Not Everything Can Be Measured in Euros

Crypto: gambling token or a tool for financial freedom? Hans Stegeman calls it an “elusive wheel of fortune,” while Hester Peirce defends privacy and decentralization. And with Roman Storm’s trial questioning open-source liability, is crypto paving the way for digital liberation?

Hans Stegeman, chief economist at Triodos Bank, recently compared crypto in a column to an “elusive wheel of fortune.” He argues that crypto falls short of its promise of being stable and universal digital money: it is neither a reliable medium of exchange, a secure store of value, nor a consistent unit of account. Instead, he sees it primarily as a “gambling token” driven by sentiment and scarcity—and, quite ironically, through stablecoins it now relies on the very government-issued currency it once sought to supplant.

This is criticism we hear often, particularly from economists who measure crypto against the standards of the existing monetary system. But what if that isn’t the right standard? What if crypto’s true value isn’t about price stability, but about protecting individual freedom and privacy?

Suppose Stegeman is genuinely curious and ready to explore further. In that case, he might do well to revisit the remarks made by SEC Commissioner Hester Peirce. A familiar and respected figure, Peirce spoke last week at the Science of Blockchain Conference in Berkeley—not to praise high returns or quick riches, but to deliver a piercing appeal for preserving financial privacy in an age when it’s been all but eroded.

Some thoughts on peanut butter, watermelon, and the importance of financial privacy: https://t.co/y2JntFjjB1

— Hester Peirce (@HesterPeirce) August 6, 2025

Peirce began with an anecdote about her grandfather and the era of telephone operators—the human links who once had access to every conversation. Automation replaced those operators and, in doing so, granted people more privacy. The point is that technology can eliminate intermediaries and thereby protect our personal lives. The same applies in finance: public blockchains, cryptography, and zero-knowledge proofs enable the transfer of value and information without a central authority overseeing the process.

It may sound harmless until you consider how deeply financial surveillance is embedded in our society. In the U.S., the Bank Secrecy Act forces financial institutions to act as extensions of law enforcement. Every year, tens of millions of suspicious transactions are reported—often without any follow-up. This “sledgehammer” approach, as Peirce terms it, ends up targeting not only criminals but also ordinary citizens and organizations, especially those operating outside the mainstream.

And therein lies the rub, according to Peirce. In a society that prizes freedom, it should be understood that citizens must be able to use their money without every transaction being recorded in a government database. Yet this is our reality, and many seem to accept it. The common retort of “I have nothing to hide” ignores the broader dangers of living in a society where everything—and everyone—is constantly monitored, as privacy experts have long warned.

In this context, she cites Eric Hughes’s A Cypherpunk’s Manifesto: “We cannot expect governments, corporations, or other large, faceless organizations to grant us privacy out of their beneficence.” In other words, if you want to preserve your privacy, you need to secure it yourself—and technology can be a powerful ally in that effort.

This brings us back to the core of Stegeman’s critique. He evaluates crypto based on the monetary properties that matter for today’s state-issued currency. In contrast, Peirce focuses on the structural power of the current system and how technology can decentralize that power. For her, crypto is compelling not because it lets you buy a loaf of bread at the local bakery, but because it offers a way to store and transfer value outside the reach of excessive control.

Even stablecoins, which Stegeman sees as paradoxical, fit into this framework. While they do represent fiat money, they make that money programmable, globally accessible, and directly tradable without bank intervention. For those living under capital controls or in unstable banking systems, that could mean the difference between economic freedom and total dependency.

Peirce acknowledges that technology can be misused, but she argues that this risk shouldn’t justify banning the entire toolkit. A screwdriver can be used as a weapon, but no one suggests registering every screwdriver. In her view, it is far more dangerous to require that every transaction pass through a traceable, centralized system.

This is why she strongly opposes attempts to hold open-source developers liable for what others do with their code. A permissionless, immutable protocol can’t simply be altered to meet reporting requirements. Forcing developers to build in such controls, in her words, is “forcing intermediation where the markets can function without them” — and that ultimately undermines the benefits of decentralization.

The difference between Stegeman and Peirce can be summed up in one question: do you view crypto as a new kind of euro or as a new kind of infrastructure? Those who see it as the former focus on its instability and limited usability, while those who see it as the latter recognize a system that, despite its imperfections, offers opportunities the existing system would never willingly provide.

