The price briefly climbed above $120,000. Investors proved sensitive to concerns about the U.S. economy and how the Federal Reserve might respond in the coming months.

This afternoon at 4:00 PM, Fed Chair Jerome Powell will deliver a speech at the central bankers’ conference in Jackson Hole. In previous years, Powell’s remarks there have set the tone for subsequent policy. Will today be any different?

The expectation is that Powell will maintain a firm stance—balancing the risks from a weakening labor market against rising inflation, with inflation as the main concern. Interest rates can only be reduced to neutral once it’s clear that tariffs aren’t causing persistent inflation. For now, no rate cuts are anticipated.

Over the past two weeks, investors have positioned themselves accordingly. That “risk-off” sentiment is evident in Bitcoin’s 10% drop and Nasdaq’s seven consecutive days of declines in the tech sector.

Even now, the futures market implies that investors are pricing in a 70% chance of a rate cut on September 17. If Powell sends a strong signal that it’s too soon for lower rates in September, risk assets could experience a significant downturn.

On the other hand, if Powell unexpectedly adopts a dovish stance, leaving the door more open for lower rates than anticipated, the recent two-week correction could be enough to spark a new rally.

The $112,000 level we reached yesterday is significant. In fact, the zone between $108k and $112k is pivotal; it has seen peaks in December, January, and May.

Our baseline scenario is that, since mid-July, once we broke above this zone, we embarked on a new upward phase. The target range of $150,000 to $165,000 for this weekly cycle was partly based on previous cycles in this bull market—although those levels now seem distant.

A variety of indicators show that investors have grown more cautious, from distribution patterns in on-chain data to the low capital inflows into spot Bitcoin ETFs.

The coming days will determine which of these two scenarios becomes our new baseline:

- A swift recovery that sees August end with a strong rally, pushing the weekly cycle high above $130,000.

- If the weekly cycle’s peak remains at $124,500, we may have to settle for a disappointing outcome. In that case, the rally from the $74,500 low on April 7 would represent a 67% increase—not bad, but significantly lower than the average 100% seen over the past two years.

It’s important to note that the second scenario doesn’t signal the end of the bull market. While a weekly close below the 50-week moving average would be a strong warning sign, we’re still comfortably above that level.

A clue in favor of the second scenario is the condition of the U.S. stock market. It, too, is nearing the end of its weekly cycle, seemingly approaching a cycle low.

Below is the Nasdaq-100 chart. A reasonable target is the previous high, around $22,000. In a few weeks, the 50-week moving average will also be near that level—a solid support and a good base for a new upward phase.

It would be unusual for the crypto market to surge while stocks are falling. If the stock market follows that path, Bitcoin’s highest attainable level might remain confined between $112k and $120k for several weeks.

Next, we’ll cover the following topics for our Alpha Plus members:

- The daily & weekly cycle

- “No Bitcoin moonshot until this metric turns around”

