If it walks like a bear...

Bitcoin slips to $82,000, flirting with November's lows. The evidence increasingly points to a bear market. Time to reassess our scenario probabilities.

For months, Donald Trump has been hinting at an imminent announcement of Jerome Powell's successor as chair of the Federal Reserve. The emerging picture was this: if Powell won't cut rates now, the next Fed chief will.

Candidates were falling over themselves to show Trump just how dovish they are. They tried to outdo each other with the number of rate cuts they envisioned. All to please the emperor. If Trump wants a dove, he'll get a dove.

Monetary doves focus primarily on economic growth and low unemployment. They often favor a looser monetary policy with lower rates, accepting that inflation might run a bit higher as a result. Good for risk assets and scarce holdings.

Monetary hawks are stricter and want the books balanced. Sustainable debt, limited budget deficits, and no risk of runaway prices. They only stimulate when the economy is screaming for it, and even then only if inflation allows.

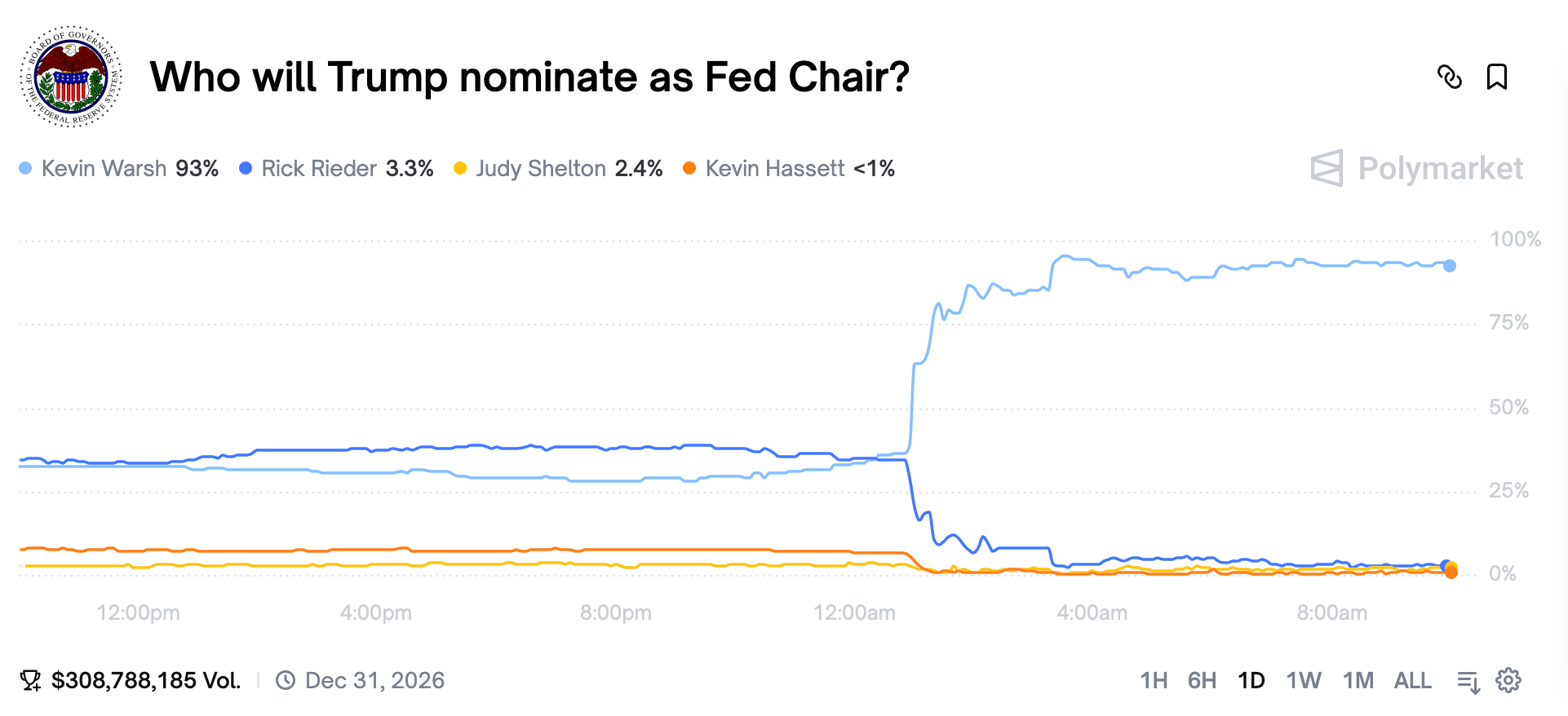

Last night, the rumor mill kicked into gear that the new Fed chief would actually be revealed today. On Polymarket, a name surged at 1:00 AM: Kevin Warsh. He was one of two Kevins who had been frontrunners for months. But now he'd been spotted at the White House for a meeting with Trump. Shortly after 3:00 AM, the Wall Street Journal reported they expect Trump to announce his choice of Warsh in the near term.

Financial markets didn't seem particularly enthusiastic. Stocks, bitcoin, gold, and silver all took a step down, while the dollar strengthened slightly.

A curious reaction. What was the market worried about? Anna Wong, chief economist at Bloomberg, wrote last week that Warsh has held hawkish views throughout his entire career. When he served on the Fed's rate committee from 2006 to 2011, he was still concerned about 1% inflation.

April 2009 - 7 months after Lehman, core PCE inflation at 0.8%, unemployment at 9%, he said: "I continue to be more worried about upside risks to inflation than downside risks."

