Now What?

No Uptober, no $400k moonshot. Bitcoin has crashed 35% as sentiment turns extremely pessimistic. With investors capitulating for the first time this cycle and rumors of a major collapse, has the bull market officially ended?

BREAKING: Eric Trump says Q4 will be "unbelievable" for your crypto bags. (source)

Well, it turns out the son of the American president was right. In the ten years we've been following the crypto market, we've rarely seen such a massive gap between what investors expected for the near future and the actual outcome.

bitcoin is going to 400k by the end of this year — Udi

No Uptober and no Moonvember. No blow-off top to $400,000. In less than two months, market sentiment has turned extremely pessimistic. The majority is now anticipating a period of weakness, somewhere on the spectrum from a deep bull market correction to a full-blown bear market. A swift resumption of the bull run now seems almost out of the question.

Four underlying trends are shaping the market:

- Early investors are taking profits around the $100,000 mark.

- Investors are selling and moving into AI stocks and gold.

- Investors are selling due to the mythical four-year cycle top.

- Investors are selling because they've hit the brakes and de-risked.

Meanwhile, macroeconomic conditions also worsened due to the U.S. government shutdown and the resulting lack of economic data, tight liquidity in the bond market, and a sense of vertigo among AI investors.

Viewed this way, it's no surprise that sellers outnumber buyers. More supply than demand. Consequently, the price drops to stimulate more demand. Because that, in essence, is what a market does: it balances supply and demand.

Rumors are circulating that major players ran into trouble during the October 10th flash crash. Tom Lee, CIO of Fundstrat, told CNBC that he expects a major market maker to have a 'hole in its balance sheet,' forcing it to dump bitcoin.

Right after October 10th, we also said that we expect some 'bodies to surface.' The most likely scenario is that large arbitrageurs were hit, those who were running a delta-neutral strategy that suddenly was no longer delta-neutral.

In such a trade, you have two positions, one long and one short, which cancel each other out. Until one of them is suddenly closed. In this case, it was the short position, due to the auto deleveraging (ADL) mechanism on perpetual exchanges. You are then left with only the long position, which becomes less valuable as the price falls.

It's a plausible story, but we have no proof. But even if it turns out to be untrue, it is currently contributing to the fear and uncertainty in the market.

When we add all this up—the four trends, the macroeconomic context, and the shock of October 10th—it sufficiently explains why the price has fallen by 30% in four weeks. The low point, at $81,600, is now 35% below the top of $126,100.

This brings us to two questions.

- I haven't exited yet, now what?

- I did exit, what’s next?

If you haven't read last Friday's and this past Monday's Alpha Markets updates, it would be helpful to do that first.

Our base case is that the uptrend on the weekly chart is over, and thus, so is bitcoin's cyclical bull market. This doesn't automatically mean we are now at the beginning of a long and deep bear market. We described four possibilities:

- Resumption of the bull market

- A period of sideways movement

- A mild bear market

- A deep bear market

A swift resumption of the bull market would invalidate our base case. The other three options are variations of our base case.