- Quarterly earnings from major U.S. retailers cloud economic outlook

- The U.S. economy is healthy, but inflation is the problem

1️⃣ The Daily & Weekly Cycle

Bert

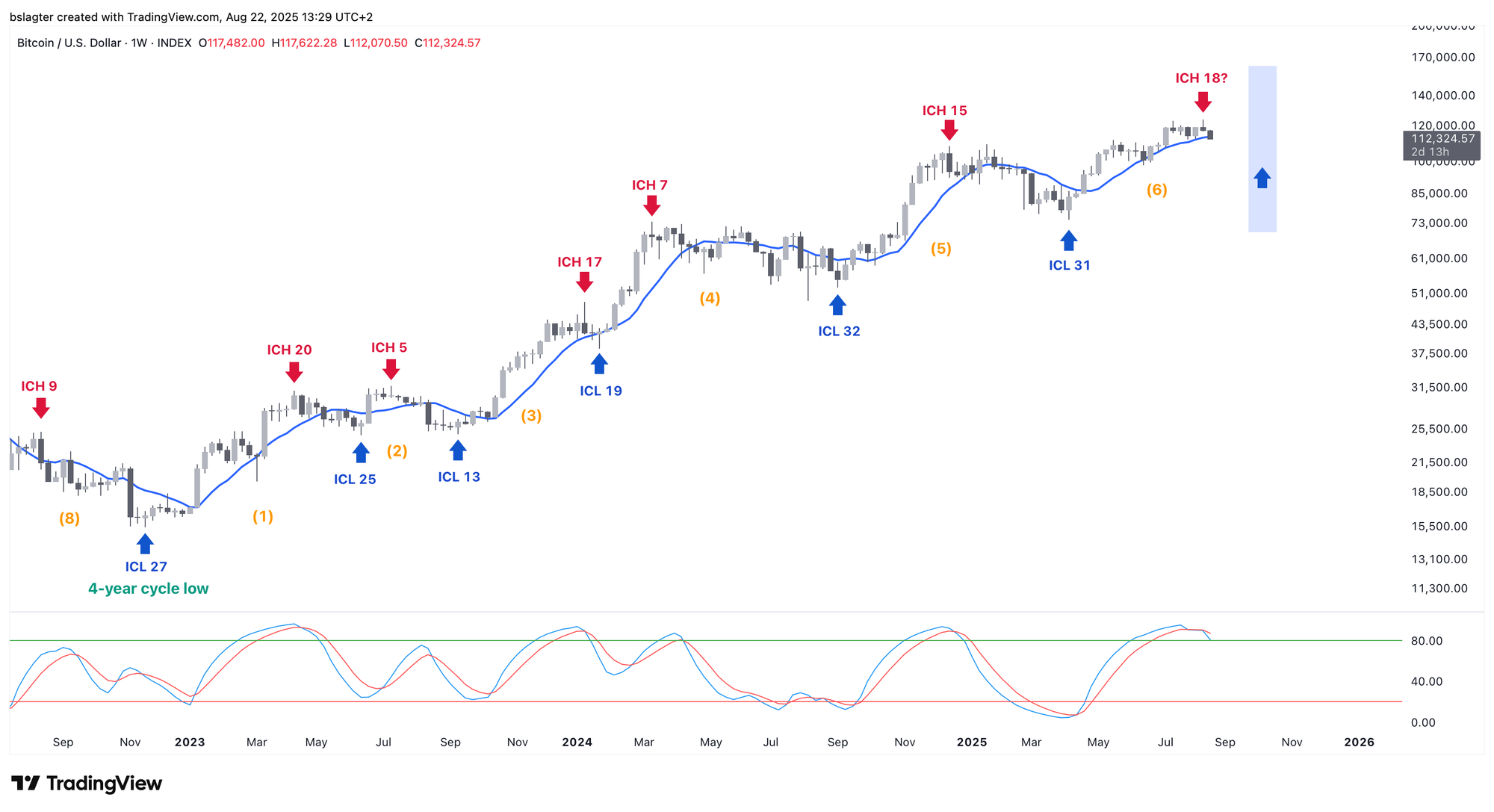

Let’s briefly examine the daily and weekly cycles. We mentioned earlier that the top of the weekly cycle might be behind us—this would mean a weekly cycle high (ICL) in week 18, a fairly common scenario.

In that case, we would expect a decline over the next six weeks, with a weekly cycle low (ICL) projected for late September or early October.

The 10-week moving average currently sits at $113,700. A weekly close below this level could point to an impending ICL, which sometimes is only a few percentage points lower than the average.

A mild ICL wouldn’t be surprising under these conditions. There isn’t enough momentum to trigger a dramatic correction—a few weeks of sideways trading might suffice to reset the market and lay the foundation for a new weekly cycle.