Could the market be worried that Trump is making a mistake by accidentally handing a hawk the keys to the central bank?

Some bitcoiners aren't concerned. Warsh was recently openly positive about bitcoin. In July 2025, he said: "[bitcoin] could provide market discipline, or it could tell the world that things need to be fixed. [..] Bitcoin does not make me nervous." He described how he learned from Marc Andreessen "how transformative this new technology can be."

But that's certainly no guarantee of a favorable regime for bitcoin, or even smooth cooperation between the White House and the Fed. Just think back to Gary Gensler, who was supposed to create a crypto-friendly climate at the SEC. Before his appointment, he taught crypto courses at MIT, so things were bound to work out.

The opposite proved true. Gensler adopted his Democratic administration's stance like a tailored suit and fought the crypto sector tooth and nail. Even developers faced lawsuits.

Which suit would Warsh choose? That of the Trump administration, that of an independent Federal Reserve, or will he simply remain the hawk he's always been?

However it plays out, for now it's another weight on the scales of uncertainty. Alongside a potential new government shutdown, possible intervention in Iran, and a potential stalling of the Clarity Act.

Bitcoin remains trapped in the price range between $74,000 and $100,000. Two weeks ago slightly above the middle, and now slightly below.

A new weekly cycle began on November 21. Our base case is that this weekly cycle fails, meaning it ends below its starting point. Below $80,500, in other words. We don't expect that endpoint until the end of Q2. Plenty of time for further sideways movement.

That would be the best version of a bear market. Processing the capitulation and despondency through time rather than price. A nice rally in the daily cycle ahead of us could help with that. Let's hope so!

We continue with the following topics for our Alpha Plus members:

- Yearly, weekly & daily cycle

- Updated probabilities for our scenarios

- Time as friend and foe for bitcoin

- Should we look at bitcoin differently?

- Are we witnessing the birth of a new world?

