Stablecoins as a Rorschach Test

Stablecoins are the market’s Rorschach test. Where alarmists see a 2008 reprise, pragmatists see a global safety net. The inkblot isn't changing, but the projections expose the system's deepening fragility. Also inside: Who really sold the dip, and the muni market's Bitcoin pivot.

Bitcoin is swinging between eighty and ninety thousand dollars. You can project almost any mood onto it. For one person, it feels like a bear market; for another, a healthy pause in a bull run. It is reminiscent of geopolitical issues or Donald Trump’s behavior: everyone looks at the same thing, yet everyone sees something different.

Stablecoins are not immune to this phenomenon either, functioning as a kind of financial Rorschach test. If you ask someone to look at an inkblot, or a stablecoin, you mainly hear what they fear, hope, or expect. Not what the inkblot itself says.

Take David Frum of The Atlantic. Last week, he viewed a stable digital dollar primarily as a reprise of 2008. In his scenario, the stablecoin market grows to four trillion dollars, that money flows massively into short-term Treasuries, the market subsequently collapses, and millions of people rush for the exit simultaneously. Frum describes this with prophetic certainty as the path to a new credit crisis. His nightmare scenario is clear: stablecoins are “by far the most dangerous form of cryptocurrency.”

Standing alongside the alarmist is the technocrat. Hélène Rey of the IMF looks at the same inkblot and sees the opposite danger: not that stablecoins might fail, but that they might succeed. In her analysis, they become so successful that they drain savings from banks and dangerously disrupt the international financial system. Rey predicts “intense lobbying,” “currency competition,” and the undermining of states' monetary autonomy.

The pragmatist listens to this and shakes his head. When Steven Miran of the Federal Reserve looks at the same spot, no nightmare appears. On the contrary, he sees a public good. His reading is sober: stablecoins are useful for people in countries where access to dollars is scarce. They don't siphon off deposit funding, because they offer neither savings interest nor bank guarantees. They are primarily digital gateways to a stable currency.

The strategist draws inspiration from the pragmatist. Macroeconomist David Beckworth extends Miran's line of thinking and sees stability emerging. Not in America, but in emerging economies that have been bending over backwards for decades to sustain their dollar loans. His point: if those countries have dollar debts but also hold dollar stablecoins, those stablecoins act as a natural hedge. If the dollar rises, the debt burden increases, but simultaneously, the value of the stablecoins appreciates.

In Beckworth's interpretation, stablecoins function as a kind of balance sheet airbag for emerging markets. And he goes even further: in a potential crisis, the Fed will likely act as a backstop for this market. The scenario that Frum outlines as a nightmare becomes part of the safety net in Beckworth's view.

To prevent the story from becoming entirely too optimistic, the lawyer steps forward. The U.S. Department of Justice makes it clear that stablecoins also have a criminogenic element. As they integrate into the banking system, it becomes easier to launder stolen funds through that channel. The recent case against Firas Isa, an ATM operator alleged to have converted millions in cash into crypto, is cited as evidence.

So, what do we see when we lay all these projections side by side? The same thing as with a real Rorschach test: no one is looking at the inkblot itself. Everyone is looking at their own fear, their own ideology, and their own economic model.

Stablecoins aren't dangerous because they might fail or succeed, or because they undermine or strengthen the state. They are dangerous, or useful, because they expose something nobody really dares to look at: the fragility of the existing system, the diversity of interests, and the vast gap between how the world is and how policymakers would like it to work.

More Alpha

Are you a Plus member? If so, we continue with the following topics:

- Who actually sold last week?

- New Hampshire opens muni market to bitcoin

- The FUD of this 'bear market'

1️⃣ Who actually sold last week?

Erik

Between Monday, November 17, and Friday, November 21, the price of bitcoin collapsed completely. Who were the weak hands? Rumors are circulating about a large market maker that suffered fatal damage during the flash crash of October 10 and is now forced to unload a large position. Is this true? We haven't been able to verify this yet. However, we can run through the other usual suspects of a sell-off. Consider the miners, the whales, and two recent additions to this list: the DATs and ETF holders.

ETFs: Outflows, but not dramatic

Two weeks ago, just before the price dump accelerated, we wrote that the balance sheets of the American spot ETFs were holding up well: there was little to no net outflow. But last week, the bitcoin funds saw nearly $1.2 billion in assets drain away. Thursday, November 21, entered the record books as the second-worst day since launch, with a net outflow of $900 million. In total, the funds experienced their third-worst week ever.

This doesn't sound great. But consider that despite the largest correction in BTC since the ETFs went live, no outflow records were broken. About 14,000 BTC flowed out of the funds last week, out of the more than 600,000 BTC still held by them: just slightly more than 2%.

This is the zoomed-out picture over the past 12 months: the last few weeks were not good, but not disastrous either.

