Bitcoin breaks through $94,000

After eight weeks trapped below $94,000, bitcoin finally broke out this week. The price came within a hair's breadth of $98,000 on Wednesday. But how high can this rally go?

After the capitulation to $80,500 on November 21, bitcoin's price remained trapped below $94,000. For eight weeks, every attempt to break through failed. This week, it finally happened. The price rose Tuesday to well above $95,000 and came within a hair's breadth of $98,000 on Wednesday.

This is a meaningful move. After a prolonged consolidation, a new rally has finally begun. The big question is how high it will go.

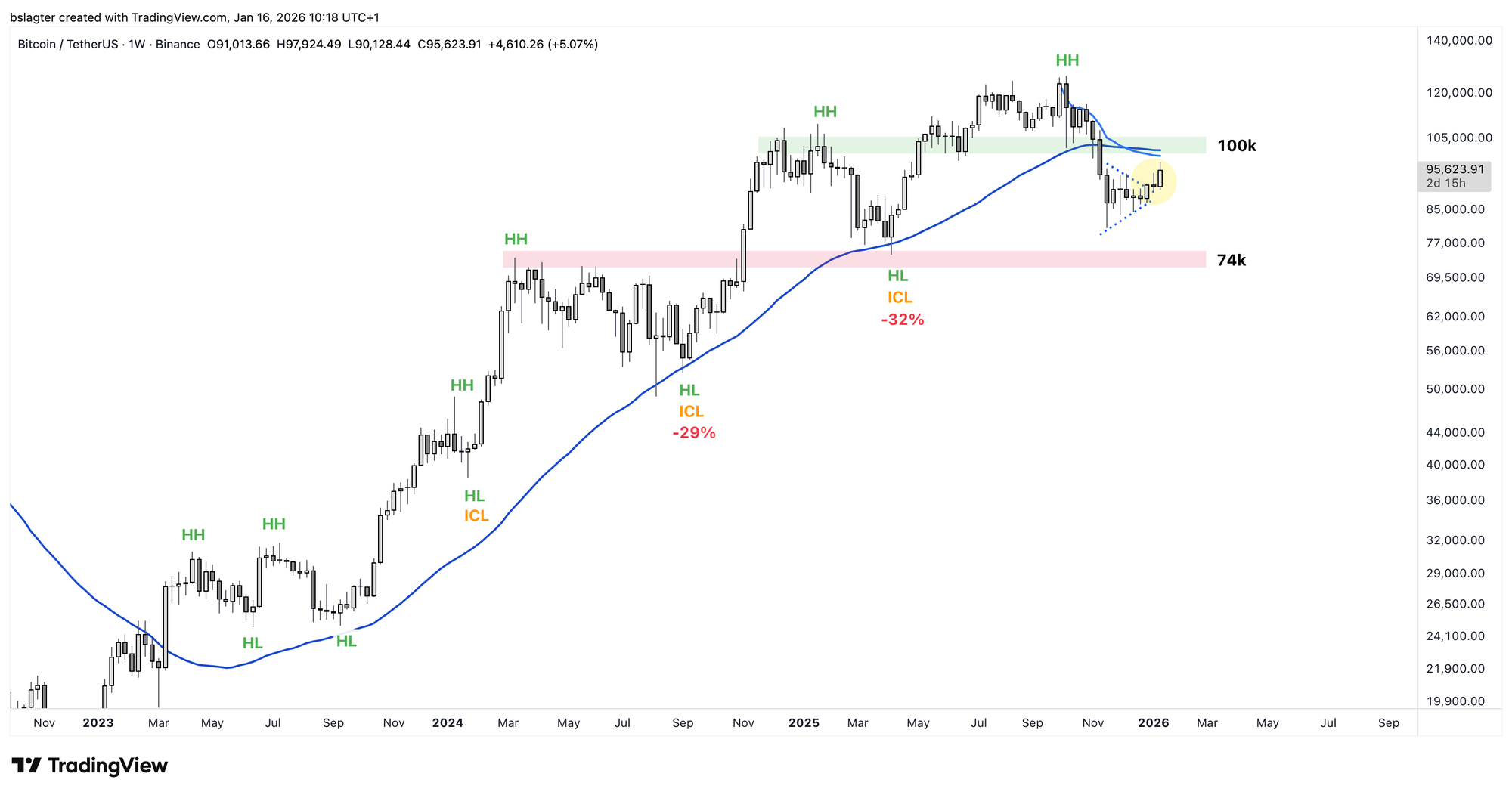

Our base case is that we're heading toward a lower high (LH) on the weekly chart, stalling below the all-time high of $126,000. That would confirm that the uptrend on the weekly chart—the bull market—is over, and we're on our way to a yearly cycle low.

It makes sense that we'd first test $94,000 as support. If that test holds, the path to $100,000 opens up. That's where the year-length moving averages sit—the 12-month, 50-week, and 400-day. The volume-weighted average price (VWAP) from the $126,000 top on October 6 also runs through that level.

Our base case is that we break through $100,000. That would wake the bulls from hibernation and bring some optimism back to the crypto market. We've already spotted the first "buckle up" post. Above 100k, expect the inevitable "omega candles" and "250k soon" calls to follow.

Will that enthusiasm provide the liquidity sellers need to continue their rotation out of bitcoin? Or is that chapter closed, with buyers now in control?

The answers to these questions will determine whether this rally takes us to new all-time highs, or stalls somewhere between $100,000 and $126,000. We're betting on the latter, with $108,000 to $110,000 as a logical price target.