That is precisely the heart of her argument. Privacy and sovereignty are not automatic byproducts of well-intentioned governments or corporations; they are the result of deliberate choices in both legislation and technology. Crypto isn’t a miracle cure, but it is one of the few technological developments in recent decades that might genuinely shift the balance of power.

Anyone who asks only whether crypto is already a stable currency misses the bigger picture. Peirce would urge us instead to ask what remains of our freedom if we fail to build alternatives.

More Alpha

Are you a Plus Member? Then we move on to the following topics:

- Trump opens the door for crypto in pension funds

- Roman Storm convicted: precedent or misdirection?

- Base experienced downtime: ‘bullish downtime’?

1️⃣ Trump opens the door for crypto in pension funds

Erik

On August 7, Donald Trump signed an executive order designed to make it easier for Americans to include cryptocurrencies in their 401(k) retirement plans.

The order directs the SEC to adjust its rules so that crypto can be offered as a standard investment option alongside stocks and mutual funds. Unlike in the Netherlands, U.S. employees can choose for themselves the assets in which their employer invests on their behalf.

JUST IN: 🇺🇸 Crypto Czar David Sacks says the executive orders President Trump signed today will give 90 million Americans access to crypto.

— Watcher.Guru (@WatcherGuru) August 7, 2025

Currently, American employees must resort to expensive and cumbersome workarounds to include crypto in their retirement plans; this option is available only through certain providers and within set limits. In 2022, the Department of Labor under President Biden even warned employers to use “utmost caution” when dealing with crypto.

Large pool of potential capital

This is no small matter: U.S. 401(k) portfolios collectively hold around $8.7 trillion in assets.

Depending on the figures, roughly 28% of Americans already own crypto—albeit not through their retirement funds. For investors who contribute regularly, this 401(k) option offers another way to dollar-cost average. Of course, this could drive prices higher and potentially reduce volatility, given that it’s difficult to withdraw funds from a pension plan.

people only make a fuss about downtime for chains with actual users.

— R🐽ter (@0xrooter) August 5, 2025

bullish downtime. https://t.co/np4oGdtaGe

Timing and scope

The measure will not take effect immediately; entities such as Fidelity and BlackRock must first implement the new rules, a process expected to take between 6 and 12 months. It remains unclear which cryptocurrencies will be offered, though BTC and ETH are the obvious choices—with others potentially added later.

2️⃣ Roman Storm convicted: precedent or misdirection?

Peter

Roman Storm, co-founder of Tornado Cash, was convicted in the U.S. this week on one charge: knowingly operating an unlicensed money transmitting business. The jury couldn’t reach a verdict on money laundering and sanctions violations, meaning the harshest penalties are off the table for now. Still, that single offense could result in up to five years in prison.

Roman Storm was convicted for conspiracy to operate an unlicensed money transmitting business under Section 1960.

— Jake Chervinsky (@jchervinsky) August 6, 2025

The jury was deadlocked on money laundering and sanctions. DOJ will decide in the coming days if it wants to retry those charges in a new trial.

A sad day for DeFi.

At first glance, this appears to be a typical case of unlicensed banking. But in the crypto world, the nuance lies in the definitions. According to FinCEN guidelines, developers who do not control customer funds—as is the case with non-custodial protocols—are not considered “money transmitters.” Storm fit that profile: Tornado Cash is open-source, permissionless, and immutable. However, the judge opted for a broader interpretation, so the jury didn’t even have to decide whether Storm actually controlled customer funds.

This broad interpretation has made the verdict controversial. Coin Center described it as “Kafkaesque” and warned that the case sets a dangerous precedent: developers without control over funds risk being held criminally liable. Lawyers such as Jake Chervinsky and Zack Shapiro have called it a sad day for DeFi, arguing that Section 1960 was never intended to target open-source programmers—and that this decision should be appealed.

Coin Center’s Seven Takeaways from the Storm Verdict:

— Peter Van Valkenburgh (@valkenburgh) August 6, 2025

▪️ 1. The sole conviction—unlicensed money transmission (18 U.S.C. § 1960)—turns mainly on legal/regulatory interpretation (“does this count as money transmission?”), not jury fact-finding.