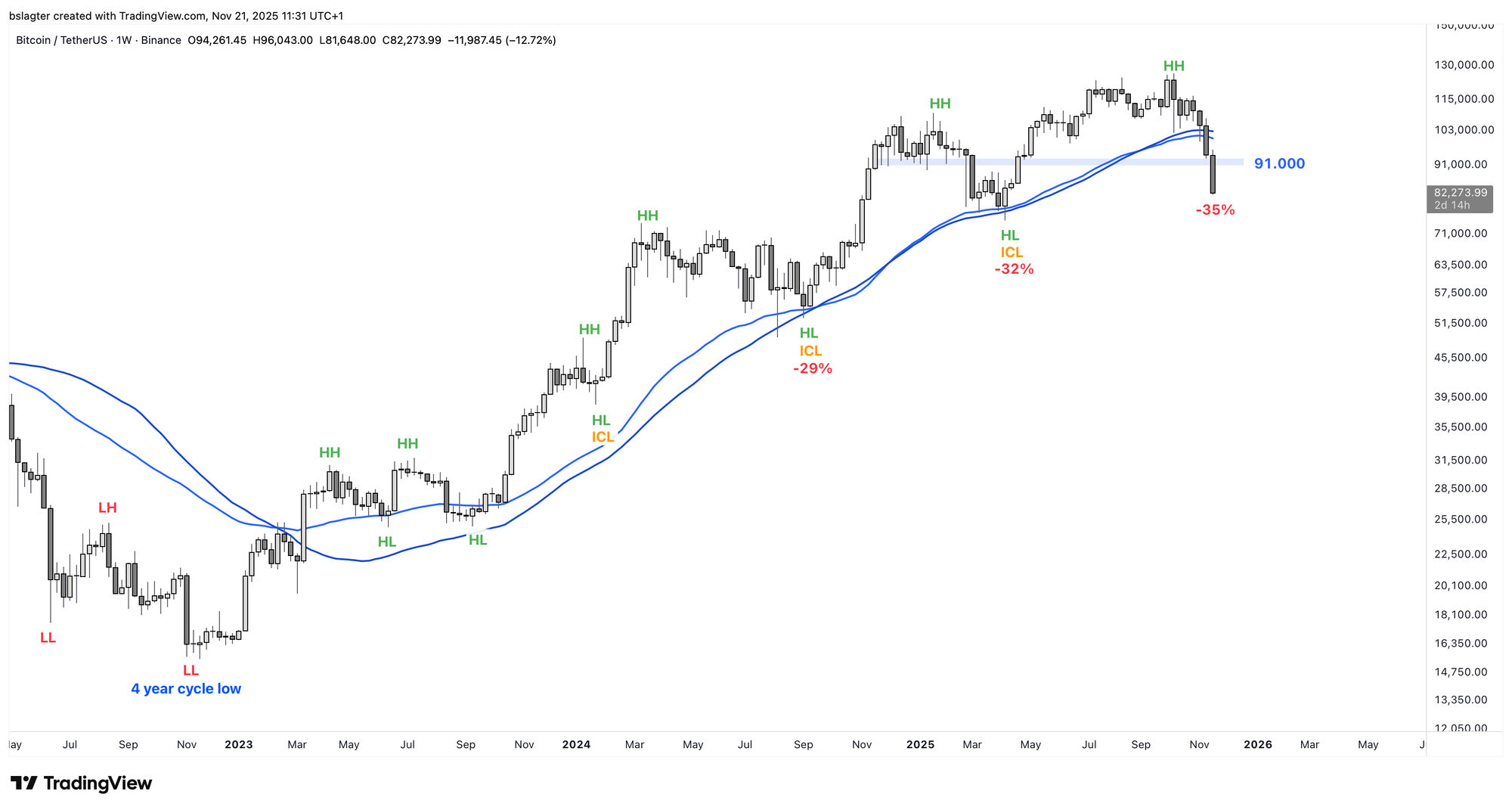

The sharp price drop over the past week and the deteriorating macroeconomic picture are arguments for the end of the bull market. But we will only get definitive confirmation when we first set a lower high (LH) on the weekly chart.

It's likely that we will start a new period of ascent sometime in the coming weeks, the beginning of a new weekly cycle:

- Will it take us to a new all-time high? That would be a higher high (HH) on the weekly chart, and thus a continuation of the bull market. Scenario 1.

- Will it take us to a top that is lower than $126,000? That would be a lower high (LH) on the weekly chart, and thus confirmation of the end of the bull market. Scenarios 2 through 4.

In any trend (up or down), you have counter-trend movements. In a bull market, we call that a correction. In a bear market, a relief rally or counter-trend rally. The beginning of a weekly cycle is always upward, even in bear markets.

The question is when we will get such a rally, and how high it will go. I actually expected it sooner. This downward move has been very persistent. There are analysts who suspect an unnatural cause, a party systematically liquidating a huge position. This results in selling pressure that is insensitive to the price.

With each waterfall drop, another group of investors decides to sell. Either because they are following their plan, or because they cannot tolerate the loss. Supply increases while demand stays away.

