They're In!

BlackRock’s bold Bitcoin ETF in 2023 ended crypto’s playground days. Now, 84% of pros are bullish, 85% are investing, and a whopping $9B in an 80,000 BTC sale barely stirred the market. Is this the dawn of true institutional maturity? The crypto reset is here.

Back when BlackRock submitted its application for a spot Bitcoin ETF in June 2023, it marked a turning point. Not because it was the first application—that honor belongs to many others—but because it was BlackRock. The world’s largest asset manager, with an almost impeccable record at the SEC, took a clear stand for Bitcoin. From that moment on, everyone knew that Bitcoin’s early, childish phase was over. In the eyes of major financial players, Bitcoin had been recognized as a serious investment.

Fast forward to 2025, and a new report from the American law firm Barnes & Thornburg confirms what many had already sensed: institutional investors are no longer hesitating—they’re fully committed.

Barnes & Thornburg isn’t a crypto promoter. It’s one of the largest legal service providers for private investment funds in the US. The firm advises more than 100 funds, ranging from hedge funds to private credit vehicles, from billion-dollar funds to emerging venture capital firms. Their annual Investment Funds Outlook provides a snapshot of what’s currently on the minds of general partners (GPs), limited partners (LPs), and other professionals managing billions in capital. And what does it reveal?

