Order Out of Chaos

From chaotic stock indices to a crypto jungle: AI tokens, wild whale trades, and tokenized equities are rewriting the financial playbook. Is decentralized finance set to upend old power dynamics? Discover how Grayscale, Wynn, and Kraken are shaping the future.

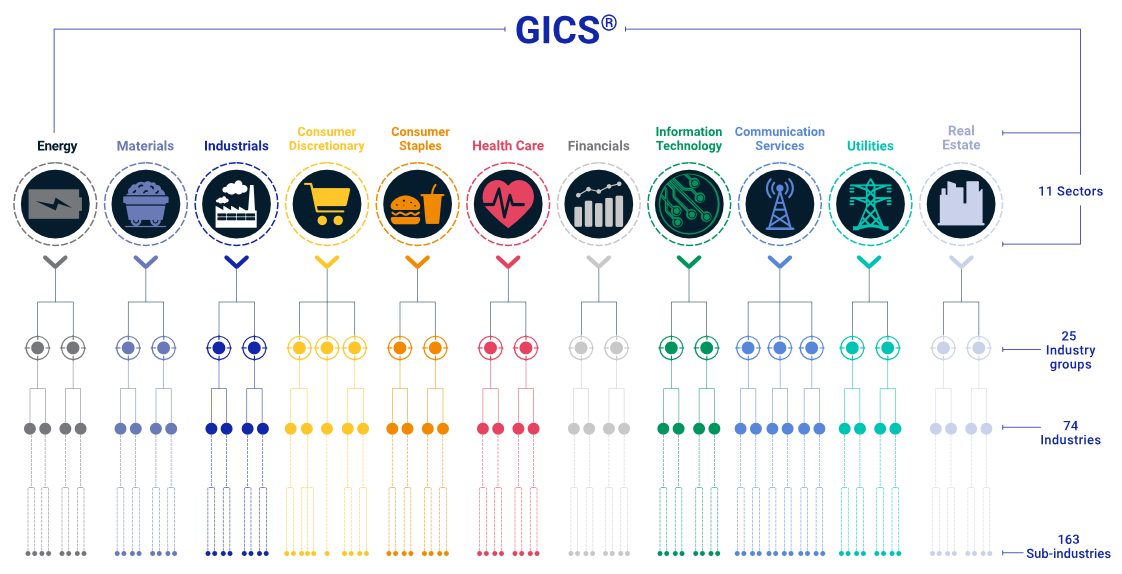

In the 1990s, a notable phenomenon emerged on stock exchanges: investors could follow everything, yet it became increasingly difficult to make sense of it. Companies like Apple, ExxonMobil, JPMorgan, and Walmart—vastly different in nature—were all lumped together in indices, much like wandering through a department store without distinct sections. Then, in 1999, MSCI and S&P declared that this had to change.

They introduced the Global Industry Classification Standard (GICS), a system that assigns every publicly traded company to a specific sector—from Financials to Healthcare, from Real Estate to Consumer Discretionary. Suddenly, investors could compare like with like, apply sector rotation strategies, and build ETFs that truly resonated. The chaotic department store transformed into a well-organized supermarket with clearly defined aisles, making investing more transparent and professional.

