Should Bitcoin be nothing but money?

A 2014 blockchain wedding vows ignited a fierce debate: Is bitcoin just money or a canvas for wild innovation? With miners going green and Wall Street eyeing digital assets, are we witnessing a bitcoin identity crisis—or its bold reinvention? Dive into the crypto revolution!

On a rainy day in 2014, a newlywed couple recorded their wedding vows using a bitcoin transaction. No notarial attachment or IPFS add-on—just a direct inscription on the blockchain. Public, permanent, and immutable, the text was neatly embedded via OP_RETURN, which allows small amounts of data to be added to a transaction without cluttering the ledger with extraneous unspent outputs.

By 2025, this would likely have sparked a fiery debate. “Abuse! Bitcoin is money, not a guestbook!” Such outbursts aren’t uncommon. In recent years, criticism has been directed at ordinals and inscriptions—a method of giving specific sats meaning with text, images, or other data. While some see creativity, others perceive spam and abuse.

After a brief lull, the bitcoin world has once again been drawn into a heated debate on the same issue. The key question remains: Should bitcoin be confined to its essential function—pure money, and nothing more?

OP_RETURN WARS

— Jameson Lopp (@lopp) April 28, 2025

EPISODE IV: NIXTHEFILTERShttps://t.co/IJxyZc87dI pic.twitter.com/KoEewzySNt

At first glance, that argument seems logical. Bitcoin started as digital money, so why not stick to that? The problem is that trying to narrowly define bitcoin’s purpose can undermine its very foundation.

Sure, you could attempt to restrict the protocol. You might limit scripts to simple payment methods, reduce OP_RETURN to zero bytes, or block anything that hints at creativity or deviation from the norm through new rules or filters.

But people are ingenious. Even if you ban explicit data insertion, they will find subtle ways to embed it—in public keys, in signatures, even within fees. It quickly becomes a game of cat and mouse.

Moreover, any new restrictions would soon hit a wall: backward compatibility. Old transactions could become invalid, wallets might fail, and users would leave. Meanwhile, innovations like Lightning, Taproot, and multisig—all of which strengthen bitcoin—depend on scripting flexibility.

Then there’s the philosophical objection. If you confine bitcoin so tightly that only monetary use is permitted, it starts to resemble the very system it was meant to disrupt—a system that dictates what’s acceptable and what isn’t. Bitcoin, however, is neutral. It doesn’t judge the purpose behind a transaction; it simply verifies that it’s valid. And that’s what makes it work.

Still, the desire to see bitcoin used solely as money is understandable. After all, that’s its raison d'être—and it’s what most people believe will fundamentally upend the traditional financial system, which now appears to be faltering. If bitcoin were widely and structurally used only as money, this ‘war’ over its purpose might never have arisen; creative uses would simply come at too high a cost.

For now, though, only a handful of people seem genuinely interested in bitcoin purely as money. Currently, it isn’t the hundreds of thousands of financial transactions keeping the bitcoin network active, but rather the subsidies paid to miners. The space where bitcoin transactions await confirmation is nearly empty. The result? Ample room for playful experiments, spam, and even abuse—after all, transactions are almost free.

The title of this newsletter takes on a new meaning in that light. Both sides of this ideological and technical battle are glued to their screens, forgetting to look outside. Meanwhile, a more pressing issue looms in the real world.

If bitcoin is reduced to pure money, will it still exist in 20 years?

Perhaps the bitcoin community can move past this conflict if we stop obsessing over what bitcoin should be and instead focus on ensuring it can become what it needs to be. That requires patience, a willingness to tolerate uses you might not choose yourself, and the understanding that freedom only holds value when you’re willing to extend it to others.

The revolution promised by bitcoin isn’t just monetary. It’s a revolution in trust, ownership, free expression, and resistance to censorship. This resilience demands space, flexibility—and a little gray area.

If bitcoin is to be the money of the future, it must be more than just money. It must serve as a foundation for further innovation—even if you don’t agree with every new idea.

So yes, today we might raise an eyebrow at a new inscription, protocol proposal, or artistic outburst on the blockchain. But perhaps one day our grandchildren will look back on these moments just as we now view those wedding vows from 2014—as evidence that bitcoin lived, that it was used, and that it had the freedom to be more than merely a ledger of balances.