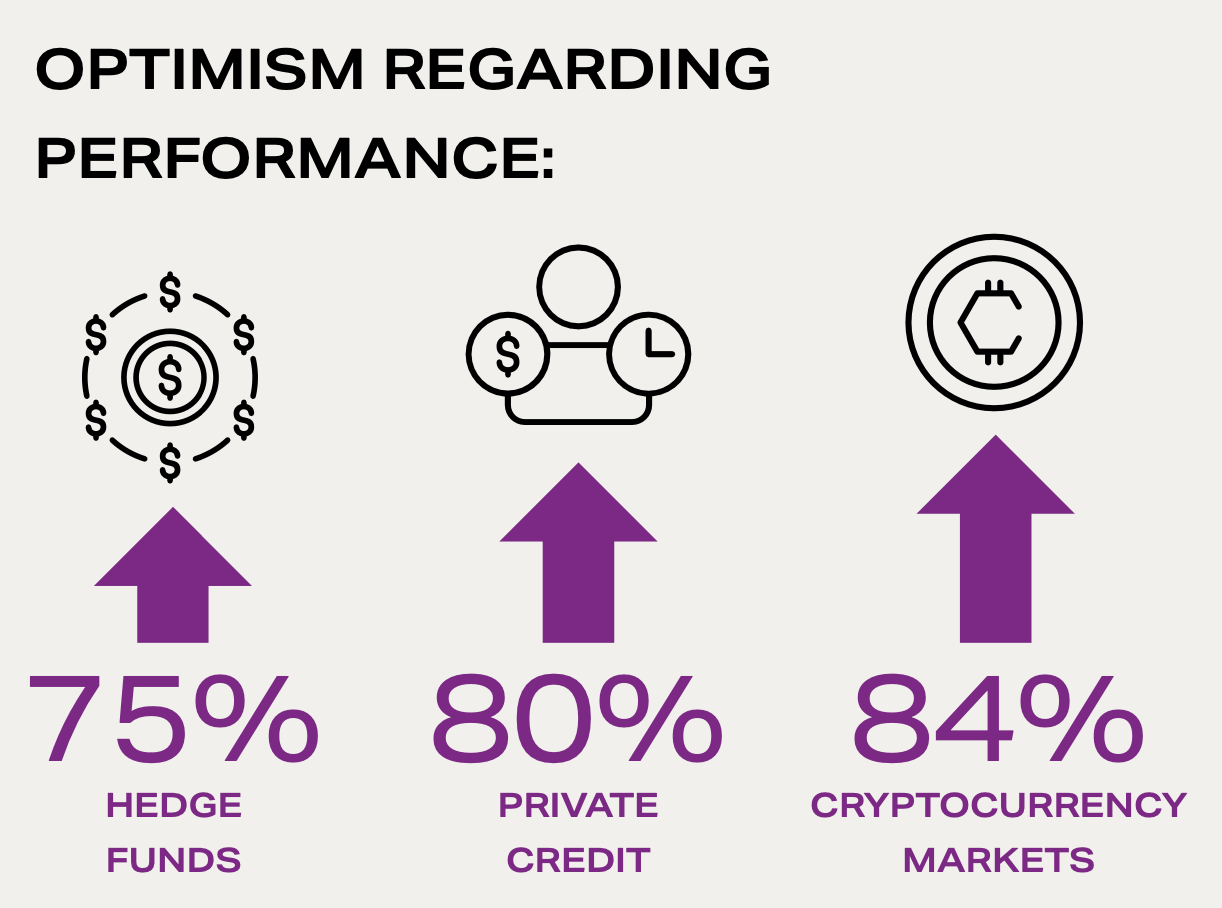

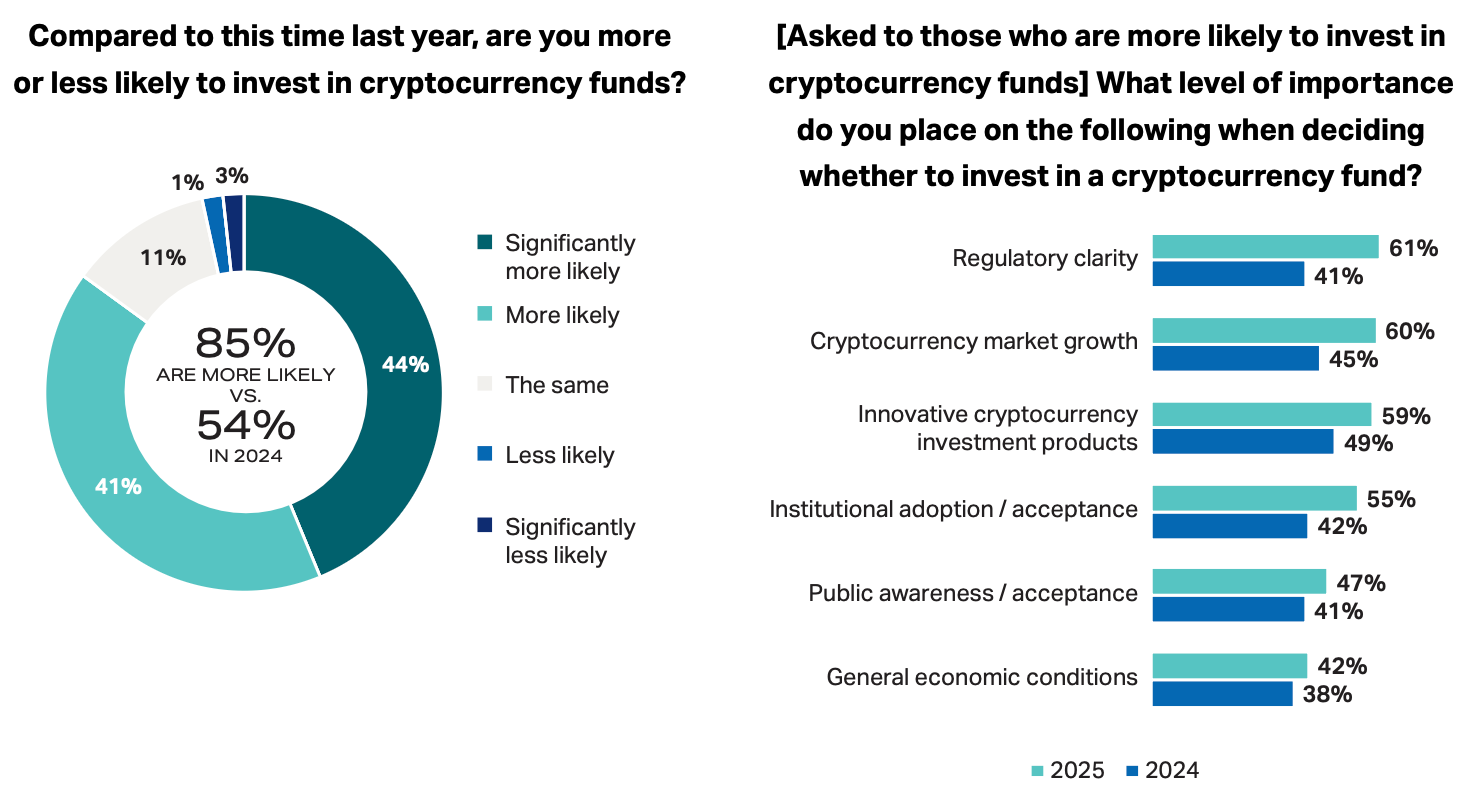

➡️ 84% of respondents are optimistic about crypto.

➡️ 85% plan to invest (more) in it in 2025.

