The Seasonless Market

Bitcoin's famous four-year cycle is over, declare analysts. The market has entered a 'maturity era' driven by ETFs and liquidity, not halvings. Like the grain markets of old, Bitcoin is losing its predictable seasons. What happens when the calendar no longer counts?

In the nineteenth century, the price of grain followed a rhythm as reliable as the seasons. After the harvest, silos would be overflowing, and farmers had to sell off a portion of their stock to pay their debts. The result? The price dropped quickly. As supplies dwindled, the grain price would bottom out, only to rise slightly again in the winter. By spring, stocks were nearly depleted, and anyone who wanted to bake bread had to dig deeper into their pockets. Everyone knew that pattern. Traders, millers, bankers: they all lived by the seasons.

Until, suddenly, the world became smaller.

In the second half of the nineteenth century, railways were built across America, followed by telegraph lines. For the first time, a trader in Chicago could find out what a shipload of grain was worth in New York or Liverpool in a single afternoon. The markets, once separated by journeys that took weeks, began to breathe in unison.

The impact was tangible. The old seasonal cycles of harvest, abundance, and scarcity faded away. Prices flattened, and fluctuations became less predictable. Agriculture remained seasonal, but the market no longer was. Technology had taken time out of trade.

William Cronon described it in Nature’s Metropolis. What once revolved around weather and harvest now revolved around storage, transport, and liquidity. Chicago became the nerve center of this new world: a marketplace without seasons.

More than a century and a half later, the same seems to be happening to Bitcoin. For years, it too had a rhythm: the famous four-year cycle. Each halving of the block subsidy led to scarcity, a new bull market, and a subsequent crash. It almost seemed like a law of nature: halvings in 2012, 2016, 2020… three cycles, three peaks, three troughs.

But a growing number of analysts are now declaring that era over. Galaxy Digital wrote last week:

Bitcoin has entered a new phase – the ‘maturity era’ – in which institutional absorption, passive flows, and lower volatility dominate.

And market maker Wintermute states bluntly:

The concept of the four-year cycle is no longer relevant. The mechanics that once drove it simply don’t matter anymore in a mature market. What drives performance now is liquidity.

The halving still exists, but its grip on the market is loosening. The market has since become financialized, filled with ETFs, funds, and algorithms that continuously arbitrage. The shocks are getting smaller, the peaks flatter, and the troughs shorter. Not because Bitcoin is less relevant, but because the system around it is becoming smarter and deeper.

Just like the grain markets of the past, Bitcoin is also losing its seasons. The predictability is disappearing, and with it, a piece of the romance. But something else is taking its place: maturity. A market that no longer thrives on cyclical ecstasy, but on constant inflow and structural trust.

Today's traders will have to learn the same lesson as the farmers of yesteryear: in a world without seasons, it's no longer the calendar that counts, but the flow of capital.

More Alpha

Are you a Plus member? Then we'll continue with the following topics:

- ETF outflows limited during price dip

- Coinbase CEO plays with Polymarket bet

- ‘Bitcoin never shuts down’

1️⃣ ETF outflows limited during price dip

Erik

Sentiment in the crypto market is grim. Bitcoin has dropped about twenty percent since its peak on October 6. On social media, accusations are flying back and forth. Who can we blame? Is it old whales finally taking profits? Investors who just got in and are suddenly getting cold feet? Or is it the 'boomers' who are panic-selling their ETF positions?