▪️ 2. The court, at the…

The contrast with the Netherlands makes this ruling even more striking. Alexey Pertsev, Storm’s colleague, was not convicted in the Netherlands for lacking a license; his case focused solely on money laundering—the very charge that Storm avoided in the U.S. It’s as if both countries are examining the same facts through entirely different legal lenses. In the Netherlands, the threshold for money laundering is higher, whereas in the U.S., the standard for “money transmission” is lower. In both cases, the developer ends up caught in the crossfire.

There's also a bitter irony: Storm appears to have been convicted prematurely. Meanwhile in Washington, a different tide is turning. SEC Commissioner Hester Peirce has publicly warned against holding open-source developers accountable for the actions others take with their code, arguing that imposing such requirements on an immutable protocol would undermine the very essence of decentralization.

Adding to the momentum, the Blockchain Regulatory Certainty Act—currently awaiting debate in the Senate—explicitly states that developers are not “money transmitters” if they do not manage customer funds. Had this law been in effect, Storm likely wouldn’t have faced trial for this charge.

Yet it’s U.S. Attorney Jay Clayton, a Trump appointee, who is celebrating the verdict. Although the legal and political landscape is shifting, Storm remains trapped in the old paradigm. His appeal is more than just a personal fight—it’s a test case for whether the U.S. will continue to criminalize open-source developers merely because others misuse their code.

In the coming days, we’ll find out whether the U.S. Attorney’s Office will retry the two stalled charges in a new trial. Even if it doesn’t, this verdict sends an ominous message: anyone who writes code capable of moving money risks being classified as a money transmitter—even if they never actually handle the funds.

For that reason, the defense is preparing to challenge the verdict. On the bright side, Storm can count on strong support from the community:

Privacy is normal, and writing code is not a crime. https://t.co/BD55K5GDW3

— Ethereum (@ethereum) August 7, 2025

3️⃣ Base experienced downtime: ‘bullish downtime’?

