Deceptive Calm

Bitcoin sits in a deceptive calm: headwinds from profit-takers, macro uncertainty and cycle fears clash with tailwinds from policy, institutions and easing prospects. What the winter at the Somme tells us about what comes next.

In the winter of 1916-1917, after months of senseless violence at the Somme, the front suddenly fell silent. No more major offensives, barely any ground gained, just an uneasy calm. Soldiers stood knee-deep in mud with no idea what the next day would bring. It wasn't that nothing was happening. Quite the opposite. But the activity seemed to be pulling in opposite directions. The wind was blowing from two sides at once, keeping everyone exactly where they stood.

It's a bit like the stalemate the bitcoin market finds itself in.

On one side, there's headwind. A colourful array of reasons to sell. Investors who got in early are taking profits above $100,000. Others are swapping bitcoin for AI stocks and gold, the shiny narratives of the moment. Some have seen the logical end of the mythical four-year cycle. Yet another group is simply pulling the handbrake—strategically, out of caution, doubt, or fatigue after a long ride up.

People often ask me "how certain are you that the four year cycle is broken?"

— Jeff Park (@dgt10011) October 15, 2025

All you need to do is look at these three charts. pic.twitter.com/TrzL8W2ubA

On top of that, the macro landscape temporarily deteriorated. The US government shutdown created uncertainty, partly because essential economic data wasn't being published. Liquidity in the bond market tightened. And even the AI rally got vertigo; when the world's favorite growth story stumbles, it creates nervousness elsewhere too.

All together: significant headwind. But strangely enough, it still hasn't really brought the bitcoin market to its knees.

Because in the US, new policy is increasingly aligning behind bitcoin and the broader crypto sector. After years of threats from Washington, embrace now follows. Major financial institutions are entering the market as if they'd always planned to. The ETF investors participating in large numbers are proving remarkably steadfast. Months of price swings, corrections, and uncertainties seemingly leave them unfazed.

And then there's the macro tailwind that's only gently perceptible. Central banks backing away from further tightening. Rate cuts drawing closer. Nothing stops this train, Lyn Alden chants audibly in the background.

This is pretty interesting

— Will (@WClementeIII) December 7, 2025

Larry Fink says Blackrock is seeing several sovereign wealth funds starting to accumulate BTC into the drawdown pic.twitter.com/1ygZ5QqpqX

The result? Wind blowing from two directions at once. And because of that, bitcoin seems to hang in limbo. Which brings us back to the winter at the Somme: there, the calm turned out not to be rest, but the result of tension.

Underground, tunnels were being dug, supplies were being stockpiled, and entire divisions were changing position. The silence was actually a boiling point. Only in hindsight did historians see how inevitable the next major movements were.

For bitcoin too, the calm doesn't feel like tranquility, but like nervously waiting for a decision. While the price crawls sideways, whales are building positions. Developers keep working on the networks where value is being locked up. More and more countries are experimenting with crypto regulations that actually enable adoption. And a growing number of sovereign wealth funds are building new bitcoin reserves.

That's what's deceptive about long consolidations: they feel like standstill but behave like a spring being slowly compressed. The tension builds, but nobody knows when it will release. Only in hindsight does it look logical. That was true in 2013, in 2017, and in 2020–2021. And possibly again in 2026.

The winter at the Somme shows that silence is rarely the end state. It's the moment when forces are being redistributed. One waits, another builds. One fears, another gathers courage. And one day, one of the winds dies down—the fear or the hope—and the movement that seemed inevitable in hindsight begins.

More Alpha

Are you a Plus member? Then we continue with the following topics:

- Fusaka shows where Ethereum is headed

- Ruble stablecoin on the rise, banned in the EU

- Ten charts that define 2025

1️⃣ Fusaka shows where Ethereum is headed

Peter

Ethereum is being developed at a rapid pace. You really only see this when you put the list of upgrades side by side. Last year, Dencun brought blobs, an improvement that made using Layer 2 networks cheaper. Last summer, Pectra followed with smaller but important optimizations to the execution layer. And now, less than six months later, Fusaka is live.

The upgrade was activated Wednesday evening and was completed without issues within 15 minutes. There's more signal in that than you might expect. Ethereum was regularly criticized in recent years for developing too slowly, with upgrades that were too heavy. Fusaka was meant to break that pattern: a compact, sharply defined release, focused on what needs to be solved now. That succeeded.

Someone had to make the Fusaka cheat sheet.

