Crossing the Chasm

Year-end reflection: 2025 marked a pivotal moment. Bitcoin and crypto bridged the gap from pioneers to the mainstream—but through two radically different paths.

A new technology doesn't spread randomly through a group of people.

It starts with innovators and early adopters who see the potential long before it's better than the alternatives. It's still expensive, slow, and clunky. Using it requires persistence and forgiveness. A love for technology or ideological conviction compensates for the shortcomings.

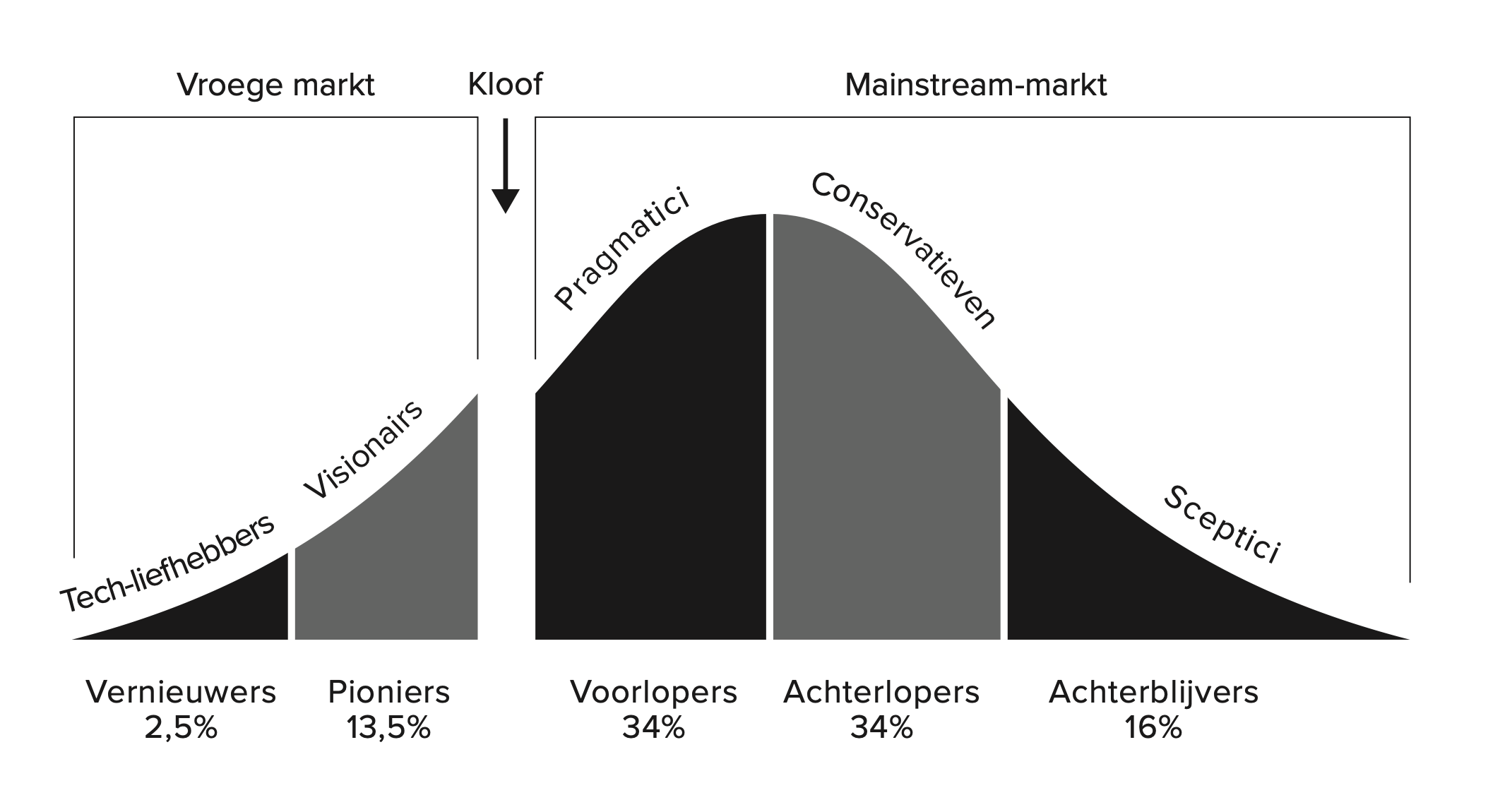

A widely used theory about this comes from the Frenchman Gabriel Tarde, popularized by Everett Rogers in his book Diffusion of Innovations. Central to the theory is the description of an innovation's lifecycle. Rogers distinguishes five stages, each with its own group of people who accept the new product or idea.

