Money on the Move

In 1932, Wörgl’s demurrage system sparked an economic revival by forcing money to flow. Fast forward to today—bitcoin hits $120K, and companies are hoarding ETH. Could rethinking money be the key to revitalizing global markets? Discover the bold parallels.

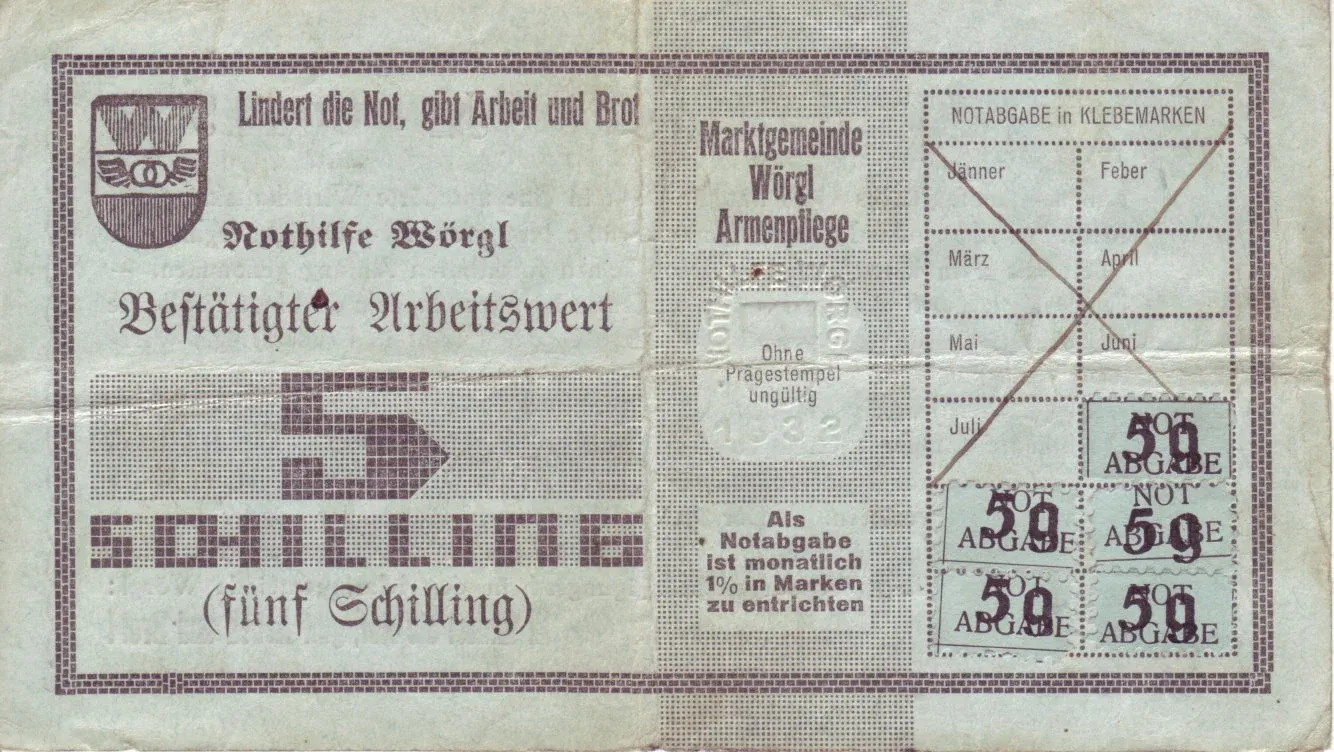

It all started with a stamp. Every month, you had to purchase one and affix it to your banknote. The cost? One percent of the note's value. Any money that wasn’t stamped lost its validity. In other words, stagnant money was punished—only money that kept circulating remained valuable.

This isn’t a fictional dystopia. For this story, we travel back to 1932, when we find ourselves in Wörgl, Austria—a mountain town that, in the midst of the Great Depression, dared to revolutionize its monetary system.

And it worked.

The 1930s crisis gripped Europe. Governments slashed spending, banks collapsed, and unemployment soared—not because there wasn’t work to be done (infrastructure needed repair, projects were stalled, and workers were desperate for employment) but because the money that once flowed freely had come to a standstill.