— James | Ethereum Foundation ⟠ | Snapcrackle.eth (@Snapcrackle) December 3, 2025

Here you go pic.twitter.com/C32z6Xiy9L

The centerpiece of the upgrade is called PeerDAS. The problem is well-known: Layer 2s dump their compressed transaction data onto Ethereum's base layer, where validators must fully download and verify it. That costs bandwidth and energy; it slows down precisely the parties that need to scale Ethereum.

PeerDAS changes these rules. Validators no longer need to inspect all the data but can simply take small samples. The principle resembles data-sampling: you check enough to know with high confidence that the entire package is correct. This lowers costs for validators and speeds up settlement for Layer 2 networks, which now generate most of the traffic. Especially smaller and newer node operators benefit, as hardware requirements decrease.

Around PeerDAS, twelve additional EIPs have been bundled. Old fields in network messages are being cleaned up, transactions and blocks get clear maximum sizes, intensive operations are priced more fairly, and future upgrades are being prepared.

Fusaka, @Ethereum's next major upgrade, is right around the corner.

— Conduit (@conduitxyz) December 1, 2025

It touches everything from blobs and gas to validator UX.

We broke down every EIP by what it actually means for builders and operators 👇 pic.twitter.com/FEGrXJArzE

The effects of Fusaka will only become visible in the coming months. Developers are gradually increasing the number of blobs to see what the network can handle.

Meanwhile, teams are already looking ahead to Glamsterdam, the next upgrade. What goes into it isn't set yet, but the direction is clear: smaller, frequent releases that incrementally increase the network's scalability, instead of one mega-upgrade that has to solve everything at once.

Fusaka coincides with notable statements from SEC Chair Paul Atkins. He suggests that the American financial market will migrate to blockchain networks within two years. For Atkins, tokenization isn't about ideology, but about transparency, efficiency, and better risk management.

🚨SEC Chair Paul Atkins: 🇺🇸"All U.S. markets will be on chain within two years." pic.twitter.com/y8118oDNcO

— Coin Bureau (@coinbureau) December 6, 2025

If he's right—and more institutions are speaking in the same direction—one pressing question emerges: which networks are technically capable of supporting such a migration?

Right now, Ethereum is the big winner in this context, with more than 65% of all tokenization activity recorded on it. Whether it can maintain that lead? At least it won't be because of the pace at which upgrades follow each other. Moreover, those upgrades show what Ethereum is quietly preparing for: becoming exactly the infrastructure Atkins is talking about.

SEC Chair Paul Atkins said "all U.S. markets will be on chain within two years."

— Joseph Young (@iamjosephyoung) December 7, 2025

ethereum leads tokenization with a dominant 65.72% market share.

all U.S markets will be on chain on ethereum.

2️⃣ Ruble stablecoin on the rise, banned in the EU

Erik

The vast majority of all stablecoins in circulation are pegged to the US dollar. The currency that surprisingly ranks second is the Russian ruble. The stablecoin A7A5, less than a year after its launch, has surpassed the euro stablecoin EURC in market share. Since late November, it has been officially forbidden for EU residents to trade A7A5.

The EU's 19th sanctions package has just sanctioned the issuer and banned transactions involving A7A5, the cryptocurrency linked to Russian sanctions evasion which our @Cen4infoRes investigation exposed in June. Check it out https://t.co/FMGcgp9ya4 pic.twitter.com/CDJR5j7EgN

— Elise Thomas (@elisethoma5) October 23, 2025

In a new sanctions package against Russia, the European Union for the first time targets not only crypto companies but explicitly stablecoin A7A5 and its issuer, the Kyrgyz company Old Vector. The European Council:

"The stablecoin A7A5, created with Russian state support, has grown into a prominent instrument for financing activities in support of the war of aggression. Therefore, sanctions are now being imposed on the developer of A7A5, the Kyrgyz issuer of that coin, and the operator of a platform where large volumes of A7A5 are traded. Transactions with this stablecoin are also prohibited throughout the EU."

Earlier, the US OFAC had already sanctioned the entire ecosystem of exchanges and companies around this stablecoin. Only a small number of Russia-connected exchanges offer A7A5. Additionally, a decentralized exchange has been created, a special 'window' for swapping A7A5 to dollar stablecoins. This way, rubles can slip into the broader ecosystem.

With Putin's blessing

Like most authoritarian states, Russia has had a problematic relationship with crypto over the years. So why is this stablecoin tolerated and even encouraged? A7A5, which is issued on Tron and Ethereum, is part of a network sanctioned by the Kremlin. Central to it is a fugitive Moldovan oligarch, convicted as the mastermind behind the "theft of the century," and the Russian state bank Promsvyazbank (PSB), which has close ties to the military-industrial complex.