That is the very reason it will still exist in twenty years!

More Alpha

Are you a Plus member? If so, we continue with the following topics:

- Cambridge: Bitcoin miners 52% sustainable

- How bitcoin is carving a space on Wall Street

- Is Europe being sidelined again?

1️⃣ Cambridge: Bitcoin miners 52% sustainable

Erik

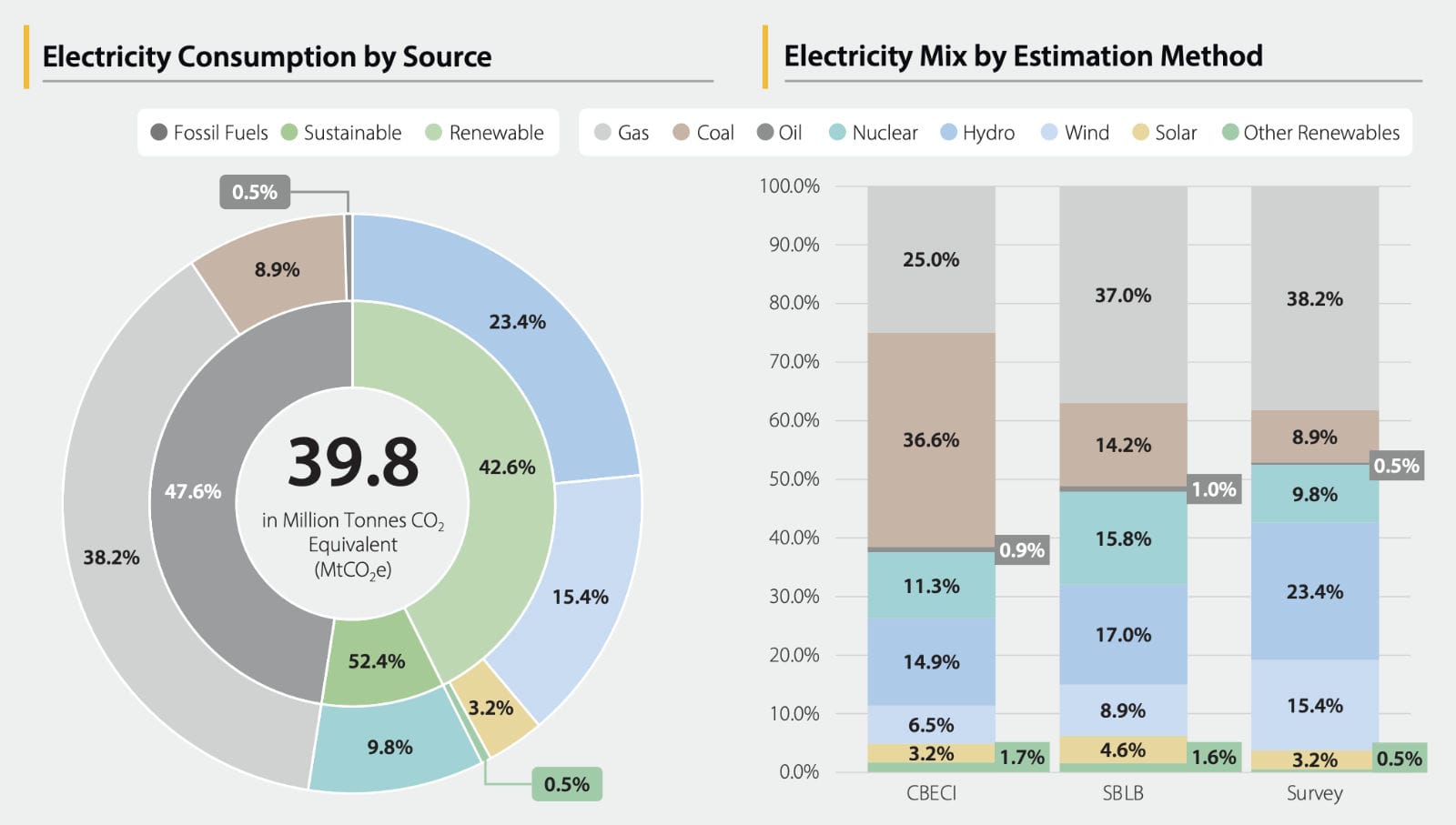

A new report on bitcoin mining has been released by the renowned Cambridge Centre for Alternative Finance (CCAF). The findings are striking: over 52% of the energy used by miners now comes from sustainable sources, compared to about 37% in the 2022 report. This supports the claims of advocates who have long argued that the so-called “energy-guzzling” activity is becoming increasingly sustainable.

