Tech Stocks Hit Record High – Is Bitcoin Next?

Nasdaq 100 tops records as tech bounces back amid geopolitical unrest and tariff disputes. Meanwhile, bitcoin teeters near its all-time high—could renewed market optimism propel crypto to break new records?

The American tech index Nasdaq 100 reached a record high yesterday. After a 26% drop between February and April, the technology sector staged a remarkable recovery despite unrest in the Middle East and ongoing tariff disputes.

Two months ago, we wrote the following about the U.S. stock market:

Every bear market begins with a correction, but not every correction turns into a bear market. The S&P 500 has reached a crossroads. On April 7, it fell to 20% below its all‐time high—a steep correction, but not yet a bear market.

Since then, this broad stock index has rebounded and now shows only a 10% loss. Roughly half of the drop has been recovered. And that brings us to a crossroads.

If this correction turns into a bear market, this is the zone where the recovery will stall. Between 50% and 61.8% of the drop will then be recovered, after which the decline continues. However, if the correction is behind us, prices will simply continue to rise from here.

In the meantime, the outcome is clear: prices continued to rise. And if futures are to be believed, the S&P 500 will hit a new record high when the American stock market opens this afternoon. No matter how alarming the news and headlines may seem, the market is setting record prices.

How can this be? Two reasons:

Firstly, the traditional alternative is less attractive. Bonds have long been the counterpart to stocks in a conventional 60/40 portfolio, but for various reasons, investors are showing less interest in government debt.

Secondly, markets are looking beyond short-term turbulence to the robust stimulus that is driving long-term global economic growth. War in the Middle East? Tariff disputes between China and the U.S.? The market believes everything will eventually settle down.

After breaking through the 61.8% retracement point and reaching new record highs, the baseline scenario is that the bull market that began in 2009 will continue in the coming years—perhaps even deepening further. There could even be another round of the economic cycle, where robust growth pushes stock prices even higher.

The chart below shows 70 years of the broad American stock index S&P 500, adjusted for consumer price inflation. You could say it represents the purchasing power of your shares. Years of expansion and contraction have alternated.

Even the current secular bull market will eventually transition into a secular bear market—a period of more than ten years during which your stocks will be underwater.

There are many reasons to suggest that such a downturn is imminent—geopolitical shifts, wars, and unsustainable national debt. However, becoming defensive too early is just as misguided as holding on for too long.

Especially when economic growth is largely fueled by extensive support and stimulus from governments and central banks. In such an environment, prices for stocks, real estate, commodities, and everyday goods all rise. The purchasing power of bonds and savings can quickly evaporate.

As long as the party is still going, it makes sense to hold risk assets in your portfolio—particularly investments with an element of scarcity. Real assets, things that cannot be easily printed, like gold, bitcoin, real estate, and certain stocks, are especially attractive.

Will the record highs in American stocks now trigger a breakthrough for bitcoin to reach new records?

Based on fundamental developments, you might expect so. Geopolitical tensions are subsiding and conflicts are being resolved. The U.S. seems to be moving toward the end of the trade war. American government officials and regulators are positive and constructive about crypto on many fronts.

Yet bitcoin was stuck this week at $108,000—just a few percent shy of its all-time high of $112,000. How can this be explained? Shouldn’t bitcoin be “the fastest horse in the race” when risk assets are gaining momentum again?

The exceptionally successful IPO of Circle and the significant price surges of Coinbase have attracted attention in recent weeks. Perhaps they captured some of the capital that would otherwise have flowed into bitcoin. But that alone doesn’t fully explain why a new all-time high has not been reached.

The key likely lies in last weekend’s events. While the markets were closed, America bombed nuclear bunkers in Iran, causing bitcoin’s price to drop from $105,000 to $98,000.

Under the circumstances—an escalating conflict and low weekend liquidity—a drop of a few percent is not immediately alarming, especially since the price quickly recovered to $105,000 on Monday.