People clutched their last schillings in fear. Businesses dared not invest. Banks withheld credit. Money was frozen like ice; it was there, but it wasn’t moving.

Wörgl felt the impact too. But it had something other villages didn’t: a mayor with a plan. Michael Unterguggenberger—a pragmatic thinker with a technical background—had a clear vision of money: it should empower people, not paralyze them.

Inspired by thinkers like Silvio Gesell, he decided to launch an experiment. The municipality issued its own currency, known as Arbeitswertscheine. These banknotes would lose value each month unless you purchased a tax stamp. In essence, money had to keep moving—if it sat idle, a cost was incurred.

It might sound gimmicky, but it functioned like an economic defibrillator. The municipality paid workers in the new currency. They spent it at the baker, who then used it at the carpenter, who in turn used it to pay taxes. Instead of hoarding money, everyone scrambled to spend it before the next month began. And so, money began to fulfill its true purpose.

Within thirteen months, the village funded twenty infrastructure projects—from building a bridge and a new road to installing street lighting and a ski jump. Unemployment dropped, taxes were collected once more, and commerce revived.

The world watched in astonishment. Delegations from France, Czechoslovakia, and even the USA came to see the Wonder of Wörgl. What was happening there?

The secret was actually simple. Unterguggenberger understood that money only retains value when it circulates—acting as the oil in an economic engine. The village hadn’t stumbled upon extra gold or received miraculous credit; it had boldly redefined the medium of exchange.

“In the depths of the depression of the 1930s, the Wonder of Wörgl demonstrated how a local monetary system can help pull an economy out of the quagmire on its own. The secret to its success lay in an effective collaboration between government, businesses, banks, and the people.”