Confused about how this A7A5 cryptocurrency scheme is set up? @disconnect has got you covered. pic.twitter.com/d9yMBUzRtc

— Mike Eckel (@Mike_Eckel) December 2, 2025

Together, the bank and the oligarch run the company A7, which according to Chainalysis processed $79 billion in transaction volume in less than a year. Proof that Putin has given his blessing to A7 is that he personally called in at the opening of a branch in September.

A stablecoin for international trade

Since the Ukraine war, Russia's banking system has become practically inaccessible to trading partners from the EU. Major Russian banks suffer under sanctions, SWIFT connections are limited, and foreign banks barely dare to accept rubles anymore.

This stablecoin has jumped into the gap created by the lost liquidity in the ruble market. The real rubles stay at a Russian bank, while claims on those rubles can travel as tokens over blockchain rails—bypassing SWIFT. Russia's trading partners can receive, pass on, or exchange those tokens on an exchange without visibly doing business directly with a Russian bank.

That A7A5 is probably actually used for this—for international trade—is also Chainalysis's conclusion:

"Notably, A7A5 trading occurs predominantly on a limited schedule between Monday and Friday, suggesting that A7A5 is a medium of business exchange as opposed to a retail token."

The question now is to what extent A7A5 will be affected by the EU's new sanctions package. For trading partners, using A7A5 in the EU has suddenly become a high-risk activity. Due to the new sanctions, this is becoming an increasingly risky and difficult route in practice.

The maturation of stablecoins

Stablecoins have played a prominent role in the most recent cycles. In a sense, A7A5 is a new example of the 'acceptance' of stablecoins as a mature means of payment. A7A5 is politically highly sensitive, but economically speaking, it's a data point on the same chart where EUR stablecoins and Asian variants are visible: for non-dollar-based stablecoins too, clear use cases exist.

3️⃣ Ten charts that define 2025

Peter

December is traditionally the time when the sector takes stock. Sometimes with long essays, but sometimes more concisely. With some charts, for example. That brings us to an X thread from Ishmael Asad (Bitwise): ten charts showing what 2025 was really about, and perhaps already previewing the themes of 2026.

1) Crypto Wrapped 2025: 10 Incredible Crypto Charts

— Ishmael Asad (@AsadIshmael) December 4, 2025

If you look beyond the prices (it's hard, I know) you'll see there's a ton of major developments happening across crypto right now. Traction mounting, new doors opening, and users staying.

