The Bull Seduces You Into Dancing

Jesse Livermore, the Great Bear of Wall Street, made millions betting against a bubble—only to lose it all by overtrading. Today’s bull market teases with soaring altcoins, new stablecoin rules, and ETH’s revival. Will you stick to your plan or repeat history?

In 1929, Jesse Livermore was enjoying his moment in the spotlight. While Wall Street was gripped by panic, he made hundreds of millions of dollars during the stock market crash. He had bet against an overheated market, and when it finally collapsed, he was the one who had seen it coming. He earned the nickname “The Great Bear of Wall Street”—filthy rich and a living legend.

Yet, things eventually took a turn for the worse.

He lost everything once more, just as he had in previous cycles. Not because his analysis was off, or because he was reckless, but because he simply couldn’t stop trading. The temptation of one more trade was stronger than the wisdom of “enough is enough.”

Livermore’s tragic story ended in isolation and suicide. His life serves not only as a captivating tale but also as a stark warning—not against the market, but against our own weaknesses.

The Allure of Momentum

We are currently in a bull market. Prices are climbing, altcoins are stirring, finfluencers are making outlandish price predictions, and many investors are eager to “do something” again. For some, the fear of missing out slowly gets under their skin. In such an environment, it’s all too easy to forget that you can also choose not to trade, that you don’t have to grab every coin. Every click, every trade, comes at a cost—mental energy, the potential for mistakes, and capital that might be better left untouched.

Picture this: ETH at $8,000, then $80,000, then $706,000 pic.twitter.com/Qo0omACVa6

— sassal.eth/acc 🦇🔊 (@sassal0x) July 20, 2025

In the latest episode of the Blockworks podcast Empire, Jason Yanowitz and Santiago Santos discussed just that: a bull market is not only about where you put your money, but also about how you allocate your time and attention.

A bull market can make you impatient. It encourages you to be quick, active, and on top of every move. Before you know it, you might feel like a kid in a candy store—jumping from one sweet allure to another—only to end up with a metaphorical stomachache on the sidewalk.

The irony is that the quicker everything rises, the greater the risk of overreaching.

Livermore Was No Amateur

Livermore wasn’t a gambler or an impulsive speculator. He recognized patterns in price movements long before technical analysis became a thing. He even wrote books on risk management, the importance of patience, and discipline. And yet, he repeatedly fell short.

In a diary entry, he once recorded: “It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!”

He understood it well and documented it, yet he couldn’t stick to his own advice. The flaw wasn’t in his strategy, but in his behavior. The lesson here is that knowing what to do is only the first step—you also have to follow through, especially when the pace is dizzying.

Think Backwards

Santos advises his listeners to reverse their thinking. “Assume you can’t time the peak of the bull market, and work backward from there.”

Don’t ask yourself: “What more can I grab?”

Instead, ask: “What can I do now so that I can look back with satisfaction later?”

Only a few have truly reaped significant gains in previous cycles by chasing obscure coins. Especially during short-lived peaks, it’s nearly impossible to exit in time. The frenzy comes and goes so quickly that many investors are left reeling.

The ones who fare best are often those who do little. Those who stayed with bitcoin, held onto their positions for the long term, and didn’t try to time the top—but instead captured the middle. They had a plan and stuck to it.

Do You Really Want to Beat Bitcoin?

The most crucial question Santos raised was: are you planning to beat bitcoin?

Consider this: there are hundreds of funds staffed with experienced analysts, with access to seed deals, inside information, and expert teams. Even among these smart, well-funded entities, only a fraction manage to outperform bitcoin. Yanowitz estimated that about 10 percent do—if that.

Most traders and funds believe they can outsmart the market, but the market has a way of punishing that overconfidence.

Bitcoin is the safe, steady bet. It doesn’t lure you into making endless trades. Its movements are measured and it rarely makes the headlines with sensational charts or dramatic podcast segments.

Yet bitcoin remains the benchmark—the standard. It’s also been the winner in every cycle so far. Most coins vanish, most projects falter, and most promises fade away. But bitcoin endures, growing stronger, larger, and increasingly significant with each cycle.