To compile the data, the CCAF examined 49 mining companies—20 of which are publicly listed, including Marathon and Riot. Notably, these companies produce 48% of the network’s total hashrate, indicating that the study covers a significant portion of the industry.

One reason for the noticeable rise in sustainable energy usage is that this report includes off-grid miners—those not connected to traditional power grids. Operating near hydroelectric facilities or capturing methane at oil fields, these miners typically rely more on sustainable energy sources.

The key findings of the report:

- 52.4% of the energy consumed by bitcoin miners comes from sustainable sources—42.6% from renewables such as hydropower and wind, and 9.8% from nuclear energy.

- Natural gas is now the largest fossil fuel energy source for mining, accounting for 38.2% of consumption, while coal’s share has dropped to 8.9%.

- Estimated annual greenhouse gas emissions from bitcoin mining stand at 39.8 megatons of CO₂-equivalent, roughly 0.08% of global emissions.

Another noteworthy finding is that 87% of decommissioned mining equipment is either recycled or repurposed—a stark contrast to the portrayal of the industry as a major source of electronic waste.

The report also notes that bitcoin mining can help stabilize the electricity grid.

Confirmation of What Insiders Claimed

The report validates claims made by several industry insiders over the years — think Nic Carter, Troy Cross, and Daniel Batten. Batten, in particular, has stressed the potential for mining to reduce methane emissions by utilizing excess gas from oil fields. Now, Cambridge confirms that 5.5% of the network’s total CO2 emissions are offset by capturing methane that would otherwise be released into the atmosphere.

Methane mitigation:

— Daniel Batten (@DSBatten) April 28, 2025

However, when the impact of mining using carbon reducing sources (such as flare gas power) are factored in, net emissions drop to 37.6 MT CO2e.

Meaning, methane mitigation is currently offsetting 5.5% of total network emissions (close to my estimate of 7%) pic.twitter.com/nHcyF2BLq9

This raises an interesting question: will policymakers adjust their stance on mining now that it’s proving more sustainable? Many policy frameworks have been built on the assumption that mining relies primarily on fossil fuels.

Bonus question for those who remember 2020: Will Elon Musk permit Tesla payments in BTC again? In 2021, he stepped back from the idea, arguing that bitcoin miners weren’t using at least 50% sustainably generated energy.

What do you think?

2️⃣ How bitcoin is carving out a space on Wall Street

Peter

She delivered it with a calm certainty, as if it were the most natural thing in the world. BlackRock CIO Samara Cohen appeared on BlockWorks’ Empire Podcast. When asked what currently preoccupies institutional investors, her answer was as clear as it was revealing: “It’s bitcoin first, and a distant second.” Ether? Minimal interest. Altcoins? Barely worth mentioning.

This remark is more than just a soundbite. Samara, who leads BlackRock’s ETF team at the world’s largest asset manager, serves clients ranging from pension funds and insurance companies to family offices and high-net-worth individuals. Her insistence that bitcoin is the primary focus speaks not to hype or social media trends, but to the gradual integration of bitcoin into the heart of the financial system.

What makes her statement even more compelling is the context in which she places it. She discusses it not in tech jargon or ideological terms, but purely in economic ones: “Particularly in this environment,” she emphasizes—a world marked by slow growth, high geopolitical tensions, unpredictable monetary policies, and declining trust in traditional institutions. In short, an environment where even the classic 60/40 portfolio is under pressure.

For many institutional investors, bitcoin isn’t a speculative bet but a tool to safeguard portfolios against risks that traditional instruments can’t easily hedge. Cohen describes it as a “diversifier” – a term that carries almost a magical ring in investor circles because genuine diversification is rare. Unlike most assets that move in lockstep during economic stress, bitcoin increasingly operates on its own terms—unaffected by corporate earnings, interest rates, or borders, and governed by a steadfast monetary policy.

