Seventeen years of bitcoin—what now?

Seventeen years after the genesis block, bitcoin is no longer a revolution. What has really changed since the 2008 banking crisis, and what role does bitcoin play in the financial system today?

First of all: best wishes from the entire Bitcoin Alpha team. We're going to make this another educational and valuable year together. Right through all the turmoil, because the tone has already been set. All signs point to an eventful year ahead.

The bitcoin world has already passed its first symbolic day. We're talking, of course, about January 3, 2026. The day bitcoin turned seventeen. Young enough to still raise questions and doubts, yet old enough to have history. Because if you look at the very first bitcoin block, you'll still see that one sentence engraved in it: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

Happy birthday Bitcoin.

— Brian Armstrong (@brian_armstrong) January 3, 2026

17 years since the genesis block. pic.twitter.com/9upbZPCm3f

That headline circulated during a period when the financial system was under pressure, to put it mildly. Banks went bankrupt, financial markets pulled the emergency brake, and governments intervened. In the Netherlands, Fortis and ABN AMRO ended up in state hands. These were emergency measures, taken to avert a systemic crisis—a form of administrative damage control.

Satoshi Nakamoto published the whitepaper in October 2008, shortly after the collapse of Lehman Brothers, at a time when the cracks in the financial system became visible to the general public. We don't know for certain whether bitcoin was intended from the start as a direct response to those events. But we do know that bitcoin emerged at a moment when trust could no longer be taken for granted. The reference in the so-called genesis block served not as a manifesto, but as a permanent record of that context.

In the years that followed, bitcoin grew into an alternative. Not just technologically, but also mentally. A system without a monetary backstop and without a central party that can intervene at will. That idea gave bitcoin its appeal, but it also revealed something else: the responsibility that comes with that freedom.

Seventeen years later, that picture has become less romantic, but more interesting. Banks haven't disappeared. Quite the opposite. They've become deeply involved in the bitcoin ecosystem: as custodians, as ETF providers, as infrastructure suppliers. A large portion of bitcoin holders prefer bank your bitcoin over be your own bank. Over the years, bitcoin has served as a mirror for a wide range of themes—from ideologies and systemic risks to personal appetite for risk and responsibility.

Part of that reflection relates to the bailouts of 2008 and 2009. These consisted of political decisions: guarantees, capital injections, and nationalizations. In the years that followed came a monetary phase in which central banks expanded their balance sheets, partly to cushion the costs of crisis management. By keeping interest rates low, debt was made bearable. That process was stabilizing, but came with financial repression: savers lost purchasing power and real interest rates remained negative for extended periods. Put differently, the price of the major risks that banks took was largely paid by the public.

Bitcoin found its role in this tension. Not as a direct solution, but as a latent escape route. A system that cannot be adjusted to serve political or monetary goals.

In the fiat system, liquidity is a flexible concept. When a systemically important institution gets into trouble, a central bank comes to the rescue with additional liquid funds. In the bitcoin world, that option doesn't exist. Bitcoin is scarce and inelastic. Losses cannot be technically repaired. They can only be compensated, for example in the form of euros or dollars, but the underlying damage remains visible.

That doesn't mean the old financial magic has disappeared. Outside the network's core, markets exist where leverage, rehypothecation, and complex structures can be deployed. Derivatives and yield products can economically mimic the characteristics of fractional banking. The difference is that these activities are conducted on a foundation that doesn't bend. Bitcoin leaves less room for prolonged illusions that everything is fine.