– Wim Boonstra, Professor of Economics and Monetary Policy at the VU

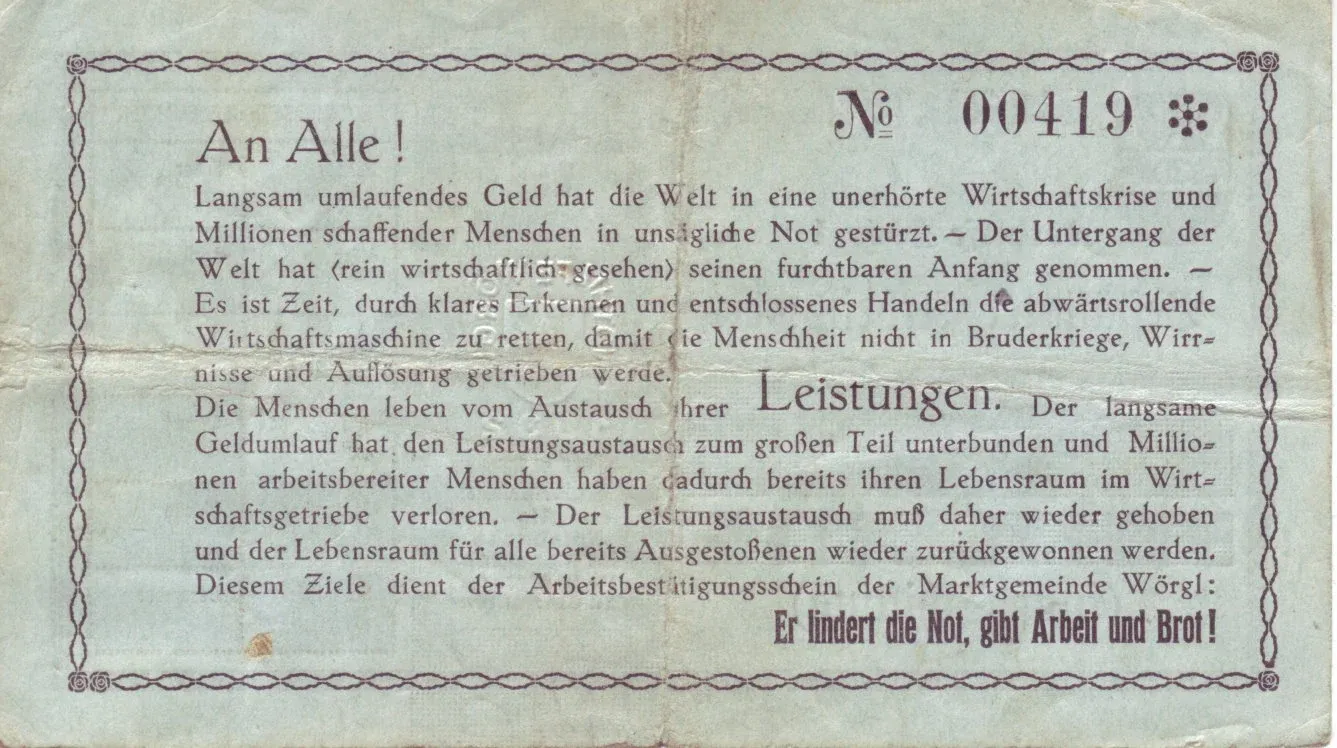

Its success was also its downfall. In 1933, the Austrian central bank declared the experiment illegal, arguing that issuing money was a state monopoly. In short, within a month the system ground to a halt. The banknotes disappeared, and Wörgl’s economy reverted to the same stagnation as the rest of the country.

At a time when governments believed that money should remain scarce and public spending should be reduced, Wörgl proved otherwise: money could be dynamic, and scarcity is sometimes a deliberate choice. This makes it particularly interesting to compare Wörgl’s experiment with something seemingly very different: bitcoin.

Whereas the Wörgler demurrage currency needed to circulate quickly to retain its value, bitcoin actually appreciates the longer you hold it. In bitcoin’s world, doing nothing is rewarded. While Wörgl’s currency was engineered to encourage immediate spending, bitcoin was designed as a counterbalance to money that is too readily spent.

Two completely different models, yet both send a clear message: the existing monetary system is flawed. More importantly, money is not a natural law—it’s an agreement, a protocol that we can design and redesign as needed.

Wörgl emerged from the depths of deflation, while bitcoin was born out of outrage over inflation and monetary excess. Both were forged in times of crisis, and both pose the question: how should money influence human behavior?

It’s a lesson worth revisiting in 2025. If a one-cent stamp was enough to change behavior, what might a digitally scarce, borderless protocol achieve?

Or, as the mayor himself put it: “It’s not a lack of labor, will, or resources—it’s only the money.”

And that, it turns out, is something that can be created.

More Alpha

Are you Plus Member? Then we continue with the following topics:

- Trend: Companies Hoarding ETH

- Bitcoin Breaks Through $120,000 – A Stepping Stone?