1️⃣ Yearly, weekly & daily cycle

Bert

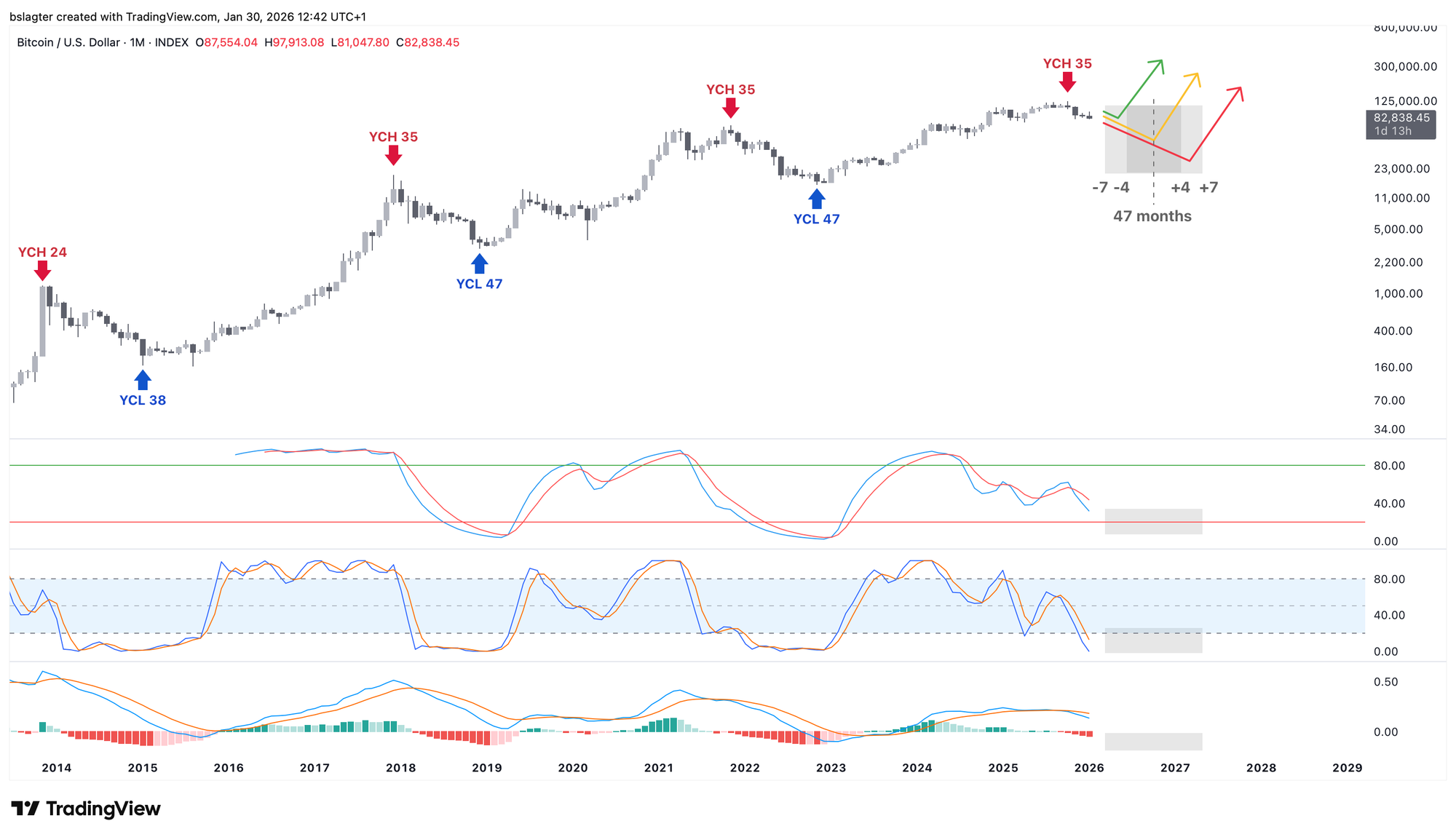

Let's take a look at where we stand through the lens of cycle analysis. We'll start with the yearly cycle. We plot this on the monthly chart, with the 10-month moving average as the dividing line between the rising and falling portions of the market cycle.

In a few days, we'll know what the chart looks like with January included. The oscillators at the bottom will take another step down and are already well on their way to the zone where bottoms are typically formed.

Assuming an average length of 47 months, a spread of -15% to +15% yields a time window from March 2026 to May 2027 for the yearly cycle low (YCL), the bear market bottom.