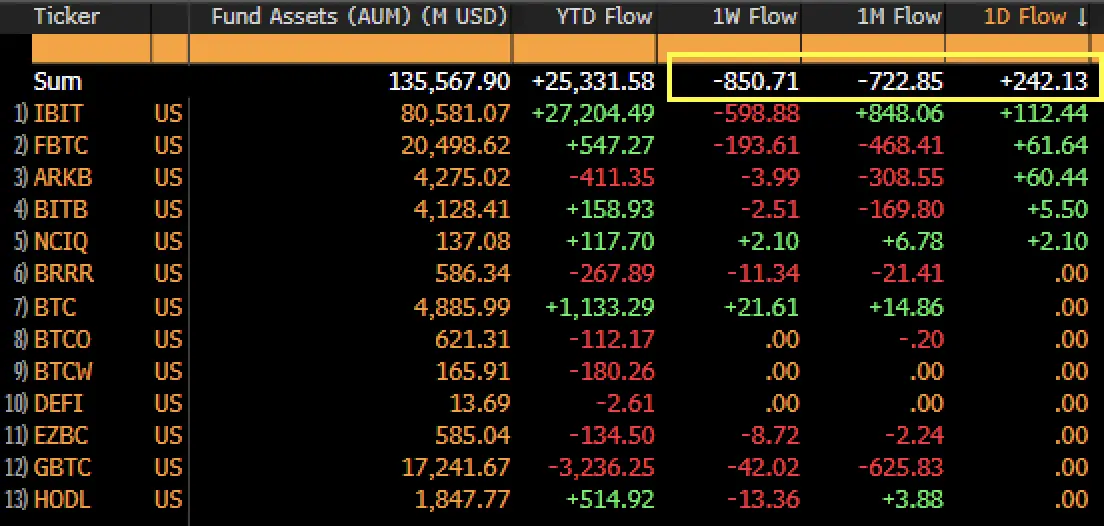

According to figures shared by Bloomberg analyst Eric Balchunas, the sell-off couldn't have come from the latter group. Over the past month, net outflows were only $0.7 billion, and in the last 7 days, during the most intense part of the crash, they were $0.85 billion. That's only about half a percent of the total assets in all BTC ETFs ($135 billion).

The conclusion is clear: ETF investors are not the sellers. So who is? Balchunas, cryptically:

Told y’all the ETF-using boomers are no joke. So who’s been selling? To quote that horror movie, “ma’am, the call is coming from inside the house”

So, is it the whales?

