Wall Street's Wilhelm II

Will bitcoin defy the doubters? Once dismissed as a fraud—echoing past missteps by leaders like Kaiser Wilhelm II—bitcoin now endures over 15 years, even as banks pivot. Can digital scarcity and innovation outlast the old guard?

"I believe in the horse. The automobile is merely a passing trend."

This quote is attributed to Emperor Wilhelm II, who was both literally and figuratively still riding high in the early 20th century. Horses were everywhere— the economy ran on horseshoes and hay. And then, out of nowhere, a clattering, odoriferous machine was hailed as the future? Utter nonsense.

It has become a classic example: a leader who failed to recognize a fundamental innovation because he was stuck in his own time.

A century later, JPMorgan CEO Jamie Dimon exhibits a similar sentiment. In 2017, he dismissed bitcoin as a fraud. Anyone investing in it was deemed foolish, and anyone trading it through his bank was shown the door immediately—no debate allowed. In his view, bitcoin was even worse than tulip mania; a bubble without value, future, or purpose.

You might expect reality to have caught up with him by now. Yet, according to Belgian economist Geert Noels, he still remains fixated on bitcoin:

One of the most interesting meetings in my professional life: a private conversation with Jamie Dimon - CEO of JP Morgan.

— Geert Noels (@GeertNoels) June 24, 2025

One of the quotes: “Bitcoin is a fraud, in 10 years from now it will be closed down. “ pic.twitter.com/kr1BeCESxz

"In 10 years, bitcoin will vanish." This statement is reminiscent of the spirit of Wilhelm II—or that of Ken Olsen, founder of computer company DEC, who declared in 1977 that there was no reason for anyone to own a computer at home.

Olsen was by no means a fool. His company was a pioneer. However, he saw the computer as a specialized tool meant for scientists and engineers. The idea of having one in every household, alongside the microwave and coffee maker? Pure nonsense.

Jamie Dimon fits that mold perfectly—a successful banker who spent years dismissing bitcoin as nothing more than a digital joke: full of hot air, criminal nonsense, clunky, and utterly unscalable. And in some respects, he was right—bitcoin was indeed slow, cumbersome, and hardly suited for everyday transactions.

But just like the early automobile, which broke down more often than it ran, these shortcomings weren’t a deal breaker. It wasn’t about speed or ease of use—it was about autonomy, freedom, operating outside the existing framework, and digital scarcity. And, much like Wilhelm, Dimon simply struggled to comprehend it.

And yet, something is changing. Not in his core beliefs, but in his actions. Over time, JPMorgan began offering bitcoin services to affluent clients, published analyses on bitcoin as digital gold, and developed infrastructure for bitcoin ETFs. Recently, Dimon stated:

"I don’t think you should smoke, but I defend your right to smoke. I defend your right to buy bitcoin."

The man who once warned that merely touching bitcoin could get you fired now says, "I wouldn’t do it myself, but I won’t stop you either." It’s reminiscent of an old-fashioned mayor who once banned pinball for being a corrupting influence on the youth, only to later admit in his twilight years, "Oh well, let them play."

Dimon hasn’t been converted; he remains lukewarm. And that in itself might speak volumes.

Meanwhile, bitcoin continues unabated. The network has been operating for over fifteen years without central control and with virtually no downtime. Countries are embracing it, exchanges are listing it, and billions of dollars in ETF capital are flowing in. While political parties, currencies, and even nations may falter, bitcoin endures.

It seems very likely that...

— Jason Maier (@cjasonmaier) June 29, 2025

Bitcoin will outlast the Democratic Party

Bitcoin will outlast the Republican Party

Bitcoin will outlast the United States (as it is currently understood)

Bitcoin will outlast the concept of Nation State (as it is currently understood)

That might sound exaggerated. But is it really so?

In any case, bitcoin now has an established track record. Politicians come and go, interest rates fluctuate, and banks merge or collapse, yet bitcoin continues to add blocks without interruption. That’s what makes it so hard for people like Dimon to comprehend: they view the world through the lens of power, hierarchy, and control, while bitcoin operates on protocols, transparency, and voluntary participation.

We can hardly blame Dimon for his perspective. His entire career was built on centralization. Yet, his statements have become timeless documents—not so much about the innovation, but more about the world he once knew.

More Alpha

Are you a Plus member? Then we move on to the following topics:

- It’s Pouring MiCA Licenses

- Bitkey: Hardware Wallet Without a Seed Phrase?