At the expense of innovators and early adopters, a technology can mature enough for the mainstream market. The general public isn't as sensitive to novelty or 'cool tech'—they're pragmatic. It just has to work. It needs to be faster, cheaper, more enjoyable, or more convenient than what they were using before.

Geoffrey A. Moore describes in his book Crossing the Chasm that many innovations fail at the transition from early adopters to the masses. He visualizes this as a large chasm that must be bridged. Often it doesn't work out. A technology then proves not user-friendly, accessible, or useful enough to convince the general public.

By contrast, the early majority want to buy a productivity improvement for existing operations. They are looking to minimize the discontinuity with the old ways. They want evolution, not revolution. They want technology to enhance, not overthrow, the established ways of doing business. And above all, they do not want to debug somebody else's product. By the time they adopt it, they want it to work properly and to integrate appropriately with their existing technology base. - Crossing the Chasm

In hindsight, the moments when an innovation crossed the chasm and reached the majority are often easy to identify. The smartphone in 2010. Cloud software in 2014. Netflix in 2016. Electric cars in 2019. Video calling in 2020. Mobile payments in 2020. Generative AI in 2023.

Sometimes there's an external cause that forces technology upon us, like legislation or a pandemic. Think of video calling and contactless payments. But often there's a killer app, an application so attractive that it makes the effort of adopting the underlying technology worthwhile.

Lotus 1-2-3 was the killer app for the PC. The web browser was the killer app for the internet. Super Mario was the killer app for Nintendo: millions of kids absolutely wanted a Nintendo because they wanted to play Mario, and that was only possible on a Nintendo.

You'll find them in our list of examples too. WhatsApp was the killer app for the smartphone: no more costs for text messages and everyone together in a group. If you didn't have a smartphone, you couldn't join the conversation. Google Docs was the killer app for the cloud. ChatGPT was the killer app for generative AI.

And what about bitcoin? Or the crypto ecosystem in the broader sense?

Over the past eight years, we've written and spoken extensively about the adoption of bitcoin and smart contract networks like Ethereum and Solana. For example in this article series in 2020 and in Ons geld is stuk in 2021. At the time, the conclusion was crystal clear: we were still with the early adopters with a gaping chasm ahead of us.

The final weeks of the year lend themselves well to reflection. Often you stumble over the noise that colored the daily news. Knots vs. Core. The Bybit hack. The explosion of treasury companies. The disappointing price action.

But 2025 was the year we crossed the chasm.

We need to split this into two parts. Bitcoin and the broader crypto ecosystem each have their own network effect and their own killer app.

Bitcoin's killer app is 'digital gold'.

In bitcoin circles, gold was already used as a metaphor ten years ago, but the crossing to the majority began in January 2024 with the launch of the spot bitcoin ETFs. A two-year process followed in which financial institutions, regulators, supervisors, and investors gave digital gold its place. With Vanguard's approval in early December 2025 as the finishing touch.

Big names attached their reputation to the term digital gold. The first blow came from BlackRock CEO Larry Fink. He appeared on business channel CNBC and characterized bitcoin's role in a portfolio as digital gold.

In early 2025, the U.S. government established a strategic bitcoin reserve, with the following words in the founding decree: As a result of its scarcity and security, Bitcoin is often referred to as "digital gold".

Regulators treat bitcoin as a digital commodity. Even Federal Reserve Chairman Jerome Powell, who is accustomed to weighing his words carefully, confirmed the classification: "It's like gold—it's just virtual and digital".

Bitcoin has crossed the chasm and become an acceptable component of a diversified investment portfolio. The fact that bitcoin is also freedom money, and peer-to-peer electronic cash, has faded into the background.

Because at the same time as bitcoin, something else also made the crossing from early adopters to the early majority: stablecoins.

The majority adopts new technology voluntarily and without coercion once it's better than the alternatives they have. With stablecoins, hundreds of millions of people can save and pay with digital dollars. Globally, fast, and cheap. Not as censorship-resistant as bitcoin, but good enough for most people.

Stablecoins are for many people synonymous with 'tokenized dollars' following the Circle and Tether model. But it's actually a broader category. An interest-bearing stablecoin is a 'tokenized money market fund' or a 'tokenized treasury bill'. USDe from Ethena is more of a 'tokenized hedge fund'.

A major role is likely reserved for on-chain bank money, or: 'tokenized deposits'. It remains book-entry money and a claim on a bank, but transferable 24/7 within seconds to the other side of the world.