In a rising market, sellers postpone their sales (because they'll get more for it tomorrow), and in a falling market, buyers postpone their purchases (because it will be cheaper tomorrow). The result is a chart like the one below.

‘I haven’t exited yet, now what?’

This morning, the price was at $82,000. You might be thinking: if only I had hit the brakes on Monday, I would have exited at $92,000. Maybe you're kicking yourself, thinking you made the wrong decision.

But what if we had seen a recovery to $102,000 in recent days? Then you would probably have been glad you waited a bit longer.

Hindsight is always 20/20. Making decisions under uncertainty means thinking in probabilities. You weigh them with the knowledge you have at that moment, always trading off potential profit against potential loss.

If you do one thing, you can't do the other. If you exit, you miss the drop from $92,000 to $82,000, but you also miss the rise from $92,000 to $102,000. And you don't know beforehand which of those two paths we will take.

Now there are three possibilities.

Option 1: You sell anyway. This is a reasonable option if you've discovered that a price of $82,000 is beyond your pain threshold.

Option 2: You decide to hold your position through this bear market. This is a good option, especially for investors who started with bitcoin recently and still have a modest position. In previous bear markets, we often saw new investors hodl their initial purchase and use the bear market to build a larger position and lower their average purchase price through dollar-cost averaging (DCA).

