Investing Isn't About Risk, It's About Fear

Forget risk! A new study reveals that fear—not risk—drives markets. Stocks may underperform for decades until FOMO and FOL shift the game, while ETH ETFs see record inflows. Ready to rethink how you invest?

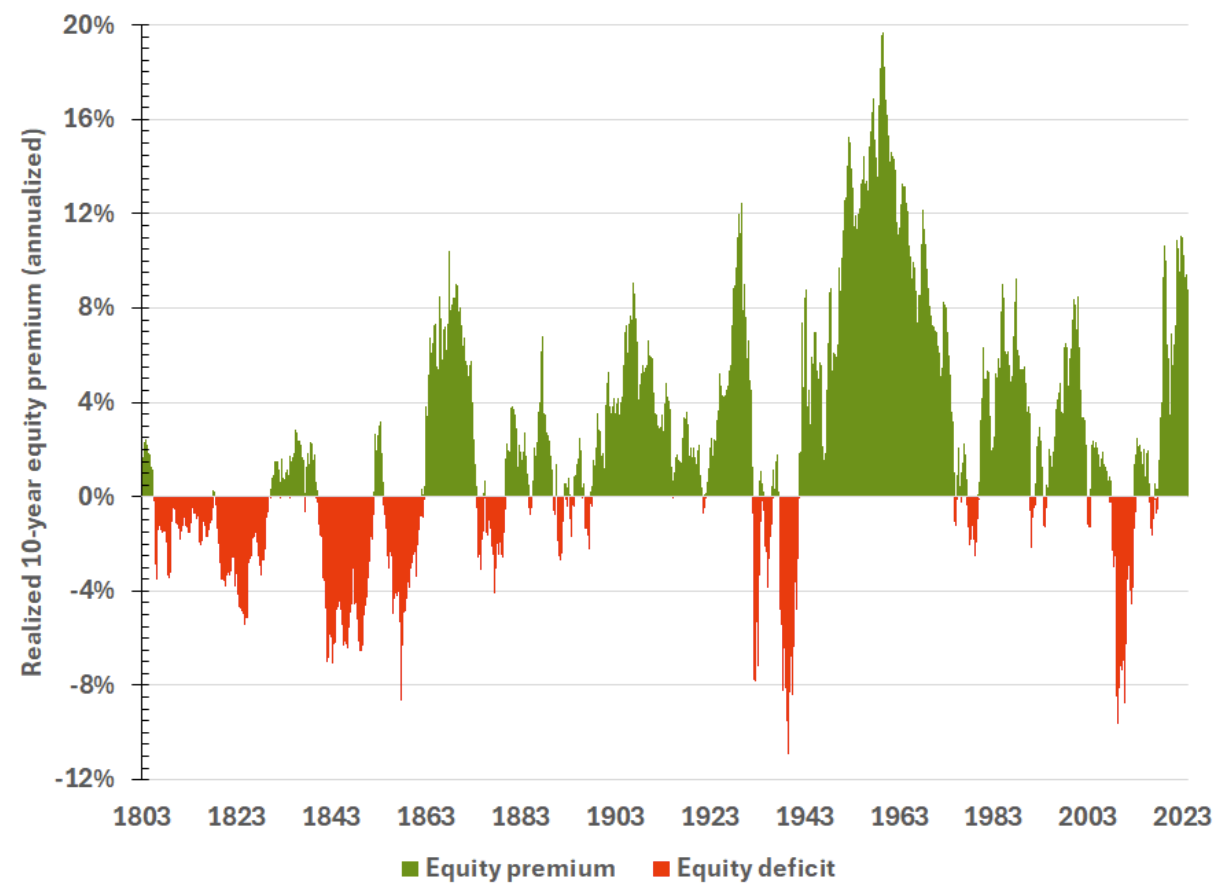

Imagine an investor who diligently puts his money into the stock market back in 1804. He buys on dips, reinvests dividends, and follows every rule to the letter. After ten years, he compares his returns with those of his neighbor, who had prudently invested in government bonds. To his dismay, he falls behind. Even after twenty years, he remains in the red. Thirty years, fifty years… only after 97 years (!) does he consistently outperform bonds. And after 129 years, the 1929 market crash once again erodes his gains. Not even Jeanne Calment, the longest-lived person on record at 122 years, witnessed an investor’s journey where stocks ultimately and decisively beat bonds.