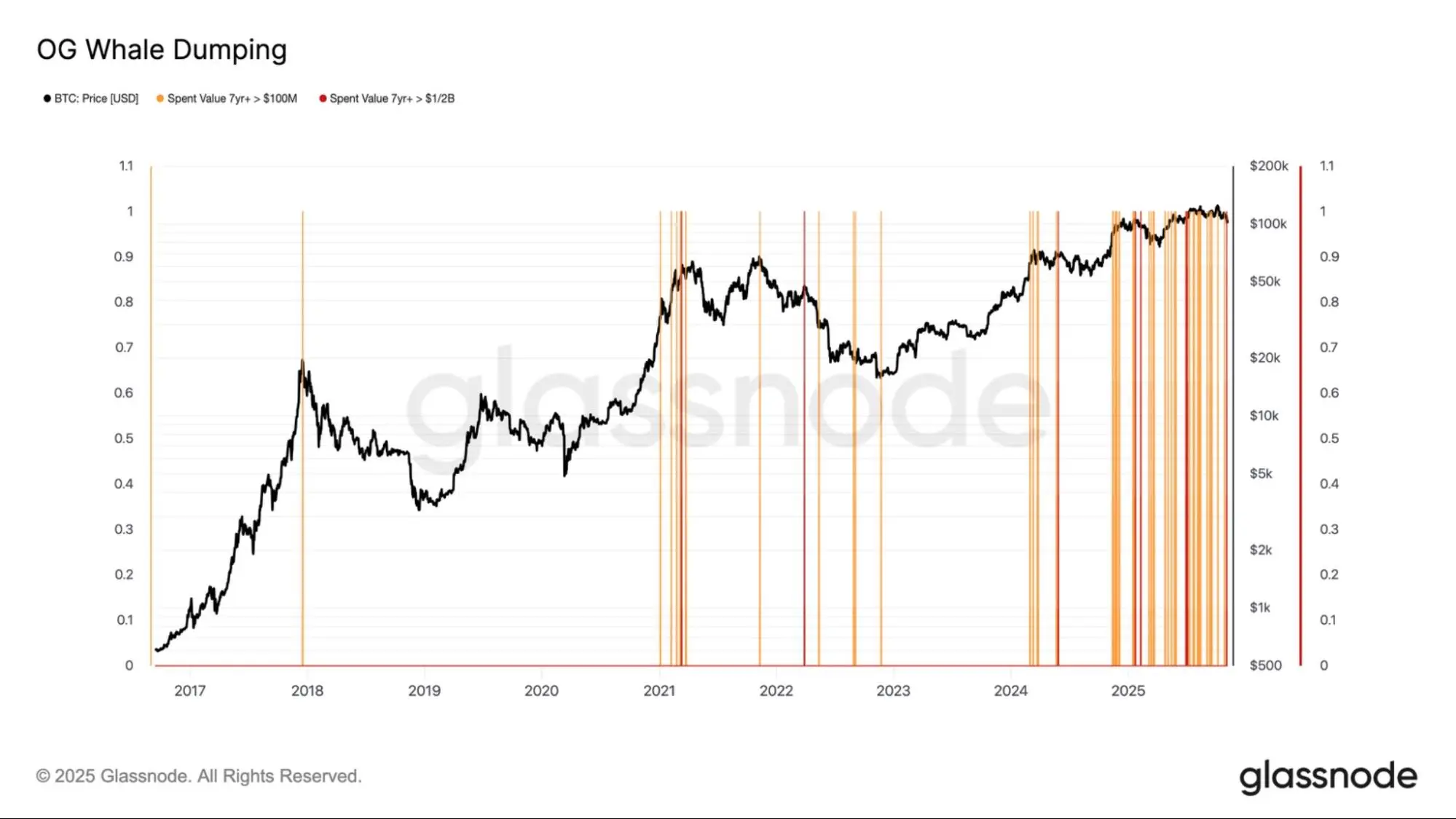

By “from inside the house,” Balchunas is referring to investors who have been in Bitcoin for years. Some analysts pointed to the following chart from Glassnode:

On the blockchain, we can see that old, wealthy addresses have become active again, especially in the last twelve months. Orange in the chart represents coins that were moved, with a total value of over $100 million, and that hadn't moved for more than 7 years (red: over $500 million). This is often interpreted as "old holders dumping." The conclusion from Charles Edwards: “OGs are cashing out.”

But while this interpretation has found broad support (it's also known anecdotally that many large clients have sold their old positions), some caution is warranted, according to analyst Willy Woo. He explains that the chart above only shows that coins are leaving old addresses. It is impossible to deduce the *purpose* of that movement from this data.

Indeed, there are indications that early Bitcoin holders are moving (part of) their stack to ETFs. In the US, this has tax advantages. So it's not just selling, but also asset relocation.

A quiet transfer from old to new

So, we're not seeing panic, but distribution: a shift within the entire group of Bitcoin holders. Certainly, the old guard is selling part and moving another part from cold storage to ETFs.

In both cases, this fits into the concept of 'the IPO of Bitcoin,' or 'the great rotation.' Bitcoin, once a symbol of anti-system thinking and personal sovereignty, is now being absorbed into the very financial system it once challenged. For the first time, parties with large portfolios have a market with enough liquidity to exit without causing the price to completely collapse. And on the other side, institutional buyers are ready to take over those coins.

The data shows that they have continued to do so, even in recent gloomy times. Because pension funds and corporate treasuries buy structurally, not emotionally. They rebalance and enter gradually, even during corrections.

2️⃣ Coinbase CEO plays with Polymarket bet

Erik

Which terms will Coinbase use during its third-quarter earnings presentation? You could bet money on the answer on the prediction platform Polymarket. This apparently did not go unnoticed by CEO Brian Armstrong. During the presentation, he rattled off a few terms that were being bet on. Market manipulation or a harmless joke? And is this a problem for Polymarket?