Erik

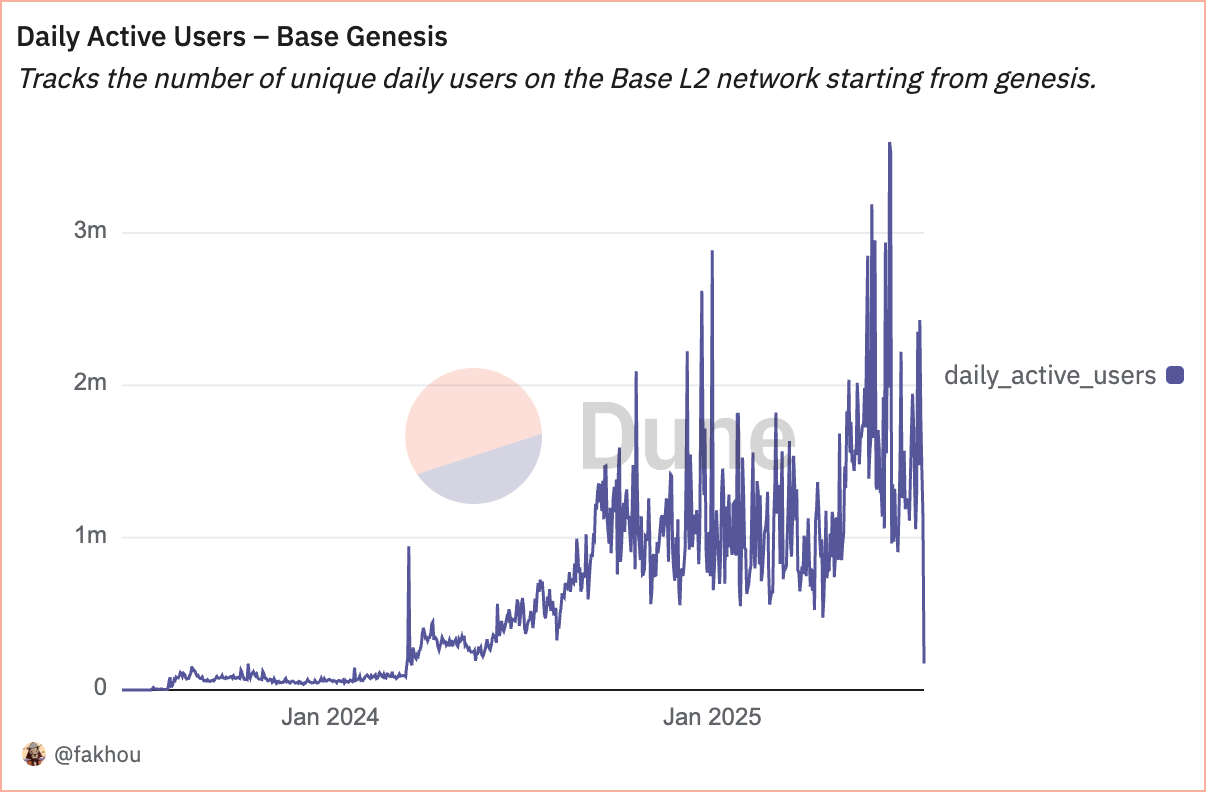

On August 5, Base—Ethereum’s Layer 2 network built by Coinbase—experienced a brief outage. Block production halted for half an hour, which, at a 2-second block time, adds up to a significant number of missed blocks. Ironically, the intense attention to this downtime is actually good news for Base, as it shows that people are actively using the network.

The cause of the stalled block production was a software update that temporarily required the use of a backup sequencer. This component, which processes incoming transactions and passes them to the underlying network, encountered an error during the switchover—a mistake that developers quickly corrected manually.

people only make a fuss about downtime for chains with actual users.

— R🐽ter (@0xrooter) August 5, 2025

bullish downtime. https://t.co/np4oGdtaGe

The popular new Base app

Following Base’s downtime, there was a surge in activity—a testament to the network’s adoption, which received a fresh boost with the beta launch of the Base App on July 16.

Coinbase markets this app as an “all-in-one crypto app.” It features built-in wallet functionality and is designed to be much more user-friendly than traditional crypto wallets. New users don’t have to manage a seed phrase; all they need is an email address to get started. And gas fees? They’re largely a thing of the past.

A groundbreaking aspect of the app is its integration with the NFT minting platform Zora and the social network Farcaster. Users’ posts are shared on Farcaster, and as a content creator, you can have your posts automatically minted into creator coins using Zora. Fans can then purchase these tokens directly within the app using USDC.

On record day, July 27, Base registered approximately 40,000 to 50,000 token launches—a sharp increase from the average of 4,000 before the Base App’s launch.

The promising rollout of the Base app bodes well for Coinbase’s broader strategy—to position Base as a bridge to a Web3 experience accessible enough for mainstream adoption.

It’s encouraging to see that Coinbase’s ambitions extend beyond merely selling crypto. In that light, Base’s technical hiccup can indeed be viewed as “bullish downtime.”

🍟 Snacks

To wrap up, here are a few quick updates:

- SEC exempts liquid staking from securities rules. As long as providers don’t promise returns and merely act administratively, they have little to fear from the SEC. This clarity removes a significant legal threat for DeFi and bodes well for protocols like Lido and Jito, whose related token prices have surged in recent days.

- The SEC-Ripple case is officially over. Both parties have withdrawn their appeals, upholding the 2023 ruling that only the sale of XRP to institutional participants falls under U.S. securities law. For violating these rules, Ripple will pay a $125 million fine, finally closing this chapter after years of litigation.

- Trump seeks to ban the debanking of crypto companies. A new executive order aims to prevent banks from denying service to customers on political or ideological grounds. “Reputational risk” may no longer serve as an excuse to bar crypto companies from accessing banking services—putting an end to Operation Choke Point 2.0 once and for all.

- Harvard and Brown invest in BlackRock’s bitcoin ETF IBIT. Harvard has become the 29th largest shareholder in the fund with a $117 million stake, while Brown has invested over $13 million. According to ETF analyst Eric Balchunas, university funds are notoriously hard to sway. Although their stake is small relative to their total assets, it represents a breakthrough for a traditional anti-ETF stronghold.

- Algeria bans crypto completely. New legislation makes the possession, trading, mining, and even the promotion of crypto punishable by up to one year in prison and fines of up to $7,700. Once a rapidly growing crypto market in North Africa, Algeria has chosen criminalization over regulation, arguing that crypto poses a threat to financial stability and national security, with risks of tax evasion, fraud, and criminal misuse.

- The CFTC launches a “crypto sprint.” The regulator is set to act immediately on recommendations from the President’s Working Group on Digital Asset Markets. The goal is to realize Trump’s vision of turning America into the world’s crypto capital. Working together with the SEC, the CFTC is pursuing Project Crypto, which focuses on 24/7 trading, perpetuals, and clearer rules for innovation.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!