This example is drawn from a new paper by Rob Arnott and Edward McQuarrie, two heavyweight figures in the financial world. Their message is designed to disrupt conventional thinking: investing isn’t primarily about risk—it’s about fear.

The Classic Idea of Risk

Since the 1960s, economists and investors have believed that higher risk brings higher reward. The logic is straightforward: those who dare to face the uncertainty of fluctuating stock prices should eventually be compensated. Risk can be measured—in terms of variance, standard deviation, beta—which makes it ideal for models, spreadsheets, and charts.

However… reality isn’t so tidy. History is full of periods when stocks failed to reward investors for taking on extra risk and instead underperformed for decades. Other so-called “risk premiums” have proven just as unpredictable, sometimes even defying theory.

The bitter truth is that economists have known this for half a century, yet they continue to apply new “patches” to their models. In the paper, the authors liken this to Ptolemy’s ancient notion that the sun revolved around the Earth—an idea that didn’t match reality, but by adding yet another circle, astronomers managed to keep the model alive.

From Risk to Fear

Arnott and McQuarrie propose a radically simpler diagnosis: it’s not risk, but fear that drives the market.

And fear isn’t symmetric. Investors don’t dread gains the way they dread losses. No one panics over an unexpected 20% increase. What truly moves us are two very human emotions:

- Fear of Loss (FOL): the dread of losing and watching your capital disappear.

- Fear of Missing Out (FOMO): the anxiety of missing out on gains that others are enjoying.

While traditional theory viewed both sides of volatility as equally undesirable, this distinction clarifies why markets often behave irrationally. Sometimes FOL takes over and investors rush to cash or bonds, while other times FOMO drives a mad dash into dotcoms, meme stocks, or bitcoin.

Fear is Universal

Importantly, this isn’t true only for individuals. Pension funds and professional asset managers also experience FOMO—though they call it “benchmark risk.” No one wants to fall short compared to their peers or competitors.