The mildest version of a bear market would see us make a relief rally to a lower high (LH), followed by a decline to a lower low (LL) below $80,500. In that case, $74,000 is the obvious target. That would be the minimum requirement to call it a yearly cycle low—the bear market bottom.

This would fit the scenario outlined by Bitwise, among others, where we've essentially been in a bear market for much of 2025 in many respects. They expect a new bull market to begin in early 2026.

This is our preferred scenario. We'd actually welcome it more than a continuation of the bull market, where price shoots straight to new records. That sounds nice, but a swift transition to a bear market would still be hanging over the market.

It's more comfortable if we establish a bear market bottom on most indicators through a "bear market by time." If we then rise to a new all-time high, the market could interpret that as the start of a new bull market.

We continue with the following topics for our Alpha Plus members:

- The weekly cycle

- Have the scenario probabilities changed?

- Finally alt season?

- Hope for bitcoin from U.S. credit markets

- U.S. economy continues to surprise to the upside

1️⃣ The weekly cycle

Bert

If we print a weekly close above $94,000 in the night from Sunday to Monday, that's solid evidence that November 21 was indeed a weekly cycle low (ICL), and that we've started a new weekly cycle.

✅ A weekly close above the 10-week moving average (90.4k)

✅ A weekly close above the candle of the low (94.2k)

✅ The momentum oscillator is starting a new cycle

➡️ The 10-week moving average is curling up

That means we're now in week 8 of this weekly cycle. Recently, these cycles have averaged around 30 weeks. Looking further back, we see a wide range between 20 and 40 weeks. Shocks can sometimes cause a sudden end or a delayed end to the weekly cycle.

