Bitcoin: the Return of Res Publica

From ancient Rome’s rebel republic to today’s decentralized Bitcoin, history echoes its lessons. As central banks tremble and geopolitics shift, could Bitcoin be the modern safeguard of freedom? Discover how a digital protocol is challenging the old order.

Let's travel back to ancient Rome. Not to admire Caesar's marble statues or Nero's decadent palaces, but to witness a much earlier, foundational moment in history. It's 509 BC, and the Romans had enough of their king, Tarquinius Superbus, known as "the Arrogant." They drove him out of the city—not to install a new monarch, but to experiment with something groundbreaking: a public affair, a res publica.

No one stands at the top; rather, power is shared. Instead of placing blind faith in a single leader, the Romans put their trust in laws, rituals, and institutions. Consuls, senators, and tribunes provided checks and balances long before the concept was even named. It wasn’t perfect, but the idea was powerful: power should never rest with one person. It must clash, be divided, and keep itself in check—not out of idealism, but for self-preservation.

This res publica endured for nearly five centuries, and even after its eventual demise its ideals continued to resonate. Emperors avoided the title of king, preferring instead the term princeps or first citizen. They maintained the facade of a living republic because Romans preferred the ideal to admitting that their freedom had been surrendered. The republic may have died, but its legend lived on. After all, power that isn’t shared eventually becomes dangerous.

Fast forward to 2025. Gone are the marble palaces, replaced by glass skyscrapers. Instead of consuls, we have central banks. And while wars over grain have faded, conflicts now erupt over data, semiconductors, and money flows. Once again, a pervasive unease fills the air. You can sense it everywhere: the system is straining. The dollar remains the world's reserve currency, but its dominance is increasingly in question. A single interest rate hike by the Federal Reserve sends shockwaves through global markets, while China and Russia chart their own courses. The BRICS nations are building alternative payment systems, and trade wars have become routine—not just exceptions. Whether it's semiconductors, energy, or data, free trade now carries an unmistakable geopolitical sting.

Amid all this uncertainty, something noteworthy is unfolding. The world is actively seeking alternatives. You don’t have to be a revolutionary to see that a system under pressure from too many directions at once becomes extremely vulnerable.

One of those alternatives is bitcoin.

For some, it’s still a speculative asset—a digital nugget of gold in your wallet. Yet those who take a closer look see it differently: it's not just a coin, but a robust infrastructure. It isn't a company or a leader or a nation; it's a set of rules—immutable, transparent, and universal. That is precisely what gives it strength in an era when money, power, and opportunity are increasingly determined by where you live, who you are, and what you believe in.

Bitcoin is not a nation’s currency, but a protocol for the world. It isn’t an euro limited to Europe or a yuan governed by party policies; it’s a network operated by thousands of nodes across continents, cultures, and regimes. Every transaction serves as confirmation that the system works without a central gatekeeper—no permission is needed to access, participate, or transfer value.

In a sense, bitcoin is a modern res publica.

S&P Global says #Bitcoin is on their radar.

— TFTC (@TFTC21) April 10, 2025

They call it decentralized, geopolitically neutral, and a potential safe haven. pic.twitter.com/bw6f0IWg6e

Instead of a senate, there are nodes. Instead of laws, there are cryptographic rules. And rather than relying on authority, you place your trust in code. While the Roman republic operated through rituals, forums, and votes, bitcoin runs on consensus mechanisms, digital signatures, and open-source software. They aren’t exactly the same, but the principles are strikingly similar: power that is widely distributed is power that is far less susceptible to corruption.