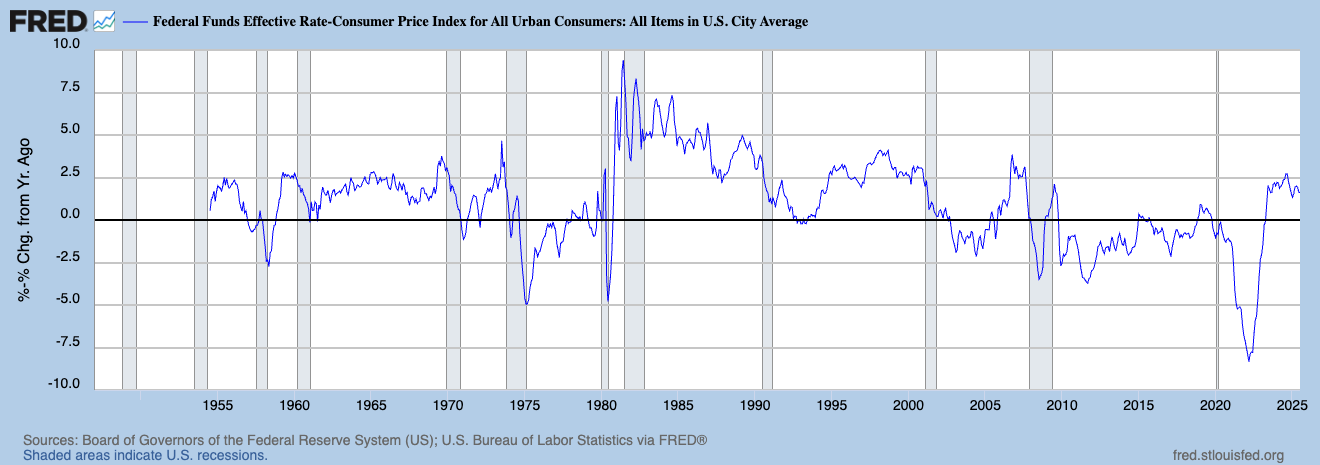

Moreover, as Arnott and McQuarrie point out, no asset is completely free of fear. Even cash, long considered the ultimate safe haven, can be unsettling. Think of the negative real interest rates over past decades that steadily eroded savers’ purchasing power. Even TIPS, designed to protect against inflation, delivered guaranteed real losses for extended periods. Fear is everywhere.

What Does This Mean for Investors?

Arnott and McQuarrie’s analysis offers a reality check that can shift your perspective on investing:

- More risk does not necessarily mean more reward. History often tells a different story. Blindly trusting the adage “in the long run you always win” can be perilous.

- Your emotions play a larger role than your spreadsheets. Investing isn’t just about numbers—it’s about understanding how fear, both yours and that of others, influences the market.

- Safety is relative. Even bonds and cash carry risks. Sometimes, not participating can be as dangerous as incurring losses.

- Markets are a mirror of our psyche. Bitcoin serves as a prime example—no other asset so clearly demonstrates how FOMO and FOL alternate, sending prices soaring or plummeting.

Confirming or Proving?

Does this “prove” that fear is the market’s driving force? Not exactly. The authors themselves admit that they are not presenting a complete model or a comprehensive empirical test. Their proposed metric, “upsilon,” is more of a thought experiment than rigorous science.

What the paper does achieve is an affirmation of what investors intuitively feel every day: markets are not rational machines but battlefields of emotion. The interplay of FOMO and FOL leaves little room for neat risk theories.

Those who grasp this concept not only see the market more clearly but also gain insight into their own behavior. Ultimately, investing may be less about managing risk than about managing your fears.

More Alpha

Are you a Plus member? Then let's continue with the following topics:

- Ethereum ETFs break records

- Amdax launches bitcoin reserve in Amsterdam

- Circle and Stripe challenge Ethereum

1️⃣ Ethereum ETFs break records

Erik

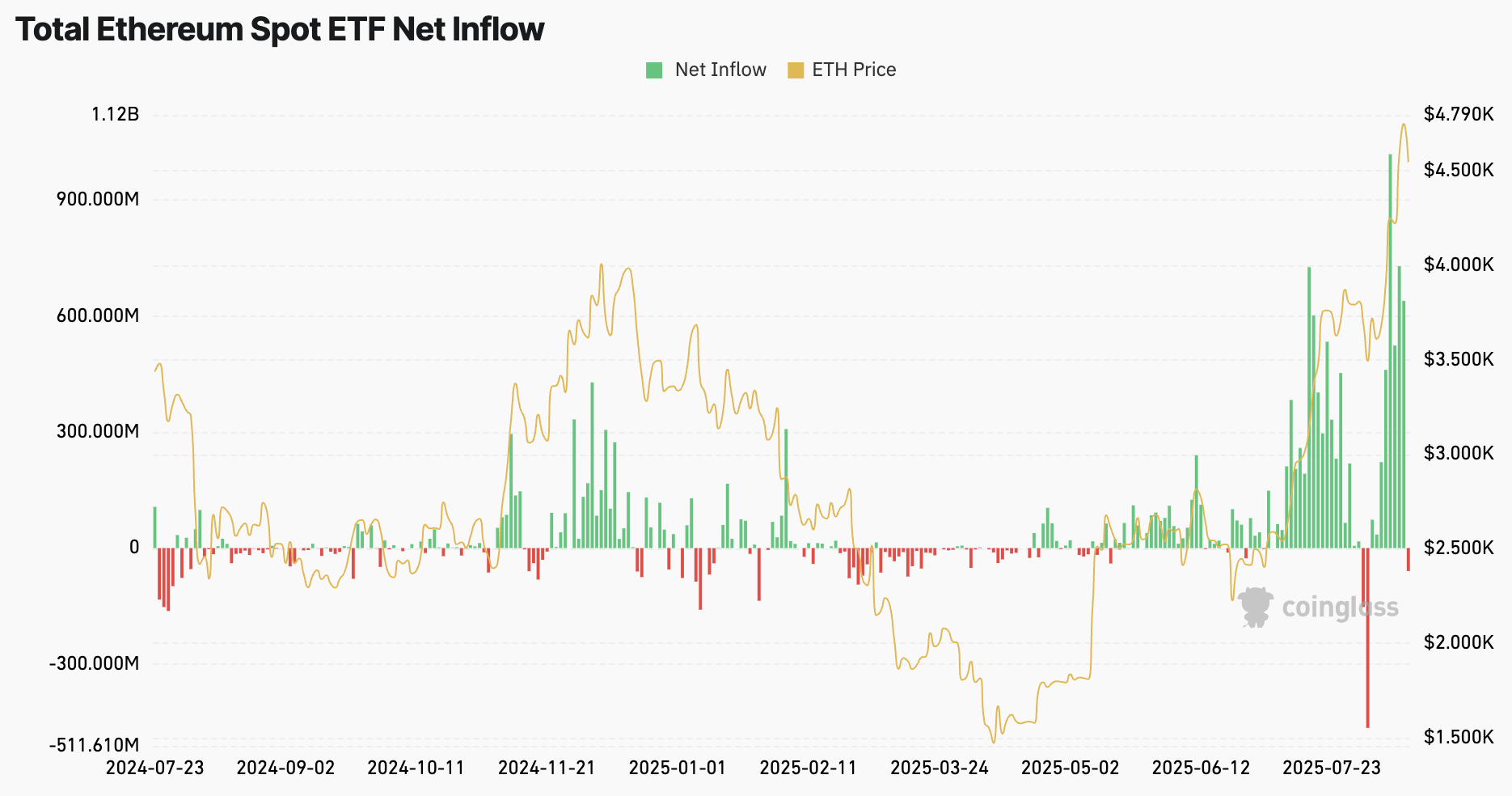

Recently, U.S. spot Ether ETFs have shattered records, attracting their highest inflows since launch. On August 11 alone, more than one billion dollars flowed into these funds, contributing to a record week with a net inflow of $3 billion.

The inflows over the past 12 months, as shown in the graph below, are measured in dollars—and when measured in ETH, those inflows also hit a record high.

As with spot Bitcoin ETFs, BlackRock’s fund clearly leads the market. BlackRock’s ETHA reached $10 billion in assets under management for the first time at the end of July, achieving that milestone in just 251 days since launch. This makes it the third-fastest ETF ever to hit that level, with the two fastest being BTC ETFs. The old narrative that Ethereum ETFs are underwhelming can now be set aside.

It’s no surprise that the recent surge in fund inflows coincided with a sharp rise in Ether’s price. Last week, ETH briefly surged above $4,700—nearly matching its November 2021 peak. Trading volumes during this period also set new records. A high trading volume strongly suggests that the price breakout is supported by genuine market backing rather than being a fleeting anomaly.

Record trading volume for spot eth ETFs…

— Nate Geraci (@NateGeraci) August 15, 2025

Look at this chart.

Good indication that institutional investors getting more involved.

via @sidcoins pic.twitter.com/obUhP98wHz

The institutions are coming

The rapid surge in inflows indicates that institutional interest in Ether is heating up. While retail investors can purchase ETH on crypto exchanges, some institutional players—such as pension funds—rely on ETFs to gain exposure to Ether’s price.

The explosive inflows into ETH ETFs represent a second catalyst behind Ether’s recent price surge. An earlier sign of institutional interest was the rise of Ethereum treasury companies, which we’ve covered several times in recent weeks. In just the past two months, companies like SharpLink Gaming and BitMine Immersion have acquired nearly 2 million ETH.