Stand Still While Others Run

Jesse Livermore always aimed to outsmart the market. He tried to pinpoint the turning point, predict reversals, and time the peak—each time he convinced himself that he saw more clearly than everyone else, it marked the start of his downfall.

A bull market tempts you to sprint along, but the real skill lies in standing still—sticking to your plan and focusing your time and energy on what truly matters.

Because when you give in to the bull’s lure, you risk ending up trampled in its wake.

More Alpha

Are you a Plus member? Then we continue with the following topics:

- Stablecoin Regulations in the US: the GENIUS Act

- The New Story of ETH

- Quantum Threat: A Dormant Problem Comes to Light

1️⃣ Stablecoin Regulations in the US: the GENIUS Act

Erik

It was “Crypto Week” on the US House floor, and several bills were under discussion. Among them, the measure on stablecoins—the GENIUS Act—was perhaps the most significant. The bill had already passed the Senate, marking a milestone as it was the first time the US government granted banks permission to issue dollars on the blockchain.

During this Crypto Week, other bills were on the agenda as well, such as the CLARITY Act, which lays out when a crypto should be classified as a commodity or a security—and which regulator will oversee it. There’s long been a need for such clarity, and the CLARITY Act is expected to be approved by the Senate next week. Additionally, a measure was discussed that would counter the rise of digital central bank money in the US.

Today, President Trump signed the GENIUS Act into law, a historic piece of legislation that will pave the way for the U.S. to lead the global digital currency revolution. pic.twitter.com/UCha4xpYZM

— Treasury Secretary Scott Bessent (@SecScottBessent) July 18, 2025

The final measure, which has yet to pass, is designed to stop the US central bank from issuing dollars directly to the public. With these three laws in place, Trump is fulfilling an important campaign promise he made to the American crypto industry.

While Trump signed the GENIUS Act, the CEOs of Coinbase, Kraken, Robinhood, and others welcomed the move. An interesting detail: Paolo Ardoino received personal thanks from the President. Ardoino, CEO of Tether (USDT), is a pioneer in the stablecoin arena—a space that for years struggled with a tarnished reputation. That acknowledgment must have felt like a major win for the beleaguered yet highly profitable company.

Tether ♥️ pic.twitter.com/yZnimVxSwR

— Paolo Ardoino 🤖 (@paoloardoino) July 18, 2025

Requirements for Stablecoin Issuers

Stablecoins are now officially part of the US financial system. For the first time, a nationwide law specifies how stablecoins can be issued and what must back them.

Not every startup is eligible to issue stablecoins in the US. To do so, one must become a Permitted Payment Stablecoin Issuer—that is, a bank or fintech company with a federally chartered license.