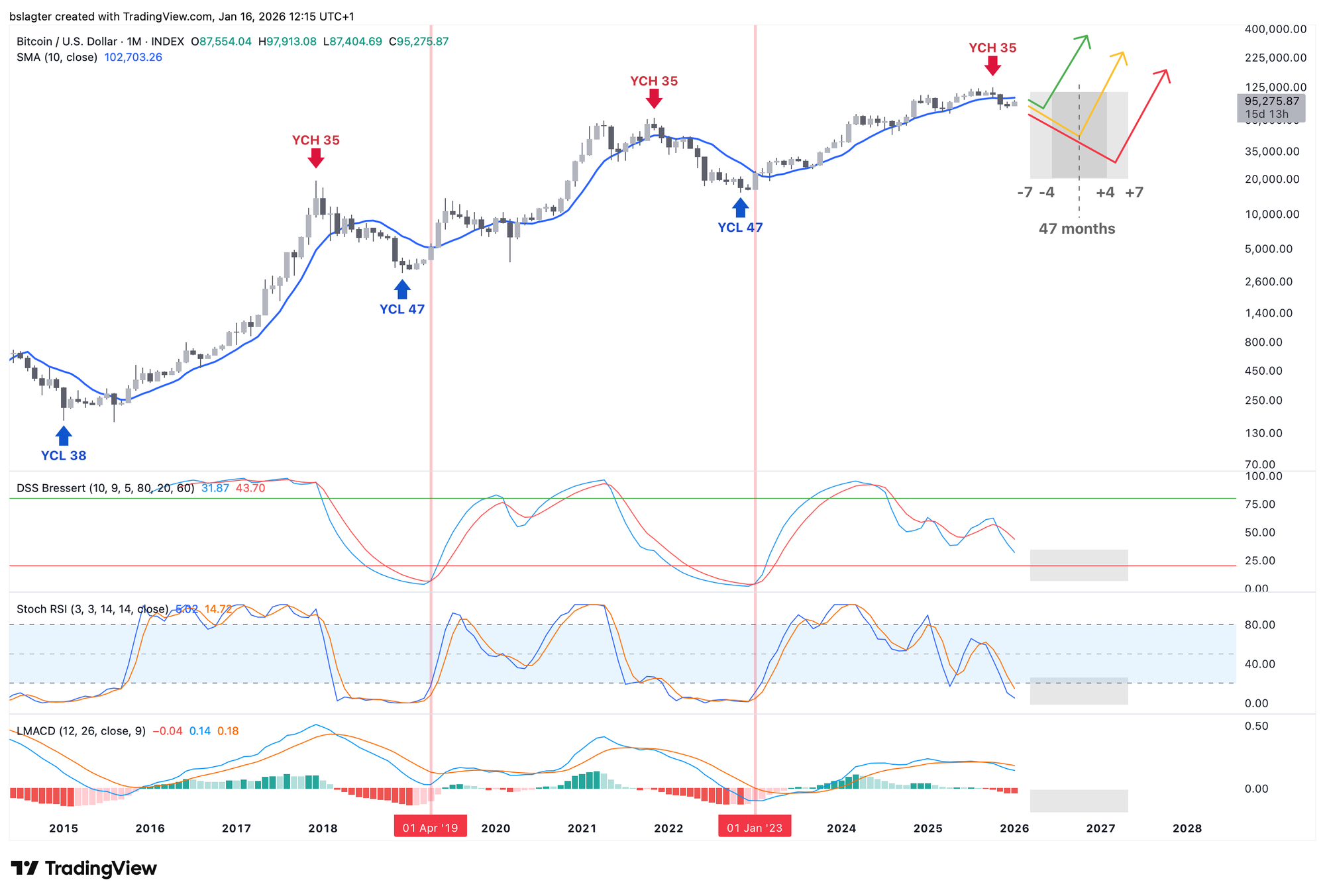

As we discussed in last week's Markets, March 2026 is the first month that falls within a 15% window around the average yearly cycle length.

In March, weeks 15 through 18 of this weekly cycle fall. That would be a very short weekly cycle. A weekly cycle low (ICL) in the second quarter is more likely.

Ideally, that ICL would also be the yearly cycle low (YCL)—the bear market bottom. We probably won't know that for certain until a few months later. Confirmation comes when we rise to a new all-time high, or when indicators on the monthly chart confirm a new yearly cycle.

2️⃣ Have the scenario probabilities changed?

Bert

When I created four scenarios in the November 14 Markets edition, I didn't expect the associated probabilities to remain unchanged for very long. But to this day, they're still the same:

- Bull market continuation: 30%

- A sideways period: 40%

- A mild bear market: 20%

- A deep bear market: 10%

You could argue that the absence of a V-shaped bottom and quick recapture of the 50-week moving average makes (1) somewhat less likely. On the other hand, the stability around $90,000 makes (4) somewhat less likely. But in both cases, not enough that I would adjust the percentages.

For many indicators, little has actually changed since November—from bitcoin dominance and MVRV to funding rates. In last week's Markets, I updated the charts for all four scenarios, and visually the price action still fits all four quite well.

