Is Hard Money Failing?

Brendan Greeley argues hard money once punished the masses—but bitcoin’s digital nature breaks old limits. Venture capital is surging, Solana is in the spotlight, and crypto’s future is being rewritten. Is bitcoin the predictable hero born from past monetary missteps?

In early August, Brendan Greeley, a financial historian and columnist at the Financial Times, wrote an essay that left a lasting impression. Not because he was spouting nonsense—in fact, he presented his objections to hard money and bitcoin in a remarkably candid and pointed manner. That is exactly why his arguments deserve our attention.

Brendan expresses a fondness for the so-called “crypto dads”: men with children who enjoy a good cup of coffee and are fascinated by the history of money. He enjoys talking with them, yet he often finds himself at an impasse. They view bitcoin as proof that its increasing price validates its ideology, while Brendan sees history as largely a tale of misery when money becomes too rigid. Two well-meaning fathers, engaged in a conversation that simply misses the mark.

just possibly the best greeley everrrr. first glance, I thought the river was his summer place on the chesapeake. must-read. by moms, by dads. https://t.co/sshViZOfkX @bhgreeley

— tom keene (@tomkeene) August 9, 2025

His main point is straightforward: deflation has historically been disastrous for most people. Only buyers operating in an environment devoid of trust—or creditors benefiting from rising repayments—managed to come out ahead. For everyone else, hard money was a straitjacket, a “grinding punishment.” He cites examples such as the Italian city-states, which used gold for trade but relied on silver for everyday transactions, and American colonists who resorted to paper money as a compromise with London. He also references economist Barry Eichengreen, who argued that it was ultimately democracy that ended the gold standard—after all, most people despised it.

At this point, his argument begins to wobble a bit. Consider the Italian city-states: they didn’t opt for silver because gold was too “hard,” but rather because gold was impractical for small transactions. You don’t pay for a loaf of bread or a glass of wine with a coin worth half a month’s rent. For large, international exchanges, gold remained in use, and the exchange rate between gold and silver was notably stable. Similarly, the colonists issued paper money not out of a love for inflation, but simply because there was a coin shortage. Paper money kept the economy moving—a purely pragmatic solution. Many historical monetary choices were driven by practical concerns rather than a principled dismissal of hard money.

And that is exactly a problem bitcoin does not face. One bitcoin is divisible into one hundred million satoshis, which means you can pay for something as luxurious as a villa or as modest as a cup of coffee. The old problem of coins being too valuable simply no longer exists. Here, Greeley misapplies historical context to bitcoin; what once was a limitation has now been technically resolved.

His broader objection to deflation also warrants reconsideration. The deflation he refers to was often a consequence of a money shortage in a growing economy—more trade and more people, but the same number of coins, leading to too little money to keep things flowing. In such cases, deflation could act as a punishment, dragging the economy into a spiral of reduced demand, increased bankruptcies, and heavier debts.

But bitcoin isn’t a replica of the gold standard or the economic context in which it was applied. Bitcoin exists in a digital economy where productivity and innovation are continually driving prices down. Think about the rapid advancements in computers, the internet, artificial intelligence, and other major technologies. These developments make goods cheaper without leaving us poorer—in fact, we all benefit. Viewed in this light, bitcoin seems a far better fit for today’s economy than the outdated image of a coin that’s too rigid for everyday use.

Moreover, just because the gold standard fell under democratic pressure doesn’t mean people necessarily wanted inflation. What people crave is predictability—money that won’t vanish in a puff of smoke due to mismanagement or war. In many countries today, citizens vote with their feet, choosing bitcoin not because they inherently love deflation, but because they seek a form of money that their governments cannot easily destroy.

Brendan argues that crypto feels like “finance as if the past never happened.” Yet bitcoin was born out of past pain. It emerged from the 2008 banking crisis and decades of inflation and monetary experiments that repeatedly failed ordinary savers. Bitcoin doesn’t ignore history—it responds to it.

In the conclusion of his column, Brendan expresses a wish that bitcoin would remain entirely separate from the dollar. But that battle has already been lost. Bitcoin is already an international currency, and whether you like it or not, the dollar will always be measured against it. Suggesting that bitcoin should avoid the dollar is like saying the internet should steer clear of newspapers—it’s simply not an option anymore.

The real choice belongs to free people. They decide whether bitcoin will play a role in their daily lives. In the financial economy, bitcoin has already proven its worth, as reflected by its rising price. But price alone doesn’t reveal its true role in the real economy—that’s where bitcoin can truly take root and determine who is right: Brendan, or me.

What do you think?

