Spectacularly Good and Utterly Disappointing

Bitcoin hovers near its 2025 opening price—a fitting end to a split year. Record ETF inflows meet negative returns. The great rotation continues as $100k shifts from destination to starting point.

For the first time, dictionary.com chose a number - 67 - as its word of the year. Aura farming, broligarchy, and tariff didn't make the cut.

Numbers are the lifeblood of the bitcoin world. Just about everything is numbered, from blocks to BIPs. Every news item revolves around a number. The number of bytes in OP_RETURN, the number of bitcoins in Saylor's vault, and the number of basis points Powell will hand out this time.

And the price, of course.

But we'd rather not talk about that this holiday season. Never before has the gap been so wide between the price and practically every other metric. It was a spectacularly good year and at the same time an utterly disappointing one.

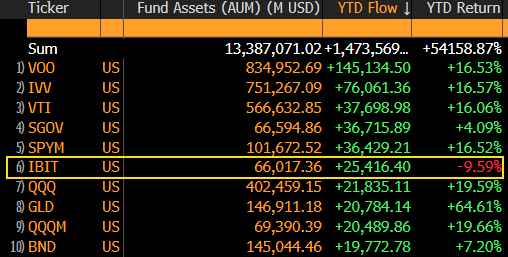

The Bloomberg overview below, shared by ETF expert Eric Balchunas, captures the two faces of 2025 in a single image.

BlackRock's IBIT, the largest bitcoin ETF, ranks sixth in the list of ETFs with the highest capital inflows. Nestled between the S&P 500 and Nasdaq 100, and two spots above the largest gold ETF. Spectacular. But it's also the only one on the list with a negative return. Disappointing.

Over the past two years, 'digital gold' has crossed over from early adopters to the early majority. We wrote extensively about this in last week's Markets.

Bitcoin became attractive to the masses but lost some of its charm for the old guard. They look back wistfully to the days when bitcoin was still rebellious, a peaceful protest, a cryptographic indictment. Bitcoin was supposed to restore sovereignty to the individual and offer an escape from the destructive economic policies of their local dictator.

The lavish embrace by major financial institutions makes the reference to the bank bailouts in the first bitcoin block somewhat ironic. Just as it's ironic that people in emerging economies seem to prefer digital dollars after all.

Is the marriage to Wall Street a necessary stepping stone on the path to a world where bitcoin plays a meaningful role as independent and neutral money? Or does a muzzled and leashed bitcoin have no reason to exist, and did we witness the beginning of its decline this year?

These bittersweet reflections remind me of the early 2000s. About a decade after Tim Berners-Lee made the World Wide Web accessible to the public in 1993, the internet lost its wild side. Pioneers and pirates were tamed by laws and irresistible apps from tech companies.

It's part of a technology coming of age. The internet has certainly not faded into obscurity.

It's normal, wrote Jordi Visser in the widely read piece Bitcoin's Silent IPO, for an IPO to come with a change in shareholders. You often see a rotation from founders, employees, and early investors to a broader group of investors. As a result, the price tends to stagnate for a while.

We called this the great rotation back in late summer:

A massive rotation is underway. Old investors are (partially) exiting and passing their bitcoin on to a new group. This has been happening for a year at a pace of $1.3 billion per day.

A pile-up of narratives gave every bitcoiner a custom-tailored nudge. Finally reached the long-awaited milestone of 100k. Time to look ahead and diversify. Quick, pivot to AI and gold. And according to the halving cycle myth, the top should come in October, so I'd better sell now.

A tremendous amount of bitcoin hit the market, without us even coming close to this year's price targets. These aren't new investors taking profits after a euphoric bull run, because there was no euphoric bull run. This is the Silent IPO.

For this group, $100,000 was the destination. For new investors, $100,000 is the starting point.

Since the launch of the spot bitcoin ETFs in January 2024, $700 billion in new capital has flowed into the bitcoin market, calculated using the realized price in on-chain data. That's nearly twice as much as during the entire 2019-2021 bull market.

In the tragedy of 2025 lies the hope for 2026:

The amount of bitcoin held by investors selling based on these narratives is limited and shrinking. After all, you can only sell your bitcoin once.

The amount of dollars held by investors now entering at $1.3 billion per month is practically unlimited. If just 1% of the $305 trillion in global financial assets (BCG, 2024) were to flow into bitcoin, that would be enough to sustain $1.3 billion per day for 6 years.

Bitcoin currently trades at $89,000, just below the 2025 opening price of $93,300. It would be fitting to close the year (barely) in the red, as a final nail in the coffin for the idea that the halving cycle determines price. The pattern of "three green years followed by one red year" can then join the heap of debunked beliefs.

A symbolic end to a year that was both spectacularly good and utterly disappointing.

We don't expect much action in the final days of the year. It's the holiday season and many investors have closed their books. We likely won't see a new short-term trend until early 2026.

That means I'm entering the new year with the following base case scenario.

1. Secular (long-term)

My secular investment thesis for bitcoin is continued adoption as digital gold and prices of (well) over $1 million sometime between 2030 and 2040.

Bitcoin is attractive because of the asymmetry between the two extreme outcomes: million (success) or zero (failure). From the current price, the potential upside is $920k and the potential downside is $80k.

2. The market cycle

I expect we've seen the top of the yearly cycle and are now heading toward a yearly cycle low (YCL).

The probability distribution from the November 14 Markets edition remains unchanged:

- Resumption of the bull market: 30%

- A period of sideways action: 40%

- A mild bear market: 20%

- A deep bear market: 10%

3. Weekly cycle

I expect November 21 was the weekly cycle low (ICL), and we'll soon begin a relief rally. A price target around $110,000 is realistic—enough to get investors excited again, but still a clear lower high (LH) on the weekly chart.

A weekly close above $95,000 and a signal from the oscillator at the bottom of the chart would confirm a new weekly cycle. That's not the case yet.

An alternative scenario is that we take another step down in early January before a new weekly cycle begins.

4. Short-term

The short-term trend is still down. We're below the moving averages that accompany this trend. A breakout above the array of descending lines on the chart below would confirm a new short-term uptrend.

I expect we'll continue to drift around $90,000 over the coming week. Holidays, year-end dynamics, low liquidity. But it won't be long before the market picks a direction.

Final thoughts

New to Bitcoin Alpha? In 2023, we wrote several foundational pieces about our perspective on the crypto market. These can be useful background on our approach, assumptions, and scenarios.

All previous editions of Alpha Markets can be found in the archive. Questions, comments, and suggestions are always welcome in the community.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!