However, the market is not a Markov process, where the likelihood of future scenarios depends solely on the current price. The market has a memory; we call that path dependence. It isn’t just about the price being $105,000 now, but also about the journey that got us here.

Last weekend (as highlighted in pink), we saw technical damage: a daily close below the 50-day moving average, a weekly close below the 10-week average, a lower high (LH) and lower low (LL), and a price that fell below the starting point of this daily cycle, resulting in a failed daily cycle.

From various perspectives, analysts and traders now view the price differently than they did last week. Indicators that were once fully in the green are now turning orange or red. Concerns about a bearish divergence on the weekly chart and similarities to the 2021 double top are growing.

Last week, we described it as a tug-of-war between bears and bulls. The bears have struck a blow that bitcoin feels, while stocks do not—simply because their markets were closed. If the bulls want to claim victory, they must force the bears over the threshold toward new all-time highs above $112,000.

We continue with the following topics for our Alpha Plus members:

- Will ETH, like COIN, benefit from the success of stablecoins?

- Altcoins are falling further behind bitcoin

- A rare and powerful signal for the U.S. economy

- These dates have suddenly become crucial for bitcoin

1️⃣ Will ETH, like COIN, Benefit from the Success of Stablecoins?

Bert

The American enthusiasm for stablecoins is unmistakable. Broad support in the Senate for the GENIUS Act, the blockbuster IPO of stablecoin issuer Circle, and the Finance Minister’s TV appearance—where he predicted that stablecoins will hold $3.7 trillion in government bonds by the end of this decade—all attest to this trend.

Coinbase’s stock also benefited, surging 60% over the past two weeks from $230 to $375. Coinbase is a co-founder of Circle and receives half of the interest income generated by its reserves.

In addition to the stocks of Circle and Coinbase, ETH stands to gain from the growth of stablecoins, according to Tom Lee of Fundstrat. He notes that USDT and USDC now account for about 25% of the transaction fees on the Ethereum network. As the volume of crypto dollars in circulation grows by a factor of 15, ether will also benefit.

The prices of COIN and ETH have moved in tandem for years. Only in the last six months have they significantly diverged. For ETH to close the gap, it would need to double to around $5,000.

2️⃣ Altcoins Are Falling Further Behind Bitcoin

Bert

Is ETH on the brink of a breakout? The section above outlines that possibility, and other analysts are now cautiously expressing renewed interest in ETH. Such a revival could send shockwaves through the crypto market. Ether has been gradually losing ground to bitcoin for four years, and most investors no longer take that for granted.

This could serve as a catalyst for the entire altcoin market. While bitcoin is only now reaching new record highs, altcoins remain well below their peaks from December and January. Many altcoins haven't even approached the highs of the 2021 bull market.

The chart below illustrates:

- The ratio between bitcoin’s market capitalization and the S&P 500 (in dark green).

- The ratio between the total market capitalization of all altcoins (excluding stablecoins) (in light green).

Bitcoin’s price, adjusted for stock performance above its 2021 record, has nicely tested the breakout level as support, whereas altcoins lag significantly behind.

The widening gap is also evident in the bitcoin dominance chart, which shows bitcoin’s share of the total crypto market. Bitcoin’s dominance is steadily rising, reaching its highest level since January 2021 this week.

We repeatedly see that dominance turns resistance into support and propels prices upward. If you’re still waiting for an alt season, this support level (A) must first be broken, along with the related averages (B). Until then, simply holding bitcoin remains the better choice.

3️⃣ A Rare, Powerful Signal for the U.S. Economy

Thom

Investors often treat financial cycles as if they were governed by immutable natural laws. For example, there’s a persistent belief that bitcoin always reaches a climax in the final year of its four-year cycle. Unfortunately, reality is less predictable: price movements are influenced by a multitude of factors relevant to bitcoin at any given time.

The same applies to the U.S. economy, which plays a crucial role in bitcoin’s price development. When asked what typically follows a period of strong economic growth, most investors answer: a recession. While that is often the case, it is not inevitable.