- Bitcoin’s Hashrate Plummets Following Airstrike on Iran

1️⃣ It’s Pouring MiCA Licenses

Peter

Within a few weeks, Coinbase, Kraken, Bitvavo, BTC Direct, and Amdax each received a MiCA license. One after another, licenses are being granted, as if European regulators are finally catching up.

To the uninitiated, this might seem like mundane administrative news—but don’t be fooled. For the first time, unified European rules for crypto services have emerged, applying not by country but across the entire European Economic Area. One license now unlocks access to thirty markets. For years, it was a patchwork of national interpretations and ambiguities; now, there’s a strict, uniform standard.

For the companies that have secured the license, it meant months of hard work. The MiCA requirements are stringent—from capital buffers and integrity assessments to governance and customer protection. These rules, drawn from the mature financial world, have been applied to a sector still reinventing itself. It’s impressive that young organizations like Amdax and Bitvavo can meet these demands.

However, this isn’t a time for congratulations. MiCA is not a promise of prosperity—it’s a rulebook. And the question remains: will the game continue to be played?

Yes, the rules are clearer, but that alone doesn’t guarantee that Europe’s crypto market will thrive. Licenses are just one piece of the puzzle. Companies need room to grow and innovation must be fostered. There’s a risk that Europe becomes a space where you’re allowed to play, yet never truly competitive on the global stage.

In the Netherlands, not everyone has obtained the regulator’s green light. This is painful, as from July 1, 2025, participation without a license will be prohibited. The regulator argues that applicants were too slow and their paperwork incomplete, while the applicants contend that the deadlines were too tight and the AFM’s responses too sluggish.

Anyway, the stage is set. The ball is on the penalty spot, and the “big boys” are in the game. We’re eager to see how this match unfolds!

2️⃣ Bitkey: Hardware Wallet Without a Seed Phrase?

Erik

With great power comes great responsibility—a truth well known to anyone storing bitcoin in cold storage. While having full control over your crypto assets is empowering, it also means you bear the risk of making a mistake that could cost you everything. For that reason, various storage alternatives have emerged to share some of that responsibility. The hardware wallet Bitkey is one such new option.

Launched in May by Jack Dorsey’s Block, this hardware wallet offers a way to manage BTC without the need to safeguard a seed phrase. Bitkey targets users who prefer not to leave their BTC on an exchange but also don’t want to shoulder full personal responsibility.

Most wallets give you one route to recovery: a seed phrase.

— Bitkey (@BitkeyOfficial) May 14, 2025

Bitkey gives you three.

No single point of failure. No napkin risk. No need to memorize 24 words.

Just secure, practical self-custody — without the stress.

Read more: https://t.co/6cRbNhNa19 pic.twitter.com/1JDmqg0MFZ

What Makes Bitkey Special?

Bitkey features a distinctive hexagonal design and a built-in fingerprint scanner. While this striking design sets it apart from many hardware wallets—which typically just require a PIN—the difference goes beyond aesthetics. It marks a shift in how recovery is managed.

The core of Bitkey’s innovation lies in generating three keys:

- One key remains on the hardware wallet itself.

- Another is stored on the user’s smartphone, encrypted in the cloud (for example, via iCloud).

- The third key is held by Bitkey using a Hardware Security Module (HSM).

To authorize a payment, two keys are required—a method known as 2-of-3 multisig that helps avoid reliance on a single key. With Bitkey, you first use your phone and then your fingerprint on the device to complete a transaction.

The extra safety net comes from the third key, which is stored by the company behind Bitkey. If you lose either the cloud-stored key or your Bitkey device, the company can help recover access—after a set time-lock period and once you’ve verified your identity.

Comparison with Casa

Casa, a well-known name in the bitcoin world, has offered a “seedless” multisig service for years. Much like Bitkey, it allows customers to opt out of storing a separate seed phrase, keeping it solely on the device. Similarly, Casa stores one key through its app while holding another key in the cloud.

So, what sets Casa’s offering apart from Bitkey? For one, Casa charges $250 per year. Additionally, with Bitkey you’re tied to a dedicated device featuring a fingerprint scanner, whereas Casa lets you use, for example, a Ledger or a Trezor.

This increased dependency on the Bitkey device is the Achilles’ heel of the solution. Every approach has its trade-offs—it ultimately comes down to balancing ease of use and reliance on a third party versus the complete control and potential vulnerability of managing your own storage.