More Alpha

Are you a Plus member? Then we move on to the following topics:

- The Return of Venture Capital

- Rabobank: Crypto Important for Investors

- Solana in the Spotlight

1️⃣ The Return of Venture Capital

Erik

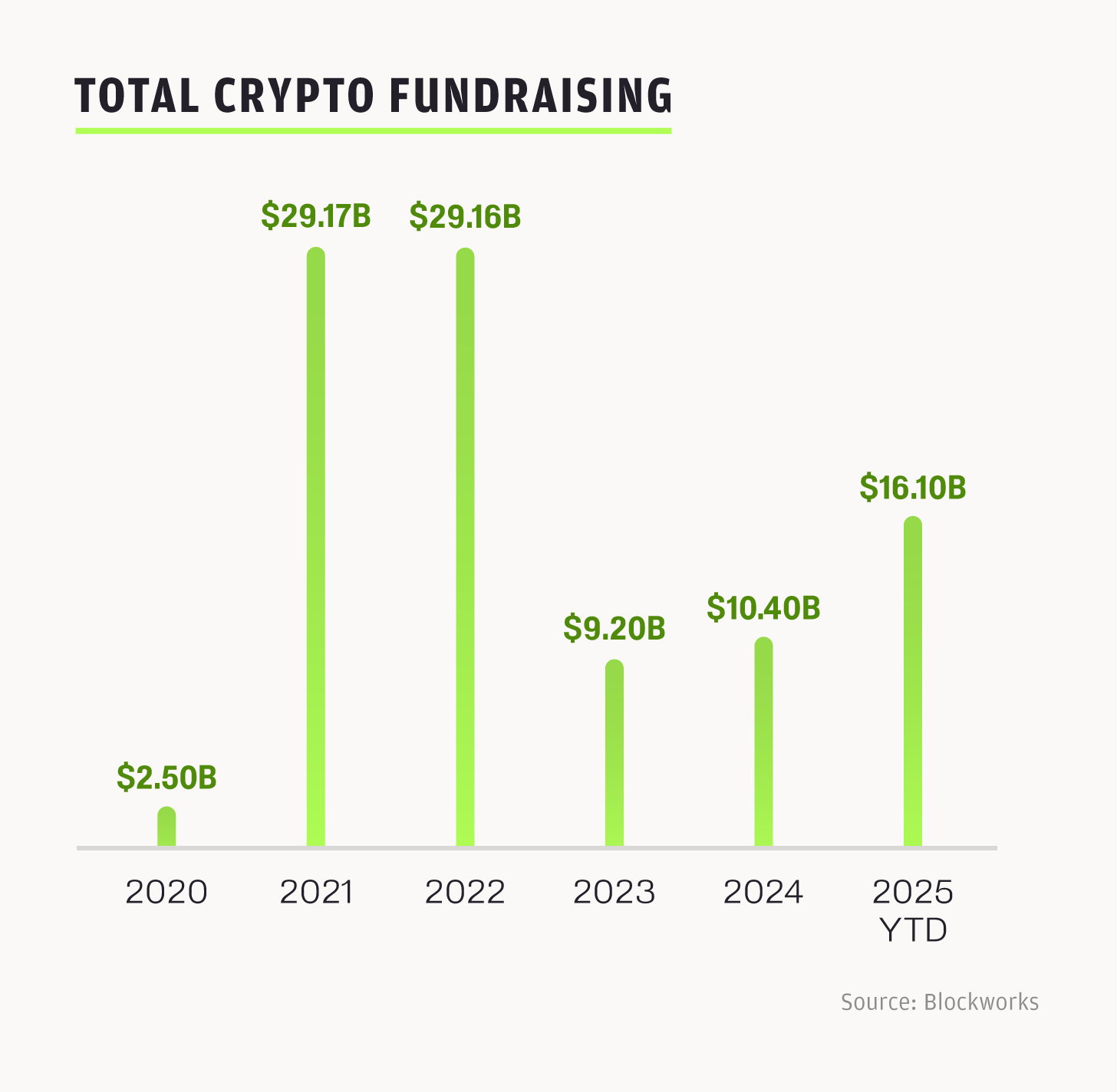

Venture capital is the fuel that is as reviled as it is revered. No matter how you look at it, when you invest it somewhere, growth is spurred. In this regard, the crypto industry is having an exceptional year in 2025. By the end of June, over 16 billion dollars had been raised from these financiers, and there were more than a hundred mergers and acquisitions.