Miners: Selling pressure is rising

Selling pressure from miners is increasing, with flows to exchanges—a sign of potential selling—at their highest level since May.

It is interesting to think about this dynamic. At current bitcoin prices, miners are still profitable. The average cost for all miners to produce one bitcoin is now about $70,000. In short, there are no forced sales just yet. But there is huge demand for AI data centers. If BTC generates lower returns, it becomes lucrative for miners to switch to AI. The costs of this switch can be financed by selling a portion of their BTC reserves. More on this in the Satoshi Radio broadcast from last Thursday.

DATs: Problems at altcoin companies

Digital Asset Treasuries (DATs) are publicly traded companies with large crypto reserves. They have taken a hard hit. Recently, Cryptonews estimated that many large BTC treasuries are now firmly in the red. MicroStrategy is the major exception there. The company holds 649,870 BTC in its vault and, with an average purchase price of $74,400, is still sitting on over $6 billion in unrealized profit. Many other bitcoin companies, including Marathon and Metaplanet, are now seeing their shares trade at a discount relative to the underlying bitcoin. At that point, an incentive arises to sell BTC from reserves to buy back shares.

The losses are even greater for corporate treasuries with a high ETH balance. Bitmine holds about 3.5 million ETH worth $9.75 billion and is now grappling with an unrealized loss of $4.5 billion (-31%). SharpLink (850,000 ETH) is sitting on an unrealized loss of $770 million (-25%).

Some parties are already actively selling. ETHZilla, for instance, sold $40 million in ETH to finance a $250 million share repurchase program. SOL treasuries like Forward and Upexi are also deep in the red and announced major buybacks.

Unfortunately, a complete picture of the sales (and plans) of all DATs is missing. But it is clear that these companies can be structural sellers in a bear market. The longer prices and stocks remain under pressure, the greater the chance that treasuries will liquidate their ‘pristine collateral’ to protect their share price and narrow the mNAV discount.

Relatively high selling pressure from Americans

The Coinbase Bitcoin Premium Index represents the difference between the price of BTC on the US exchange Coinbase and on a 'global' exchange like Binance. If the bars in the chart below are green, BTC is more expensive on Coinbase. US buyers are then bidding more aggressively than the rest. Typically during a crash, if BTC is slightly cheaper on Coinbase, it is a sign that American investors were driving the selling, while demand outside the US remained relatively stronger.