Let's take a look 🧵

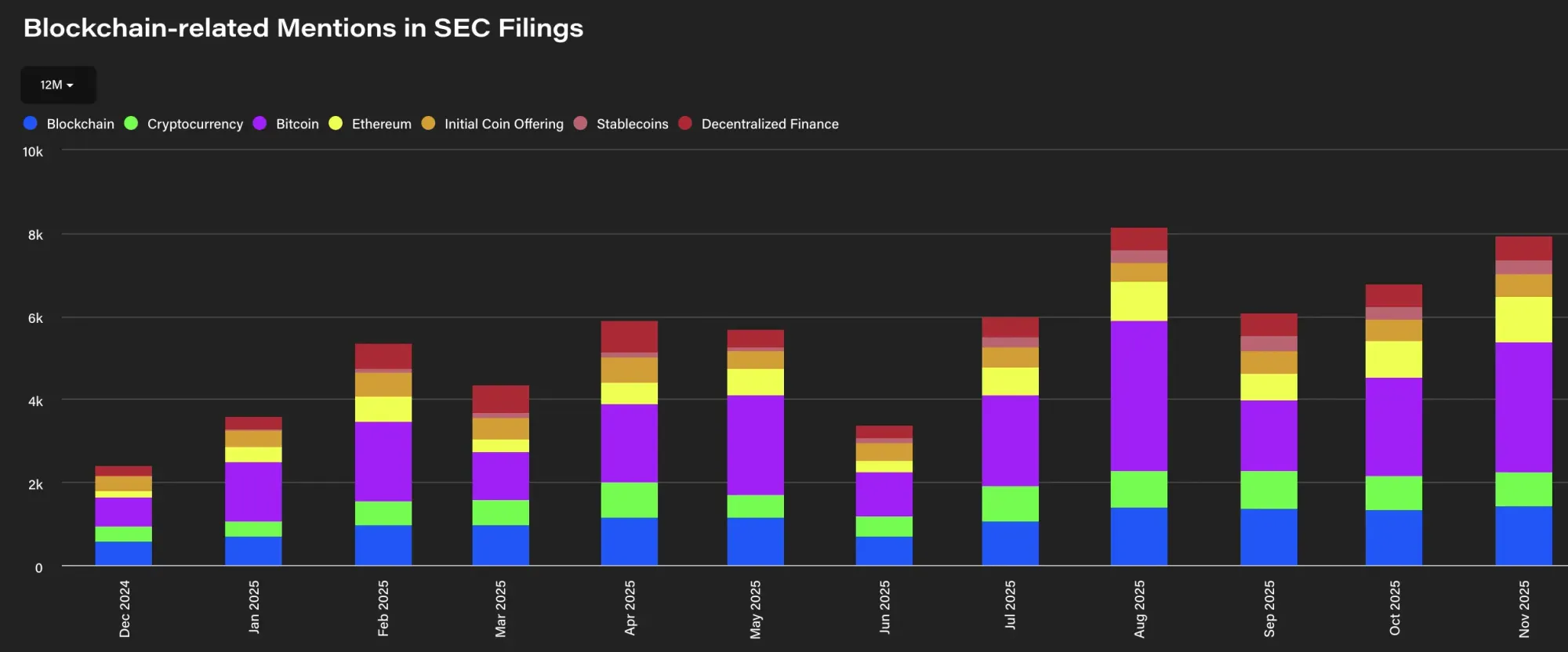

One of the charts relates to a party you might not expect here: the SEC. The number of references to blockchain in documents filed with the regulator has nearly quadrupled this year. That's the data behind the policy changes initiated by the Trump administration: giving the crypto world room instead of suffocating it.