- Phantom Brings Perps to Your Pocket

1️⃣ Trend: Companies Hoarding ETH

Erik

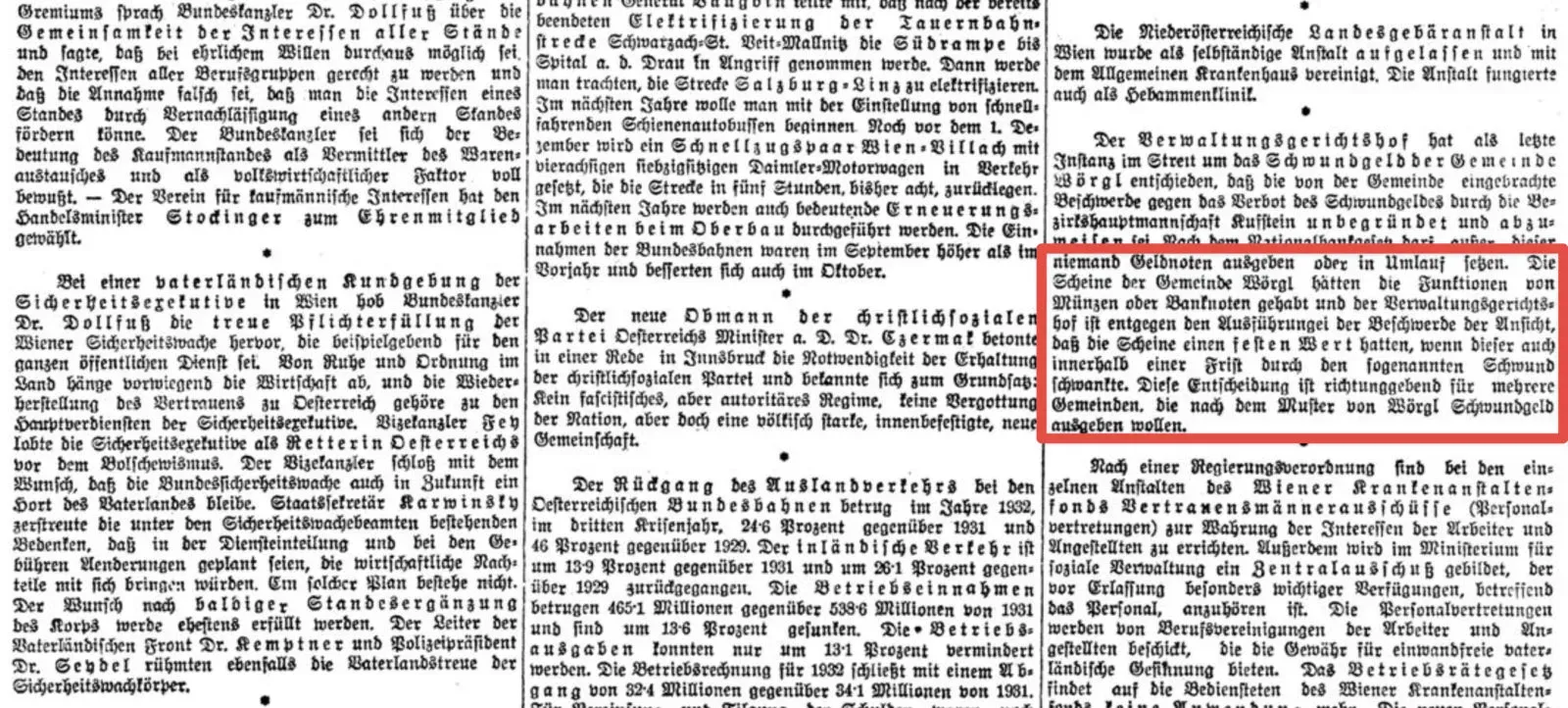

As is well known, over the past year a wave of companies has added bitcoin to their balance sheets. A similar trend is now emerging among publicly traded companies accumulating ether. Eleven publicly listed companies have recently amassed roughly 500,000 ETH on their balance sheets.

Using ETH as a treasury asset is a very recent phenomenon. Most of that half a million ETH was acquired within the last two months. Compared to the bitcoin holdings of public companies, the amounts of hoarded ETH are still minimal. In contrast, publicly traded companies currently hold over 850,000 bitcoin—more than 4% of all BTC in circulation—while ETH represents less than half a percent of its total supply.

The pioneers of this emerging ether trend are SharpLink Gaming, Bit Digital, and BTCS, all listed on NASDAQ. According to data from StrategicETHReserve.xyz, SharpLink holds over 200,000 ETH, followed by Bit Digital with more than 100,000 ETH.

Notably, BTCS announced this week a new purchase target of $225 million. “This is about scaling ETH per share,” said Charles Allen, CEO of BTCS. The company—short for Blockchain Technology Consensus Solutions—stakes its ETH and is active in DeFi, generating returns in ETH. Similar to its bitcoin-focused predecessor, BTCS aims to increase the amount of ETH per share.

BTCS Inc. is raising its funding target to $225 million to accelerate its Ethereum accumulation strategy.

— Charles Allen (@Charles_BTCS) July 9, 2025

This is about scaling $ETH per share—not just raising capital.

With a maturing crypto regulatory environment and increased institutional focus on Ethereum, now is the time… pic.twitter.com/cTcqs2Jjp0

Leading the pack in ETH holdings is SharpLink Gaming. The company proudly states on its website that it was among the first to begin hoarding ether.

If you’re wondering why a company with “gaming” in its name would hoard ETH, it’s because Consensys is behind the strategy and is actively raising capital. Consensys, a key software firm in the Ethereum ecosystem founded in 2014 by Ethereum co-founder Joseph Lubin, invested $425 million in SharpLink Gaming in May 2025. Shortly afterward, Joseph Lubin joined SharpLink’s board as chairman.

The question now is: are these isolated incidents or the start of a broader trend? We lean towards the latter.