And if you zoom out, you'll see that alongside stablecoins, all kinds of other (financial) assets besides dollars and euros are being brought on-chain through tokenization. This year we saw the first experiments with 'tokenized stocks', for example.

Bitcoin and the broader crypto ecosystem both made their crossing this year. So why isn't that visible in the price?

For two different reasons.

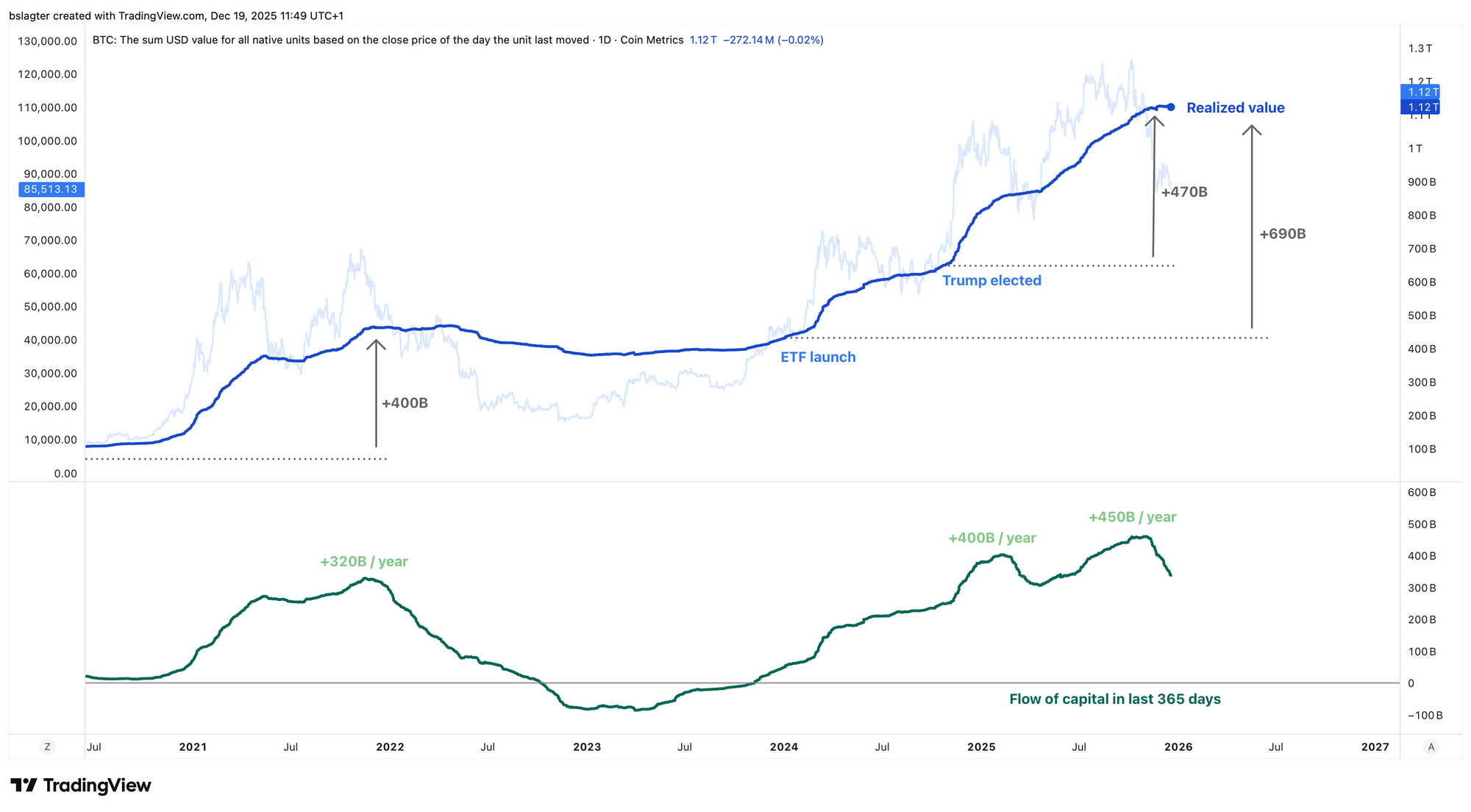

With bitcoin, the network effect of digital gold is largely captured by BTC. Since the launch of the ETFs, based on on-chain data, $690 billion in new capital has flowed into bitcoin. The largest portion of that we saw in the past year: $470 billion since Trump's election.

The reason this hasn't resulted in a price explosion yet is because 'bitcoin's IPO' has given the group on the left side of the chasm the opportunity to realize some of their gains: Bitcoin's silent IPO and The Great Rotation.