Why? Not because the hype has returned, but because several key boxes have been checked off:

- Regulatory clarity (61%)

- Market growth (60%)

- Innovative investment products (59%)

This places crypto alongside hedge funds and private credit—sectors that, according to the report, tend to thrive in volatile times. And that’s exactly where we find ourselves now. With rising interest rates, trade tensions, and uncertain policies, the reliable predictability of the past is gone. In this environment, Bitcoin is no longer being ignored; it’s being embraced.

It’s notable, however, that economic uncertainty isn’t the primary driver for crypto investments. While 72% of respondents view the overall market situation as promising, crypto investors mainly cite other factors. In institutional circles, Bitcoin isn’t yet seen as a “safe haven” but as an asset evolving into maturity.

The takeaway from this report can be summed up in one word: normalization. Not the wild peaks of retail euphoria, but the steady, subtle adoption of institutional capital—the kind driven by spreadsheets rather than memes. And that capital is now saying, “We’re in.”

More Alpha

Are you Plus member? If so, we continue with the following topics:

- “Institutional Investors”: Who Are They and What Do They Want?

- Companies Stockpiling ETH Continues

- This Reveals the Sale of 80,000 BTC

1️⃣ “Institutional Investors”: Who Are They and What Do They Want?

Peter

They’re in, but who exactly are “they”? What motivates them? And how do their considerations differ from what we’re used to in the crypto world?

Let’s be honest: the average crypto investor thinks in cycles, narratives, and memes. But institutional capital operates differently. Barnes & Thornburg’s report offers insights you won’t want to miss, because when the big players show up, it pays to truly understand who they are.

Who Are the Respondents?

Barnes & Thornburg surveyed 121 professionals from the investment world, including:

- 40% limited partners (LPs)

Think of investment banks, pension funds, endowments, and family offices. - 37% general partners (GPs)

These are the fund managers themselves. - 23% service providers

Legal, administrative, and compliance firms.

The responses came from individuals working at hedge funds, private equity firms, venture capital firms, investment banks, and private credit funds. Together, they manage billions. In short, these are the people making investment decisions on a scale we rarely see—and their actions eventually ripple through to affect market prices.

Why Are They Investing in Crypto?

Unlike typical Bitcoin investors, these parties don’t view crypto merely as an inflation hedge or an alternative currency. Instead, they focus on whether it’s a suitable investment—taking into account regulations, available products, market size, what their competitors are doing, and public acceptance of investing in it. What’s missing are the traditional macroeconomic arguments like inflation and monetary erosion that resonate more in the consumer space.

They’re looking for predictability, scalability, and solid infrastructure. They don’t necessarily want to be the very first movers, but they also don’t want to be left behind. And once the structures are in place—thanks to new exchange products and clearer regulations—the signal is clear: the time to invest has come.

What Does This Mean for Us?

These institutions aren’t reckless—they only step in once risks are mitigated, products are mature, and the rules are clear. Key considerations for them include:

- Custody

Who is safeguarding the assets? - Valuation

Are there acceptable methods for determining value? - Exit liquidity

Will they be able to exit when needed?

For retail investors, this is a signal that the current cycle is driven not merely by hype or the halving, but by the structural integration of crypto into asset managers’ portfolios.

This evolution also reshapes what counts as a “good project.” While a compelling story or brand remains important, factors like regulatory compliance, corporate structure, auditability, and product formats (ETFs, notes, funds) are becoming decisive.

Time for a Supercycle?

Those who view institutional investors as a monolith—simply “bullish now”—miss an important point. They didn’t appear overnight. They move slowly, incrementally, and according to a different logic. They aren’t seeking a revolution; they’re after returns within a defined framework. And for the first time ever, crypto is providing that framework.

The burning question now is how much influence these players’ involvement will have on Bitcoin’s typical price behavior. Will we leave behind the rigid four-year cycle and enter a phase of gradual, sustained growth?

As long as they deploy capital in the crypto market, these players could well redefine the space. But before you start counting your riches, remember that their participation also means they believe there’s a clear exit strategy.