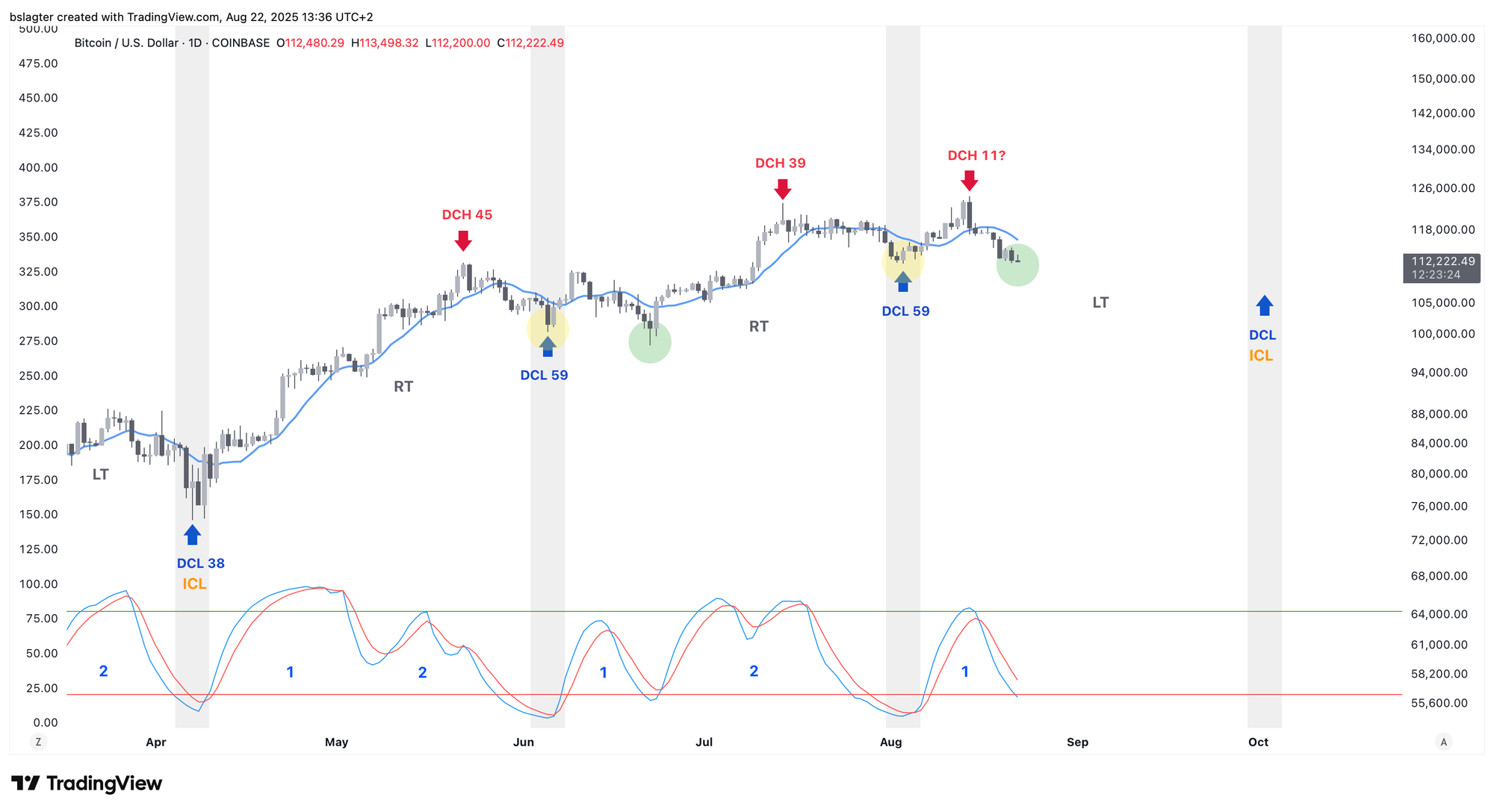

This would yield a very modest daily cycle, peaking on day 11. In fact, the current cycle closely mirrors the previous one. Back then, we also observed about two weeks of unexpected weakness (yellow) following the initial phase (green).

A sudden, sharp recovery would complete the pattern. However, since we’re now in the third daily cycle of this weekly period, such a strong rebound seems less likely.

2️⃣ “No Bitcoin Moonshot Until This Metric Turns Around”