Do these companies’ purchases fully explain the ETF inflows? Not entirely, since treasury companies have other avenues for obtaining ETH aside from ETFs. They prefer to manage their Ether on-chain so they can stake it or generate returns in other ways. Clearly, the current institutional “ETH craze” is starting to establish a broader foundation.

2️⃣ Amdax launches bitcoin reserve in Amsterdam

Peter

Amdax is determined to put Europe on the Bitcoin map. Today, the company announced a new venture, Amsterdam Bitcoin Treasury Strategy (AMBTS), with plans to list on Euronext Amsterdam and grow into one of the world’s largest Bitcoin treasuries.

AMBTS is starting from scratch with a clear mission. First, it will raise capital from private investors to purchase its initial Bitcoins. Next, it plans to list in Amsterdam, making it accessible to institutional investors. In the long term, the company aims to expand through the capital markets and eventually hold at least 1% of all circulating Bitcoin—a bold “moonshot” equivalent to over 210,000 BTC.

𝗔𝗺𝗱𝗮𝘅 𝗶𝗻𝗶𝘁𝗶𝗮𝘁𝗲𝘀 𝗔𝗺𝘀𝘁𝗲𝗿𝗱𝗮𝗺 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗧𝗿𝗲𝗮𝘀𝘂𝗿𝘆 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 (𝗔𝗠𝗕𝗧𝗦)

— Amdax (@AmdaxNL) August 18, 2025

We are proud to announce that Amdax initiated AMBTS B.V. (‘AMBTS’), with the intention to list a Bitcoin treasury company on Euronext Amsterdam. The long-term ambition… pic.twitter.com/QBToYCYcO6

This initiative naturally evokes a strategic vision. Amdax intends to build a European alternative that is fully regulated and listed locally from day one. This will enable pension funds, insurers, and asset managers in Europe to directly invest in a company holding Bitcoin on its balance sheet—without relying on American products like BlackRock’s ETFs.

The choice of Euronext is both striking and logical. As the largest exchange in continental Europe, home to heavyweights like ASML and LVMH, it may not match the size and liquidity of U.S. markets, but that makes this initiative even more significant. It gives European investors their own gateway to Bitcoin under the trusted framework of a regulated exchange-traded fund.

Amdax emphasizes that AMBTS will operate independently, with its own governance and strategy, while still leveraging the experience and licenses of its parent company. In recent years, Amdax has invested heavily in regulation and compliance, and it is now one of the first crypto companies in Europe to hold a MiCAR license.

Dutch crypto leader Amdax will launch a Bitcoin Treasury Company AMBTS on Euronext, targeting 1% of the BTC supply. Good to see a financial firm as the first to announce this in The Netherlands, not through an RTO or SPAC, but a real IPO with prospectus.https://t.co/CGZH3hF4Dm

— Marc van der Chijs (@marcvanderchijs) August 18, 2025

It remains unclear how large the initial fundraising round will be. The press release only mentions “private investors” and a “head start” for the Bitcoin strategy.

In any case, for the first time in Europe, work is underway on a publicly listed company that makes Bitcoin the centerpiece of its business strategy—not as a side hustle, but as its primary focus—with an ambitious milestone on the horizon.