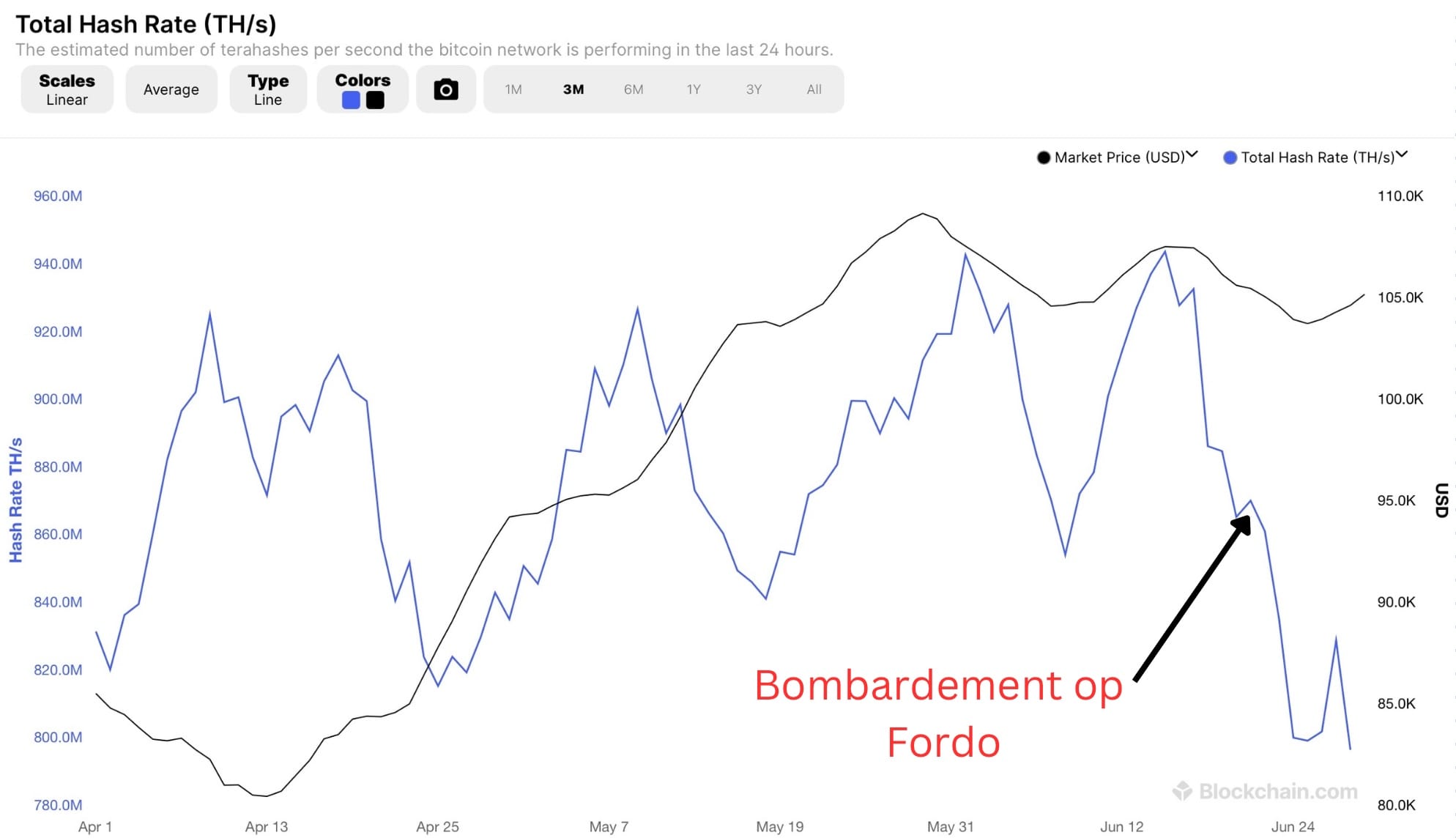

3️⃣ Bitcoin’s Hashrate Plummets Following Airstrike on Iran

Erik

It may feel like ages ago, but it’s still fresh: the US airstrike on Fordo, the so-called nuclear facility in Iran. Shortly afterward, the bitcoin network’s hashrate—the total computational power of its miners—dropped by over 10%. Some commentators even speculated that a major mining operation might have been struck.

However, bitcoin mining expert Daniel Batten points out significant caveats to that conclusion. Sharp declines in hashrate are not unusual; long-term data shows drops of 20% or more occur regularly—often on a monthly basis—without any clear geopolitical trigger.

