Time to Break and Rebuild

Trump’s tariffs ignite chaos: Nasdaq plunges, gold surges to record highs, yet Bitcoin stands firm. Are we witnessing mere election theatrics or the onset of a systemic reset? Dive into a market where protectionism fuels volatility and breakthrough tech might just reshape finance.

Last week, the panic didn’t come from an external threat. There was no pandemic, no natural disaster, no hack or accident. This time, the stress in the financial markets came from within—from politics.

President Donald Trump added fuel to the fire with an announcement that reverberated worldwide: new import tariffs on Chinese goods, higher duties on Taiwanese chips, and extra taxes on European cars. A deliberate move—a bold act of protectionism. And the markets? They were shaken. The Nasdaq plunged, and the volatility index (VIX) snapped back like a long-compressed spring.

At 12:01 Trump's tariffs officially took effect.

— Joe Weisenthal (@TheStalwart) April 9, 2025

Tariffs are now at their highest level in 100 years. pic.twitter.com/PWHcm247BT

The question then is: how should we interpret this? How do we place such drastic, overtly polarizing policies within a broader context? Is it just election rhetoric, or are we witnessing something deeper, something structural? What if this tension isn’t a flaw, but a deliberate feature—exactly what a disoriented society should experience?

A number of thinkers—historians, economists, and systems theorists—offer a lens for understanding these periods. They focus not on quarterly reports but on generational cycles; not on inflation rates but on waves of civilization. Strikingly, they all reach a similar conclusion: these periods of chaos, however disruptive they seem, are recurring and follow distinct patterns.

Take William Strauss and Neil Howe, who in The Fourth Turning describe how societies move in cycles: from growth to stability, from stability to disintegration, and from disintegration to crisis—only for it to begin anew. That crisis phase—where we find ourselves today—is when old institutions crumble, trust in leaders evaporates, and citizens are forced to reinvent themselves. It is a time of confrontation, but also of transformation.