3️⃣ Circle and Stripe Challenge Ethereum

Peter

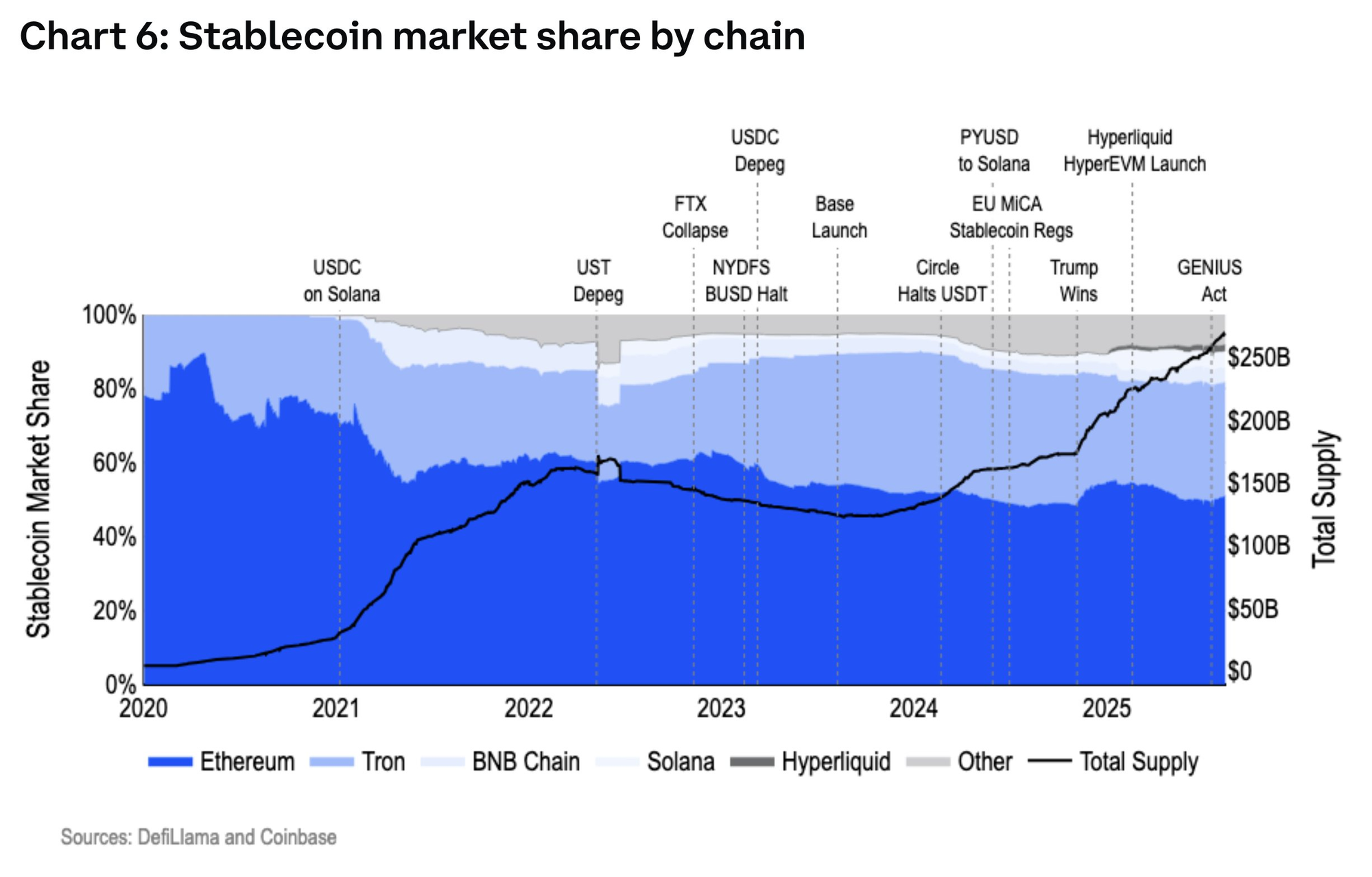

Ethereum is widely recognized as the engine behind stablecoins, with the majority of USDC and other dollar token transactions running on its network. However, this week that narrative was challenged as Circle and Stripe unveiled their own blockchain networks.

Circle introduced Arc, a network specifically engineered for payments and currency transactions. Notably, USDC is used as the network’s gas. Transactions are either immediately final or not processed at all, underscoring Circle’s commitment to speed, predictability, and control—qualities essential for payment systems. Arc is built on Malachite, a relatively new consensus engine previously utilized by Starknet, and is expected to be operational by early 2026.

Introducing Arc, the home for stablecoin finance.@Arc is an open Layer-1 blockchain purpose-built to drive the next chapter of financial innovation powered by stablecoins.