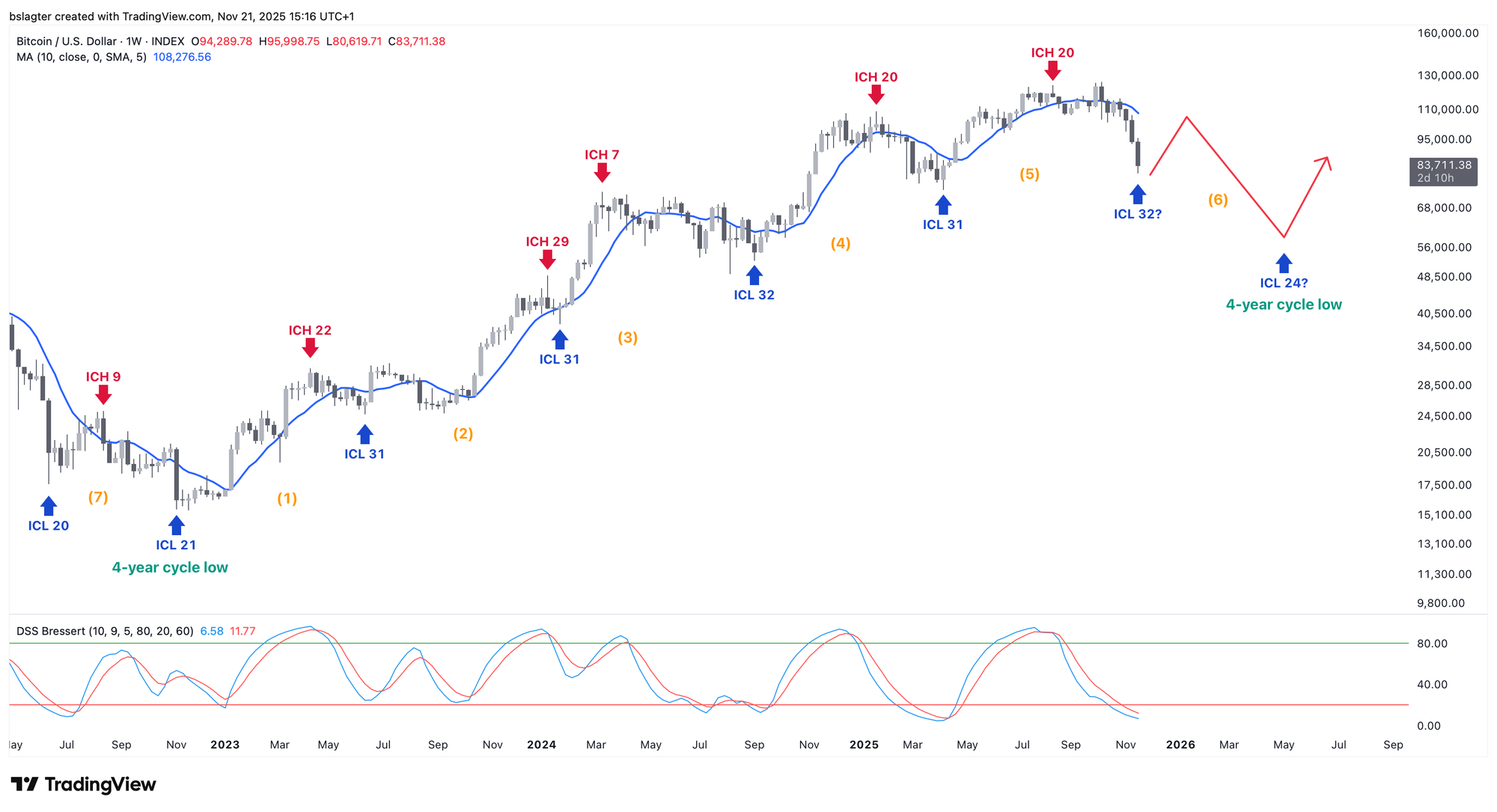

Option 3: You wait for the relief rally, the start of the new weekly cycle. In our base case, this rally ends below the all-time high of $126,000, but it is entirely reasonable to expect that we will get above $100,000.

This could be a decent approach. Wait until the price has risen above $100,000, and then set a stop-loss at $92,000. That way, we're at least at the same price as Monday's "hit the brakes" level. But if it turns out the bull market is continuing after all, we also capture that upside.

A relief rally could look like this on the weekly cycle chart.

‘I did exit, what’s next?’

I have heard from many people that they (partially) exited between Saturday and Monday, and that it feels great.

We must realize that it's mostly "luck" that the price continued to fall to $82,000 (-$10k). Because for all we know, we could have been at $102,000 (+$10k) now, and it might have felt different.

I am especially proud that these Alphas followed their plan, not that it immediately paid off in the next few days. After all, it's a plan for months, not days.

Some have a clear destination for their realized profits. I heard about renovations, vacation homes, and sabbaticals, and of course, diversification into other asset classes.

Others have the main goal of buying back bitcoin during the bear market, preferably more than they had before. How do you approach that?

Option 1: You use the dominant moving average as a signal again. For example, by entering on a weekly close above the 50-week moving average.

Option 2: You buy back a portion periodically or at specific price levels. This way, you buy at roughly the average price of the bear market.

Option 3: You look for well-known bottom signals, such as the collapse of crypto companies, scathing columns from the ECB, and journalists triumphantly dancing on the crypto market's grave.