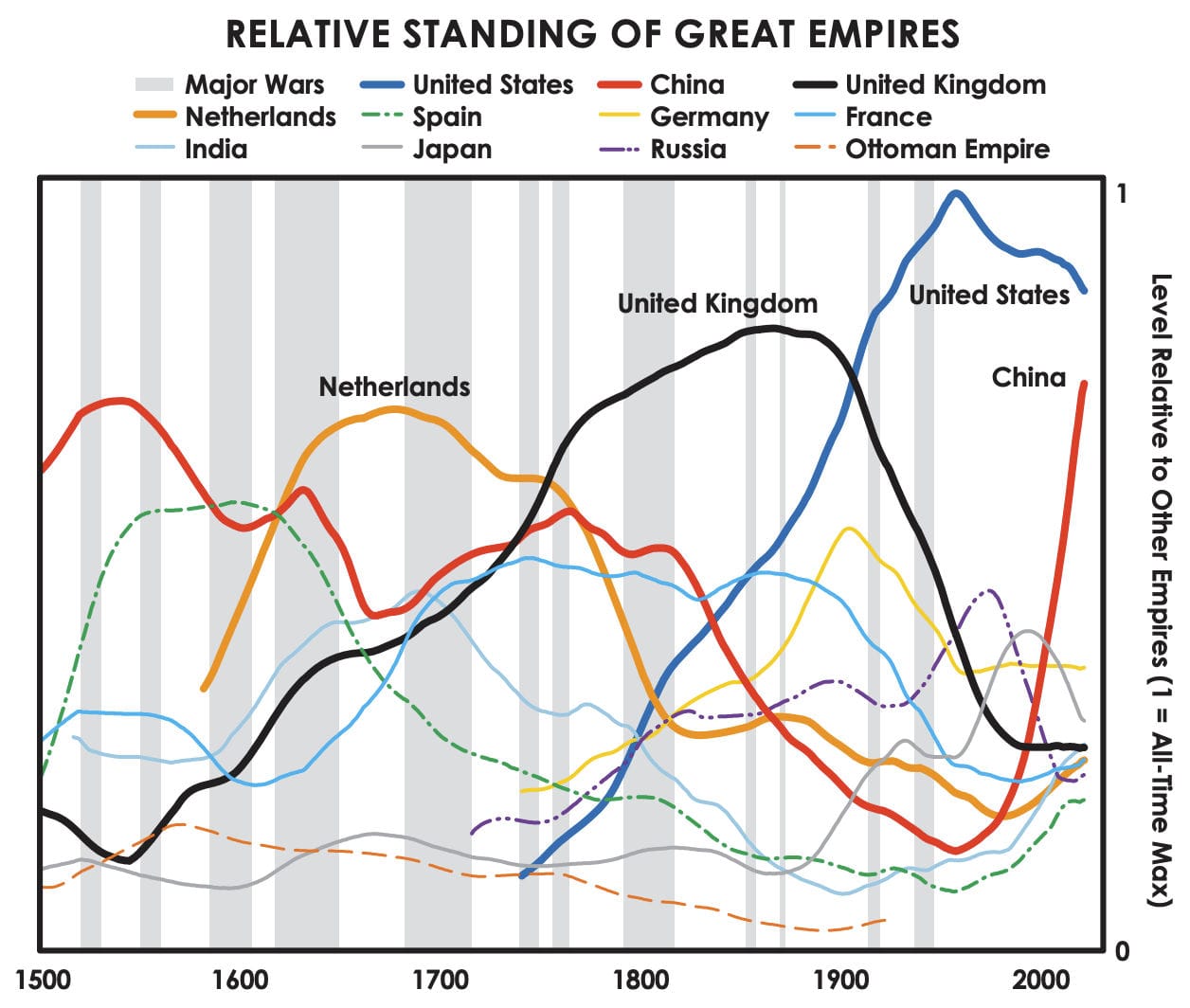

Ray Dalio, of Bridgewater and author of The Changing World Order, examines empires and sees that every empire—from the Netherlands to China to the US—goes through the same stages: creativity, growth, decadence, and decline. According to his model, we are now in a phase marked by high debt, crumbling social cohesion, declining confidence in money, and rising international tensions. His charts on wars, debt levels, and currency devaluation read like a weather forecast warning of an approaching storm. Yet he asserts that if you understand the pattern, there’s nothing to fear. You know where you are in the cycle—and where the opportunities lie.

