Bitcoin Surpasses $100K: Entering the Next Phase of the Banana Zone

Bitcoin just broke the $100K mark, surging 40% since April and fueling a bullish momentum across crypto. With altcoins and ETH bouncing back despite US policy uncertainty, is alt-season here—or just a fleeting rally? Next targets could push Bitcoin to $150K+.

The signals are positive. The bull market holds firm, and we're just beginning a new weekly cycle. Both the data and the chart suggest optimism for the coming months.

That was our take last week, though we stressed that uncertainty surrounding the US government's economic policies still looms over the market like a dark cloud. It hardly seemed that widespread optimism and a high appetite for risk would return so quickly.

The fact that prices continued to rise over the past week fits perfectly with our base scenario. Yet, the rapid pace and strong conviction behind the move are surprising. Not only is Bitcoin gaining traction, but the rest of the crypto market has also seen a significant leap in recent days.

Let's start with Bitcoin. It surpassed the $100,000 milestone for the first time since early February yesterday. Since April 7, its price has surged 40% — from $74,500 to $104,000.

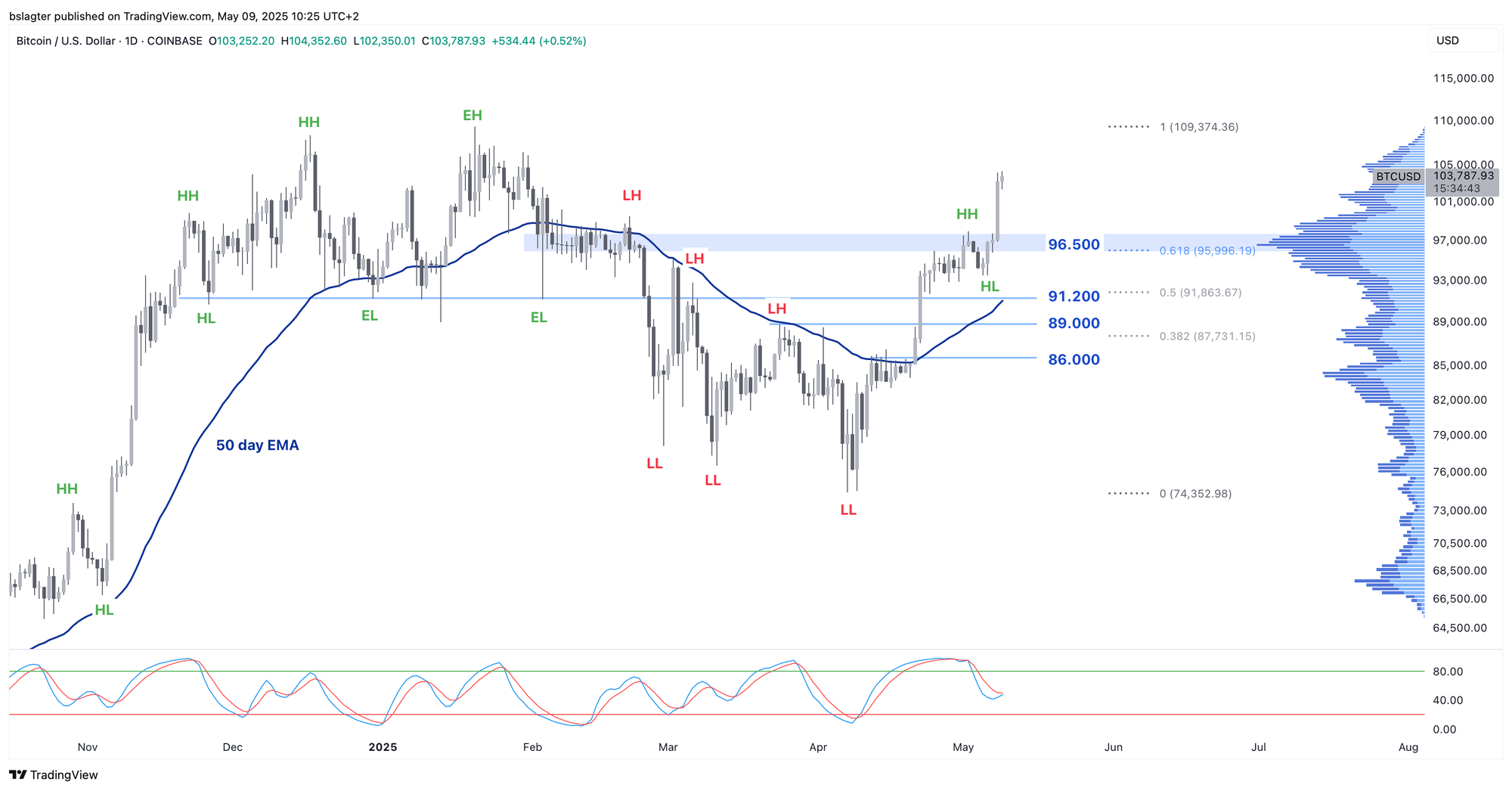

The chart below confirms that all the criteria have been met: the short-term trend has shifted from down to up.