2️⃣ Companies Stockpiling ETH Continues

Erik

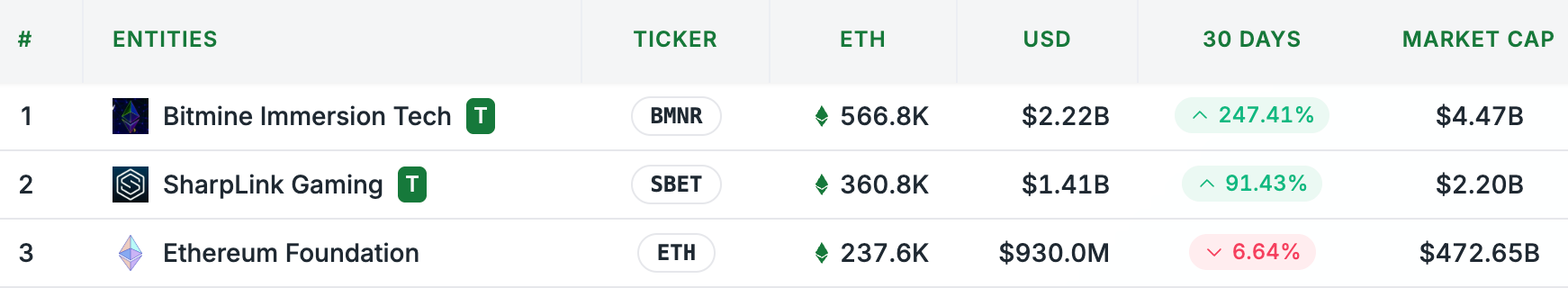

Two weeks ago, we noted the emerging trend of publicly traded companies adding ETH to their reserves. That trend shows no sign of slowing down, with a new frontrunner emerging. Bitmine, listed on the New York Stock Exchange, now holds over 560,000 ETH—more than all companies combined just two weeks ago.

On July 14, Sharplink Gaming was still the top ETH consumer; now, it’s Bitmine Immersion Tech, which boasts over $2 billion worth of ETH in reserves.

It’s an ironic twist that Bitmine—a company known for Bitcoin mining using immersion technology, where mining equipment is submerged in water—is now the largest holder of ETH. Recently, Tom Lee joined their Board of Directors. Lee comes from traditional finance and has long extolled the virtues of crypto on CNBC. Perhaps he can become for ETH what Saylor is for BTC in traditional finance: an advocate and educator.

🚨BREAKING:

— CryptoGoos (@crypto_goos) July 26, 2025

Tom Lee's BitMine now holds over $2 billion worth of Ethereum, becoming the single biggest $ETH holder in the world. pic.twitter.com/oA3Da5vHHM

ETH as an Asset That Generates Returns

What Michael Saylor can do with BTC, ETH treasury companies are now set to do with ETH. They employ traditional financial instruments to invest in crypto, thereby giving professional investors—who might not otherwise have the mandate to buy ether—exposure to its price.

There are compelling reasons for investors to turn to ETH companies. With ETH, returns can be generated through staking, making it useful not only as a reserve asset but also as a source of revenue. ETH companies highlight the difference between digital gold (Bitcoin) and digital oil (Ether). Andrew Keys of Ether Machine and Tom Lee are betting on this potential. Their companies deploy acquired ETH not only through staking but also in liquidity pools and other advanced yield strategies.

A new class of public companies is emerging.

— Galaxy (@galaxyhq) July 24, 2025

These firms are building Ethereum treasuries to earn yield, support the protocol, and reshape how corporate capital interacts with decentralized networks.

📊 ETH concentration across leading firms: pic.twitter.com/ORVpIjsevs

Moreover, even for those investors who can purchase ETH directly, there are valid reasons to invest in ETH companies. Much like how Strategy increases the number of bitcoins per share by capitalizing on volatility, a similar approach can be applied to ether (or other altcoins). For example, a company might buy aggressively during price dips and then, during periods of market optimism, raise fresh capital through bonds or new share issuances—using that money to purchase even more BTC or ETH.

Investors ideally want the share price of companies like Strategy or Bitmine to act as a leveraged play on the BTC or ETH price.

A Word of Warning

This approach, however, carries inherent risks. Can these companies manage these risks effectively? In the previous market cycle, we saw companies like Celsius and BlockFi collapse due to poor risk management, irresponsible risk-taking, and even outright fraud.

3️⃣ This Reveals the Sale of 80,000 BTC

Peter

Last week, an early Bitcoin adopter—an “OG”—sold no fewer than 80,000 BTC, totaling over $9 billion. The sale was facilitated by Galaxy Digital, the investment vehicle of Mike Novogratz, and ranks among the largest Bitcoin transactions ever executed.

The massive $BTC sell-off is over!

— Lookonchain (@lookonchain) July 26, 2025

Galaxy announced that they have completed the sale of over 80,000 $BTC($9B+) for a Satoshi-era investor.https://t.co/UStiBGMNSohttps://t.co/q6ebpcxCUv pic.twitter.com/xsUkXhhY9F

Notably, the market barely reacted.

The sale strategy was more blunt than surgical. As soon as Galaxy received the coins, it routed them straight to well-known exchanges like Binance and OKX. There was no carefully structured OTC process or intricate setup to mitigate the price impact—it was simply a straightforward sale.