That last option could be tricky. After all, the well-known top signals didn't work either. It's quite possible that the market's fundamental character has changed over the past two years. No manic peaks in the bull market and no depressive troughs in the bear market.

It pays to prepare for a few difficult moments. For example, if the price recovers to above the 50-week moving average and then begins a real bear market, as in 2022 (A). Or if we get a period without a clear trend, where the price fluctuates around the dominant average (B).

The chart below, by the way, is scenario 2 of the bear market scenarios: "a period of sideways movement."

If we do indeed get a new weekly cycle soon, and the price recovers to above $100,000, you can count on faith, confidence, and enthusiasm returning as if nothing happened. The bulls will get loud again, predicting a swift rise to new all-time highs.

They might be right, but last week we gave that scenario only a 30% chance. And that chance hasn't gotten any bigger this week.

In a bull market, it pays to be bullish because the optimists are right more often than the pessimists. In a bear market, it works exactly the other way around.

If we break above $126,000 and set new all-time highs, then it will be time enough to throw all bear market scenarios in the trash and become bullish again.

Until then, our base case is that the bull market is over.

Whatever the coming months may look like, our long-term vision remains unchanged.

We expect governments worldwide to stimulate their economies, and central banks to support this with accommodative monetary policy. We expect exponential technology, such as AI and robotics, to remain an engine of economic growth.

This is a favorable secular environment for (a) risk assets, (b) real assets, and (c) scarce assets. Bitcoin fits very well into a portfolio tailored to this outlook.