- We have risen above $86,000 and are once again trading above the dominant moving average.

- We have surged above $89,000, reaching the price level at which we recorded a higher high (HH) once again.

- We are now above $91,200, placing us back within the price range of the peak formation from December and January.

- We have climbed above $96,500, the level where the bulk of trading occurred.

The rally over the past month has seen hardly any corrections—perhaps just brief pauses. You might think that this eagerness comes from speculators in the futures market, but that isn’t the case. This surge is driven by the spot market and large investors.

Zooming out to the weekly chart, we can clearly see the start of a new weekly cycle. A slight touch on the 50-week moving average coincides with testing the previous peak as support, and then the price rockets upward.

In this market cycle, we've observed four weekly cycles, each with roughly a 100% rise from the bottom and about a 50% increase above the previous cycle’s high. (Refer to the second chart in last week’s Markets section for an illustration.)

If this pattern holds over the coming months, the price could target between $150,000 and $165,000, likely reaching that level around August—given that the peak of an upward weekly cycle typically occurs about 17 weeks after it begins.

Not only is Bitcoin surging, but many altcoins have also leaped upward in recent days. Ether, the second-largest cryptocurrency, is currently trading at $2,450—about 40% higher than two days ago. This is noteworthy, especially since ETH had underperformed during this bull market. More on ETH shortly.

The chart below shows the total market value of altcoins ranked from 11th to 125th by size. On TradingView, this index is called “OTHERS,” and some analysts also refer to it as the “altcoin index.”

While the altcoin market lags slightly behind Bitcoin, it is clearly showing signs of a new uptrend. A new higher high and a rise above the dominant moving average indicate further recovery ahead. While Bitcoin is already chasing its all-time high, the altcoin index still needs to climb about 70% to reach that level.

As altcoins make a comeback, a familiar refrain returns—one that hasn't been heard in months. Raoul Pal predicts that Bitcoin’s dominance has peaked and will soon start to decline: “the hallmark of the next phase of the Banana Zone.” James Choi echoes this sentiment, stating, “Alt-season is here.”

However, it seems premature to draw that conclusion. Although Bitcoin's dominance dipped slightly this week, on a broader scale the drop is barely noticeable. There isn’t much evidence to suggest that this was the peak of a rise that has lasted more than three years.

Alt-season has been declared countless times over the past three years, only to prove to be a temporary upswing each time. Could it be different this time? That would be good news for Bitcoin, as a euphoric altcoin market tends to attract new investors who ultimately gravitate towards Bitcoin.

We continue with the following topics for our Alpha Plus members:

- BTC in dollars vs. BTC in euros

- The comeback of ETH?

- Powell plays second fiddle in Trump's orchestra

- Is Donald Trump's trade war merely a temporary phenomenon?