In other words: that price will follow eventually.

For the rest of the crypto market, it's different. There, prices were also dismal in 2025, but for a different reason. The problem wasn't the (abundant) supply from old hodlers, but the (missing) demand from new investors. The altcoin market consists of innovators and speculators, and both groups live on the left side of the chasm. The growth has stalled, simply because everyone who wants to be in altcoins is already in.

That tokenization creates a lot of value is clear. It's no coincidence that practically every bank and fintech is working on it. But where is that value captured?

In the tokens of the networks, like ETH and SOL? In the tokens of second layers and DeFi protocols, like OP, ARB, AAVE, CRV, and UNI? Or in the share prices of companies building products on them, like Coinbase, Circle, Stripe, and JP Morgan?

In the coming years, each individual crypto token must prove why it has value, and why a market cap of tens or hundreds of billions is justified. We think at best a handful will succeed.

The chart below shows the total market value of numbers 2 through 125 on the rankings, excluding stablecoins, measured against the Nasdaq 100 technology index. In 2016 and 2017, the altcoin market grew by a factor of 10,000. Since then, the market has been moving sideways for eight years.

Two technologies made the crossing from early adopters to the majority in 2025: bitcoin as digital gold, and crypto as global infrastructure for recording digital assets.

With bitcoin, BTC will capture the majority of the network effect's value. That's simply how it works with money-like assets. The ownership is the use.

With crypto, we'll have to wait and see who benefits most from borderless transactions where ownership transfers instantly from sender to receiver. ETH and SOL? Or perhaps banks, payment providers, tech companies, and thousands of startups building something cool that makes regular people happy. From Polymarket to point-of-sale systems with digital dollars for Argentine SMEs.

2026 will likely indicate the direction this develops. An exciting year ahead!

Last Tuesday, Bert was a guest on BNR Cryptocast to discuss the adoption and network effect of crypto. A great deep dive!

We continue with the following topics for our Alpha Plus members:

- How is bitcoin doing?

- Was this the end of a 16-year cycle?

- ETF investors underwater, but not selling

- Rising real rates put pressure on bitcoin

- Is the debasement trade still alive?

1️⃣ How is bitcoin doing?