Since these companies are publicly traded, they offer investors exposure to ether. Surely, investors are keeping Saylor’s successful bitcoin strategy in mind. Furthermore, these ether shares provide exposure to the staking income generated by the companies—something that wasn’t previously possible. Although Ethereum ETFs exist, none so far allow for the reinvestment of staking rewards.

Overall, Wall Street seems to be warming up to Ethereum. Much like MicroStrategy did with bitcoin in the past, these companies will be educating Wall Street and investors about ETH and DeFi through quarterly earnings calls and publications.

2️⃣ Bitcoin Breaks Through $120,000 – A Stepping Stone?

Peter

It happened last night. Bitcoin investors witnessed an important milestone on their screens: $120,000. Not as a lofty dream or aspirational target, but as a tangible benchmark. While it might trigger moments of euphoria—and perhaps even set off some usual antics—the key question remains: what does this level signify?

OFFICIAL: $120,000 BITCOIN ALL TIME HIGH⚡️ pic.twitter.com/WeMtdQIoJl

— Bitcoin Magazine (@BitcoinMagazine) July 14, 2025

Is $120,000 a peak, or is it merely a stepping stone to even higher levels? Everything points to the latter.

This breakthrough didn’t occur by chance. For weeks, a solid foundation has supported the price climb: billions of dollars have flowed into the market through American spot ETFs, and the political tide in the U.S. is shifting in bitcoin’s favor. Combine that with rising global liquidity and a narrative gaining traction, and you have all the ingredients for a trend that’s still unfolding.

$IBIT blew through the $80b mark last night, fastest ETF to get there in 374 days, about 5x faster than the previous record, held by $VOO, which did it in 1,814 days. Also at $83b it's now 21st biggest ETF overall.. via @JackiWang17 pic.twitter.com/a0LuvfeSek

— Eric Balchunas (@EricBalchunas) July 11, 2025

Next week, the U.S. House of Representatives will host “Crypto Week.” Several legislative proposals are on the agenda—addressing stablecoins, regulatory roles, and even a ban on a digital dollar. Each of these signals that bitcoin is starting to cement its political standing. With Trump openly expressing support, sentiment in Washington is clearly shifting.

In this context, it’s logical that more institutional investors are entering the market. For the first time, they feel protected and acknowledged—thanks to new legislation, mature market infrastructure, and the ability to invest in bitcoin through firms like BlackRock, Fidelity, or Franklin Templeton just like stocks.

Yet, it’s notable that public sentiment remains measured. There are no dramatic headlines, no FOMO at the barber, and no excited gossip in schoolyards. Seasoned observers know that actual peaks are usually accompanied by mass hysteria—frenzy, even taxi drivers recommending altcoins—but that scenario still seems far off.

From a technical perspective, there’s no clear end in sight either. A recent analysis by Bert suggests that bitcoin is in the midst of its typical weekly cycle—a series of price increases lasting about six months, which in previous cycles has doubled the price. If history repeats itself, prices between $150,000 and $165,000 seem plausible in the coming months.

In short, this breakthrough is more a signal of momentum than a terminal milestone.

3️⃣ Phantom Brings Perps to Your Pocket

Peter

Years ago, trading futures meant going to a crypto exchange like BitMEX. There, you encountered a cockpit brimming with charts, order books, sliders, and tables. The environment was raw, and leverage was rampant—with 100x being standard. It was the realm of adrenaline junkies, often exuding more confidence than their account balances warranted.

Fast forward to 2025, and you can trade these very products with just three taps on your phone—directly from your wallet, without any central platform. Phantom, the popular Solana wallet, integrated Hyperliquid’s markets this week—a rapidly growing perps exchange boasting no order books, no gas fees, and no accounts. In the EU, the feature is already live.

Introducing: Phantom Perps 👻 ♾️

— Phantom (@phantom) July 8, 2025

Go long or short in just a few taps.

100+ markets. Up to 40x leverage. All in your pocket.

Powered by @HyperliquidX pic.twitter.com/YDKjUGBdEn

This move is the icing on the cake following an eventful week in the perps arena. Hyperliquid was first to launch pre-market trading on $PUMP, the upcoming token from the betting platform Pump.Fun. Coinbase and Binance soon followed suit, while Aevo pushed the envelope further by offering 1000x leverage—yes, you read that correctly—on shares of companies like Coinbase, Circle, and MicroStrategy. Even Coinbase itself acquired the team from Opyn, a perps platform on Ethereum. Everyone's diving in.