1️⃣ BTC in dollars vs. BTC in euros

Bert

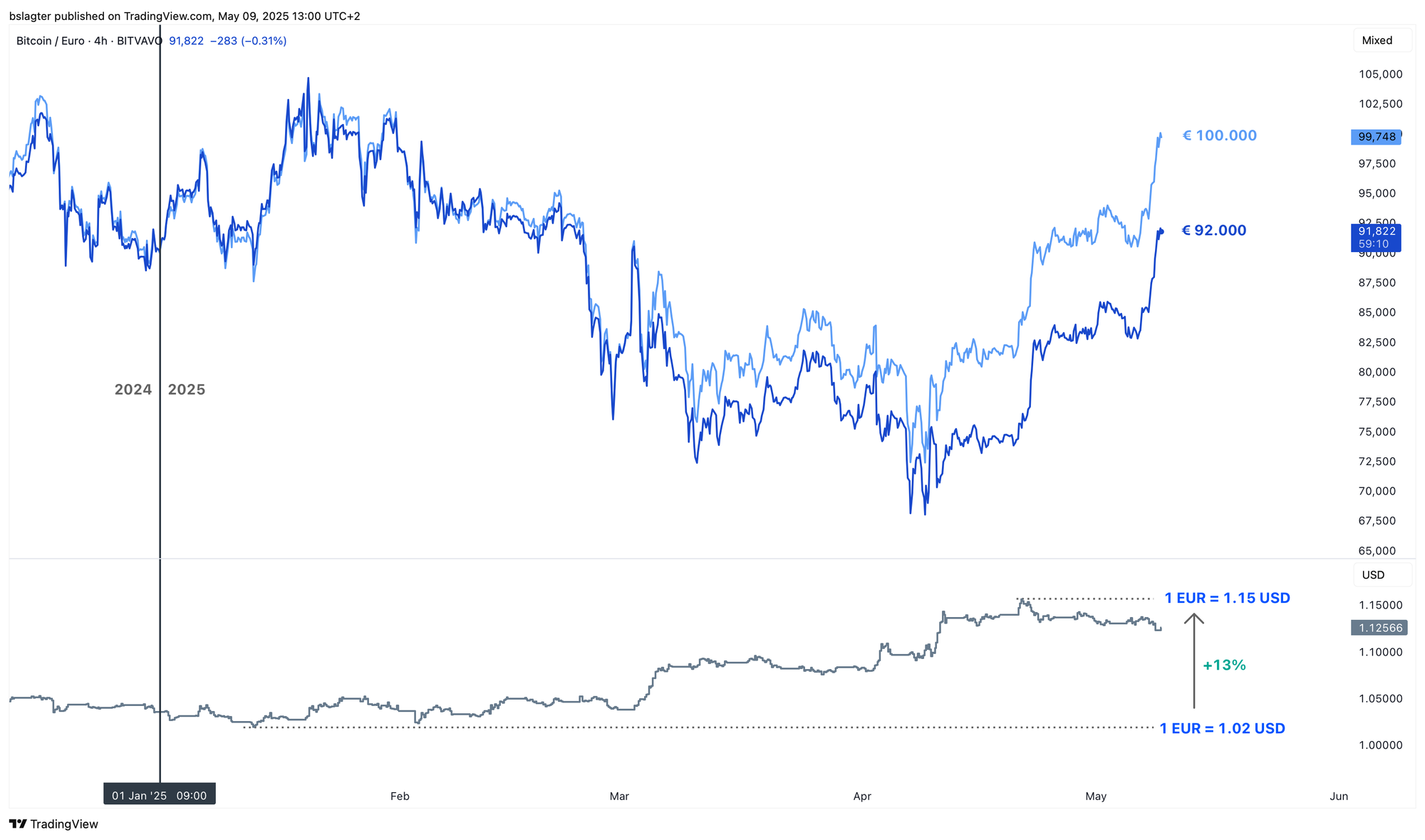

We're now back above $100,000 — the price we often saw on the boards in December and January. However, as European Bitcoiners, we are about ten percent less wealthy than before.

Between January 13 and April 21, the euro appreciated against the dollar by 13%, moving from $1.02 to $1.15. A Bitcoin priced at $100,000 was then worth €98,000, and is now around €89,000.

In the chart below, the dark blue line represents the current price of Bitcoin in euros, while the light blue line shows its value in euros as of January 1. If the dollar had not weakened, we would now be receiving thousands more euros per Bitcoin.

A stronger dollar likely won't come until the trade war ends and the US economy revives—but that remains out of reach for now. Until then, take solace in the fact that when you buy Bitcoin, your euros go further!

2️⃣ The comeback of ETH?

Bert

Often dubbed the black sheep of this bull market, Ether—the coin from the largest smart contracts platform—has not been particularly popular and has frequently been the target of ridicule. Is a turnaround on the horizon?

Within the Ethereum community, there's been extensive debate about how to reverse this trend. While there’s no definitive solution, one school of thought argues that second-layer networks should pay more for using the base layer.

This illustrates the difference between value creation and value capturing. While the Ethereum blockchain generates significant value, is ETH able to capture it – or does that value instead end up benefiting the stocks of companies and tokens of projects operating on a second layer?

Numbers don't lie: Ethereum boasts by far the strongest network effect among all blockchains used for decentralized finance and tokenization. The vast majority of financial institutions and tech companies involved in tokenization are building within the Ethereum ecosystem.

For investors, however, this wasn't enough of a reason to favor ETH over the past few years. The ETH/BTC ratio has been declining since the start of this market cycle in the fall of 2022. Even after the recent surge, ETH/BTC remains 73% below its peak.

Have we seen a bottom in recent weeks? There are several indications—both fundamental and technical—that suggest so. Nevertheless, if there's one lesson history has taught us, it's that excessive optimism about ETH can come with harsh consequences. Caution is warranted.

The chart below indicates a logical bottom and a recovery with potential. A weekly close above $2,150 paves the way for a ride toward this cycle's peaks, around $4,100.

To reach a ratio of 0.08 ETH/BTC, Ether would need to move above $8,000 at the current Bitcoin price. For now, ETH’s ascent is merely the first step in recovering from a few particularly challenging years.

3️⃣ Powell plays second fiddle in Trump's orchestra

Thom

The US central bank (Federal Reserve) kept its policy rate unchanged on Wednesday, maintaining a range of 4.25% to 4.5%. However, its policy statement featured a notable change: the Fed now explicitly warns about the risk of stagflation.