Armstrong is no Elon Musk; his move was deadpan, but it had a subversive quality in the style of the beloved and reviled rocket man. Armstrong:

I was a little distracted because I was tracking the prediction market of what Coinbase will say on their next earnings call. And I just wanted to add here the words: Bitcoin, Ethereum, blockchain, staking and web3. To make sure we get those in before the end of the call.

Afterward, the CEO dedicated a short tweet to it:

lol this was fun - happened spontaneously when someone on our team dropped a link in the chat https://t.co/tQiV3B9jUj

— Brian Armstrong (@brian_armstrong) October 31, 2025

There was no shortage of criticism. Adam Cochran, for example, tweeted:

If I were the CEO of an exchange with CFTC regulated products, I would simply not purposefully manipulate the outcome states of prediction markets on other CFTC regulated exchanges during an earnings call… and then post about it on Twitter…

Is Armstrong's action indeed problematic? It certainly would be if Armstrong himself had bet on the outcome. There is no evidence of that, nor is anyone suggesting it.

Market Awareness

Some critics raised the point that the subject of a bet can become aware of the bet and adjust their behavior to influence the outcome.

But is this really a problem, and can it be prevented at all? In this case, Brian Armstrong explicitly stated that he was aware of it and then proceeded to play with the outcome. Now that Polymarket has gained wide recognition, people know that their actions are being bet on. Consciously or unconsciously, this can influence their behavior. It's unavoidable.

And because everyone knows this now, bettors can factor it into their assessment of a wager. People betting on the words in a politician's speech must consider that the politician knows this and may take it into account.

And that's nothing new. The entire market is steeped in this recursiveness of 'they-know-that-I-know-that-they-know-that...'. When Jerome Powell of the US Federal Reserve gives a speech, he knows there has been speculation on his words for weeks. He knows that every word he uses has an effect on the market. And the market knows that he knows; and he, in turn, knows this when he writes his speech. As long as Powell (and Armstrong) are not trading on inside information, there seems to be no issue.

What's certain is that this incident was great publicity for Polymarket!

3️⃣ ‘Bitcoin never shuts down’

Peter

In Miami this past week, President Trump stood on the stage of the America Business Forum. It's his favorite setting. A willing crowd, shiny suits, and a drumroll. “We’re making the United States the bitcoin superpower,” he proclaimed, warning that China would seize the opportunity if America didn't. It sounded like the Trump we often hear: big, loud, and elusive.

JUST IN: 🇺🇸 President Trump says crypto "takes a lot of pressure off the dollar. It does a lot of good things."

— Bitcoin Magazine (@BitcoinMagazine) November 5, 2025

"We're making the US the #Bitcoin superpower, the crypto capital of the world". pic.twitter.com/31xK1qCnys

He sketched a new America that embraces crypto. “I’ve ended the war on crypto,” he said. “It helps the dollar.” But what that means exactly remained vague. There were no new plans, no new data, and no new laws. Only the image of a president who has suddenly elevated Bitcoin to a patriotic symbol.

Yet, the outlines are visible. Under Trump, a U.S. Strategic Bitcoin Reserve was established this year, to be filled with seized coins. And with the GENIUS Act, America finally got a legal framework for stablecoins. His team also opposed a centrally issued digital dollar. Crypto as an ally, not a threat; that's the new line.

Whether it's convincing remains to be seen. Trump's words are political fireworks: the right tone for a presidential term in which he inflates his own hero status.

A few days later, a phrase emerged that did stick. Not from Trump, but from his Treasury Secretary, Scott Bessent. On October 31, not coincidentally the anniversary of the Bitcoin whitepaper, he wrote on X:

17 years after the white paper, the Bitcoin network is still operational and more resilient than ever. Bitcoin never shuts down.@SenateDems could learn something from that.

— Treasury Secretary Scott Bessent (@SecScottBessent) October 31, 2025

It was a subtle jab at the Senate, which had plunged the country into a shutdown due to political squabbling. Bessent added: “Senate Democrats could learn something from that.” But his words struck a deeper chord. Against a backdrop of closed government offices, he gestured towards a network that never closes.