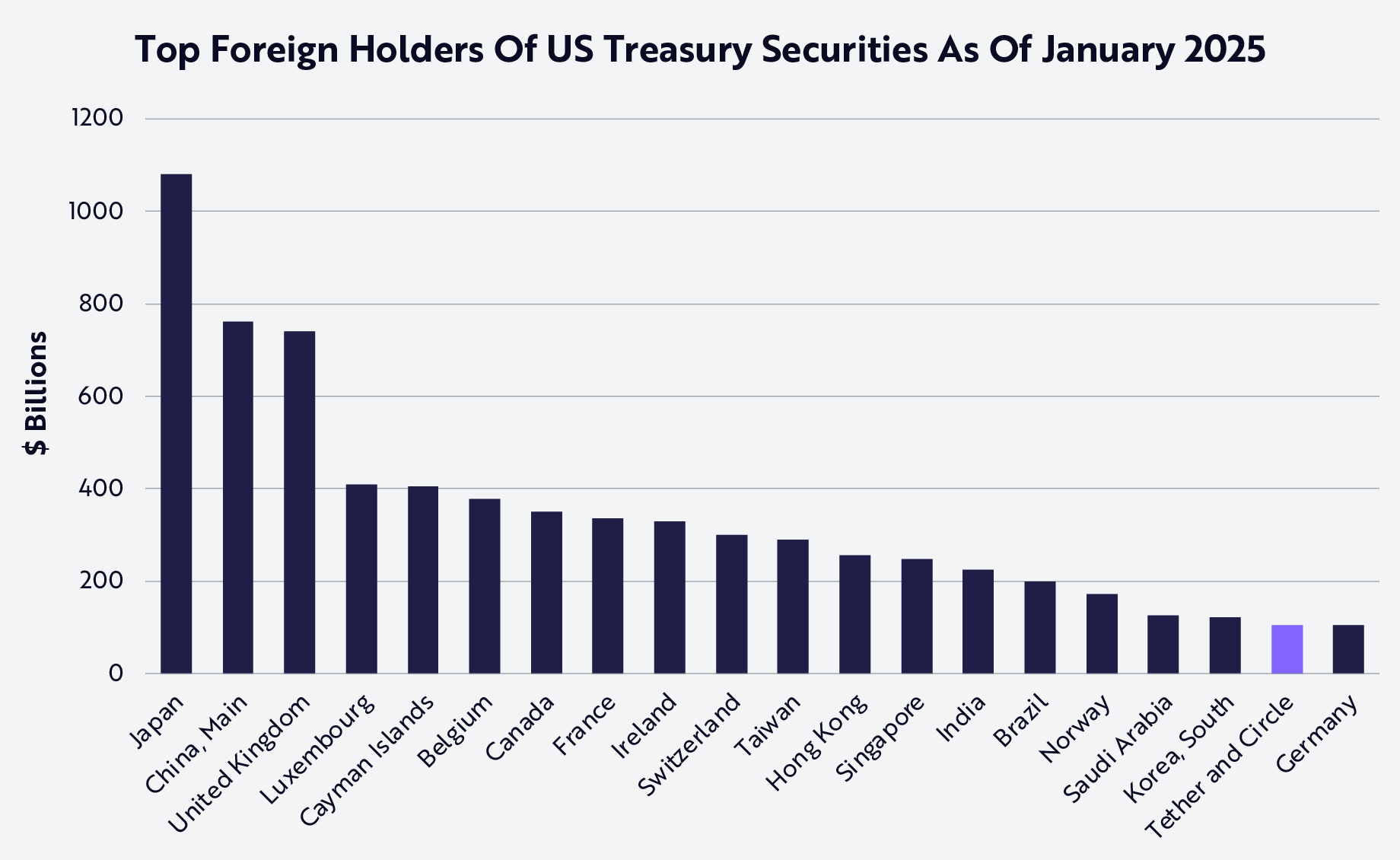

Issuers are required to disclose their reserves on a monthly basis and undergo an annual audit. Naturally, these reserves must consist of dollars or similarly secure assets, such as short-term US Treasury bonds—especially favored by the US government.

Impact of the Law

These new regulations pave the way for large-scale adoption of stablecoins. As the supply of crypto dollars expands, liquidity for platforms offering blockchain versions of assets like stocks will also increase. Just last week, we discussed what Robinhood is planning in Europe, and payment providers like Stripe and Visa have already integrated stablecoins.

The current circulating value of stablecoins is around 250 billion dollars. Now that every American bank can issue stablecoins, that number could easily multiply tenfold in the coming years. And it’s not just us saying this—Treasury Secretary Scott Bessent himself predicts that stablecoin supply could reach three trillion dollars by 2030.

But why is Bessent so bullish on stablecoins? The answer is simple: the US government needs a new buyer for its debt. Not because other countries are unloading it, but because a significant amount of new debt will need to be issued in the upcoming years. In recent times, stablecoin issuers like Tether and Circle have even sneaked into the top 20, thanks to the interest they earn from these bonds.

Of course, these developments benefit not only stablecoin issuers but also the blockchains that support them. And in this regard, one blockchain stands out above the rest... Ethereum. 👇

2️⃣ The New Story of ETH

Peter

“Narrative follows price.”