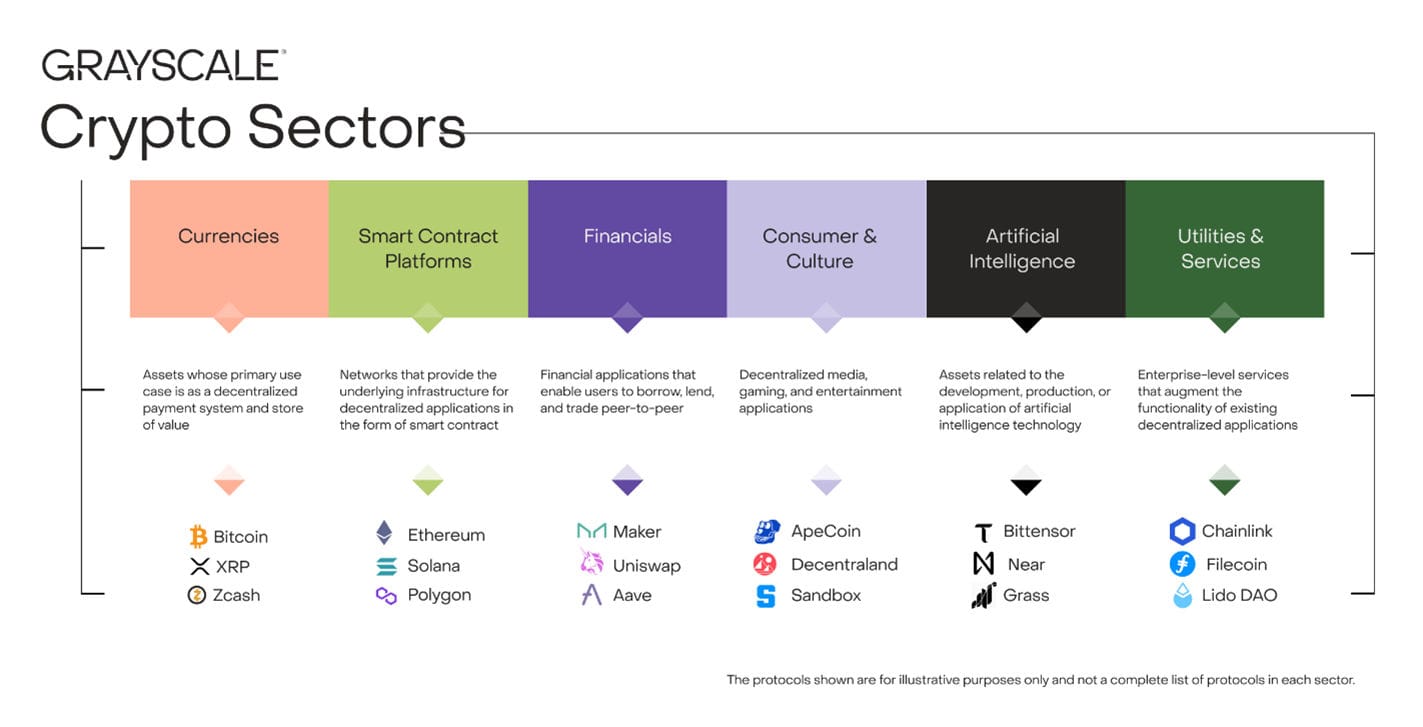

Fast forward to 2025. The crypto world now appears similarly chaotic—memecoins mixed with serious infrastructure, casinos alongside decentralized exchanges, and AI protocols coexisting with stablecoins. Fortunately, several key players are striving to introduce order. For instance, Messari and Grayscale are employing their own patented GICS-like system, developed in collaboration with index builder FTSE Russell.

Their system, known as Crypto Sectors, already features robust categories similar to the stock market: Currencies (e.g., bitcoin), Smart Contract Platforms (e.g., Ethereum, Solana), Financials (DeFi), Consumer & Culture (NFTs, games), and Utilities & Services (infrastructure).

And this week, a sixth category was added: Artificial Intelligence.

Grayscale asserts that the convergence of AI and crypto has evolved into more than mere hype. Just two years ago, this sector didn't even have a name. Today, it encompasses 20 tokens with a combined market cap of $21 billion (compared to only $4.5 billion in Q1 2023). These aren’t merely visionary whitepapers—they represent active networks with users, revenue, and tangible growth.

Consider Bittensor, which Grayscale regards as the flagship of the sector. It’s an open network where AI models compete for rewards while collaborating on a collective learning process. Users earn TAO tokens for their contributions, and the network is increasingly segmented into 'subnets'—small, specialized AI projects within the broader ecosystem. Remarkably, its token even follows a bitcoin-like halving model, underscoring its serious ambitions.