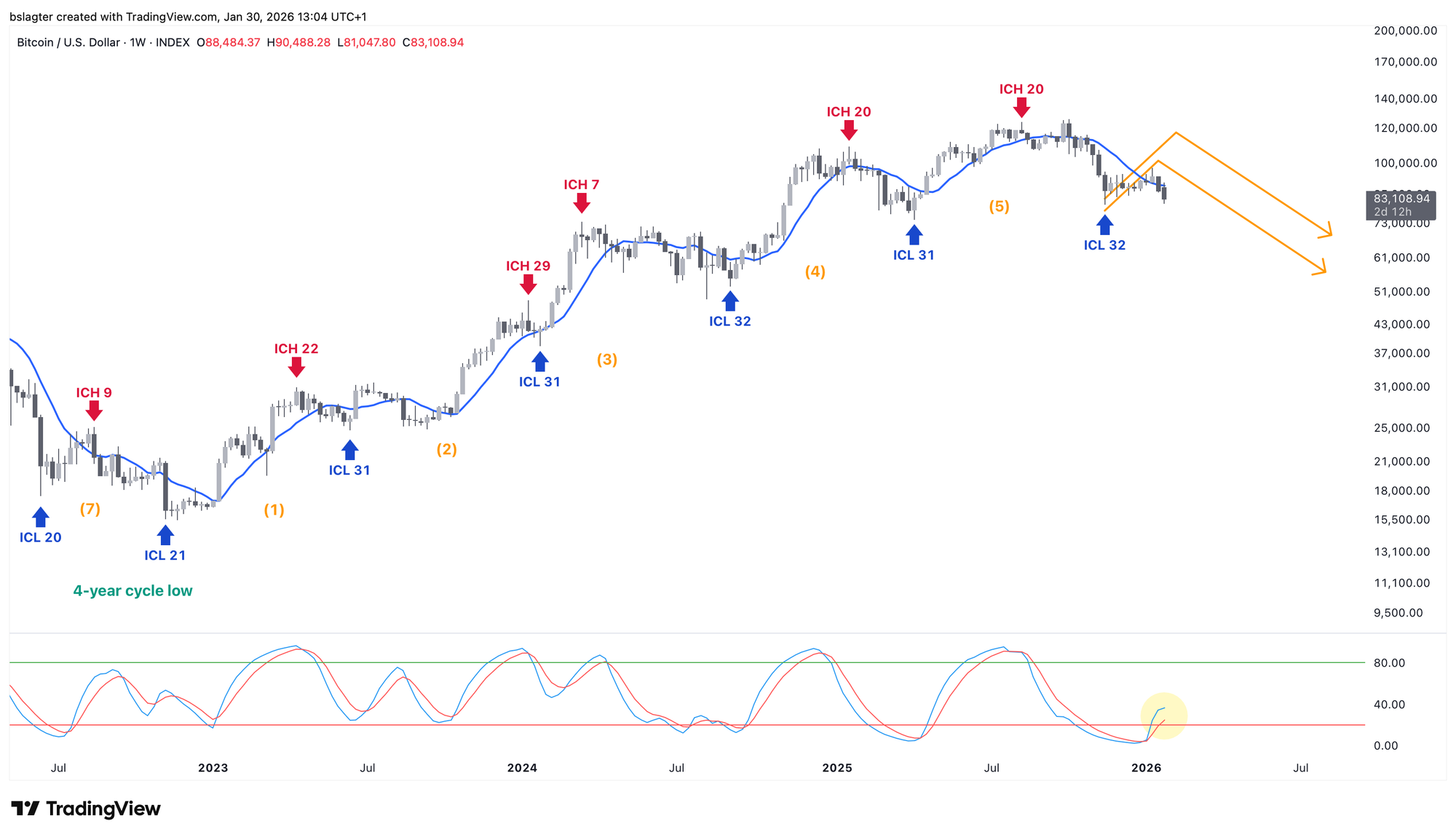

We're now in the tenth week of this weekly cycle. By now, it's certain that November 21 was a weekly cycle low (ICL). We've had a weekly close above the 10-week moving average, the oscillator is curling up, and we're now well outside the 'timing band' where the ICL typically falls.

In week 9, we dipped back below the 10-week moving average. That doesn't fit well with a bull market. More on that shortly.

In the declining portion of the yearly cycle, weekly cycles are by definition declining. We therefore expect this weekly cycle to fail and end below $80,500. We also expect this weekly cycle to be 'left translated' (LT), meaning the top sits to the left of center.

It's possible that the $98,000 on January 14 was already the top of this weekly cycle (ICH). But it doesn't have to be. It could also rise above $100,000 in February and then head toward the ICL.