What also stood out during the discussion was Cohen’s measured tone. There were no flashy crypto buzzwords or evangelical speeches—just the steady, composed demeanor of someone who builds enduring infrastructure. That in itself is a powerful signal: if the world’s largest asset manager can incorporate bitcoin into its long-term strategy without hesitation, it’s a mark of maturity as an investment.

We’ve long seen bitcoin flirting with the fringes of the financial system. But listen closely, and you notice a shift in conversations like this. Bitcoin is no longer the radical outlier that the establishment must defend against—it has become the truly disruptive element in a world that is increasingly falling short of its promises.

Institutional investors aren’t chasing thrills; they’re seeking protection—from stagnation, from eroding purchasing power, from political currency manipulation, and from a system that’s cracking at the seams.

“It’s bitcoin first.”

Wall Street has gotten it. Now, the rest must catch up.

3️⃣ Is Europe Being Sidelined Again?

Peter

At Token2049 in Dubai, where crypto’s key players convened this week, former Binance CEO CZ made a statement that landed like a bombshell. “We advise many countries on how to set up a crypto reserve like in the US,” he remarked. And he added, “Europe isn’t part of the discussion; it’s missing on the map.”

In other words, Europe is noticeably absent from a strategic conversation that is gathering pace around the world—particularly regarding national bitcoin reserves. Bhutan is already involved, and at the very least, the US is holding its ground. According to CZ, he is advising countries on wallet infrastructure, custody solutions, and the right timing, all from the sidelines. Europe? It remains out of the picture.

This isn’t an isolated case. Significant developments in the crypto space have long since moved outside the EU, flourishing in the US, the Middle East, Latin America, and especially in Asia, where governments are embracing the potential with stimulus programs, flexible regulations, and genuine curiosity. These regions are emerging as new hubs, while the EU remains mired in paperwork and risk management as others build the future.

The consequences are clear: if you don’t develop the technology yourself, you become dependent on others. You might draft regulations for an industry that’s being built elsewhere, but eventually, your oversight won’t carry any weight—leaving you with elaborate legislation while the rest of the world moves ahead.

But not in Europe. There, innovation still seems to follow regulation. Perhaps!

🍟 Snacks

To wrap up, here are some quick highlights:

- Strategy doubles its commitment to bitcoin. The original “21/21-plan” was doubled in early May to “42/42”. The goal is to raise $84 billion before 2027—half through equity and half through bonds—to purchase bitcoin. The company now owns 553,555 BTC (2.6% of the total), acquired at an average price of $68,448. According to Strategy CEO Phong Le, 70 publicly traded companies now have a bitcoin strategy.

- Three American financial giants take the next step in crypto. Morgan Stanley, Charles Schwab, and Goldman Sachs are significantly expanding their offerings: Schwab plans to offer spot trading within a year, Morgan Stanley is preparing a launch via E*Trade, and Goldman Sachs is focusing on on-chain money market funds and lending. This is a clear signal that traditional finance is gearing up for the next phase of cryptocurrency adoption.

- Visa and Mastercard bring stablecoin payments to the high street. Visa, together with Bridge (from Stripe), is launching payment cards that let you spend stablecoins at any merchant accepting Visa, initially in Latin America and eventually worldwide. Meanwhile, Mastercard is building the necessary infrastructure to enable stablecoin payments at checkout, backed by Circle, Paxos, and OKX, among others. Stablecoins are making the jump from digital wallets to everyday shopping.

- Bunq becomes the first Dutch bank to enter the crypto world. Starting this week, customers in the Netherlands and five other EU countries can trade directly through the app in over 300 cryptocurrencies, including bitcoin, ether, and solana. The neobank is partnering with Kraken on this initiative, catering to the many digital nomads seeking one app for both banking and crypto. Other European countries, as well as the UK and the US, are expected to follow soon.

- American prosecutors demand 20 years in prison for Celsius founder Alex Mashinsky. Having pleaded guilty to fraud and market manipulation—including inflating the CEL token price and misleading customers—Mashinsky’s actions are said to have resulted in nearly $7 billion in losses. The verdict is expected on May 8. If this becomes the new benchmark, other so-called “celebrity scammers” might want to take note.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!