It might be a bit boring and unsatisfying, but the lack of direction actually fits the probability distribution we currently have, where we've placed most of our chips on a "bear market by time."

In recent weeks, we saw some capitulation in narratives. By that I mean people declaring a particular story dead:

- Bob Loukas: "Bitcoin should have printed a god candle on FED attack"

- Karel Mercx: "The verdict is in: the debasement trade is Gold & Silver, not Bitcoin. A frontal attack on the FED sends metals to fresh ATHs while BTC sits 20% below its peak. The narrative is broken. Investors are choosing the original hard money over the digital experiment. Book closed."

Bitcoin has failed, is the message. It's an echo of "bitcoin is heading toward irrelevance," as the European Central Bank wrote in November 2022.

Lately, there's been buzz about X deliberately suppressing crypto, thereby "killing CryptoTwitter."

But it's not just X's algorithm, writes Benjamin Cowen, "Viewership to crypto has been dropping across platforms." Don Alt agrees: "The algo didn't kill CryptoTwitter. Price Action did. Once the market goes up only again you'll see this place buzzing with life. It's how it's always been."

Retail has checked out. And all of this at a price of $96,000.

When we line everything up like this, scenario 2 remains the favorite. A few years from now, we'll look back and see the price moving sideways between 75k and 125k for 24 months from November 2024 to November 2026. Followed by a new bull market.

3️⃣ Finally alt season?

Sam

It's become painfully clear in recent years that an alt season—where nearly all altcoins rise more than 10% for multiple consecutive days—no longer exists. Many influencers continue to announce an alt season with some regularity, despite years of disappointment for altcoin holders.

Great for hopium and probably likes, but painful for followers who take these statements as truth. Of course, there are short periods where select groups of altcoins outperform bitcoin, but these gains are often followed by deep corrections.

So are we in one of those outperformance periods now? 2026 started very strong, and some altcoins had already gained 30 to over 100 percent in the first week of the new year. That sounds great, but given the strong downtrend since October 10, 2025, it's still just a small consolation.

The downtrend of the final months of 2025 was often accompanied by resistance from the 100 and 200 4-hour EMAs. In the chart below, those are the orange lines. After this strong downtrend finally broke, it was followed by a significant rise toward the next trend, namely the 100 and 200 1-day EMAs—the white lines.

What you'd like to see is such a strong move followed by strength. Unfortunately, what we mostly see is that the majority of altcoins printed a lower high last Wednesday compared to the first week of January. Meanwhile, the chart below shows that bitcoin finally broke out of its range with a higher high last Tuesday and Wednesday.

For now, this appears to be a sign that broad risk appetite in the crypto market isn't there yet. It will be interesting to see whether altcoins do print higher highs if bitcoin continues its rally above $100,000. If they fail to do so, this "alt season" will also end in disappointment.

4️⃣ Hope for bitcoin from U.S. credit markets

Thom

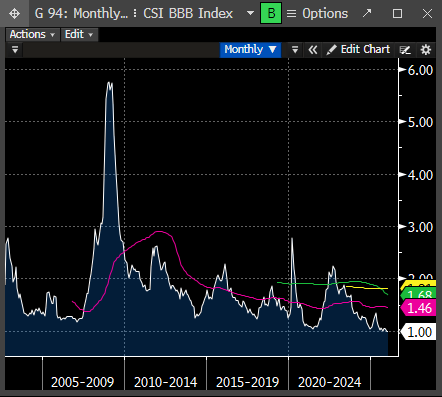

While bitcoin's price action leaves much to be desired, the credit cycle in the United States continues to send hopeful signals. In the first full week of January, companies raised more than $95 billion through 55 investment-grade bond issuances. That made it not only the busiest week since May 2020, but also the strongest start to a year ever.

That flood of new debt is no coincidence. Demand for top-quality dollar debt is exceptionally strong, causing relative borrowing costs for companies to fall to their lowest levels in years. Relative is the key word here: it's not about the absolute interest rate companies pay, but the extra premium on top of U.S. Treasury yields. That risk premium is currently at historic lows, which is why companies are falling over each other to raise capital.