Then there’s Grass, a network that gathers data worldwide for AI labs—not via a Silicon Valley data center, but through millions of browsers globally. This decentralized approach to web scraping has paid off: according to its founder, Grass now generates tens of millions in annual revenue.

Wow - $GRASS has effectively confirmed it’s selling data, at scale, to major LLM players citing “mid 8-figure revenue.”

— Richard Galvin (@richwgalvin) March 28, 2025

Based on it's latest daily scrape volume (entirely demand-driven) and pricing - assuming 90% cheaper than the lowest-cost residential proxies at scale - we… pic.twitter.com/nx5sLMdFeN

Then there are AI agents from platforms like Virtuals and ElizaOS—software that acts on your behalf by searching, comparing, and even processing payments. They enable microtransactions in real time without relying on Visa or PayPal, something traditional systems can’t offer but blockchains can, according to Grayscale. With the rise of stablecoins (including a new standard from Coinbase designed specifically for agents), it seems something truly exciting is on the horizon.

Grayscale now categorizes the sector into three segments: AI Platforms (e.g., Bittensor and Near), AI Tools & Resources (e.g., Grass and Akash), and AI Apps & Agents (e.g., Virtuals and Story Protocol). While the exact criteria for selection aren’t entirely clear, one requirement is that AI isn’t just an add-on—it must be central to the protocol.

Introducing the Artificial Intelligence Crypto Sector.

— Grayscale (@Grayscale) May 27, 2025

The #AI Sector includes 20 tokens with a combined market capitalization of $20 billion — up from just $4.5 billion in Q1 2023*.

Learn more about the AI Crypto Sector: https://t.co/LmvVvv9WHr

*Source: Artemis, Grayscale… pic.twitter.com/xrlPMBYK2o

Why does this matter? Because AI is currently controlled by a handful of companies—OpenAI, Google, Meta, and Amazon. Their computing power, data, and models are all centralized. While this setup is convenient, it also carries risks: bias, censorship, and a lack of transparency. Essentially, you have to hope everything turns out well.

Decentralized alternatives are trying to break this cycle by building open networks, leveraging public datasets, and offering transparent models. But that only works if the infrastructure cooperates—if data can be shared without intermediaries, payments processed without permission, and access provided to everyone rather than just employees of tech giants.

That’s why, in Grayscale's view, crypto and AI are a natural fit.

Crypto provides a framework for AI—facilitating access, rewards, and ownership, as well as enabling agents to operate autonomously with real-time financial flows. And admittedly, that really captivates us—not merely because of the hype but because it encapsulates the promise of decentralized technologies: redistributing power, returning ownership to individuals, and breaking open closed systems.

Grayscale believes this deserves its own category, and we'll be keeping a close, respectful eye on it!

More Alpha

Are you Plus-member? Then we’ll continue with the following topics:

- Interest in the dollar is steadily declining

- ‘Wynn’ loses $20 million on Hyperliquid

- Kraken wants to reinvent the stock market

1️⃣ Interest in the Dollar is Steadily Declining

Peter

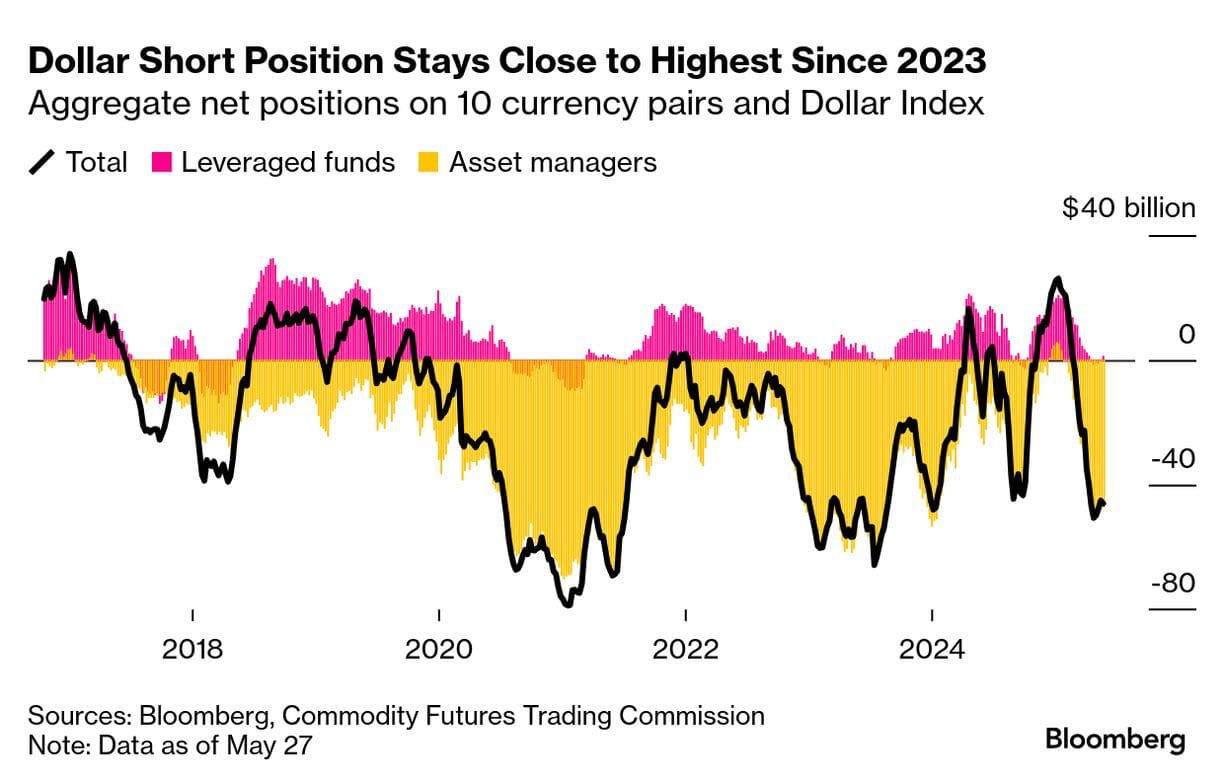

The dollar is experiencing its worst year in decades. Since January, it has fallen by more than 7% against other major currencies. According to Bloomberg, sentiment among currency traders is the most negative it has been in five years. Major banks like JPMorgan and Deutsche Bank expect further weakness—even as American stocks continue to rise.

The primary reason is political uncertainty. Since Donald Trump returned to the White House, economic policy has become erratic—import tariffs are announced, withdrawn, and then reintroduced. With the market unable to predict the next move, investors are seeking refuge elsewhere. Even a brief truce in the trade conflict with China only provided a short-lived rebound for the dollar.

Strategists at Goldman Sachs are even talking about the end of “American exceptionalism.” Asian countries, including Taiwan, are now urging banks to reassess their exposure to U.S. government bonds. In options markets, there’s heavy betting on further declines in the dollar, suggesting that investors are preparing not for a temporary dip, but a long-term shift.

“US exceptionalism is eroding gradually, and these moves have longer to run.” – Kamakshya Trivedi, Head of Forex at Goldman Sachs

Against this backdrop, ECB President Christine Lagarde spoke in Berlin on Monday about a “global euro moment.” She sees the dollar’s decline as a unique opportunity to anchor the euro more firmly as an international currency. Lagarde remarked, “This is a prime opportunity for Europe to take greater control of its own destiny.” She believes that if European governments address structural economic challenges, it could lead to lower interest rates and better protection against geopolitical risks.

Ken Rogoff, former chief economist at the IMF and a Harvard professor, also sees the dollar’s hegemony crumbling. In his new book Our Dollar, Your Problem, he points to an overlooked factor: the rise of crypto in the global shadow economy. In sectors like tax evasion, capital flight, and informal labor—once dominated by hundred-dollar bills—bitcoin and stablecoins are becoming increasingly popular.