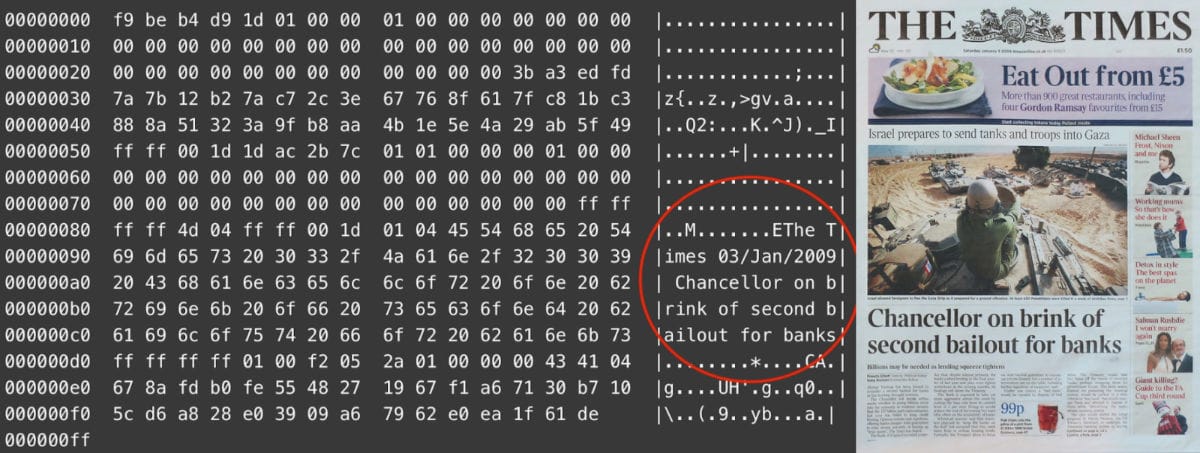

Just as the people of Rome eventually rose against the whims of a king, bitcoin emerged in the aftermath of a financial crisis in which banks were bailed out and savers penalized. The first block even featured a headline from The Times: “Chancellor on brink of second bailout for banks.” It was a digital middle finger—not to money itself, but to a system that flouted its own rules.

That said, it’s important not to get carried away by myth. Bitcoin is not flawless. Power is still concentrated among miners, developers, and companies, and access to the network isn’t guaranteed for everyone. The technology is young and has its vulnerabilities, making some applications slow and expensive. Yet the core principle remains: this system has no central authority. In a time when influence is everything, that is truly unique.

The significance of bitcoin isn’t confined to abstract ideals. Consider the Netherlands—a nation built on trade, from chips and agriculture to high-tech machinery. But that trade is increasingly challenged. ASML is no longer permitted to supply its top-tier machines to China. Farmers find themselves caught between Brussels’ regulations and geopolitical pressures, while financial institutions navigate ever-tightening sanction regimes. In such a world, having access to an alternative payment system is not merely an ideological preference, but a strategic necessity.

Decentralized networks enable instant, direct value transfers without the need for banks or governments as intermediaries. They can facilitate international trade, remittances, or even alternative credit systems. Although this is still happening on a small scale, robust systems grow from the bottom up, block by block.

Over the past ten days, bitcoin has hovered around $84,000—a figure that is as unremarkable as it is impressive. While you could spend hours analyzing its price fluctuations, the market rate is the least interesting part of the story. Volatility aside, the shift is structural. More individuals, companies, and institutions are recognizing the value of a system that operates independently of the old framework. Not because you might need it tomorrow, but because it’s unwise to assume you never will.

The real takeaway is not a call to invest, but a call to understand what is emerging: an infrastructure radically different from anything we’ve seen—a system where you don’t have to buy access, ask for permission, or carry a membership card. All you need is an internet connection and the resolve to choose freely.

Not to get rich.

But to remain free.

And that’s something you have to experience for yourself. Install a wallet. Run a node. Ask if you can pay with bitcoin somewhere. And why not send your friends some sats instead of euros using your favorite payment app.