This matters for bitcoin, even if it doesn't immediately translate into higher prices. Low credit spreads point to loose financial conditions and high risk appetite within the system. Companies can easily raise capital, investors are willing to take risk, and liquidity flows freely through the market. In such an environment, risk assets typically perform well.

This keeps the foundation for better times for bitcoin intact. The main bottleneck, however, is the lack of momentum, especially compared to other assets that are currently performing convincingly. As long as gold and silver are delivering exceptional returns, capital flows will likely continue to focus on those markets.

But capital flows are cyclical. There will inevitably come a moment when relative attractiveness shifts and investors start looking for asymmetric returns again. That's precisely when bitcoin should catch a tailwind. The macroeconomic foundation is certainly there. What's still missing is confirmation from the charts. Once those two align, things can move fast.

5️⃣ U.S. economy continues to surprise to the upside

Thom

2026 has barely begun, but the stream of macroeconomic data is already picking up steam. Last week, it became clear that the U.S. labor market is cooling further, but at a considerably slower pace than feared. In that regard, the year got off to a good start. For bitcoin, confidence is crucial: a stable economic environment increases investors' risk appetite.

This week brought new inflation figures and Retail Sales. Together, they provide a fairly complete picture of the state of the U.S. economy in a short time.

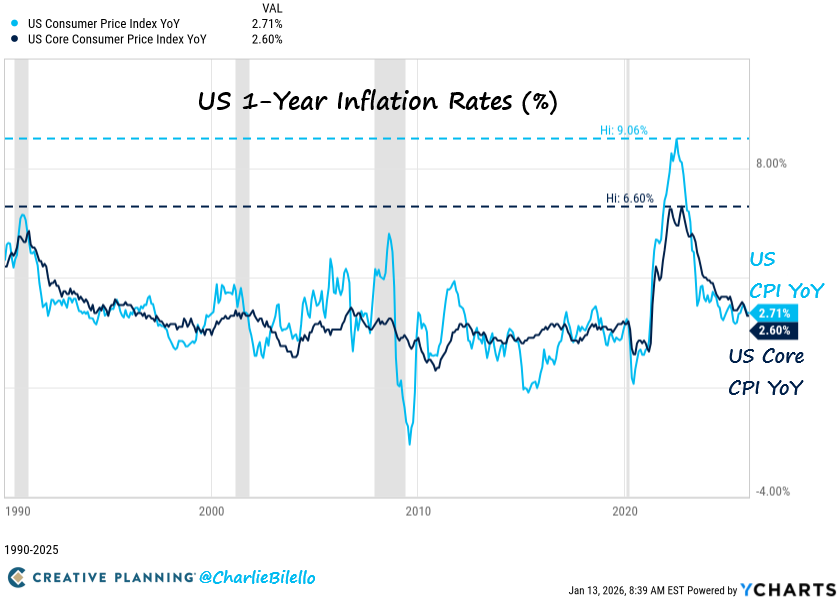

Starting with the Consumer Price Index (CPI). It came in at 2.71%, exactly in line with expectations. The cautious positive surprise was in core inflation (Core CPI), which cooled to 2.60%, while the market expected 2.70%.

This aligns well with what we see in Inflation Swaps: market expectations for inflation over the next twelve months. These currently sit just above the desired 2.0% level. Ideally, inflation would fall further toward the central bank's official target, but at this point it poses no serious obstacle to potential rate cuts, should the economy require them.

That said, it's worth keeping a close eye on these inflation swaps in the coming months. Since late 2025, there's been slight upward momentum. For now, however, inflation is not a clear problem for bitcoin.

Finally, this week we got Retail Sales: revenue figures from U.S. retail. This data says a lot about consumer health, and here we once again saw a positive surprise. Month-over-month, sales rose 0.61%, while 0.50% growth was expected. In 11 of 13 main categories, revenue was higher than a month earlier.

The picture is clear: the American consumer remains resilient. This is important because households remain one of the key engines of the U.S. economy.

In closing

All previous editions of Alpha Markets can be found in the archive. Questions, comments, and suggestions are always welcome in the community.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!