According to Rogoff, this shift has tangible consequences: lower demand for dollars could lead to higher U.S. interest rates as the country loses part of its “exorbitant privilege.” He estimates that the underground economy accounts for roughly 20% of global GDP—a massive market where crypto is increasingly used as a medium of exchange.

Notably, aside from a few finance influencers, no one expects the dollar’s status as the reserve currency to vanish overnight. But the shift is underway—not towards a single new leader, but towards a world where multiple currencies coexist: the dollar, the euro, the renminbi, gold, and bitcoin. This gradually undermines the unique position the dollar has held for decades.

This development is significant for investors. A weaker dollar makes American exports cheaper, but it can also trigger global inflationary pressures. Gold has already risen 20% this year as an alternative store of value, and bitcoin benefits not only as a hedge against inflation but also as a digital counterbalance in an era where confidence in traditional currencies is waning.

The question, then, is not only who wants the dollar, but what vision you have for its replacement.

2️⃣ ‘Wynn’ Loses $20 Million on Hyperliquid

Erik

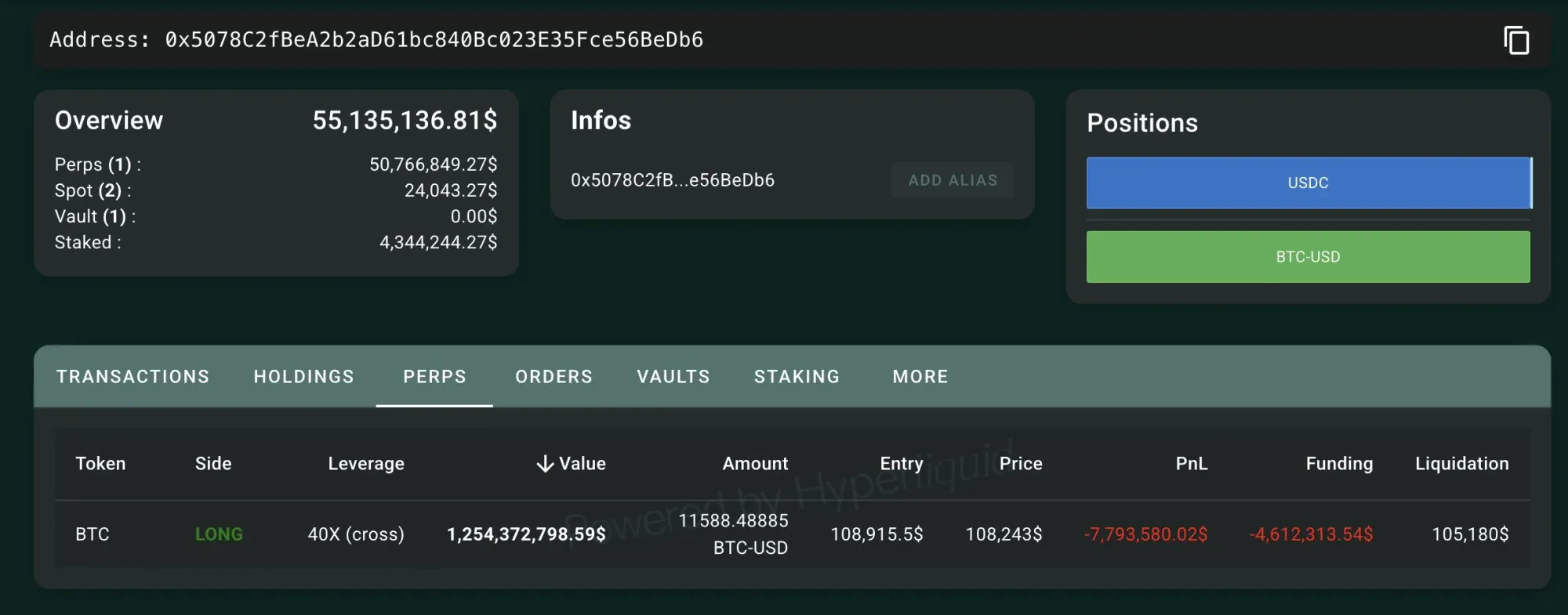

Crypto continuously produces new jargon. Last week’s standout term? The Hyperliquid Whale. In a relatively quiet week, all eyes suddenly turned to a series of outrageous trades on the decentralized exchange Hyperliquid, featuring none other than James Wynn.