Bert

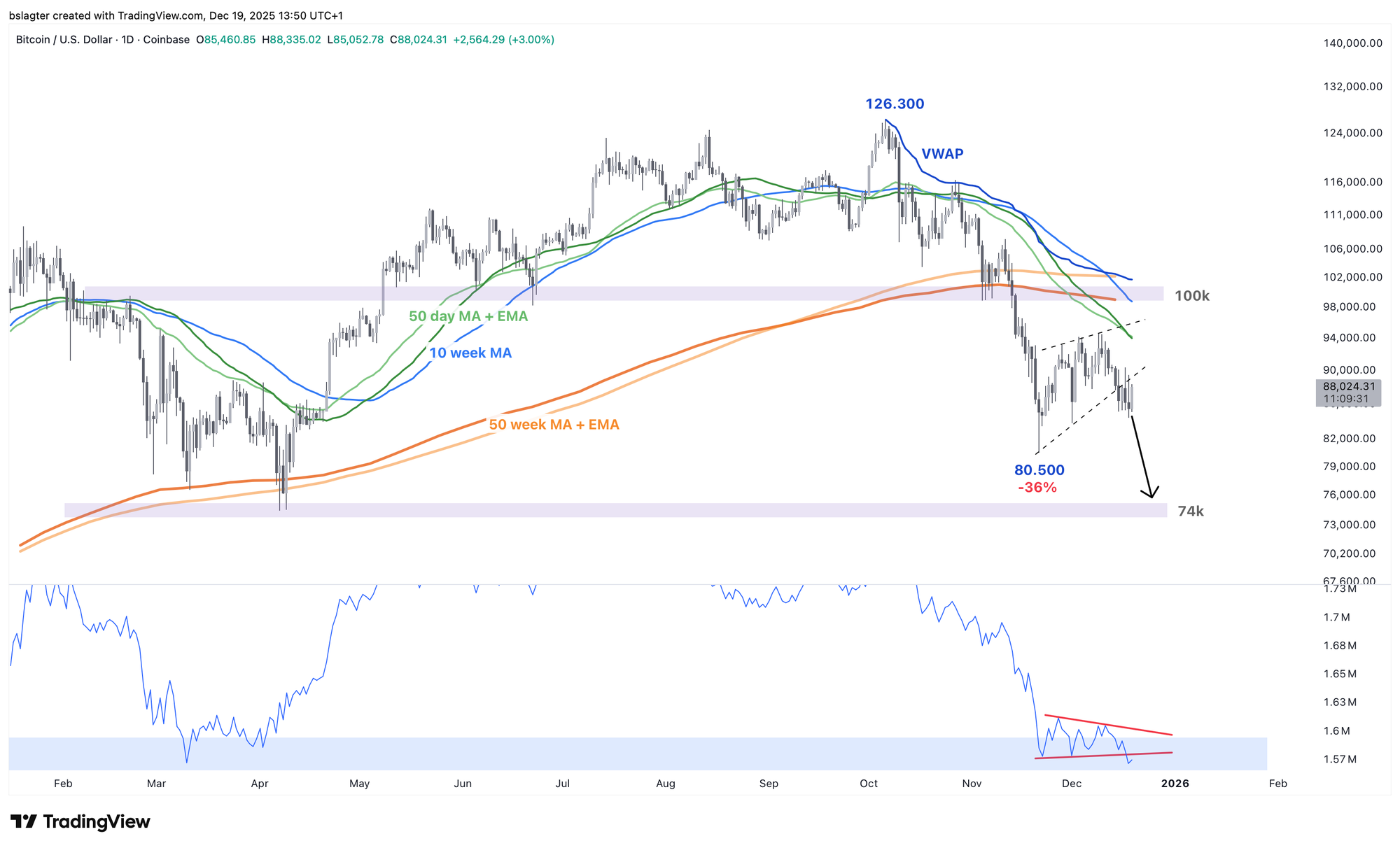

Bitcoin's price has been oscillating between $85,000 and $94,000 for four weeks now. In last week's Alpha Markets, we viewed this consolidation through two different lenses, an optimistic and a pessimistic one. Let's update those two charts with the latest prices.

The optimistic chart sees a series of higher lows and a horizontal boundary at the top. A breakout to the upside would be the starting point of the long-awaited relief rally.

The pessimistic chart sees a rising wedge or bear flag, a pattern that favors continuation of the downtrend. A logical price target would then be the zone around $74,000. That was the bottom in April 2025 and the top in March 2024.

In the context of 'volume precedes price', you can look at on-balance volume (OBV), an indicator that shows capital inflows or outflows through cumulative volume. It suggests further weakness.

It could go either way. There's something to be said for both scenarios. For the longer-term perspective, it doesn't matter much. The probability distribution from the November 14 Markets remains unchanged:

- Resumption of the bull market: 30%

- A period sideways: 40%

- A mild bear market: 20%

- A deep bear market: 10%

2️⃣ Was this the end of a 16-year cycle?