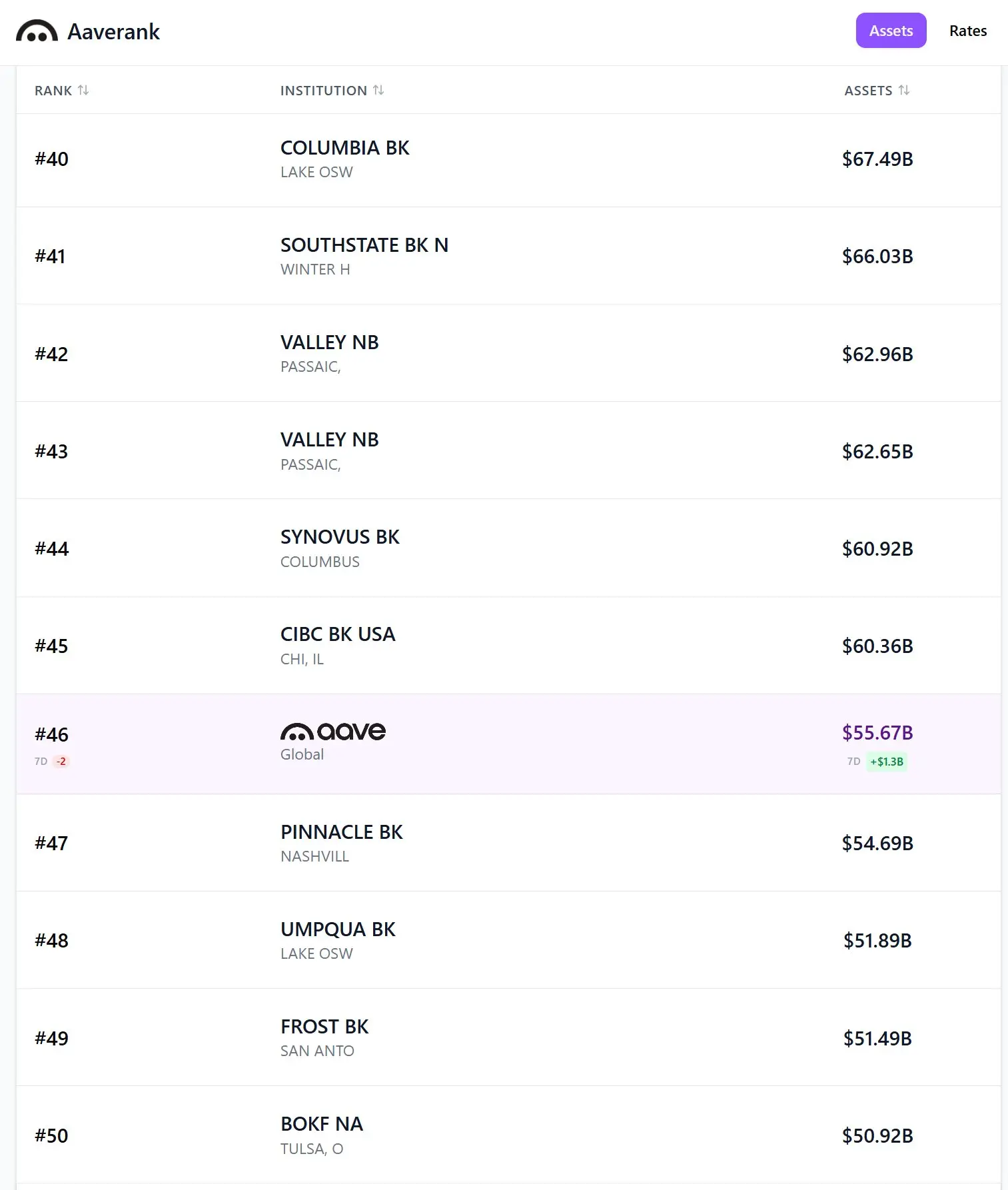

A second chart that stands out relates to Aave. The protocol crossed the $50 billion mark in assets under management in 2025 and now appears on lists normally reserved for traditional banks. That says something about this year—the growth of on-chain credit markets—but perhaps even more about next year. Now that institutions are getting used to this scale and technology, larger follow-up waves can be expected.

The other charts in Asad's thread—from stablecoins to perps and tokenized equities—tell the same story: 2025 wasn't an explosive year, but it was a year of new concrete foundations that slowly began to set. And those looking ahead to 2026 can already see contours emerging: the line between traditional markets and the crypto world is getting thinner.

🍟 Snacks

To wrap up, some quick bites:

- Argentina wants to let banks offer crypto again. The central bank is considering scrapping the years-long ban. Banks would then be able to offer trading and storage of crypto assets. The move fits the reality: many Argentines use bitcoin and especially stablecoins to ease the burden of inflation. With new rules, the BCRA wants to formalize that usage, tighten KYC/AML, and create competition with informal exchanges.

- Harvard doubles down on its 'debasement trade' and clearly chooses bitcoin. In the third quarter, the university increased its bitcoin position via IBIT from $117 million to $443 million. Gold exposure also grew, from $102 million to $235 million. According to Bitwise CIO Matt Hougan, Harvard is explicitly betting on fiat currency devaluation—and doing so in a telling ratio of twice as much bitcoin as gold.

- President Trump's new national security strategy doesn't mention crypto or blockchain at all. Striking, since Trump earlier said the US should become "number one in crypto," with an accompanying warning about Chinese dominance. The document puts AI, biotech, and quantum computing at the center as vital interests. There is a vague reference to maintaining America's "financial sector dominance" through digital innovation.

- For success, treasury companies need to be productive. According to Bloomberg, shares of American and Canadian Digital Asset Treasuries have fallen by a median of 43% this year, some by more than 99%. Investors are reportedly realizing that merely holding crypto doesn't generate cash flow, while interest and dividend costs do keep rising. According to Bloomberg, the biggest losses were suffered by companies that abandoned bitcoin as reserve capital.

- Euro stablecoins are making a quiet comeback. According to research by Decta, the market for euro stablecoins has more than doubled in a year since MiCA took effect in June 2024. Monthly volume shot from $383 million to $3.8 billion—nearly tenfold. Big winners are EURS, EURC, and EURCV. Still, it remains a niche: euro stablecoins pale in comparison to the $300 billion in issued dollar stablecoins.

- Western Union is developing a prepaid stablecoin card for countries with sky-high inflation. The card will be an extension of Western Union's existing prepaid products and is mainly meant to help people who receive and spend remittances. Those funds would no longer need to be held in a heavily inflating currency. Additionally, Western Union is working on its own stablecoin, USDPT, which should appear on Solana in early 2026.

- Brussels wants to centralize oversight of crypto companies. The European Commission proposes moving oversight away from individual member states and transferring it to ESMA, the EU's financial markets supervisor. Goal: end the fragmentation in MiCA enforcement and improve the quality of cross-border supervision. Earlier this year, several supervisors asked in an urgent letter for ESMA's help in overseeing the crypto sector.

- Kalshi signs deal with CNBC for real-time predictions. Polymarket's main competitor continues gaining ground in traditional media. After an agreement with CNN, it now announces a multi-year data deal with CNBC. Starting in 2026, the network will incorporate Kalshi's market probabilities—like the likelihood of a rate cut—into TV broadcasts, the website, and the app. Prediction markets are slowly but surely becoming visible to an audience of millions.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!