Wynn, dubbed “the whale,” wagered $30 million on a bitcoin rally using 40x leverage—meaning for every dollar he invested, he borrowed an additional 39. This gave his position a total value of $1.2 billion.

Such a massive position carries significant volatility risk—every percentage point change is magnified 40 times, yielding either huge gains or crushing losses. Attractive if the move is in your favor, but brutal if it isn’t. For Wynn, the rule was clear: if bitcoin fell more than 2.5%, he would wipe out his entire investment. No safety net, no margin calls; decentralized perpetual exchanges simply don’t operate that way.

Wynn managed to avoid total collapse. His position swung from a $40 million profit to a $20 million loss before he closed it, eventually finishing $10 million in the red after a sudden price drop triggered by a remark from Trump about EU import tariffs.

Not content to stop there, Wynn injected more capital and opened a new position—a $1 billion short. Unfortunately, when BTC’s price rose, he had to close this position too, incurring another loss of about $10 million.

However, this doesn’t necessarily mean the whale was recklessly gambling on a massive scale. The figures refer to one wallet traced back to Wynn, and we can’t confirm whether he held additional positions to hedge his risks.

Various estimates of Wynn’s losses also exist. Data from HyperDash, which tracks his trading over recent weeks, suggests the losses might be even steeper—up to $42 million lost in just seven days.

Apparently, Wynn isn’t too fazed by it all, as evidenced by his tweet:

The perps casino was fun. Zero regrets. Flipping $4m to $100m and back down to -$13m is one hell of a thrill. Hope many of you enjoyed it as much as I did.

— The Meme Farther (@JamesWynnReal) May 30, 2025

Most wouldn’t dare or dream to place these kind of trades. Well, they can’t, they don’t have the money to do so, nor the…

This anecdote underscores the rapidly growing scale of Hyperliquid. The platform’s developers launched it without opening its underlying blockchain network to other applications. With the total value of all open positions now exceeding that of Deribit—and already about a quarter of Binance’s—it’s expanding into a full ecosystem of applications.

As for Wynn, whether he’s a hero, a daredevil, or simply extremely wealthy remains to be seen. But one thing is clear: Hyperliquid has found its poster boy.

3️⃣ Kraken Wants to Reinvent the Stock Market

Erik

American exchange Kraken announced that it will soon offer tokenized equities—shares packaged as tradable tokens that transform traditional financial instruments for the blockchain age. Kraken’s crypto rendition of stocks will be known as xStocks.

Today we’re announcing our new partnership with @BackedFi for the launch of xStocks on @Solana 🚀@xStocksFi will offer tokenized versions of U.S.-listed equities, available soon to eligible Kraken clients in select non-U.S. markets.

— Kraken Exchange (@krakenfx) May 22, 2025

A new layer of market access, built on… pic.twitter.com/eXUnpHDipF

These xStocks represent American stocks and ETFs that can be traded outside the United States. After launch, Kraken clients will be able to purchase tokens such as AAPLx—a token representing an Apple share that tracks its price.

Why is this useful? Kraken summarizes it well:

“Have you ever asked yourself: Why can’t I trade stocks at 2 a.m.? Why is it still so difficult and expensive to access U.S. equities from outside the U.S.? Can’t crypto fix that?”

The xStocks tokens can be stored on Kraken or in external crypto wallets, meaning they can be transferred to other users or integrated into DeFi applications. This not only makes stocks more globally accessible but also opens up new financial possibilities—think fractional ownership or real-time dividend payouts via smart contracts.

Tokenized Equities?

Tokenized equities are digital representations of actual stocks, issued on a blockchain. The concept is similar to that behind stablecoins— for every digital token in circulation, the issuer holds an equivalent asset in reserve. To redeem it, you simply return the token.