— Circle (@circle) August 12, 2025

Designed to provide an enterprise-grade foundation for payments, FX, and capital markets, Arc delivers… pic.twitter.com/Z8FHUls1xY

Meanwhile, Stripe is developing its own network, called Tempo, in collaboration with venture capitalist Paradigm. This network is also optimized for stablecoin payments. With its recent acquisition of Privy’s wallet software and Bridge’s stablecoin rails, Stripe is steadily building a full ecosystem—now adding a foundational layer of its own.

Reactions have been mixed. Supporters note that both networks remain compatible with Ethereum, further spreading the EVM standard. Much like Microsoft Excel became the lingua franca of Wall Street, the Ethereum Virtual Machine could well become the universal backend for the financial sector. The idea is that as every major company adopts its own “Excel,” Ethereum’s relevance only grows.

Critics, however, caution that if transaction flows increasingly migrate into closed ecosystems, less value may flow back to Ether itself. What does this mean for ETH as an investment?

The bottom line is that stablecoin usage is expanding rapidly. Research suggests that annual payment volumes could approach the $1 trillion mark by 2030. In this context, it makes sense that major companies are eager to control their own transaction rails.

But will these initiatives be successful? Corporate blockchains have rarely achieved lasting success. Consider Hyperledger and Corda, which mostly remained experimental; J.P. Morgan’s Quorum, which was spun off; or Facebook’s Libra, which never got off the ground amid political resistance.

The common thread is this: without an open ecosystem and a unifying token to connect users, developers, and investors, there’s little incentive for genuine growth. While Circle and Stripe are currently capitalizing on Ethereum’s and the stablecoin market’s success, the key question remains: are they building a closed system for payments, or can they create a vibrant, open ecosystem in return?

🍟 Snacks

To wrap up, here are a few quick bites:

- SEC Chief Atkins is going all-in on crypto. In an interview with Fox Business, he explained that he’s mobilizing his entire agency to turn the U.S. into the “crypto-capital of the world.” Project Crypto is aimed at clarifying issues around custody, token classification, and market structure. Atkins sees it as a historic opportunity to combine innovation with capital markets—clearly signaling that Washington intends to dominate the playing field.

- America’s Bitcoin reserve is causing confusion. This morning, Minister Bessent stated that the U.S. isn’t purchasing additional Bitcoin—its reserve consists solely of confiscated coins, now estimated to be worth between $15 and $20 billion. Later on X, another account suggested that “budget-neutral” methods for accumulating more Bitcoin are being explored. Washington is clearly getting creative in its quest to become the world’s “Bitcoin superpower.”

- Google even caused panic in the crypto world. A new rule on the Play Store appeared to ban non-custodial wallets by requiring a banking or MiCA license. For many privacy-focused wallets, this could have been the end. The ensuing uproar prompted Google to clarify that the rules only apply to companies managing their customers’ funds—non-custodial wallets remain perfectly allowed.

- Uniswap wants to take the leap into the real world with a DUNA. This new Wyoming legal structure grants DAOs legal status and limits participants’ liabilities, much like how the LLC transformed business structures in the 19th century. Decisions made by governance token holders will be legally binding off-chain, enabling Uniswap to sign contracts and forge partnerships—all while remaining fully decentralized.

- Citigroup also plans to offer crypto services. Initially, the major bank will focus on the custody of Bitcoin and Ether, particularly for companies with publicly traded funds. This positions Citigroup as a competitor to Coinbase, which currently dominates 80% of this market. Additionally, after previous successful experiments, the bank is exploring the role of stablecoins in accelerating payments.

- Google has acquired an 8% stake in Bitcoin miner TeraWulf. This deal is part of a broader agreement between TeraWulf and AI platform Fluidstack. Over the next 10 years, the miner will supply Fluidstack with more than 200 MW of computing capacity. Given the significant sums and risks involved, Google is backing the venture with $1.8 billion. TeraWulf is aligning itself with the growing trend of miners increasingly moving into AI.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!