We also expect the trend of existing investors adding a small amount of bitcoin to their portfolios to remain intact, driven either by their financial advisors or by purchasing some ETFs or spot bitcoin themselves.

From that (more fundamental) hypothesis, a bear market or a deep bull market correction might also be, above all, an opportunity!

We will continue with the following in-depth topics:

- Capitulation & Realized Loss

- What's Driving the Price Drops in Bitcoin and Stocks?

- Nvidia Offers Hope for a Longer Bitcoin Bull Market

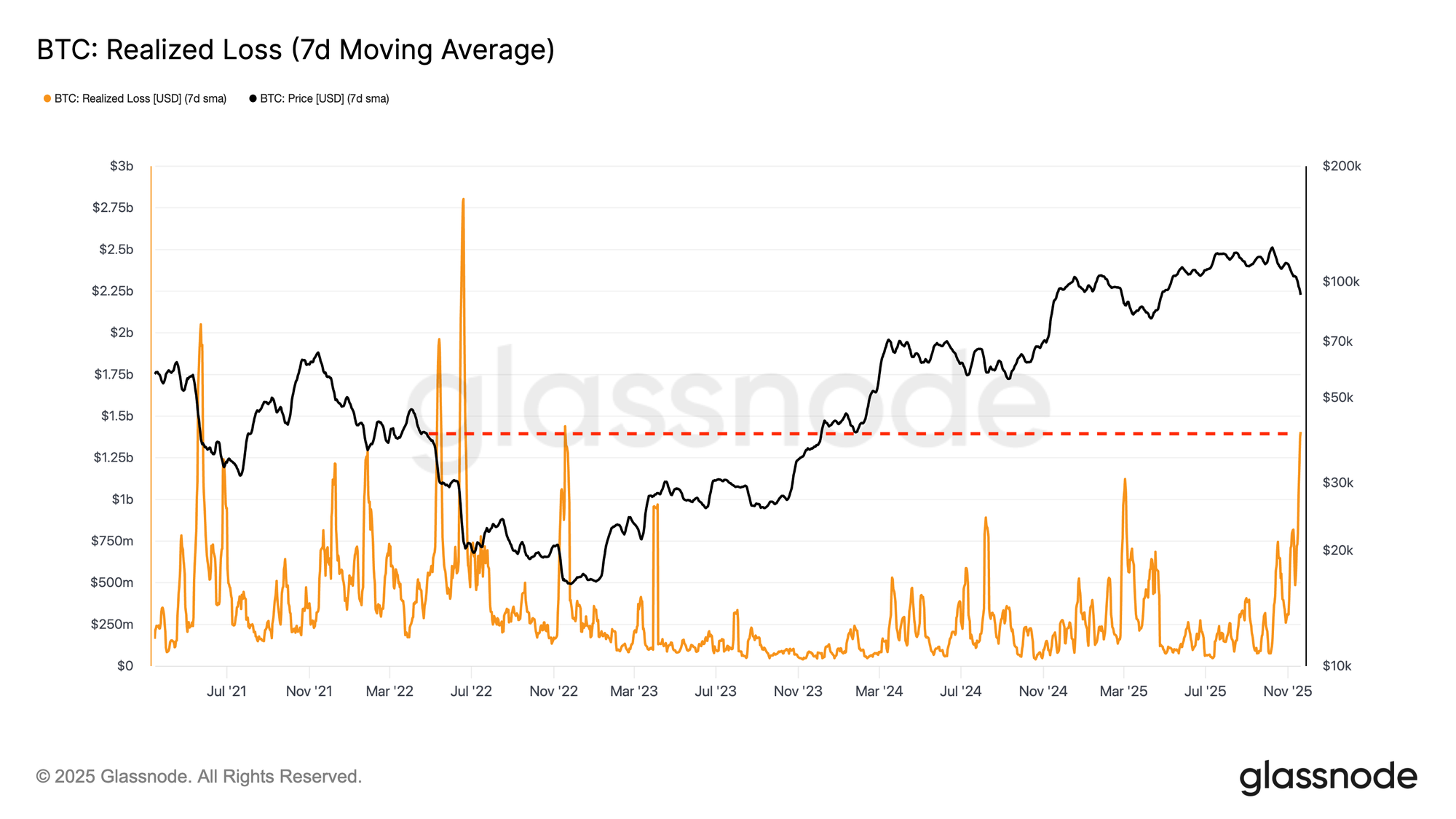

1️⃣ Capitulation & Realized Loss

Bert

For the first time this market cycle, we are seeing signs that existing investors have given up hope: capitulation. The 7-day moving average of realized loss in the on-chain data is at its highest point since the fall of FTX in November 2022.

In recent months, the supply in the market has mainly consisted of investors looking to realize profits—the great rotation.

Now, they are being joined by investors who bought above $100k and are selling at a loss. Normally, investors are only willing to do this if they do not expect higher prices in the near future.

Over the past seven trading days, we saw a total of $3.1 billion in outflows from the U.S. spot bitcoin ETFs. These are investors who, on average, paid more than $90,000 and are therefore also selling at a loss.

At the same time, around $1 billion in profit is still being taken daily. The realized profit and loss are balancing each other out, keeping the realized value stable.

The chart below shows the MVRV, the ratio between market value (MV) and realized value (RV). Because the MV is decreasing and the RV is remaining constant, the MVRV is also decreasing.

In early November, we reached a point comparable to September 2024 and April 2025, the previous two weekly cycle lows. We drew a green and a red arrow then. It turned out to be the red one.

2️⃣ What’s Driving the Price Drops in Bitcoin and Stocks?