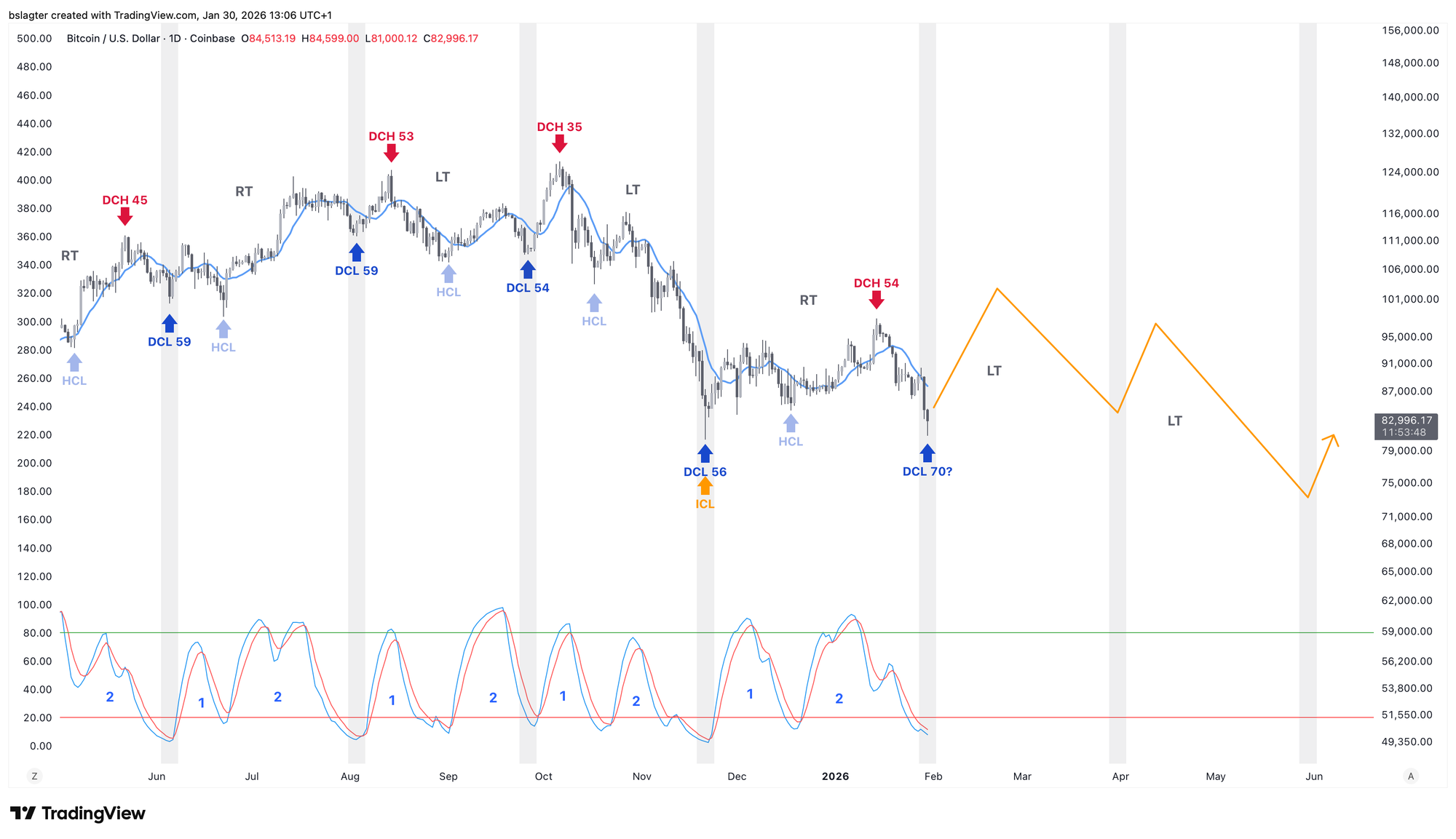

The question is really whether the daily cycle high (DCH) of the first or second daily cycle will become the ICH. It appears we're around the end of the first daily cycle. If the ICH were to occur in the second daily cycle, price would need to rally strongly from here.

The chart below shows what that could look like. Not a prediction, just an illustration of the scenario where the ICH is still ahead of us.