No this is not because Iran is secretly mining large swathes of Bitcoin using nuclear energy. Firstly, drops like this are common (see chart below) and are more likely due to ERCOT curtailment (being paid to shed load, or getting a price signal it's uneconomical to mine).… https://t.co/AxX3poncZ6 pic.twitter.com/XnL4YGaMCl

— Daniel Batten (@DSBatten) June 23, 2025

Moreover, even a nuclear reactor dedicated solely to mining would fall short of providing 10% of the global hashrate.

So what explains these dips? A plausible explanation lies in the dynamics of large US miners, particularly in Texas. There, installations are sometimes temporarily shut down due to curtailment programs. During peak demand on the electricity grid, miners receive financial incentives to power down their equipment to free up capacity for other consumers, at the request of ERCOT, the grid operator in Texas.

Mining with Nuclear Energy: Nearly 10% of the Total Hashrate

Incidentally, nuclear energy plays a significant role in bitcoin mining. According to the Cambridge Centre for Alternative Finance (CCAF), nuclear power is estimated to account for roughly 9.8% of the hashrate—surpassing even coal-powered mining (8.9%).

Nuclear energy has its advantages: it’s a stable energy source and, depending on your perspective, can be considered green. Excess capacity at existing plants is especially attractive. However, large-scale deployment is limited by high investment costs, complex regulations, and public resistance.

One notable example is a major miner in Pennsylvania. This facility, ambitiously named Nautilus Cryptomine, is the first in the United States to be powered entirely off-grid by nuclear energy, drawing power directly from a nearby nuclear reactor. In early 2025, 50 megawatts of capacity went online, with plans to expand to 100 MW later this year.

🍟 Snacks

To wrap up, here are a few quick snacks:

- Dinari becomes the first company to secure a U.S. broker license to offer tokenized stocks. The license marks a milestone by bridging regulated securities with blockchain technology. Dinari’s so-called dShares are 24/7 tradable tokens representing actual U.S. stocks and will soon be available on other platforms. This news raises expectations that financial markets are on the path to tokenization—the trading floor is moving to the blockchain.

- Ledger discontinues support for the popular Nano S wallet. The nearly decade-old hardware wallet will no longer receive updates or security patches. While the device will continue to function for now, Ledger recommends that users upgrade to a newer model. Those transferring their recovery phrases should exercise caution, as the process can be particularly vulnerable. Many users feel compelled to purchase a new device, which is understandably frustrating.

- Crypto holdings may soon count towards U.S. mortgages. The U.S. government is considering including crypto in the assessment of an individual’s assets when applying for a home loan—provided these digital assets are held on regulated U.S. exchanges. This marks a significant shift: bitcoin and other cryptocurrencies will be taken more seriously as part of a person’s net worth, even with adjustments for risk and volatility.

- Ripple and the SEC finally bury the hatchet. The two parties attempted to cement their newfound truce in court, but their effort fell short—the judge refused to overturn an earlier ruling that declared Ripple’s sale of XRP to institutional investors unlawful, and the $125 million fine remains in place. With no alternative, both sides have had to withdraw their appeals to make peace. This marks the conclusion of a protracted case that was once a bellwether for crypto regulation.

- Ethiopia has earned $55 million from bitcoin mining in just ten months. By harnessing surplus hydropower—energy that would otherwise go to waste—the country has powered bitcoin mining, generating revenue that now accounts for 18% of the national energy company’s annual income. These proceeds are being reinvested to expand the power grid, demonstrating how bitcoin not only helps reduce waste but also contributes to infrastructure development and improved living standards.

- Financial heavyweight Ric Edelman now recommends allocating between 10% and even 40% of your portfolio to crypto. The former CEO of Edelman Financial Engines and founder of DACFP now describes bitcoin and other cryptocurrencies as “indispensable for a modern investment strategy”—a notable departure from his previous advice of just 1%. Edelman sees reduced risk thanks to broader adoption and a longer investment horizon in light of increased life expectancy, suggesting there’s room for more crypto: 10% for cautious investors and up to 40% for the bold.

- An increasing number of London-listed companies are adding bitcoin to their balance sheets. According to the Financial Times, at least nine companies—including Vinanz and Oscillate—have either modified their strategies to purchase bitcoin or plan to do so soon. This trend echoes the MicroStrategy model, emerging despite historically cautious policies from British regulators. Even the FCA is now contemplating a shift in its crypto stance, signaling a change in the British financial landscape.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!