The future of finance is onchain.

— Coinbase 🛡️ (@coinbase) July 11, 2025

We're welcoming the @opyn_ leadership team to help us build it.

Faster, more transparent, and more accessible markets—for everyone. pic.twitter.com/5Cra383oXA

But why?

Perps—short for perpetual futures—are contracts that let you speculate on the price of a cryptocurrency without owning it. They have no expiration date, unlike standard futures, and allow for leverage. Essentially, you only need to post a fraction of your position as collateral, with the remainder being borrowed. It’s extremely convenient—provided the market moves in your favor.

For traders, the appeal lies in their speed, leverage, and flexibility. They can profit from both rising and falling prices, deploy capital efficiently, and realize gains—or losses—in mere minutes, or even seconds. Perps represent the adrenaline-fueled version of spot markets; not everyone is looking to HODL for years.

And for the platforms, this is where the money-making really happens. Perps are traded far more frequently than regular cryptocurrencies, and every executed order generates transaction fees for the exchange or protocol. Some analysts estimate that derivatives account for around 80% of all crypto market activity, with perps comprising the majority. Not participating means missing out on market share—hence the rush.

Phantom’s move is particularly noteworthy, as it demonstrates that wallets are evolving from simple digital vaults into fully-fledged trading platforms. Initially, you could only store assets; then you could exchange them, and now you can even speculate on leverage. The lines between broker, exchange, app, and wallet are blurring—as more and more functions are consolidated right in your pocket.

However, this increased accessibility also comes with risks. The more accessible perps become, the greater the danger for inexperienced users. A 1000x leverage might sound dazzling, but a price move of just 0.1% could liquidate your position. This isn’t child’s play. While wallets like Phantom simplify the trading process, they don’t alter the underlying risks. Perps are built for speed and amplified performance—they’re the Formula 1 of crypto, albeit without the requisite driver’s license.

For those who understand these risks, the potential of perps is clear. In capable hands, they can be valuable tools for hedging, efficient capital allocation, or informed speculation. However, this increased accessibility demands heightened risk awareness—especially now that wallets like Phantom are opening up this world to millions of users.

🍟 Snacks

In conclusion, here are a few quick bites:

- Truth Social aims to reward its paying users with its own token. Users of the “Patriot Package” are already collecting digital ‘gems,’ which can later be exchanged for a utility token on the platform and the streaming service Truth+. Trump’s media company is further developing a crypto plan that previously included wallets and an ETF. Critics warn that in doing so, Truth Social risks becoming the very grifter it has long criticized.

- Ethereum is edging back above $3,000, with strengthening fundamentals. Inflows into spot ETFs are on the rise, and some companies are shifting parts of their reserves into ETH, while its price has surged well above key averages for traders. Together, these indicators suggest that long-term investor confidence is growing. However, this rally is still in its early stages, and compared to bitcoin, ether has a long way to go.

- Ripple’s stablecoin RLUSD is establishing itself among the top 10. The stablecoin quickly grew to a market cap of over $500 million, partly due to institutional integrations with Transak and BNY Mellon. Ripple is paving the way for a significant role in mainstream finance, and the company has also applied for a banking license in the US.

- Aave remains the undisputed leader in DeFi. In Q2, the platform’s total value locked (TVL) surged by 52% to $25.4 billion. Aave now handles 48% of all DeFi loans and has captured nearly a quarter of the capital in the DeFi market. Its growth stems not only from continuous technology upgrades, such as the upcoming V4 upgrade, but also from the trust investors place in safe, mature protocols. Aave’s message? “Next stop: $1 trillion.”

- Fidelity describes Ethereum not as a tech platform, but as a digital economy with ETH as its “base money”. In a new report, the major asset manager compares Ethereum's network growth and activity to a country's GDP—where gas fees reflect consumption, staking represents investment, and token trading along with cross-chain transactions function as exports. Just as in real economies, it is the diversified use of Ethereum that lends it resilience. According to Fidelity, ETH derives its value not from interest or policy, but from its utility.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!