2️⃣ Updated probabilities for our scenarios

Bert

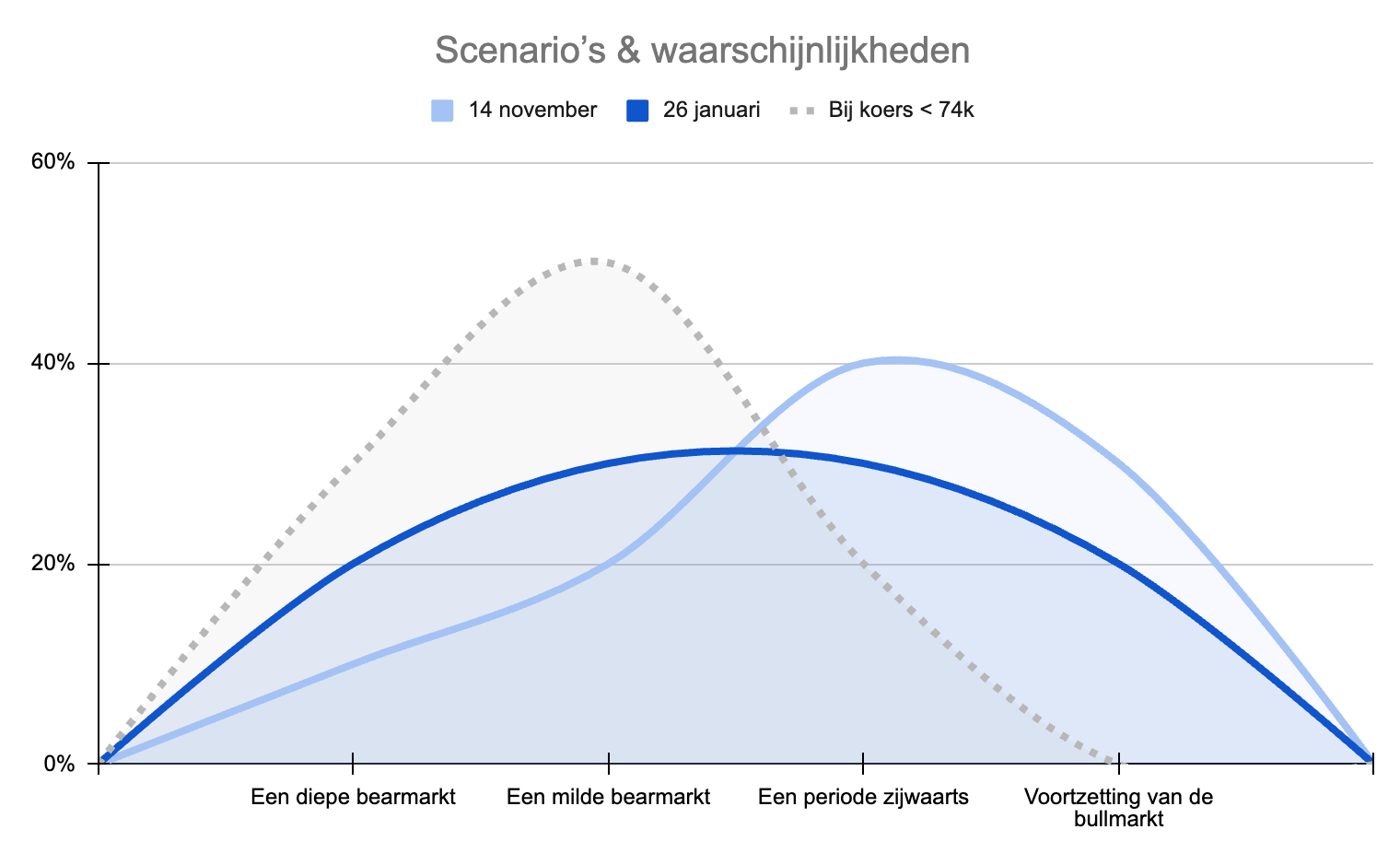

When price was heading toward a weekly close below the 50-week moving average on Friday, November 14, we created four scenarios and assigned probabilities:

- Bull market continuation: 30%

- A period of sideways movement: 40%

- A mild bear market: 20%

- A deep bear market: 10%

These percentages remained unchanged for the following ten weeks. There was new information, but nothing weighty enough to revise the odds.