At the moment, we are seeing signs of a slowdown in the U.S. economy. Yet history shows that after a period of weaker growth, a new economic cycle can begin instead of a recession.

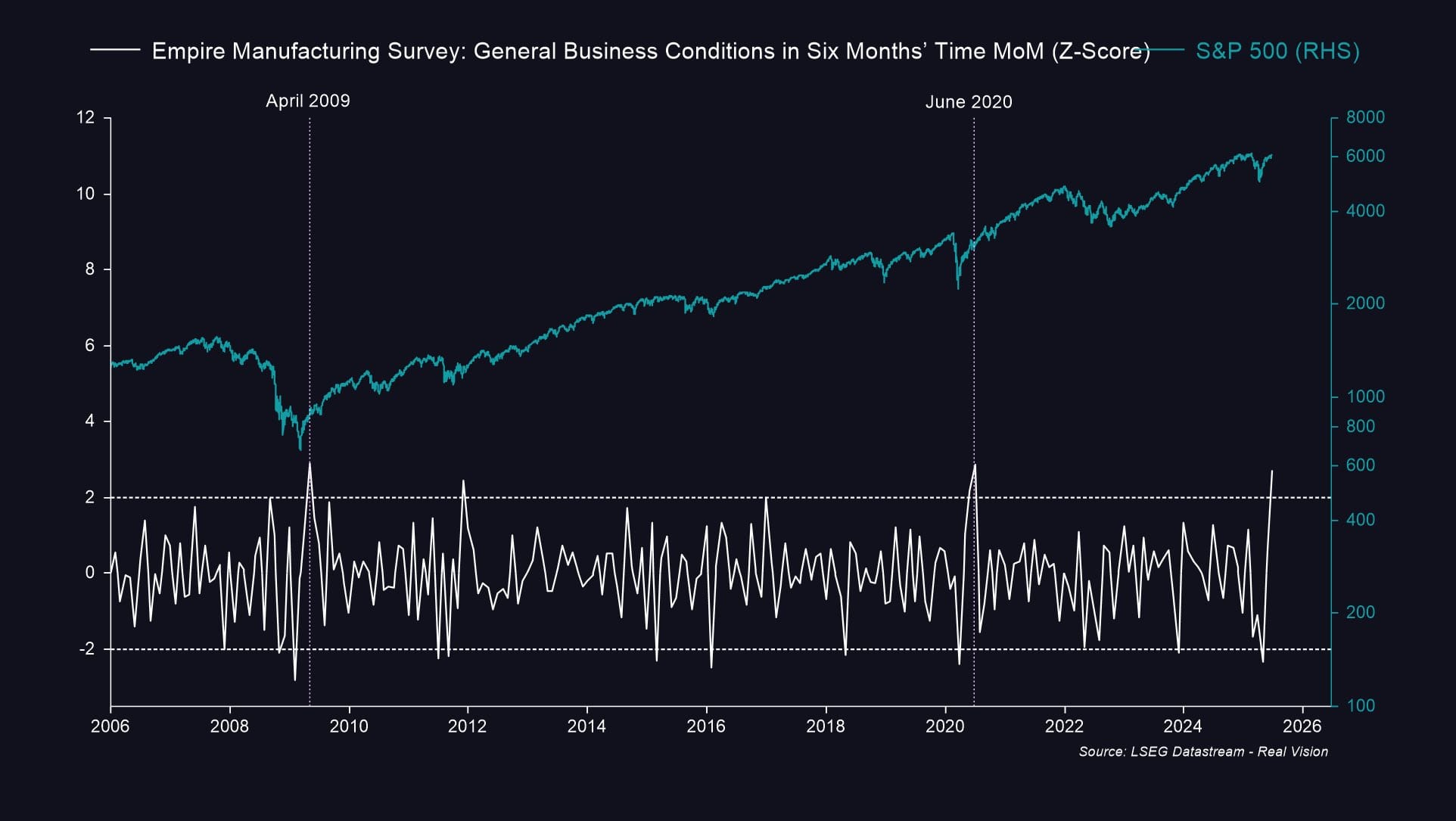

This week, Julien Bittel highlighted a striking signal for such a scenario—the likes of which we last saw shortly after the COVID-19 lockdowns. In fact, the last similar occurrence was in early 2009.