Bert

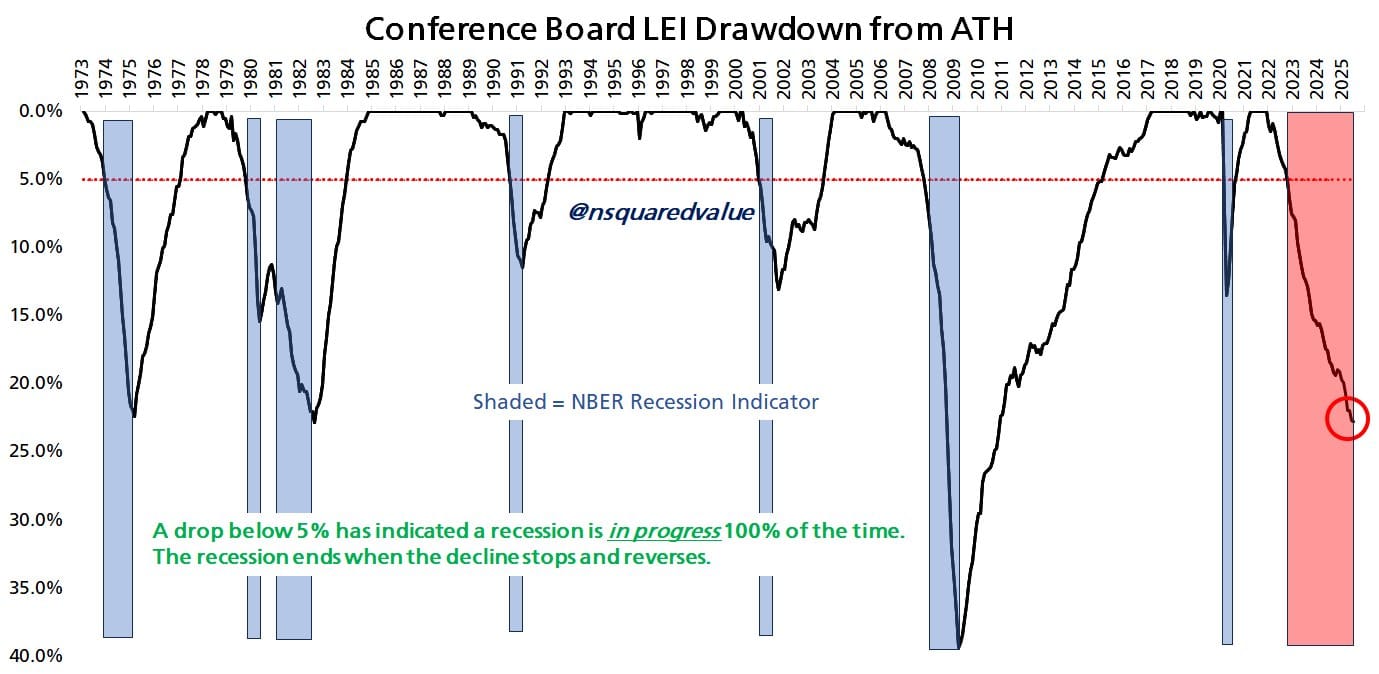

Timothy Peterson, the analyst who previously published several papers on Metcalfe’s Law, shared the following chart on X with this caption:

Leading Economic Index down again. It has fallen 41 of the past 44 months. No Bitcoin moonshot until this metric turns around.

The Leading Economic Index (LEI) gauges whether economic conditions will improve or decline in the near future. It consists of ten components related to production, the labor market, credit, and consumption.

Over the past 44 months, the index has fallen 41 times compared to the previous month. It is now more than 20% below its 2021 peak—a level typically seen only during recessions.

While we appear to be avoiding a full-blown recession (as defined by the NBER), the economy has been stagnant for several years. We currently sit at the bottom of the economic cycle, waiting for a new phase of growth.

The transition from recession to expansion is usually a lucrative period for risk assets. That’s why Peterson suggests that Bitcoin can only truly soar once this indicator turns around.

We expect this turnaround to occur in the coming months. The U.S. government is poised to significantly boost stimulus and investment. While monetary policy remains restrictive, under Trump’s approach, that too would likely ease in the coming months.

3️⃣ Quarterly Earnings from Major U.S. Retailers Cloud Economic Outlook

Thom

This week, all eyes naturally turned to the annual Jackson Hole symposium—the world summit for central bankers organized by the Federal Reserve. The highlight is Fed Chair Jerome Powell’s speech on the central bank’s interest rate policy.

However, another series of events may have impacted Bitcoin more than Powell’s speech this week. Major U.S. retailers released their quarterly earnings. Results from companies like Home Depot, Target, Lowe’s, and especially Walmart offer immediate insights into the health of the American consumer.

Consumer spending accounts for roughly 70% of the United States’ Gross Domestic Product (GDP), making it vital for economic growth. Although the earnings were not dramatic, they generally underperformed. All major retailers saw their stocks tumble this week—with the exception of Lowe’s.

At Walmart, earnings per share fell short of expectations as costs continued to climb week after week due to tariffs. See the chart below.

Sooner or later, Walmart will need to adjust inventory pricing to reflect the post-tariff era. They also expect an increase in tariff-related expenses in Q3 and Q4 2025. Nonetheless, Walmart insists that American consumers remain resilient.

Despite missing expectations last quarter, Walmart is actually raising its outlook for the full year 2025.

Yet, if we focus on price as the most telling signal, the market doesn’t entirely share this optimism. The stock price dropped, reflecting growing concerns about consumer spending, while inflation appears to be becoming a slightly bigger issue.

This creates a small crack in what had been an almost perfect picture for Bitcoin until recently. With concerns about the economy and inflation, the economic data in the weeks leading up to the September 17 interest rate meeting could prove pivotal.

In any event, the American consumer did not come through unscathed this trading week. Hopefully, in the coming month, economic data will paint a somewhat more favorable picture.