The shutdown in the US is now the longest ever. Civil servants have been sent home without pay, national parks remain closed, and even veterans' departments are running at half capacity. Political America is at a standstill. And it is precisely in this context that Bessent's tweet takes on meaning. “Bitcoin never shuts down” doesn't sound like a joke, but like an observation: this network knows no partisanship, no bureaucracy, and has no pause button.

The contrast is stark. In Washington, parties fight over blame and power, while outside that theater, a global financial network keeps running. Day and night, without hierarchy or voting. Maybe Bessent meant it ironically. Maybe not. But he said something even Trump didn't: Bitcoin exists not because of, but *in spite of*, the government.

Anyone who wants to know how far that difference extends need only look at Polymarket. There, people are trading on the question of when the U.S. government will reopen. “When will the government shutdown end?” is one of the most popular markets.

According to the latest estimates, the market is pricing in a resolution to the shutdown before November 15; precisely the date about which there is now also political optimism. A deal seems to be in the making. The market is once again ahead of reality.

DEAL TO END GOVERNMENT SHUTDOWN NEARS: AXIOS

— *Walter Bloomberg (@DeItaone) November 9, 2025

Senate Democrats signaled Sunday they’re ready to back a bipartisan package to reopen the government, sources told Axios.

At least 10 Democrats are expected to support advancing a spending and short-term funding bill. The deal…

Two powerful figures, one week, two ways of talking about Bitcoin. Trump sees a flag in it, a new star on the American firmament. Bessent sees a mirror, a system that keeps working when everything around you has stopped. And while Washington slowly reboots, Bitcoin does what it always does.

It keeps on running!

🍟 Snacks

To wrap up, a few quick snacks:

- Privacy coins seem to be experiencing a renaissance. While a large part of the crypto market was bleeding, coins like Monero, Zcash, and Dash were posting green numbers. According to analysts, this isn't a hype, but a revaluation: privacy is shifting from an ideal to a market norm. Stricter regulations make anonymity scarce, on-chain activity is rising, and privacy networks are developing into full-fledged application platforms. All the ingredients for a new narrative that is back on the menu for traders.

- Google Finance is integrating predictions from Polymarket and Kalshi. Soon, users on Google will be able to see real-time data from these leading prediction markets. This suddenly gives the young sector global visibility. It's a breakthrough: it not only validates this crypto application from an institutional perspective but also brings it closer to the daily lives of ordinary users.

- Tether’s new blockchains are off to a rocky start. Stable, a company affiliated with Bitfinex and Tether, had to halt its second funding round. The website crashed, transactions failed, and users were left angry. Its sister project, Plasma, presented as a second-layer network for Bitcoin, is also attracting few users. Tether no longer wants to just supply the fuel for the crypto market; it wants to own the infrastructure itself. The only problem: building proves harder than printing.

- Seven Ethereum teams are joining forces in Brussels and Washington. Aave, Aragon, Curve, Lido, Spark, The Graph, and Uniswap have collectively founded the Ethereum Protocol Advocacy Alliance. The goal: to get a louder voice in the political debate on crypto legislation. Developers believe they too, and not just exchanges or lobby groups, should be heard as governments worldwide write new rules for crypto.

- Five years in prison for Samourai Wallet founder Keonne Rodriguez. The judge ruled that he facilitated billions in anonymous transactions through his privacy wallet, including on darknet markets. His conviction comes at a poignant moment: just as privacy coins like Monero, Zcash, and Dash are on the rise. While the market revalues privacy, the government punishes one of its most radical defenders and abusers.

- Sequans sells $100 million in Bitcoin to pay off debts. In July, the French company made a pivot similar to that of (Micro)Strategy: holding Bitcoin as a reserve asset. Last week, it had to sell 970 BTC from its holdings, reportedly to reduce its debt load. This shows that the line between 'hodling' and having to sell is thin, raising a question for investors who put their money in such stocks.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!