This is a phrase that keeps resurfacing during bull markets. As prices soar, the market naturally crafts a story to justify it—why this time is different and why it marks the beginning of something monumental. The story doesn’t even need to be entirely factual; it just has to work.

Ether is a prime example. For years, its narrative struggled. From claims of “ultrasound money” to major upgrades with names that were hard to pronounce, the story sounded clever but didn’t help the price. Relative to bitcoin, ETH lost over 75% of its value. The ETH/BTC ratio fell from above 0.08 to as low as 0.017. Even the popular narrative that “ETH is deflationary” gradually lost its luster.

if capped-supply BTC is sound money 📢

— Justin Drake (@drakefjustin) January 22, 2021

decreasing-supply ETH is ultrasound money 🦇 pic.twitter.com/anu6QiZRcO

But the sentiment is now shifting. Over the past three months, ETH’s price has risen from $1,600 to $3,600, and its ETH/BTC ratio has rebounded to 0.03. Spot ether ETFs are now live, and on certain days, the inflows rival those of bitcoin. This is the moment when the momentum really starts to build—not only is the price rising, but so is the narrative, and this new story sounds distinctly different.

It unfolds in three chapters.

First: Ether as a reserve asset. As Tom Lee puts it, “This is the ChatGPT moment of crypto.” The well-known Fundstrat strategist is backing ether via BitMine Immersion Technologies, a publicly traded vehicle he compares to MicroStrategy—but for ETH. The idea is to attract capital to buy spot ETH, positioning it as an exposure play for the next phase of institutional adoption. It’s a rediscovery of Ethereum—a Saylor-esque narrative, but with yield.

Sharplink Gaming $SBET amended their prospectus, “Up to $5,000,000,000 of Common Stock”.

— fabda.eth (@fabdarice) July 17, 2025

F I V E B I L L I O N S 🤯 pic.twitter.com/QNyBG5KZCG

This leads to the second chapter: ETH as productive capital. Unlike bitcoin, ether generates returns. You can stake it, use it in DeFi, or put it up as collateral. The old adage—“BTC sits idle; ETH works”—now takes on new meaning in an era where cash flow and real yield matter once again.

BTC sits idle. ETH builds. pic.twitter.com/KVYyc8u85C

— sassal.eth/acc 🦇🔊 (@sassal0x) July 19, 2025

And finally, the third chapter: Ethereum as the backbone for stablecoins. According to Lee, stablecoins now account for 30 percent of all network activity. Companies like Circle, JPMorgan, and Robinhood are building on Ethereum. If predictions about stablecoins nearing a three-trillion-dollar market hold true, Ethereum’s usage could grow exponentially—not driven by speculation, but by genuine utility.

Taken together, these chapters weave a narrative of Ethereum as the financial foundation of the digital money system. It’s no longer just about being the smartest platform or the fastest L1—it’s about being the credible underlayer of finance. For the first time, this story seems to be resonating even beyond the crypto space.

But how robust is this new narrative, really?

The developments are promising, yet caution is warranted. Yes, the price has doubled, but that’s only a modest recovery after years of underperformance. And while ETF inflows are impressive, without a breakthrough above $4,100, it’s still just a revival within a trading range that has confined ether for years.

Ethereum finally has a narrative that works, but it still needs to prove itself. We’re watching closely—not running ahead, but not turning our backs either.

3️⃣ Quantum Threat: A Dormant Problem Comes to Light

Peter

What if the greatest threat to bitcoin has been lurking right under our noses for years, and we’ve done nothing about it simply because it hasn’t felt urgent?

Recently, the first Quantum Bitcoin Summit took place in San Francisco. It wasn’t a coincidence that a proposal by bitcoin developer Jameson Lopp was a focal point of the event. His message was clear: bitcoin must prepare now for a future where quantum computers could compromise current security measures.

When such computers might actually emerge remains uncertain. Some researchers suggest it could be a matter of years, while others believe it could take decades. Nevertheless, according to Lopp, now is the time to address it. Unlike previous threats—such as censorship, regulation, or bugs—this potential attack strikes at bitcoin’s very core: the cryptography protecting wallets.