4️⃣ The U.S. Economy Is Healthy, But Inflation Is the Problem

Thom

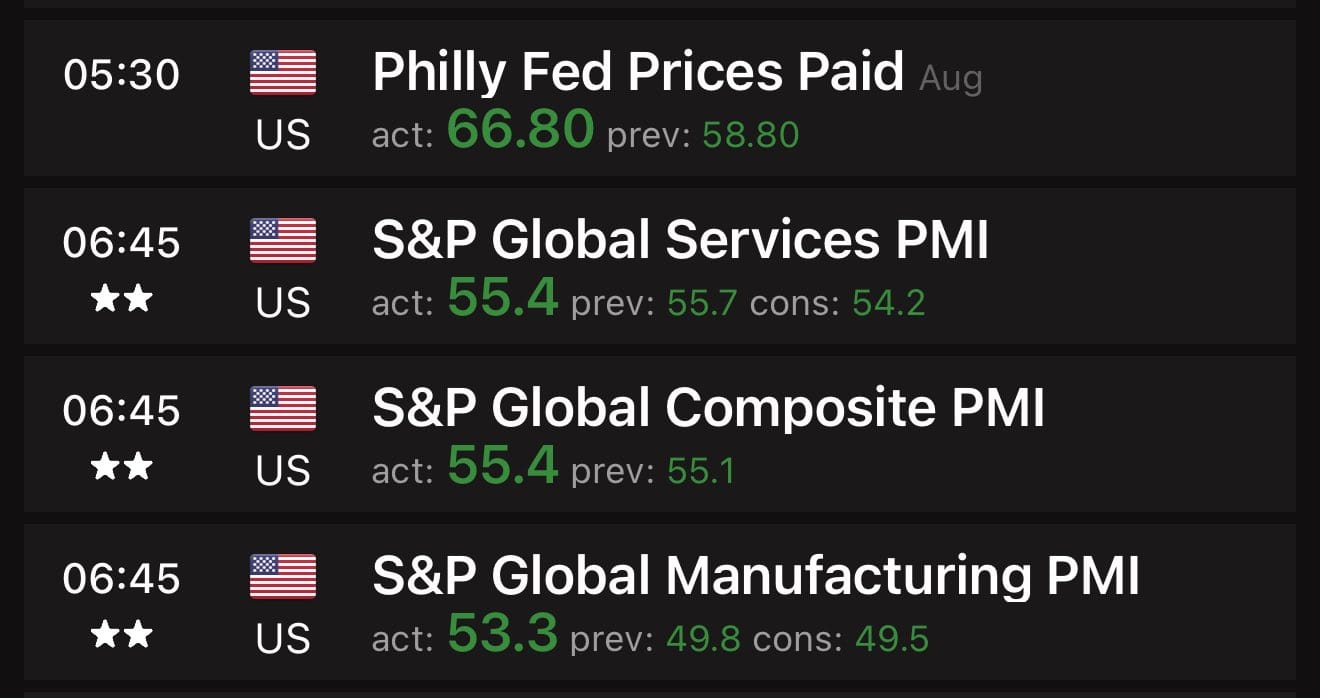

In recent weeks, Donald Trump managed to significantly sway expectations regarding the Federal Reserve’s interest rate policy. After a weak jobs report in early August, concerns about stagflation emerged, with rate cuts seen as only a matter of time.

Finance Minister Scott Bessent amplified that sentiment by suggesting a massive 50 basis point cut for the September 17 meeting.

For a brief period, the market even priced in a strong chance for that scenario—with the probability of at least one rate cut reaching 100%. It has since dropped to 75.5%, which still seems too high.

This week once again demonstrated that the U.S. economy is in good shape. Unemployment remains at historic lows, and the markets recently reached all-time highs. At the same time, inflation is rising, and many companies indicate that the full impact of tariffs on prices has yet to hit.

It’s quite remarkable, then, that the market is so convinced of a scenario featuring multiple rate cuts for the remainder of 2025.

Jerome Powell will likely refer to these factors, emphasizing the uncertainty around inflation and noting that policy decisions will be driven entirely by incoming data. In that respect, I don’t expect much in the way of theatrics at Jackson Hole.

I wouldn’t be surprised if the probability of a rate cut by September 17 falls even further. That could catch the market off guard, as it seems to have been positioned for a scenario in which the Fed might implement unnecessary or excessive rate cuts.

However, for those of us hoping for a continued Bitcoin bull run later this year, it wouldn’t be a bad thing if the U.S. economy turns out to be in better shape than the market has anticipated.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!