Bert

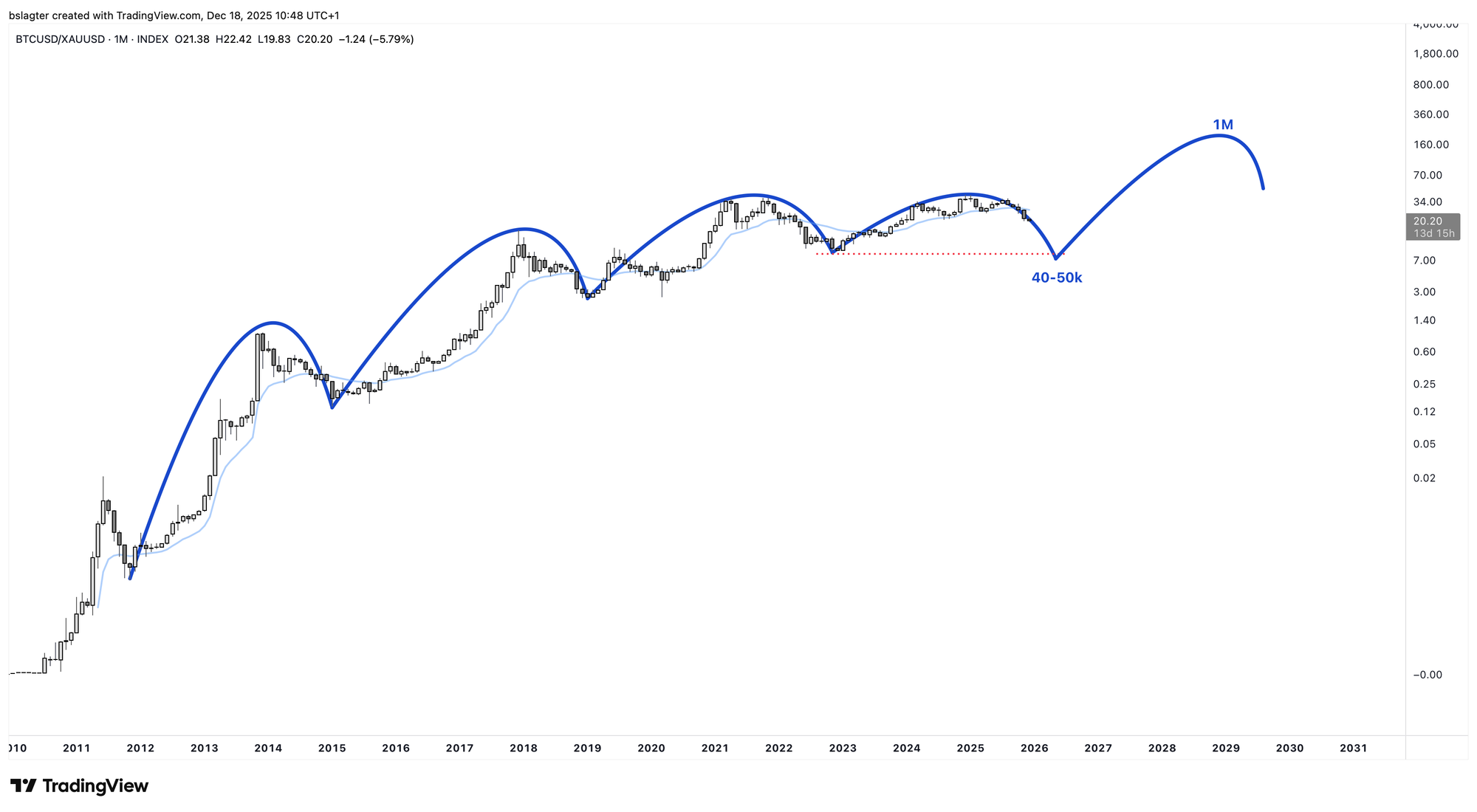

In many financial markets, we see another level above the daily, weekly, and yearly cycles. With bitcoin, we rarely discuss this, simply because we don't have enough data to say anything meaningful about it.

But speculation is always possible.

It stands to reason that there's a larger wave movement encompassing several yearly cycles. Perhaps four in a 16-year cycle? Or five in a 20-year cycle? With gold, you encounter a 16-year cycle more often.

In that case, this yearly cycle would be the last in a series of four. Then the next yearly cycle low would also be the 16-year cycle low. After that, a new series of four yearly cycles would begin, of which the first few are normally the strongest.

You would expect the last yearly cycle in such a 16-year cycle to not only underperform, but actually not go higher than the previous cycle, and with a bit of bad luck have a lower bottom. That would mean this market cycle would have a top below $69,000 and a bottom below $15,000.

With a top at $126,000 and a large distance to $15,000, the current yearly cycle doesn't fit that picture. But perhaps we shouldn't measure bitcoin in dollars, but in something less sensitive to inflation.

The chart below shows bitcoin expressed in gold. And viewed this way, this bull market indeed hasn't gone higher than the previous one, and we would already finish lower at a price of $40-50,000.

Why would the next bull market be so spectacular? Well, because it would then be the first of a new 16-year cycle. Something like in the chart below.

This is of course highly speculative and schematic, but it does help provide some structure to a possible bullish scenario. Hopium, then, but with a bit more foundation than a hockey stick drawn off the cuff.

3️⃣ ETF investors underwater, but not selling

Bert

The price of IBIT, BlackRock's spot bitcoin ETF, has been oscillating around its VWAP in recent weeks, the volume-weighted average. You could say that all paper profits have evaporated, or that roughly half of investors are underwater.

Yet ETF investors are barely selling. We occasionally see some outflows from the ETFs, but these are largely explained by professional players closing an arbitrage position. Long IBIT and short CME futures, for example.

James Check writes about this in his newsletter Checkonchain:

Despite 60% of ETF inflows occurring at higher prices, globally, we have only seen ETF outflows of around 2.5% of BTC denominated AUM. These outflows are around $4.5B, but are equally matched with declines in CME futures and IBIT options open interest. This suggests that ETF outflows are likely 'technical' in nature as basis, or volatility capture trades unwind, rather than an outright loss of conviction.

It makes perfect sense that ETF investors aren't participating in the selling frenzy that has plagued bitcoin all year. They've only just gotten in and have little profit to realize. They're not afraid of the halving cycle of exactly four years. And they're not influenced by fear and worry on CryptoTwitter. They occasionally check their diversified portfolio, and it's up this year.