Whales: Selling, but no more than usual

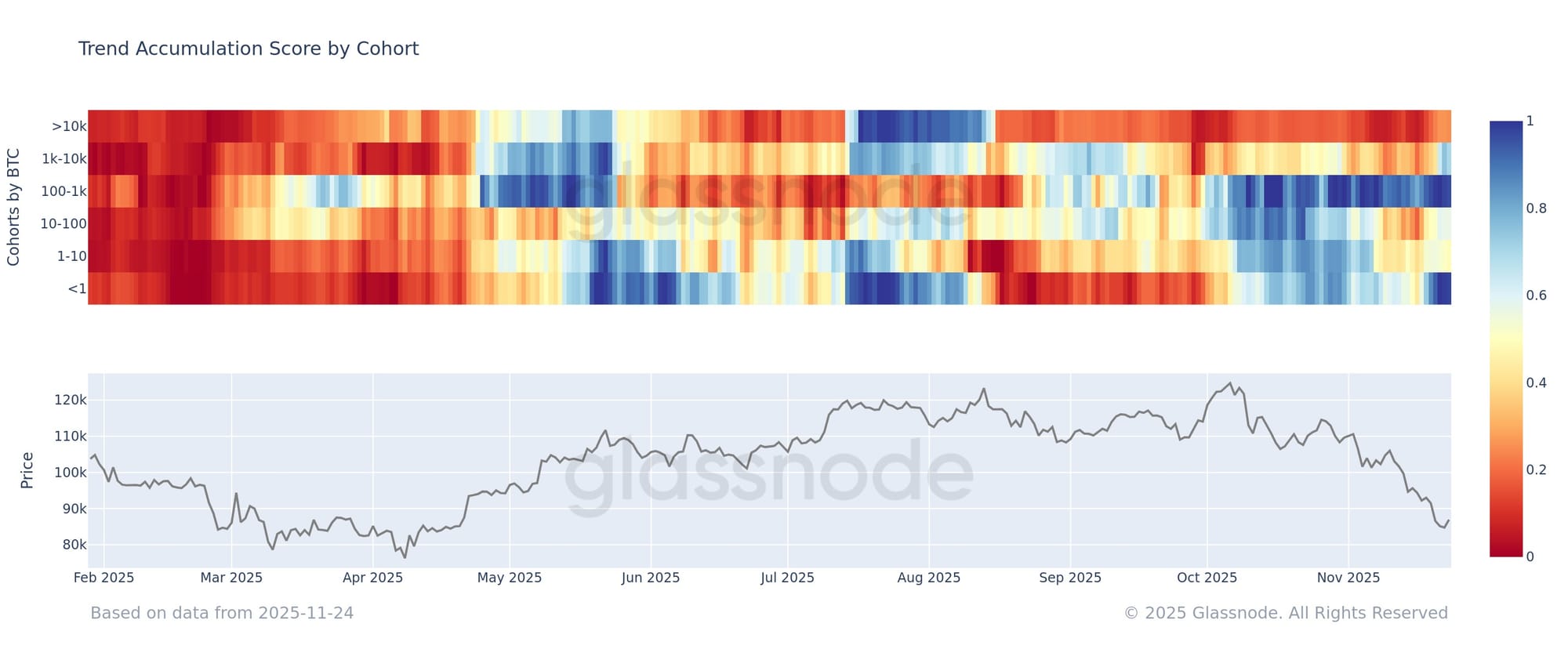

Between August and November, we saw weeks in which basically the entire market—from small to large holders—sold off some of their holdings. In the chart below, you can see this per cohort; red stands for distribution and blue for accumulation.

The past few weeks show a mixed picture. Smaller holders are tending towards accumulation, while larger ones are tending towards distribution. Those are the whales, if you will. According to Glassnode, however, this isn't unique, but aligns with the historical pattern of a market shifting from bullish to bearish.

A closer look at the monthly average spending by long-term holders reveals a clear trend: outflows have climbed from roughly 12.5k BTC/day in early July to 26.5k BTC/day today (30D-SMA).

— glassnode (@glassnode) November 13, 2025

This steady rise reflects increasing distribution pressure from older investor cohorts — a… pic.twitter.com/wECe58CV66

A positive note is that selling pressure across all cohorts seems to be diminishing somewhat. We will have to wait and see if this marks the start of a trend, or merely a pause in a larger sell-off wave.

2️⃣ New Hampshire opens muni market to bitcoin

Peter

News crossed the wire this week that one might easily dismiss as "just another crypto story." New Hampshire has approved the first bitcoin-backed municipal bond. In the financial world, such a bond is called a ‘muni’, not to be confused with ‘money’.

Behind this headline lies a step bigger than the news itself suggests. Not because bitcoin is suddenly being bought with government funds—that is not happening—but because of where this is taking place: right in the most staid, risk-averse corner of the American capital markets.

The bond isn't issued by the state itself, but via the Business Finance Authority: a state agency that gives companies access to the muni market. And that is a world apart. The muni market is the bastion of pension funds and insurers; parties that detest surprises. The rules are strict, the risks minimal, and collateral is rarely used. Most munis simply rely on a city's tax collection or the revenue from the project being financed. Think of building a hospital or a toll bridge.

A bond with hard collateral—real, liquid collateral—doesn't really fit there. Let alone collateral that many view as a speculative investment. But that is exactly what is happening now. A company wants to borrow a hundred million dollars and pledges 160 percent of that amount in bitcoin to BitGo. If collateralization drops toward 130 percent, an automatic liquidation mechanism kicks in. Thus, neither the bondholder nor the state runs any risk.

But why would a company do this? The reason is twofold. First, they don't want to lose their bitcoin; such parties believe their sats will be worth more in the long run. Additionally, the interest rates paid in the muni market are relatively low. And so an attractive scenario takes shape: cheaply raising dollars, maintaining a long bitcoin position, and simultaneously avoiding the taxes associated with selling bitcoin.

The real news isn't in the collateral; borrowing against bitcoin has been possible in the private market for years. The news is in the location. Bitcoin is being admitted here into a market segment that normally remains hermetically sealed to new asset classes. A market where risk is weighed with surgical precision and where only assets deemed institutionally "suitable" get in.

New Hampshire just did something big: it brought Bitcoin into the muni bond market with zero taxpayer risk

— Dylan Wheeler (@_dylanwheeler) November 19, 2025

It turns BTC from something you hold into something that works for the real economy

Borrow against it without selling, keep your upside, and fees flow into an innovation… https://t.co/4t5ceoRZ0R

So New Hampshire hasn't simply approved a bond. A gate has been opened. A small, but symbolically significant opening into a capital market through which billions flow daily.

3️⃣ The FUD of this ‘bear market’

Peter

Bear market in quotation marks, because not everyone is convinced that it has already begun. For our take on that, we encourage you to read the last 3 Markets editions:

- Bear market scenarios

- The handbrake

- The handbrake (not yet) pulled, and now?

The fact is: the price of bitcoin fell up to 36% below the peak in recent weeks. And as you know, that spawns new stories. Narrative follows price. In the bubbles consumers inhabit, stories often amplify sentiment. In bull markets, this tends towards intoxication, and in bear markets towards deep hangovers that descend into exaggerated anxiety and a fixation on FUD.