He refers to expectations for the business climate in American industry, which have improved remarkably. The index measuring these expectations climbed by 2.7 standard deviations—a rare outlier. While this may sound technical, Bittel argues it is a clear sign that the economy is strengthening, a sentiment that has not gone unnoticed by financial markets.

His reasoning is that expectations and sentiment often precede the actual economy because they influence behavior, and that behavior paves the way for a new economic cycle. In both 2009 and 2020, this signal preceded a strong period for the S&P 500.

A word of caution: the U.S. labor market is beginning to cool. According to Guy Berger, an expert in the field, the job market isn’t yet signaling a rate cut, but it is starting to show signs of weakness.

You might also question the reliability of the current economic data, as the full impact of the tariff war remains unclear. The Trump administration has not yet secured deals with its main trading partners, and companies may be adopting a wait-and-see approach regarding investments.

Julien Bittel points to AI-driven automation as a factor contributing to labor market weakness:

As I mentioned last week in our latest MIT update, this is partly structural and linked to the rise of AI-driven automation—a development that will only accelerate, displacing more labor. Nevertheless, a large part of the labor market remains cyclical for now and will move in tandem with the economic cycle.

However, it’s worth noting that Bittel is part of Raoul Pal’s team, known for the “Banana Zone.” They are fully committed to a bull market driven by increasing global liquidity, which means they may be prone to cherry-picking data that supports their view.

4️⃣ These Dates Have Suddenly Become Crucial for Bitcoin

Thom

The U.S. Dollar Index (DXY) continues to decline and is now at its lowest level since February 2022. This week, the dollar’s slide was driven by Donald Trump, who is increasingly persuading the market that rate cuts are imminent.

On June 18, the probability of a rate cut in July plummeted to 8% following the U.S. central bank’s hawkish decision. Since then, pro-Trump voices have ramped up their efforts, pushing that figure to the current 24.8%. Among other remarks, the following points were made:

- Trump called Powell “too late,” “stupid,” and a “blockhead” for not listening to him.

- Trump-appointed central bank officials, Waller and Bowman, hinted that a rate cut in July was indeed possible.

- Trump mentioned having three to four names in mind for Powell’s successor in May 2026, thereby encouraging central bank policymakers to push for rate cuts in their bids to become chairman.

This narrative—Trump advocating for rate cuts amid an escalating power struggle within the central bank—is gaining traction in the media. The futures market expects five to six rate cuts by the end of 2026, whereas just last week the central bank had anticipated four by the end of 2027.

The market is increasingly buying into a successful campaign led by Trump. Powell spoke this week as well, mentioning both the labor market and inflation. If the labor market weakens further and/or inflation continues to ease, he sees opportunities to reduce rates sooner.

For that reason, July 3 (job growth) and July 15 (CPI data) have suddenly become extremely important for bitcoin. If job growth disappoints and/or inflation comes in lower than expected, the pressure on central bankers to cut rates will intensify.

At the same time, Powell maintained a cautious stance, noting that:

- Economic growth remains solid;

- The labor market is cooling, but isn’t weak;

- The trade war poses a risk to inflation;

- Market risk appetite is high.

All this reporting might make you think that the U.S. economy desperately needs rate cuts, but given the broader context, Powell’s approach is understandable. Perhaps a single rate cut could reduce the risk of a recession without dangerously stoking inflation, but a series of cuts seems unnecessary.

Trump’s position makes it clear that he will stop at nothing to avoid a recession. With Powell’s tenure at the Federal Reserve coming to an end, this dynamic is likely to increasingly stimulate bitcoin and other risk assets.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!