This is evident from the Venture Capital Report released by Pantera Capital's managing partner, Paul Veradittakit. The report indicates that the crypto sector is on track to surpass the 2021 record of 29 billion dollars in capital raised. The key takeaway isn’t just the potential record—it’s the fact that the industry has once again become a favorite of venture capital, a status that seemed like a distant memory just three years ago.

Flashback to the end of 2022: things didn’t look too promising for the crypto industry. The market collapsed, and crypto companies fell like dominoes—sometimes due to mismanagement, sometimes because of outright fraud. The downfall of the American crypto exchange FTX, the largest of its kind, hit hard. It was the proverbial “dagger in the back,” the final humiliation of a hero just when the audience believed things couldn’t get any worse.

Would the crypto industry survive this? Was crypto permanently out of favor with both the public and investors? That was the fallout following FTX’s collapse in November 2022. Sam Bankman-Fried, who had portrayed himself as a benefactor, philanthropist, and savior of struggling crypto companies, turned out to be a fraudster. Insiders compared this sentiment to the dark days of 2014, when Mt. Gox—the then-largest exchange—collapsed.

Time and again, the industry kept shooting itself in the foot. It was fair to ask, which venture capitalist would ever want to invest in crypto companies again? Moreover, the AI industry had emerged as the new darling of financiers.

However, as demonstrated by the collapse of Mt. Gox, technology ultimately proves stronger than companies with flawed business models. In 2024, funding began to pick up again. Unlike previous cycles driven primarily by speculation, this renewed growth is supported by clearer regulations, a positive shift in the US, and increased institutional adoption. Consider Robinhood’s acquisition of Bitstamp, the rapid rise of stablecoins, and successful IPOs like those of Circle and BitGo. These developments have made new investors less hesitant. As Veradittakit put it:

"This is a pattern seen in other major technological shifts, where a multi-decade build-out precedes explosive growth."

Caveats

Although raising over 16 billion dollars is an impressive milestone, analysts have some reservations. Capital is increasingly concentrated in a smaller number of funds and more mature growth companies. As a result, while individual investment rounds are larger, there are fewer deals overall, making it no easier for young startups to secure funding than before.

There is also an uneven distribution of growth: while IPOs and acquisitions are booming, the market for new tokens is lagging behind. Thus, although the record sums signal maturation and consolidation, they do not guarantee that every segment of the crypto market will benefit at the same pace.

2️⃣ Rabobank: Crypto Important for Investors

Peter

Rabobank has recently conducted research on Dutch investment behavior. The figures demonstrate just how dynamic the world of investing is, and they show that crypto has firmly established a place in portfolios.

Notably, only a quarter of Dutch people between 18 and 80 report that they invest. This may seem low, especially in an era of low savings rates and high inflation. Despite numerous efforts to encourage investing, we remain stubborn savers.

A closer look reveals a highly fragmented investment landscape. Wealthy households, younger individuals, men, and the highly educated invest significantly more often. For example, 66% of households with readily available assets of 250,000 euros or more invest, compared to just 5% of households with less than 2,500 euros. As the saying goes, money makes money.

The most striking disparity appears across age groups. Younger Dutch investors are significantly more active than their older counterparts—in the 25-to-34 age range, 35% invest, compared to only 20% of those aged 55 to 64. This generational gap is due not only to differences in wealth but also to differing attitudes, with younger investors being more willing to take risks and viewing investing as a natural step.

This is where crypto comes into play. Among all investors, 26% say they own cryptocurrencies. For these individuals, crypto isn’t just a side interest—on average, they allocate a quarter of their disposable assets to it. While that is a significant amount, it appears to be a deliberate choice. The fact that they also keep nearly half of their assets in savings suggests they are not reckless. For those who don’t hold crypto, asset allocation remains more traditional, consisting largely of savings and conventional investments like stocks and funds.

Moreover, crypto isn’t embraced solely by the youngest. About one-third of investors aged 18 to 54 hold crypto, and even among those aged 55 to 80, the figure is 13%. The notion that crypto is only for people in their twenties and thirties is, therefore, inaccurate.

Why do the Dutch invest in the first place? Two main reasons dominate: building wealth (cited by 71%) and achieving returns higher than those offered by savings accounts (66%). In contrast, non-investors mostly cite risk and a lack of knowledge as reasons for staying on the sidelines.

The takeaway? Investing in the Netherlands is still not a mainstream activity, with notable disparities between young and old, rich and poor, and men and women. At the same time, crypto is quietly gaining ground—not as an exotic toy, but as a serious component in the portfolios of an increasing number of Dutch investors. Mary Pieterse-Bloem, who oversees the bank's investment policy, states:

Cryptocurrencies have now become a serious component of the investment strategy of many Dutch people across all age groups, despite their relative volatility and risk.