Thom

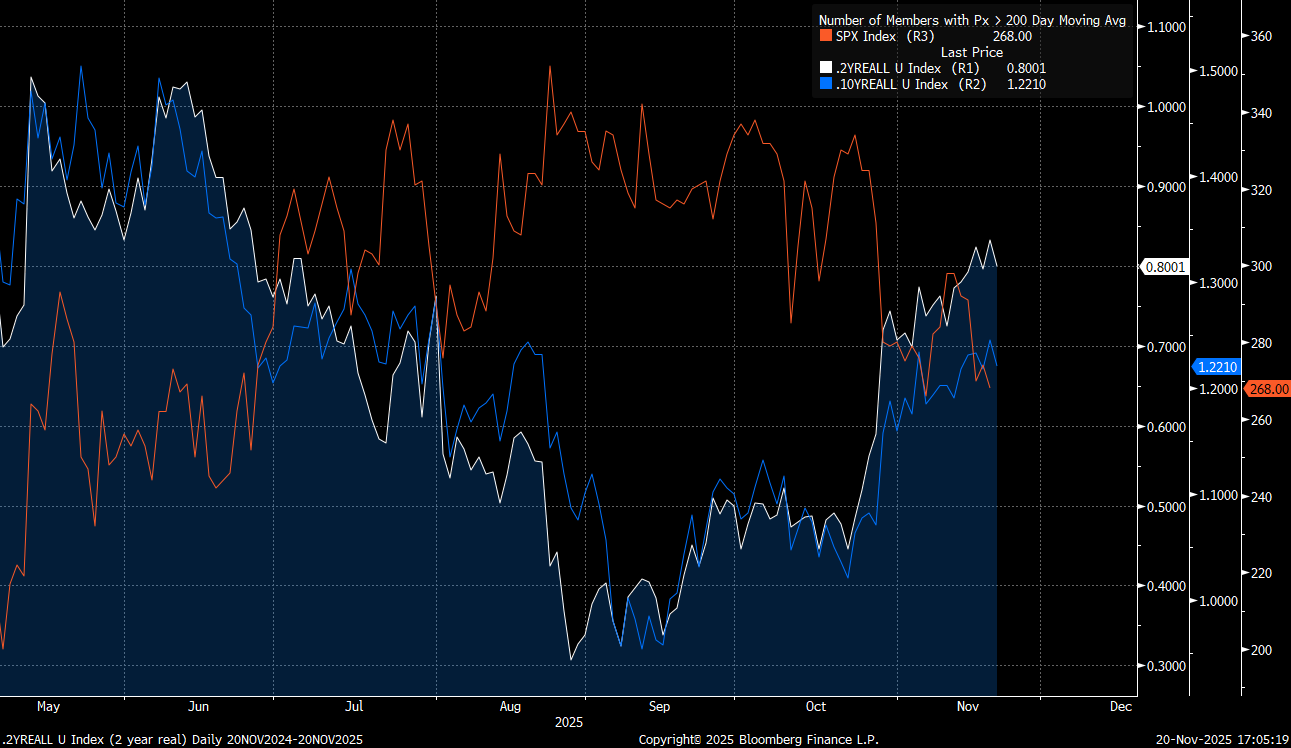

My best guess is that the rise in real interest rates is the main reason for the liquidity squeeze, and thus for the price drops in bitcoin and stocks.

This is partly the result of the U.S. central bank letting us know in late October that a rate cut in December depends on economic data. Due to the shutdown, this data is not available, which has led the market to expect that the central bank will leave rates unchanged in December.

Since that moment, risk assets have come under pressure. The slide of the S&P 500, orange in the chart below, began when real interest rates started to rise, white and blue in the chart.

The real interest rate is the actual price of capital. You get it by subtracting inflation from nominal interest rates. As soon as the real rate rises, it becomes more attractive to be in relatively safe government bonds. It's no coincidence that we're seeing the U.S. dollar strengthening now.

The strange thing is that some time ago, the U.S. central bank was forecasting a scenario with multiple rate cuts, while right now, inflation expectations are falling, which in theory should give them more room for rate cuts.

For now, I see a short-term liquidity shock, causing investors to adopt a more defensive position. There are no clear signs yet of a recession or a complete collapse of the credit cycle.

The coming weeks are going to be very interesting. If it turns out that the U.S. central bank does opt for a rate cut in December after all, that will initially cause a rally in bitcoin and stocks.

If those gains are enough to break the downward trend, the bull market could still continue. But if the momentum quickly fades after that? Then it's probably time to pack up, realize some final profits, and wait for interesting entry points for the next bull run.

3️⃣ Nvidia Offers Hope for a Longer Bitcoin Bull Market

Thom

It hasn't been the best few weeks for bitcoin, and doubts about the continuation of the bull market are growing by the day. This week, the bulls got some positive news in the form of quarterly earnings from Nvidia, the poster child of the AI revolution.

While the bitcoin price ran into further trouble, the market also began to increasingly doubt the sustainability of the AI hype. Nvidia put a temporary end to those doubts this week by presenting figures that were better than expected on all fronts.

This is important for bitcoin because the enthusiasm around AI is a key driver for the economy and the financial world. It gives investors confidence in a better future, which increases risk appetite and stimulates credit creation.

After the relatively hawkish interest rate decision by the U.S. central bank at the end of October, risk appetite declined, and we saw a rally in the U.S. dollar.

By now, it is also clear that Chairman Jerome Powell's strict stance after the rate decision was not just for show. The minutes of the last rate-setting meeting stated that many members of the committee are in favor of a rate pause in December under the current circumstances.

Fed Minutes: Many participants suggested under their outlooks it would be appropriate to keep rates unchanged for the rest of the year.

— FinancialJuice (@financialjuice) November 19, 2025

As a result, investments at the furthest end of the risk spectrum came under particular pressure.

Bitcoin also falls into that category and suffered greatly from the reduced risk appetite among investors. Nvidia's strong earnings are probably not enough on their own to bring back the hunger for risk, but they are certainly a stimulus.

To really give bitcoin a positive boost again, financial conditions need to improve. These determine the availability and cost of credit. They have worsened since the U.S. central bank's rate decision, but I wouldn't be surprised if we see a positive reversal soon.