And yet… there was hardly any movement. Bitcoin dipped briefly to around $115,000 before recovering within a day. Instead of panic, the market remained calm—as if to say, “Alright, we’ll buy it up.”

That is historic.

80,000 BTC, over $9 billion, was sold into open market order books, and bitcoin barely moved.

— Joe Consorti ⚡️ (@JoeConsorti) July 25, 2025

That's the story. pic.twitter.com/dpzgGiaWpf

This sale demonstrates that Bitcoin has become liquid enough to absorb billions in selling pressure—even when executed in a straightforward, blunt manner. Institutional players always ask themselves: can I get in and get out without jeopardizing my position? Barnes & Thornburg’s report reflects that confidence, and these sales orders only reinforce it.

This is good news for anyone who believes that Bitcoin is still at the dawn of a financial revolution. After all, such a revolution requires not just pioneers, but also deep pockets—and a market robust enough to support them.

Debate

Not everyone, however, views this event in a positive light.

Bitcoin analyst Scott Melker fueled the debate by suggesting that early Bitcoin adopters are “losing their faith.” His post sparked heated discussions on X: is this sale a practical moment of portfolio reallocation, or a sign that Bitcoin is losing its soul?

Bitcoin is amazing, but it’s obviously been co-opted to some degree by the very people that it was created as a hedge against.

— The Wolf Of All Streets (@scottmelker) July 26, 2025

Many of the most ardent early whales have seen their faith shaken and have been selling at these prices.

Some interpret the sale as a symptom of Bitcoin’s “institutional takeover.” The coin that once symbolized individual freedom is now being absorbed by Wall Street—traded via ETFs, stored in custodial vaults, and analyzed with spreadsheets. For them, early adopters cashing out isn’t a coincidence but a sign of growing alienation.

Others dismiss this view as nonsense, pointing out that the move was more about estate planning than ideological defection. After all, Bitcoin was designed as an open system. Everyone is welcome to participate—even BlackRock.

In short, Bitcoin is not only growing in market size but also in significance. It’s no longer the exclusive realm of cypherpunks; pension funds, investment firms, and even estate executors are now part of the picture. This raises questions and creates tensions, but it’s also a clear sign of maturity.

What do you think? Are you leaning toward the camp of Alienation or the camp of Maturity?

🍟 Snacks

To wrap up, here are some quick snippets:

- The Ether Machine has raised $1.5 billion to invest in Ether. The company is going public via a SPAC deal and has immediately added over 400,000 ETH to its balance sheet. The deal is expected to close in the fourth quarter of this year. Among the investors are major names like Kraken and Pantera Capital, with frontman Andrew Keys contributing nearly 170,000 ETH. Keys is known as a co-founder of Consensys Capital.

- An American lawsuit against Roman Storm reveals vulnerability. The Tornado Cash founder faces charges of money laundering and violating sanctions, with potentially decades of imprisonment on the line. However, the burden of proof appears shaky. Blockchain researchers disputed direct links to criminal funds during the hearing, and the analytical method used has been called into question. The outcome of this case could be pivotal for the legal standing of open-source developers worldwide.

- Trump Media now holds $2 billion in Bitcoin. This represents the majority of the company’s liquid assets in BTC. According to CEO Devin Nunes, Bitcoin is a tool for financial freedom and protection against financial censorship. This move instantly makes Trump Media one of the largest corporate Bitcoin holders and gives the Truth Social ecosystem a distinctly crypto flavor—although critics warn of potential conflicts of interest.

- BlackRock’s Ether ETF has surpassed the $10 billion mark. The fund, which has only been tradable since March, is the third fastest ETF ever to reach this milestone. In just ten days, ETHA jumped from $5 to $10 billion, with some calling it the “God candle” of institutional inflows. ETF.com analyst Sumit Roy attributes Ether’s rise primarily to the excitement over stablecoins and treasury companies.

- Goldman Sachs and BNY Mellon plan to tokenize money market funds. Through a new platform, fund shares will be issued as digital tokens on Goldman’s blockchain, featuring real-time settlement and use as collateral. Unlike its competitors, Goldman is taking a closed approach—upgrading existing systems rather than using public infrastructure. Worldwide, money market funds hold over $7 trillion.

- PNC Bank is set to offer crypto services through Coinbase. Customers will soon be able to buy, store, and sell digital currencies directly via their bank’s interface. Coinbase will provide the infrastructure while PNC handles customer interactions. With $421 billion in assets under management, PNC is a major player, and analysts see this partnership as the next step in integrating crypto into traditional banking.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!