And so the boomers turn out to have the strongest hands!

4️⃣ Rising real rates put pressure on bitcoin

Thom

Things are undeniably tough for bitcoin right now. The last quarter of 2025 should have been a blockbuster, but reality is different. This is partly due to tightening financial conditions as a result of rising real rates.

Financial conditions determine the availability and cost of capital. And the real rate is part of that. You get it by subtracting inflation from market rates.

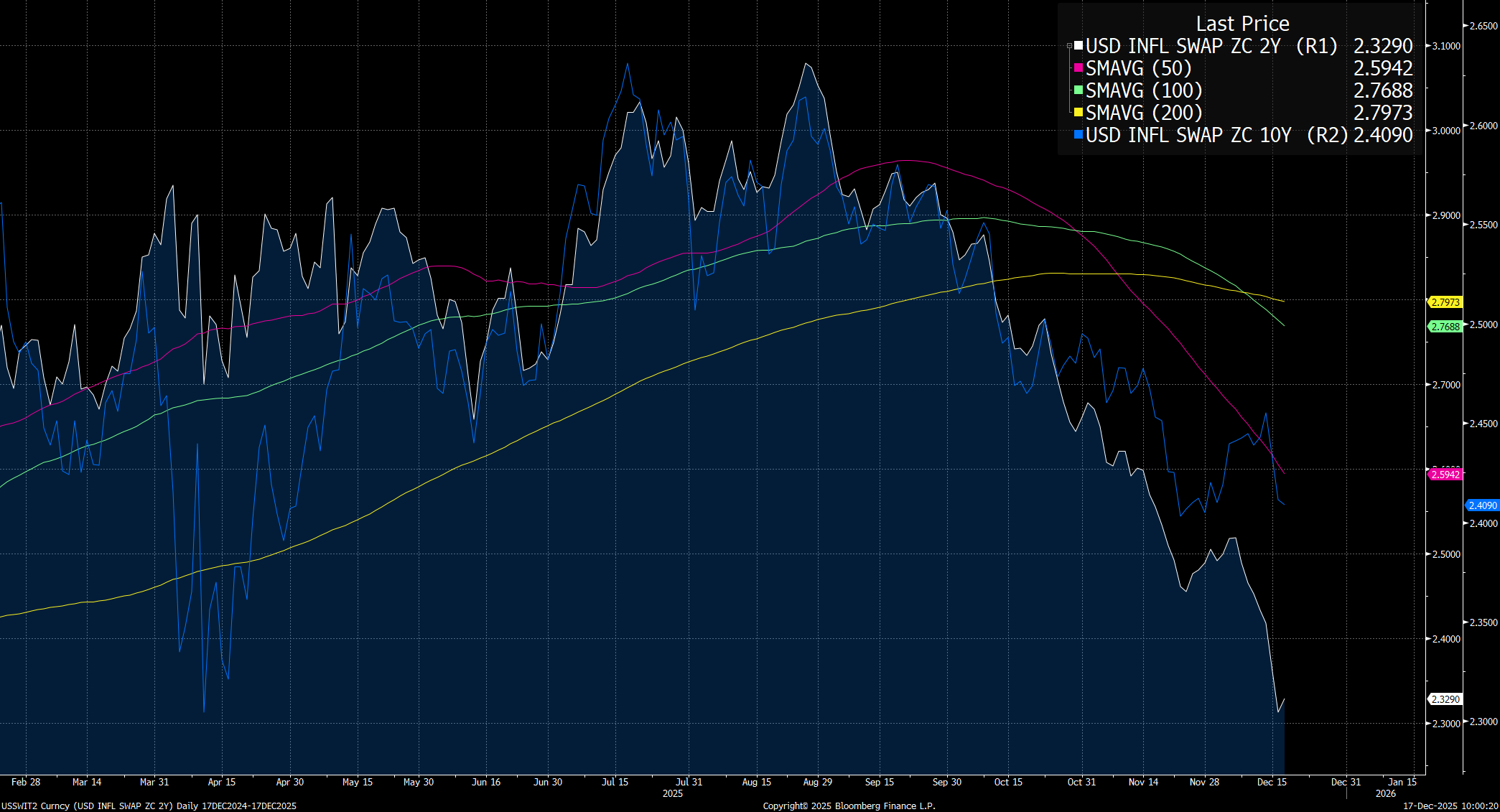

We're now in a period where longer-term rates are moving up, while inflation (expectations) are actually dropping sharply. What you're left with is a higher real rate. The actual return on holding bonds rises, and it becomes relatively more expensive for companies to borrow capital.