Source: FD.nl

3️⃣ Solana in the Spotlight

Peter

Solana is once again in the spotlight. Not because of a major technological breakthrough—the last significant innovation, xStocks, has been behind us for months—but due to a wave of speculation surrounding Digital Asset Treasuries (DATs). Companies are buying up SOL and adding it to their balance sheets in structures that strongly mirror Michael Saylor's strategic playbook.

xStocks recently reached a milestone by achieving an on-chain volume of $500 million in just six weeks. While this figure might seem modest compared to the billions traded daily with Nasdaq-listed stocks or even the volumes on Solana’s own DEXs, it serves as significant proof—within the niche of tokenized equities—that there is genuine interest in experimenting with blockchain-based stocks. Symbolic, but not insignificant.

New case study just dropped for teams scaling tokenized financial products.

— Solana (@solana) August 19, 2025

- 60+ tokenized U.S. stocks and ETFs on Solana

- Built-in compliance features with token extensions

- 24/7 trading with near instant settlement

Learn how @xStocksFi did 2B+ volume in 6 weeks 👇 pic.twitter.com/KdEb1FI4Y3

However, SOL’s impressive performance over the past 30 days isn’t due to xStocks or the network’s throughput. Instead, an increasing number of companies are seeking to purchase SOL as a reserve currency. Sharps Technology raised hundreds of millions for a Solana treasury, Pantera Capital is developing a multi-billion-dollar fund, and Multicoin, Galaxy, and Jump Crypto are establishing their own entities. The prospect of these enterprises collectively parking billions in SOL has driven its recent surge in price.

Sharps Technology, medical syringe manufacturer, plays to its strategic strengths and goes all-in crypto.

— Heikki Keskiväli (@hkeskiva) August 25, 2025

Stock $STSS +50% pic.twitter.com/QulTKf019M

There is, however, criticism. Some analysts warn that DATs could serve as a backdoor for vested investors to monetize their locked-up SOL by incorporating it into these structures in exchange for liquid shares. While hard evidence is lacking, the concern highlights a gray area between legitimate treasury strategies and attempts to circumvent lockup periods.

you can't be pushing this narrative while your buddy blows up the method

— Walmart Bagger (@BaggerWalmart) August 25, 2025

on a threadguy stream https://t.co/NMAHXawShN pic.twitter.com/VvYeWvRUSF

This brings us to the key question: Are these “Solana companies” operating legitimately? If so, they largely follow the Ethereum narrative—portraying Solana as a productive asset that not only preserves value but also generates income through staking and DeFi yields. However, concrete proof is still lacking, as only a small fraction of the SOL held in treasuries is actually being staked.

Alternatively, if they are operating illegitimately, then it’s less about robust treasury strategies and more about a mechanism for insiders to secure liquidity. The fact that this arena attracts opportunists is now beyond dispute, and therein lies the risk: if DATs primarily serve to bypass lockup periods, then the hype around Solana may prove unsustainable—fleeting, much like the speculation currently driving its price.

🍟 Snacks

To round things off, here are a few quick snacks:

- Increased search volume confirms growing interest in Ether (ETH). Searches for the second-most popular cryptocurrency have surged back to 2022 levels, driven by ETH’s strong price performance over the past 30 days relative to BTC, as well as by companies buying Ether to reinforce their cash reserves.

- Aave launches Horizon, a new market for real-world assets. Institutional investors can now borrow stablecoins against tokenized government bonds and stakes in money market funds as collateral. With partners like Circle and VanEck expected to provide liquidity and legitimacy, Aave believes it can attract up to $25 billion of traditional assets into the DeFi space.

- The US government records GDP data on-chain. The Department of Commerce uploaded a hash of the latest quarterly figures onto nine public networks—from bitcoin to avalanche. Core data was also distributed via Chainlink and Pyth oracles, with assistance from Coinbase and Kraken. The agency asserts that this will render the US economy “immutable” and globally accessible.

- The stablecoin market breaks the $280 billion barrier. Just last week, nearly $3 billion was added in new capital. Particularly notable is the growth of Ethena’s USDe, which has doubled in size since last August—now surpassed in size only by USDC and USDT. This shows that DeFi stablecoins, often offering attractive yields, can grow rapidly even in a market dominated by two giants.

- Google is developing its own blockchain network for banks. The Universal Ledger is designed as a neutral payment network, featuring smart contracts based on Python—a widely used programming language. Currently operational as a testnet and with CME Group as a pilot partner, Google is positioning itself as a serious infrastructure player in on-chain finance, with a focus on compliance and institutional applications.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!