For instance, quantum dangers are back on the map. Investors are supposedly fleeing out of fear of quantum computers that are on the verge of setting dormant sats in motion.

🚨 Bitcoin's QUANTUM apocalypse is getting closer

— Dr. Hugh Bitt (@Cat_States) November 20, 2025

In 2012: You'd need ~1 BILLION qubits to run Shor's algorithm

In 2025, Google's Craig Gidney dropped it to UNDER 1 MILLION qubits. That's a 1,000x reduction. The chart shows it all.

More algorithmic improvements are likely out… pic.twitter.com/Usc4c8U8ry

Juicy stories are emerging around AI as well. Money in the sector is allegedly being cycled among a select number of parties, resulting in artificially inflated revenue figures and share prices. Bitcoin gets hit hard by the inevitable crash, because AI startups allegedly borrow dollars against bitcoin pledged as collateral and then are forced to sell.

PROOF THAT AI IS A PONZI SCHEME (and why it's the reason for Bitcoin's crash):

— Ricardo (@Ric_RTP) November 21, 2025

Nvidia just posted the most insane earnings in tech history.

$31.9 billion in profit. $57 billion in revenue. 65% profit jump year-over-year.

Stock rallied immediately.

Then 18 hours later, it… pic.twitter.com/vuP19NGu9f

Even the US spot bitcoin ETFs are getting hammered. The major gateways to the bitcoin market have turned into crowded emergency exits. Big capital, which previously couldn't easily leave, now has a comfortable route out. The pump becomes a massive dump.

Bloomberg strategist says #Bitcoin could “go back to $10K.” 🤡 pic.twitter.com/nhdnqbrTjd

— TFTC (@TFTC21) November 19, 2025

After Operation Choke Point 2.0 comes... 3.0! This time, it's the bitcoin companies under fire. Major stock indices are reportedly going to exclude bitcoin accumulators, resulting in lower share prices and business models on shaky ground. Wall Street is allegedly being forced into this by a group of Democrats setting their sights on bitcoin once again.

Operation Choke Point 3.0 is happening in plain sight.

— MDB (@MDBitcoin) November 22, 2025

This needs more attention.

A major index provider is quietly trying to label Bitcoin-heavy companies as “ineligible,” even though every other commodity-linked industry remains fully approved.

No oil producer.

No gold… https://t.co/m633HFuZvf

We could go on like this for a while. The effective FUD contains a grain of truth. Quantum risks exist. There is bubble formation around AI stocks. ETFs have made bitcoin a mature, liquid market. And the place companies with large bitcoin reserves are permitted or required to take in capital markets is indeed under debate.

But none of this is a concrete problem now. In fact, it's not even clear if the mentioned themes are problematic. The evidence presented usually proves only one thing: the narrator's creativity. That ingenuity ensures that the same themes can just as easily return in a bull market in another form, serving as drivers for new price records.

So absorb these reports, but take them with a generous grain of salt. Keep your own investment strategy as your guide, and rest assured: if something truly substantial happens, we'll make sure you know about it!

🍟 Snacks

To close, some quick bites:

- Harvard makes IBIT its largest equity position. New documents reveal that Harvard’s endowment has placed BlackRock’s bitcoin fund at the top of its portfolio. That is a remarkable signal, given the institution is known as cautious and allergic to ETFs. Bitcoin has now received a stamp of approval from even the most conservative asset managers.

- Tether invests in lending platform Ledn. The stablecoin giant has made a strategic investment in Ledn, the platform where users in over 100 countries can take out loans using bitcoin as collateral. Ledn issued over $1 billion in BTC loans this year alone. For Tether, it's a logical expansion: more credit products without people needing to sell their bitcoin, exactly the kind of infrastructure where USDT can play a major role.

- BlackRock also wants to make ether a productive asset. The asset management giant has registered a trust in Delaware named iShares Staked Ethereum, a clear precursor to launching a fund that passes staking rewards on to shareholders. This registration is merely a procedural step; formally, the fund has not yet been filed with the regulator. In early October, fund manager VanEck took a comparable step.

- OCC gives banks green light for on-chain transactions. A new memo reveals that US banks are officially allowed to hold crypto to pay network fees. It sounds minor, but it's a clear change of course: banks are receiving support for using blockchain rails, for instance for settlement and payment traffic. The US government is moving from 'be careful' to 'integrate it'; a quiet but important step towards institutional adoption.

- Regulator SEC dials down the volume. Under Chairman Paul Atkins, the number of crypto cases has dropped by about 30% this year. The tone is shifting from aggressive enforcement to clear rules and dialogue. Combating fraud remains a priority, but the fear of sudden legal actions is decreasing. The result: a sector that dares to build again, without constantly looking over its shoulder.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!