Are you a Plus member? Then we continue with the following topics:

- Reward Offered for Cracking Bitcoin’s Cryptography

- The Hawk Defying a President

- Bitcoin is “Surprisingly Strong”

1️⃣ Reward Offered for Cracking Bitcoin’s Cryptography

Erik

A quantum computing research group called Project 11 has offered a reward of 1 BTC for cracking elliptic curve cryptography using a quantum computer. This QDay Prize challenge runs for one year, until April 2026.

Project 11 is an initiative focused on research at the intersection of cryptography and quantum computing. You might wonder why someone who succeeds in this task would settle for just 1 BTC, especially when some addresses hold hundreds of thousands of BTC waiting to be cracked. And that’s a valid point.

The reward isn’t for breaking the entire cryptographic system, but for solving a significantly simplified version. Project 11 has set up a series of cryptographic keys ranging from 1 to 25 bits—a far cry from the 256-bit encryption used by bitcoin. This is merely a test setup, very different from a real-world “crack.”

When it comes to the risk of quantum computing, a lot of people are hoping the problem is far enough away to ignore.

— Alex Pruden (@apruden08) April 17, 2025

But hope is not a plan. Understanding the timeline for when we need to act requires an accurate threat model.

That’s what the QDay Prize aims to provide. https://t.co/A83VrX6Dud

In this context, “cracking” means deriving a private key from its corresponding public key. The concept of key pairs is one of the cornerstones of cryptography: there isn’t just one key, but two. The public key is visible to all, while the private key acts as the password you use to send coins. The public key allows others to verify that you have signed a transaction with your private key.

Public/private key pairs are secure because generating a public key from a private one is easy, but reversing the process—from public back to private—is currently computationally infeasible for the 256-bit keys used by bitcoin, even with massive computing power. Whether quantum computers, perhaps using Shor’s algorithm, will ever make this possible remains an open question.

According to Alex Pruden of Project 11, there is no expectation that someone will crack bitcoin’s cryptography within a year. The main goal of the challenge is to gauge how many bits the winner can crack.

First of all, this isn’t a challenge to “break” Bitcoin. There’s already a massive incentive for anyone with a quantum computer to use it to forge a signature—and thereby steal funds from an address with exposed public keys: https://t.co/9Md3ulA0GY

— Alex Pruden (@apruden08) April 16, 2025

Need for a Future Hard Fork?

According to expert Scott Aaronson, as he explained in Bankless, Ethereum is better positioned than bitcoin to counter future quantum threats. Ethereum can switch to alternative cryptographic methods without resorting to a hard fork. For bitcoin, however, such a transition would indeed require a major upgrade.

Bitcoin is particularly vulnerable because an early version of its protocol stored public keys on-chain. This means that keys for roughly 1 million BTC—likely belonging to Satoshi—are exposed, as if thousands of vaults containing 50 BTC each were left open on the street with a note saying, “Go ahead, crack us.”

Later protocol updates began hashing public keys, adding an extra layer of security. But the fact remains: some addresses are still protected solely by their original public key.

It’s fortunate that there are voices now raising awareness about this issue while there’s still time to act. If quantum computers eventually pose a real threat to bitcoin’s cryptography, we certainly don’t want to find out too late.

2️⃣ The Hawk Defying a President

Peter

It’s quite a scene in Chicago. Jerome Powell sits across from Raghuram Rajan, the former chief economist at the IMF, surrounded by economists and business leaders. He appears calm, measured, almost bureaucratic. But make no mistake—this isn’t a routine lecture on interest rates. Powell is locked in a power struggle with a president determined to undermine his authority.

Federal Reserve Chair Jerome Powell says that the Trump administration's trade policies are moving the US away from its goals of lowering unemployment and inflation.

— Bloomberg TV (@BloombergTV) April 16, 2025

Powell spoke Wednesday at the Economic Club of Chicago https://t.co/CqvKWYGhOp pic.twitter.com/7P5YgOVftT

In both his speech and the subsequent interview, Powell hinted at his deepest concerns—not inflation and not the state of the labor market, but something more fundamental: the independence of the central bank.