This week, we're adjusting them. The immediate trigger is the weekly close below the 10-week moving average. That increases the likelihood that $98,000 was the top of this weekly cycle, and therefore that the bull market is over.

Supporting evidence for the end of the bull market has accumulated in recent weeks. From open capitulation by bitcoiners to haters writing bitcoin's obituary. The divergence between risk indicators and bitcoin. The failure of every bullish setup. Lukewarm return of liquidity to the market. Weak on-chain indicator data. And so on.

If it walks like a bear and growls like a bear, it's probably a bear.

We arrive at an 80% bear market and 20% bull market distribution. We'll only move to 0% bull market upon a lower high (LH) below $126,000 or a lower low (LL) below $74,000.

The probability of the first scenario thus drops from 30% to 20%. The distribution within the bear market scenarios also shifts slightly more negative. This is primarily due to the absence of a serious relief rally. Supporting this is some negative reflexivity we're seeing emerge. People who previously said "I'll buy at $74k" now want to wait for $50k.

We arrive at:

- Bull market continuation: 20%

- A period of sideways movement: 30%

- A mild bear market: 30%

- A deep bear market: 20%

At prices below $74,000, creating a LL on the weekly chart, we would move to:

- Bull market continuation: 0%

- A period of sideways movement: 20%

- A mild bear market: 50%

- A deep bear market: 30%

In the chart, you can see the probabilities shifting from right (optimistic) to left (pessimistic).

Below is the chart of my personal favorite scenario: a period of sideways movement. I would have liked to assign it higher probability, but you can clearly see why that's not justified. Price isn't oscillating around the 50-week moving average—it's staying below it.

3️⃣ Time as friend and foe for bitcoin

Sam

Since mid-November, bitcoin has been stuck in the price range between roughly $94,000 and $80,500, with the exception of a brief excursion in mid-January.

That's somewhat more positive than the strong downtrend that preceded it, between October 6 and November 21. But only somewhat. The asset classes that bitcoin is regularly compared to, such as the Nasdaq and gold, are at or near all-time highs.

Time could easily become the enemy. Just because bitcoin isn't moving up alongside them doesn't automatically mean it will be decoupled during a correction. If sentiment in the investment world turns outright negative, bitcoin is unlikely to escape unscathed.

But if optimism prevails and the uptrend in stocks continues, time can also be seen as a friend.

It's rare for a strong trend to be immediately followed by a strong trend in the opposite direction. That happens with parabolic rallies or downward shocks, like bitcoin experienced in late 2017 and during the covid crash. But not with a measured trend like in October and November.

It's more likely that prices move sideways for a period before the trend reverses. This certainly doesn't mean our base case is a resumption of the bull market, since market structure and indicators favor the bears. It does mean that the odds of a significant rally and possibly new highs increase the longer price moves sideways without setting new lows.

4️⃣ Should we look at bitcoin differently?

Thom

For many investors, bitcoin is still seen as a digital version of gold. That's precisely why the disappointment is so great now that bitcoin can't even come close to matching gold's recent returns. In a period where stocks are cautiously approaching all-time highs and gold is performing exceptionally well, bitcoin is lagging. This is creating an increasingly sour sentiment.

How can it be that bitcoin isn't participating in an environment that should theoretically be favorable?

Several explanations are currently circulating:

- Gold is stealing all the attention.

- The four-year cycle narrative is creating elevated selling pressure.

- There's still too much regulatory uncertainty, keeping the big players on the sidelines.

These factors are all undoubtedly playing a role to some degree in bitcoin's disappointing price action. Yet the analysts at Market Radar came up with what I consider the best explanation for the underwhelming performance: "Bitcoin isn't lagging because something is broken. It's lagging because it never was what the maximalists made it out to be from the start."

For years, maximalists proclaimed that bitcoin would eventually replace gold as the world's primary reserve asset. Bitcoin was positioned as digital gold: a superior store of value.

Based on the properties of both bitcoin and gold, there's something to be said for that, the Market Radar analysts acknowledge. At the same time, they argue that bitcoiners have gotten way ahead of themselves with such claims, creating unrealistic expectations.