Combine that with the fact that the U.S. stock market is relatively highly valued, and you've got a tricky situation. A rise in real rates has a negative effect on risk appetite, partly because more expensive capital has a dampening effect on economic growth.

You can see this situation as a brake on the growth of global liquidity, the amount of capital available worldwide for investments.

Data shows that bitcoin is extremely sensitive to changes in global liquidity growth. In that regard, it's no surprise that the digital currency is currently going through a tough period.

In the short term, I don't see a direct reason for a reversal of this trend. However, that doesn't necessarily mean bitcoin is headed for a bear market. Personally, I'm neutral on price direction for the coming weeks to months, and expect improvement toward the end of Q1 2026.

- From January 1, the One Big Beautiful Bill Act (OBBBA) from the Trump administration will provide an additional stimulus to global liquidity.

- Trump may appoint a new chairman of the U.S. central bank before May 2026, who will undoubtedly want to achieve more easing than Jerome Powell.

- In November 2026, it's extremely important for Trump to win the midterm elections, for which he needs a strong economy and financial market.

- Most major central banks are easing.

- Although enthusiasm seems to be waning somewhat, I think it's unlikely that the AI hype, and the investments that come with it, is already over.

All things considered, the probability remains greater than 50 percent for me that bitcoin and other risk assets still have a strong period ahead.

5️⃣ Is the debasement trade still alive?

Thom

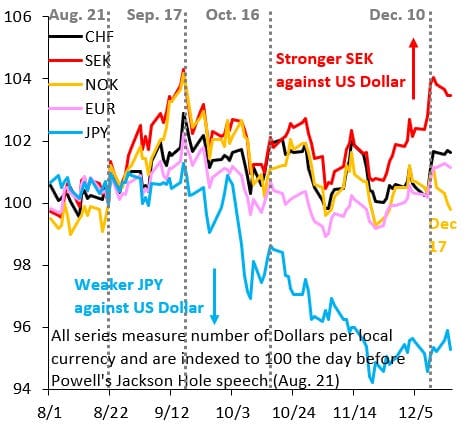

This year briefly featured the "debasement trade," the idea that the ever-growing global debt mountain means guaranteed inflation, and that gold, among other things, offers protection against it. That idea gained momentum after Jerome Powell's "dovish" speech, as Federal Reserve chairman, at the annual Jackson Hole symposium.

In mid-October, the "debasement trade" reached a preliminary peak, after which a weaker period began for gold, and the U.S. dollar seemed to catch its breath. Right now, however, we're seeing precious metals rise sharply again and the global flight from the dollar appears to be resuming.

Silver in particular is rocketing, having already risen 75 percent since Powell's Jackson Hole speech. Most precious metals have already surpassed the October highs, and gold also appears to be on track to achieve that.

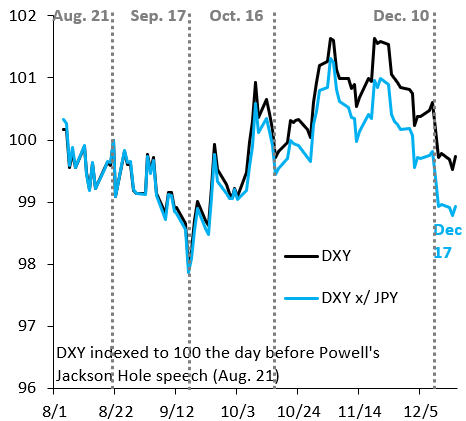

Interestingly, the U.S. dollar still seems to be holding its own reasonably well against other major currencies (blue, chart above). The reality, however, is different, as the following chart shows.

It's mainly the weakness of the Japanese yen that has kept the dollar exchange rate balanced since Powell's speech in August. Without the Japanese yen, the dollar index would have been much lower, which means the dollar is weaker than it appears.

So the "debasement trade" could well last much longer. Especially if Trump actually succeeds in seizing power within the U.S. central bank. For bitcoin, the hope is that a period emerges where it outperforms gold and precious metals, and can ride this momentum.

For example, if investors from this market decide to take some profits and move them to bitcoin. There comes a point when people in these markets are also satisfied with their unrealized gains, decide to hit the sell button, and then need to find another (temporary) home for that capital.

In closing

New to Bitcoin Alpha? In 2023, we wrote several foundational pieces about our perspective on the crypto market. These can be useful as background for our approach, assumptions, and scenarios.

All previous editions of Alpha Markets can be found in the archive. Questions, comments, and suggestions are always welcome in the community.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!