Trump isn’t content to wait for Powell’s term to end. He wants a Fed Chair who will wholeheartedly support his radical agenda. Ideally, he would like to dismiss Powell immediately, as he has with other “independent agencies.” To that end, he’s even enlisted the help of the Supreme Court. This is a serious matter: a ruling in Trump's favor could overturn a legal precedent nearly a century old, transforming the Fed from an independent institution into a political arm.

Powell responded diplomatically, but his words carried an undertone of resistance. His repeated insistence that “the law guarantees the Fed’s independence” was more than just a legal footnote—it was a firm defense, the kind you muster only when under attack.

Clearly, Powell knows he’s navigating a political minefield. Every word is measured; every sentence is scrutinized. He opts for sober repetition—a consistency that quietly declares: I am not for sale, I won’t be intimidated, and I will not be moved.

This steadfast stance is exactly what frustrates Trump, who thrives on chaos, loyalists, and firebrands. Powell, the consummate technocrat, sticks to his mandate—a determined hawk that continues to circle even under heavy fire.

REPORTER: Powell says he won't leave even if you ask him to

— unusual_whales (@unusual_whales) April 19, 2025

TRUMP: Oh, he'll leave. If I ask him to, he'll be out of there... I'm not happy with him. If I want him out, he'll be out fast. Believe me.

REPORTER: Are you trying to remove him?

TRUMP: Yeah, next… pic.twitter.com/4cT0EZ4wfP

The effect is already palpable. Powell has unhesitatingly cited four risk factors for the U.S. economy—all originating from the White House: protectionism, immigration policy, budget deficits, and deregulation. This moment of institutional pushback is rare in an era when American institutions are coming under increasing pressure.

And the market reacted immediately.

Powell’s message is clear: import tariffs are fueling inflation, which means that interest rate cuts are off the table for now. The result? The S&P 500 tumbled into negative territory. Wall Street had hoped for a gentler tone, but Powell wasn’t there to please anyone; he was there to stand his ground.

The clash between Powell and Trump isn’t just one of personalities—it represents a fundamental battle of worldviews: monetary order versus political opportunism.

If the Fed’s independence is eroded, nothing will stand between White House pressure and reckless money printing. Then the dollar becomes completely politicized, which is exactly the scenario bitcoin was designed to counter—an alternative to a monetary system compromised by those in power.

Powell is now defending the fort, but how long can he hold out? What if Trump stages a comeback? What if he manages to install a loyalist?

When Trump threatened to fire Jay Powell in his first term, the Fed chief was told it would be illegal, and he would have to fight it in court. Privately, Powell vowed he'd "spend my last nickel fighting" the attempt, as @sbg1 and I reported in "The Divider." pic.twitter.com/MobV07anI8

— Peter Baker (@peterbakernyt) April 17, 2025

The idea that central banks can remain entirely insulated from political pressure has become a myth. Anyone still believing that clearly wasn’t paying attention last week.

3️⃣ Bitcoin is “Surprisingly Strong”

Peter

On April 15, bitcoin was trading at $85,000—contrary to Bloomberg analyst Eric Balchunas’s expectation. Given the Nasdaq’s decline, the cooling of the Trump rally, and hints of ETF outflows, he estimated the price would be closer to $60,000. Yet bitcoin remains strikingly resilient. Why is that?

I always felt that ETFs (and a booming stock market) drove btc from $30k to $70k. Then, with Trump winning, it surged to $100k, but following a stock drawdown, some Trump disappointment, and a touch of ETF outflows, you'd think the price would be around $60k. So in my view, $85k is shockingly…

— Eric Balchunas (@EricBalchunas) April 15, 2025

Balchunas attributes bitcoin’s stability to a new group of holders. As he puts it, “ETFs have shown positive inflows over the past month and this year. BlackRock’s IBIT is even up by $2.4 billion YTD—that puts it in the top 1%.” He explains that these new owners have far stronger resolve, which makes a noticeable difference.