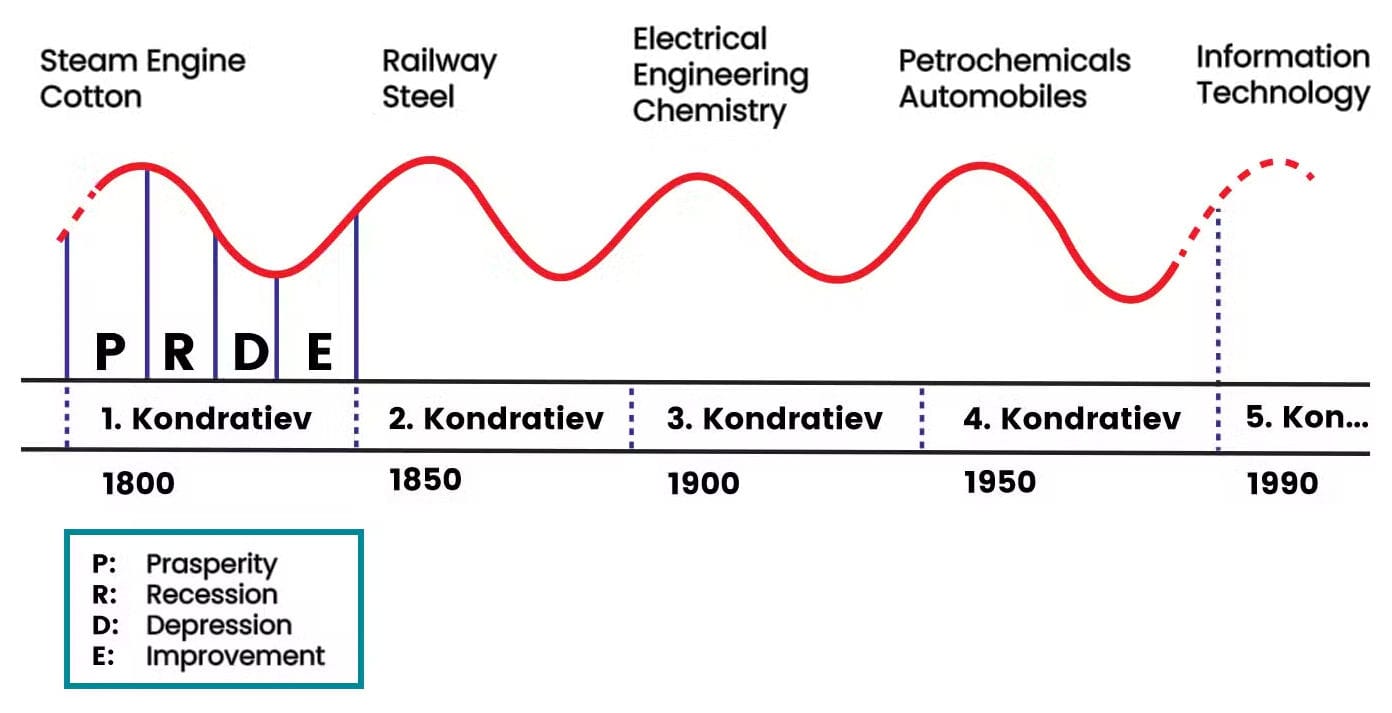

The Russian economist Kondratieff theorized long economic waves lasting 50 to 60 years. He observed how innovation and credit spur prosperity, while oversaturation and mounting debt lead to contraction—a phase he called the winter of the cycle. Not a disaster, but a reset: a period when old sectors wane and new ideas take root. It’s not a time to play it safe, but an opportunity to plan ahead.

American historian and anthropologist Joseph Tainter offers another perspective. In The Collapse of Complex Societies, he argues that civilizations often collapse not because of external attacks, but because they buckle under their own complexity. The more rules, structures, obligations, and exceptions a system has, the more vulnerable it becomes. Eventually, the cost of maintenance outweighs the benefits—and it collapses. Sometimes it goes down with a bang, and other times, like a deflated soufflé, it simply falls apart. And who survives? Those who live more simply, those who have built up autonomy.

Biologist and historian Peter Turchin supports his view with data—wages, inequality, elite growth. When too many people compete for too few elite positions, tensions escalate, Turchin believes. Picture young graduates with degrees but no prospects, workers burdened by debt and lacking stable housing, and politicians offering catchy slogans without vision. The result is instability, anger, and a clamor for radical change. And that’s exactly where we find ourselves today.

"What you feel right now is fragility," Nassim Taleb might say. The market is fragile. The political system is fragile. And the monetary system, based on debt and promises, is extremely fragile. When a fragile system is overwhelmed, it breaks. Taleb advocates for antifragility—a system that grows stronger from stress, that not only withstands volatility but learns from it. His advice is strikingly pragmatic: avoid unnecessary complexity, build redundancy, and learn from shocks. This applies not only to your finances, but also to your health, work, and relationships.

Then there’s Arnold Toynbee, perhaps less well known but equally compelling. His message is clear: civilizations don't collapse from external pressure but from a failure to respond creatively. When systems weaken, blind obedience isn’t the answer—you must innovate. Creativity isn’t a luxury; it’s a survival strategy.

Each of these thinkers, from different perspectives, essentially conveys the same message: periods of chaos are not random; they recur like the seasons. And when you know it’s autumn, you dress accordingly. It’s time to prune, to save, and to prepare for what comes next.

Be aware of the cycle, as Strauss & Howe.

Stay calm and diversified, as Dalio.

Look for opportunities in the winter, as Kondratieff suggests.

Simplify, as Tainter advises.

Understand the tensions, as Turchin explains.

Become antifragile, as Taleb recommends.

And remain creative, as Toynbee champions.

It’s easy to think that these issues are too abstract or removed from daily life. But that’s exactly the mistake that fuels our current challenges. The truth is, you are part of the system—and therefore part of the solution. Every choice you make—where you save, who you vote for, how you live, how you collaborate—matters.

Bitcoin isn’t a magic bullet. But it embodies everything discussed above. It is simple, robust, antifragile, and designed for times of systemic stress. No central control, no endless complexity, no dependency on elections or tariffs. It’s not the answer to every problem, but it’s the beginning of something new!

Are you a Plus Member? Then we continue with the following topics:

- Gold emerges as a major winner amid tariff chaos

- SwiftSync: a turbo boost for new nodes

- The best performing ETF so far is…?