The statement read: “The committee remains vigilant to risks on both sides of its dual mandate and assesses that the likelihood of both higher unemployment and higher inflation has increased.”

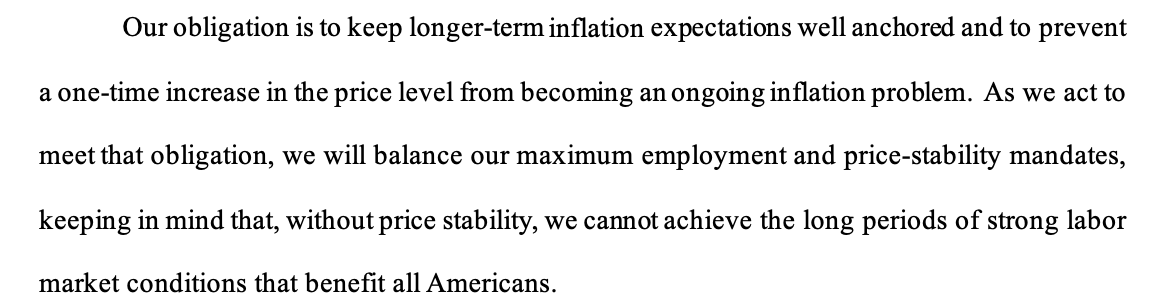

Despite the increased risk of recession, the focus remains on curbing inflation. This was evident in Chairman Jerome Powell's explanation, which indicated that policy is aimed at the aspect of the mandate furthest from its target.

Currently, that target is inflation, implying that we should not expect any rate cuts from the Federal Reserve in the near term.

Fed's Powell: If dual mandate goals are in tension, consider distance from goal and time to close gaps.

— FinancialJuice (@financialjuice) May 7, 2025

During his press conference, Powell reiterated that price stability is a necessary precondition for achieving and maintaining maximum employment. This further underscores that inflation takes precedence, and that we shouldn't expect short-term relief from the Federal Reserve if Trump's trade policies trigger an economic slowdown.

Essentially, the Federal Reserve's message is that it is waiting on the sidelines and will only implement rate cuts when the economy unequivocally demands it. Overall, this sends a negative signal to the market—at least in the short term—as it suggests the Fed will only act once the damage is already done.

However, Bitcoin broke through the $100,000 barrier for the first time since January this week. This development is closely linked to the positive developments in the trade war, which currently dominate the conversation. Whereas every word from the US central bank was scrutinized under a magnifying glass last year, it now plays second fiddle in Trump's orchestra.

4️⃣ Is Donald Trump's trade war merely a temporary phenomenon?

Thom

Donald Trump has now been in power for over three months, and investors are collectively asking: how much longer will this trade war last?

The prevailing view is that the conflict is temporary—a negotiation tactic, a strategy to increase pressure. Thus, many assume it will eventually end. But what if that assumption is fundamentally flawed?

Fund manager and analyst Quinn Thompson believes that the market is mistakenly banking on a swift end to the trade war. He asserts that Trump means what he says and genuinely intends to restructure the economic playing field with a “Main Street over Wall Street” approach.

While investors lose sleep over a crashing Nasdaq, the average Trump supporter hardly notices. The stock market is not the economy, and after the prolonged bull market since the 2008 crisis, this might be the period during which Trump aims to narrow the gap between labor and capital—emphasizing reindustrialization and using tariffs as protection.

According to Thompson, the trade war fits into the broader America First doctrine. It isn't an isolated incident or merely a pressure tactic, but part of a worldview in which domestic jobs, production capacity, and national sovereignty are valued more than global efficiency or profit optimization for multinationals. Capital must once again serve labor, not the other way around.

Ultimately, Thompson believes that the Trump administration will intervene once the financial sector truly starts feeling the pain. The big question is, at what point will that happen? Historically, the American stock market has remained robustly valued—so from that perspective, there isn’t an urgent need for Trump to act right now.

Moreover, current economic data doesn't warrant panic. Last week’s labor market reports were strong, which makes sense since unemployment is unlikely to skyrocket at the first sign of a trade war.

As long as the data doesn't give Trump ample reason to change course, investors—according to Thompson—shouldn't expect a market-friendly president. Although he anticipates the S&P 500 ending this year with positive returns, he sees the gains of recent weeks as a good opportunity to sell.

I partially agree. It seems as though risk assets like Bitcoin and stocks, after their rallies, encounter resistance—likely due to prevailing uncertainty. It's no coincidence that Bitcoin’s price surged by several thousand dollars overnight from Tuesday to Wednesday following news of negotiations between China and the US.

Looking at the overall picture, I still anticipate a new bull market once trade agreements are reached. Import tariffs will likely persist, and while this bull market might not shine as brightly as that of 2021, the fundamentals remain robust—with the caveat that it shouldn't take much longer.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!