In his proposal, Lopp outlines a phased strategy:

- First, discourage sending funds to vulnerable addresses.

- Next, introduce a soft fork: anyone who fails to migrate their coins to a quantum-secure address in time would risk losing them.

- Optionally, implement a recovery mechanism, perhaps using zero-knowledge proofs.

Today we publish a Bitcoin Improvement Proposal addressing incentive & safety issues for migrating the ecosystem to post quantum cryptography.

— Jameson Lopp (@lopp) July 15, 2025

BIP timeframes are relative to a future point at which quantum computers are deemed a significant threat.https://t.co/xUuig5YWNE

Controversial? Absolutely. The notion of “freezing” sats—even if they belong to Satoshi—challenges bitcoin’s core principle: not your keys, not your coins. But Lopp argues that this threat is so fundamentally different that the response must be equally radical.

Currently, about 25% of all bitcoins are held in addresses that have already exposed their public keys, rendering them vulnerable. Attackers with sufficient qubits might not launch a single, massive assault but could instead operate gradually, siphoning funds over months without detection. In such a scenario, the so-called “Q-Day” would only be recognized in hindsight.

So, is quantum computing a threat? Yes. But is immediate panic warranted? No. The greatest risk lies in doing nothing; Lopp has finally broken the deadlock of inaction. The conversation is now underway, and this may well mark the beginning of the next major upgrade for bitcoin.

Biggest takeaway from the Quantum Bitcoin Summit this week: the fear and uncertainty about quantum computing may very well be a greater threat than quantum computing itself.

— Jameson Lopp (@lopp) July 19, 2025

We should strive to create more certainty around how Bitcoin would respond to such a threat if it arises.

🍟 Snacks

To wrap things up, here are some quick highlights:

- Ethereum ETFs draw record capital. In July, $3.2 billion flowed into these funds, with BlackRock’s ETHA taking the lead. Last week, ETH even matched BTC’s daily inflow, and over 10% of ETH’s trading volume now comes through ETFs. BlackRock has requested permission to stake the ETH purchased by the fund, potentially providing investors with extra returns.

- Trump aims to open 401(k) pension funds to crypto investments. According to the Financial Times, Trump is working on an executive order that would allow pension funds—totaling $9 trillion—to invest in alternative assets like bitcoin, gold, and private equity. This plan seeks to remove the legal hurdles that currently block such investments.

- Coinbase launches an all-in-one wallet combining crypto, social features, and AI. The rebranded Coinbase Wallet, now called Base, aims to offer more than just transactional functionalities. Users can post, chat, save, play games, and use AI tools—all in one app. Coinbase wants crypto to become a social, mobile experience, making Base a potential Web3 portal for the masses. Whether that will succeed remains to be seen.

- Bank of America is gearing up to launch its own stablecoin. CEO Brian Moynihan confirmed this while reviewing the Q2 figures. With the infrastructure already in place and partnerships finalized, and now that Trump has given the green light, BofA could soon join JPMorgan and Citi in the race to offer a bank-backed stablecoin.

- Did the US really sell 80% of its bitcoin? A FOIA request revealed that the U.S. Marshals Service holds 28,988 BTC, far fewer than the 198,000 BTC attributed to the US government by Arkham Intelligence. So, were they sold off? No—the Marshals only manage forfeit bitcoins, which are owned by the government. The fate of many other seized bitcoins remains unresolved. The actual balance is unknown, and there’s no evidence of a sale.

- Cantor Fitzgerald plans to buy $4 billion in bitcoin via a SPAC deal involving Adam Back. The crypto pioneer behind Hashcash is contributing 30,000 BTC—over $3 billion—in exchange for shares in BSTR Holdings. Additionally, Cantor aims to raise another $800 million for further purchases. The idea is simple: to accumulate bitcoin through the stock market, much like Michael Saylor. Combined with an earlier deal involving SoftBank and Tether, Cantor’s total bitcoin investment could reach $10 billion this year.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!