Over the past fifteen months, the same players have been absorbing every sell-off—Saylor and the ETFs. They have been buying the dumps from tourists, FTX refugees, GBTC discounts, legal unlocks, and even government offloads. Saylor doesn’t sell, and according to Balchunas, ETF investors have much firmer hands than many assume.

Bitcoin ETFs have seen positive inflows over the past month and YTD, and $IBIT is up $2.4b YTD (Top 1%). Impressive—and in my view, it helps explain bitcoin’s relative stability. For the past 15 months, ETFs and Saylor have been snapping up every 'dump' from… pic.twitter.com/X40b2bgjEL

— Eric Balchunas (@EricBalchunas) April 16, 2025

Balchunas believes that over time this will lead to lower volatility and reduced correlation with stock markets—fewer active traders, more long-term holders, less panic, and more consistency. In other words, a more stable bitcoin price.

What began as a narrative—that “ETFs drive inflows”—is now being backed by empirical evidence. An $85,000 price point is, as Balchunas puts it, “shockingly strong,” especially when contrasted with a lackluster stock market, subdued enthusiasm, and diminished hype. There’s no bubble here—only strength.

🍟 Snacks

To wrap things up, here are a few brief news bites:

- Binance Advises Governments on Crypto Policy. The CEO of the world’s largest crypto exchange revealed in a Financial Times interview that the company advises governments on crypto policy. Pakistan, among others, has confirmed this. Moreover, Binance has also advised governments and sovereign wealth funds on building a strategic bitcoin reserve. Notably, Binance still commands substantial respect, even after former CEO Changpeng Zhao served a four-month prison sentence.

- Web3 Rug Pulls Are Becoming Rarer, but They’re Causing More Damage Than Ever. In 2025, DappRadar reported that over $6 billion was lost—a 6500% increase compared to last year. One project, Mantra’s OM-token, accounted for the lion’s share of that loss. While scams are becoming less frequent, they are executed more professionally and are increasingly hard to distinguish from legitimate projects. In essence, there are fewer scams, but each one causes more damage.

- In Q1 2025, $633 Billion in Value Disappeared from the Crypto Market, Yet Under the Hood, It Grew Rapidly. According to Bitwise, stablecoins processed a higher payment volume for the first time than Visa did. In their latest quarterly report, the asset manager noted that the total market value of stablecoins rose to $218 billion, the market for tokenized real-world assets grew by 37%, and the bitcoin holdings of publicly traded companies increased by 16%. Bitwise described Q1 as the “best worst quarter in crypto ever.”

- Coinbase Institutional Warns of a New “Cryptowinter”. In their monthly report, analysts noted that the value of the crypto market—all assets except bitcoin—has dropped by 41% since December 2024. They also highlighted a continued decline in venture capital. In short, inflows have stalled, and sentiment is deteriorating. Coinbase anticipates a bottom not before mid-Q2 and advises caution in the coming weeks—no panic, just a watchful pause.

- After Years of Focusing on Layer-Two Networks, the Ethereum Foundation Returns to the Basics: the Mainnet. According to co-director Tomasz Stańczak, Ethereum must reclaim its role as the hub of innovation and value creation. While stablecoins, real-world assets, and AI integrations are important, they come naturally if the foundation is robust. By simplifying its roadmap, the Ethereum Foundation aims to move beyond its role as merely a settlement layer. Ethereum must once again become the center of all activity—a protocol so attractive it draws the brightest minds of our time.

- The Gold Price is Breaking Records, and Digital Gold is Rising Alongside It. On-chain tokens like PAXG and XAUT saw their trading volumes soar last week, coinciding with a global flight to safe havens. Interestingly, bitcoin—the self-proclaimed digital gold—lagged slightly behind. While gold’s tangible role becomes more significant in times of crisis, bitcoin’s role has yet to be fully defined.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!