Similarly, Kraken will need to maintain ‘real’ stocks in reserve. This is managed by the exchange in partnership with Backed Finance, allowing the stocks to be redeemed for cash.

The idea has existed for some time, but it never really took off—perhaps due to a challenging entrepreneurial climate in the US, with unclear laws and regulations. Now that the environment is shifting and collaboration with traditional institutions is becoming feasible, there’s finally an opening for players like Kraken to launch such offerings. Even major institutions such as Franklin Templeton are now venturing into this market.

Bridge Between Stocks and Crypto

Through xStocks, Kraken aims to bridge the gap between the traditional stock market and the crypto world. With everything available on one platform—bitcoin, other cryptocurrencies, stablecoins, and stocks—the line between traditional finance and crypto is blurring. While Kraken has yet to announce which countries will see xStocks first, one thing is clear: American users will be excluded.

KRAKEN TO LAUNCH TOKENIZED U.S. STOCKS FOR GLOBAL USERS

— *Walter Bloomberg (@DeItaone) May 22, 2025

Kraken, a U.S.-based crypto exchange, will soon let non-U.S. users trade tokenized versions of popular U.S. stocks like Apple, Tesla, and Nvidia. These digital tokens, called xStocks, will trade 24/7 on the Solana…

🍟 Snacks

Finally, here are some quick bites:

- FTX has started its second round of creditor payouts. In total, over $5 billion will be distributed, with payouts of up to 120% for so-called convenience claims. Clients will receive their funds via BitGo or Kraken within 1 to 3 business days. FTX also warns of phishing attempts, as criminals are trying to steal creditors’ money through fake client portals.

- The SEC will not interfere with memecoins like $TRUMP. Commissioner Hester Peirce cautions that investors should not expect regulatory protection—even though these tokens can be extremely volatile. With President Trump’s influence in the crypto world growing, she emphasizes: “Buy at your own risk.”

- Bitcoin companies with BTC-rich treasuries stole the show at Bitcoin 2025. They have become the largest buyers in the market, and this trend is expected to continue. Companies like MicroStrategy, Nakamoto, and Asset Entities are making significant purchases—an estimated $30 billion in BTC is anticipated for the coming year. From bonds to crypto loans and leveraged structures, these companies are not only strengthening their balance sheets but also the market.

- Trading volume on decentralized exchanges climbed to $474 billion in May—the second highest ever. BNB Chain set records with $178 billion, partially due to airdrops and promotional campaigns. Hyperliquid, a DEX for derivatives, recorded a monthly volume of $248 billion and earned $70 million in fees, highlighting how quickly decentralized platforms are gaining market share.

- Trump Media raised $2.44 billion to build a bitcoin treasury. The company behind Truth Social sold shares and convertible bonds, joining a rapidly growing group of firms emulating the Saylor model. According to CEO Devin Nunes, the capital infusion “provides the financial freedom to roll out new acquisition strategies.” Shareholders, whether they like it or not, are now gaining exposure to bitcoin.

- Banco Santander plans to offer crypto services to customers of its digital bank Openbank. Spain’s largest bank is also in the early stages of developing its own stablecoin. This move comes on the heels of new EU regulations for digital assets, as Santander joins other banks aiming to bolster their presence in the crypto sector.

- Kazakhstan is launching a pilot zone called ‘CryptoCity,’ where you can pay with crypto—even for real estate. President Tokayev aims to boost digital asset adoption by creating a regulated testing environment, part of Kazakhstan’s bid to become a crypto hub in Central Asia. According to Tokayev, a crypto economy doesn’t begin with laws, but with a space to experiment.

- Pakistan intends to establish a strategic bitcoin reserve. During Bitcoin 2025, crypto minister Bilal bin Saqib announced that the country plans to hold bitcoin as a long-term reserve, inspired by the American example. Meanwhile, Pakistan is allocating 2000 megawatts of power to mining and AI centers, despite internal conflicts with the central bank, which maintains that crypto is banned.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!