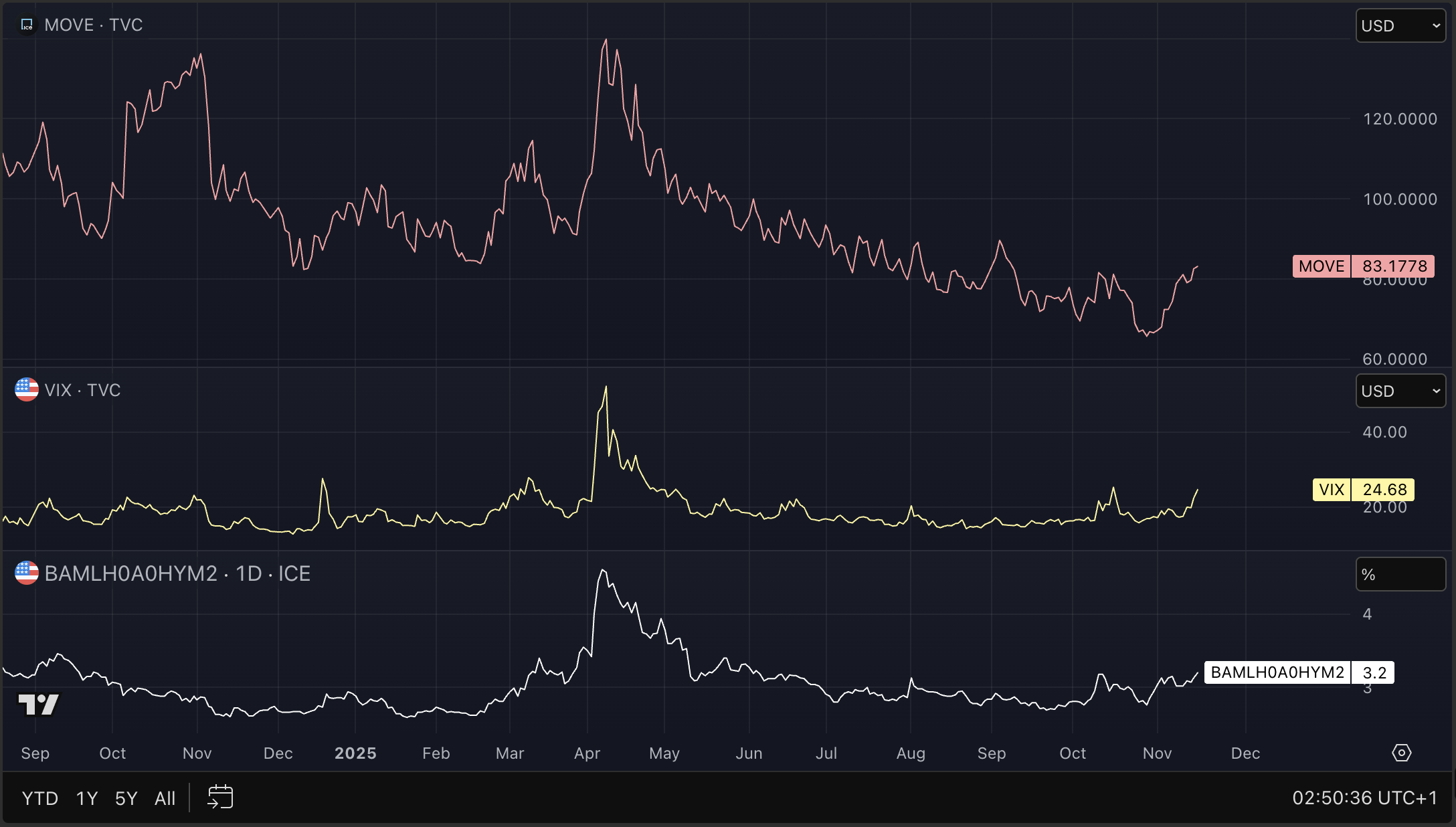

In the chart below, we see the expected volatility in the U.S. Treasury bond market (MOVE, 1st panel) rising sharply. The same goes for the expected volatility for the S&P 500 (VIX, 2nd panel) and Credit Spreads (3rd panel).

More volatility and higher Credit Spreads lead to caution among investors. At such times, the market typically chooses quality. Assets that have proven themselves, and for most people, bitcoin is not yet in that category.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!