Bitcoin could become that reserve asset one day, but it's far from that now. Central banks and traditional finance reach for gold when uncertainty rises. Gold is the safe haven of the financial world, and bitcoin is not—at least not yet.

At Market Radar, they put it this way: "Bitcoin and gold don't compete with each other. Gold competes with bonds. Bitcoin competes with stocks."

They've hit the nail on the head, in my view. When fear really spikes, and even bonds don't feel like a safe haven, investors flock to gold. Bitcoin is almost the opposite. For bitcoin, investors need to be hungry for risk, brimming with confidence, and liquidity needs to be abundant.

Bitcoin isn't a safe haven like gold, but rather an asset that could become one in the future. Investors buying bitcoin today are essentially doing so based on an expectation: a world where bitcoin plays a structural role as a reserve asset or digital store of value.

For now, that phase hasn't been reached. Currently, bitcoin needs a high degree of risk appetite among investors to perform well. And that risk appetite is precisely what's missing at the moment. In an environment where capital is being deployed more cautiously, the most speculative and forward-looking investments tend to fall back the most.

We're not seeing that pattern only in bitcoin. Look at the IPO ETF, for example, which provides exposure to recently listed companies, or ARKW, an ETF focused on innovative growth-oriented tech companies. These are quintessential investments that thrive in a pronounced 'risk-on' environment.

Together with bitcoin, these ETFs reached a local peak in October. Since then, the picture has been similar.

5️⃣ Are we witnessing the birth of a new world?

Thom

The recent period has been marked by rising geopolitical tensions and structural uncertainty. We're seeing that reflected in financial markets as well. Rates are climbing, the US dollar is losing ground, and gold is flourishing as a safe haven. We've seen this combination before, including in April 2025, but this time it feels different. Perhaps less dramatic, but more fundamental.

According to Jurrien Timmer, head of global macro at Fidelity, that's no coincidence. Markets aren't just reacting to inflation figures, rate meetings, or trade tariffs, he says—they're reacting to something bigger: a world order that's slowly shifting. Not an abrupt break or panic, but a gradual repositioning of capital in a world that's becoming less predictable.

Rising yields on 10-year US Treasuries play a central role in this. Such a rate increase isn't necessarily negative. In a classic economic cycle, long-term rates often rise because investors expect higher growth. That typically goes hand in hand with a strong dollar and stock market optimism.

That's not what's happening now. While the 10-year yield is rising, the dollar is actually weakening. Meanwhile, gold remains popular. That combination is unusual. If higher economic growth were the driving force, capital would flow toward the United States and strengthen the dollar. That's not happening.

Gold is also telling an important story here. Normally, higher rates make gold less attractive because gold doesn't pay interest. The fact that gold is rising anyway suggests investors aren't primarily seeking returns, but protection. The rate increase seems less a result of optimism and more a result of uncertainty.

A significant part of that uncertainty lies in the so-called term premium: the extra compensation investors demand for locking up money for longer periods. This premium rises when concerns increase about inflation, budget deficits, and the sustainability of the financial system. The bond market is simply demanding a higher price for lending money over extended periods.

This brings the dollar's role into focus as well. For years, the US currency was the undisputed center of the global financial system. Geopolitical tensions and financial sanctions have eroded that status. The result isn't a flight from the dollar, but a gradual diversification.

The chart below summarizes this development. Where a rising 10-year yield normally coincides with a stronger dollar and weaker gold price, the opposite is now happening. This anomalous combination has become more visible since 2025, the start of Trump's second term, as an acceleration of a trend that had been simmering for some time.

It remains difficult to say with certainty that we're dealing with an entirely new reality. At the same time, the market does seem to be pricing in this potential shift, through a gradual reallocation of capital toward hard assets.

For bitcoin, this is an interesting test. In theory, this environment offers room for the digital currency as a beacon of stability and certainty in an uncertain world. In practice, bitcoin still needs to claim that role, as I discussed in my previous piece. The question for the coming years is: can bitcoin make that leap?

In closing

All previous editions of Alpha Markets can be found in the archive. Questions, comments, and suggestions are always welcome in the community.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!