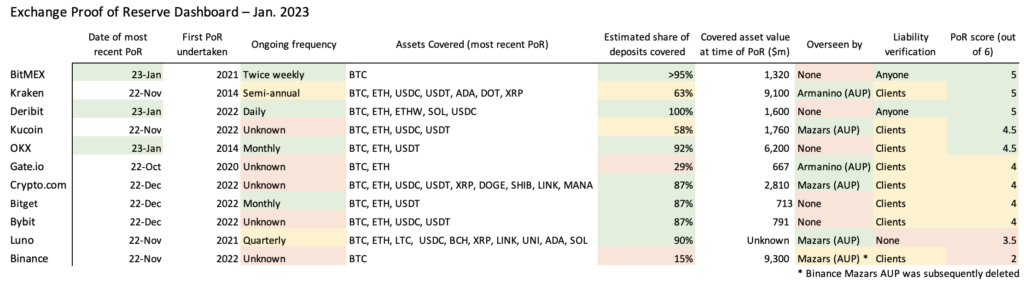

You could say that bitcoin imposes a form of discipline. This dynamic isn't new. In the nineteenth century, banks under the gold standard operated in a similar way. They financed trade and growth, but were bound to a physical reserve. Banks that issued too many claims faced bank runs. The difference from then is verifiability. Back then, citizens were entirely dependent on rumors at the bank hall; now the blockchain always reveals part of the truth. And, perhaps more importantly, anyone who claims to hold bitcoin can demonstrate it relatively easily.

Governments, banks, and other system players in 2026 certainly don't feel compelled to exercise discipline just because bitcoin exists. That effect isn't immediate, nor automatic. But the fact that the system ultimately enforces discipline is a given. This way, bitcoin can function within the existing financial system and outside of it. It offers an alternative without imposing itself.

Bitcoin's power lies not in replacing banks, but in limiting assumptions. Banks continue to provide services and take risks, but they do so in a world where a monetary system exists that cannot be expanded—and is just one mouse click away from participation for everyone, worldwide.

The headline from the genesis block therefore remains relevant. Not because banks need to be bailed out again, but because there's now a reference point for when that question arises once more.

More Alpha

Are you a Plus member? Then we continue with the following topics:

- Large-scale fraud with bitcoin ATMs

- Trump's uncomfortable relationship with crypto

- Altcoins: bad year, but not dead

1️⃣ Large-scale fraud with bitcoin ATMs

Erik

Bitcoin ATMs (also called BTMs) are a low-barrier way to get into bitcoin—if you're willing to accept the high transaction fees. You put cash in, BTC comes "out." Unfortunately, the critics have another argument to bash bitcoiners with. According to recent FBI figures, Americans lost over $333 million in 2025 through scams that rely on these ATMs.

It's remarkable how large this type of fraud has become in the US. In 2021, it was around $30 million; this year, ten times that amount. Behind those numbers are approximately ten thousand heartbreaking stories. Elderly people are hit especially hard. FTC data from 2024 shows that people over 60 accounted for about 71 percent of reported losses via bitcoin ATMs, with a median loss around $10,000 per person.

The FBI said fraudsters conned Americans out of more than $333 million in 2025, with ruses perpetrated using bitcoin ATM machines, a marked uptick over previous years as the popularity of cryptocurrencies continues to grow.

— ABC News (@ABC) December 30, 2025

Read more: https://t.co/JU64Jv1y1S pic.twitter.com/Z8XLQHLpiu

Take 85-year-old Fran Bates, for example. She thought she had her bank on the line, was directed to a gas station, and started feeding $20,000 in cash into the machine while the "bank employee" urged her on over the phone. A suspicious passerby called the police, and the transaction was stopped before it became final. Many other victims aren't so lucky.

At the same time, a recent American court case shows it's not just naive consumers using BTMs. We briefly covered this in the Alpha News of November 24. In Chicago, Firas Isa, founder of BTM company Virtual Assets LLC (Crypto Dispensers), has been charged with a money laundering operation totaling around $10 million. According to prosecutors, this was a cash to crypto model, where a nationwide BTM network was used to collect drug and fraud proceeds, convert them to digital assets, and transfer them to the fraudsters' wallets. The indictment alleges Isa knew the funds came from fraud and drug trafficking, but he and his company have pleaded not guilty. The case goes to trial in 2026.

The picture is clear: bitcoin ATMs are not just a playground for scammers, but in some cases are also actively used as money laundering infrastructure, according to US prosecutors.

The Dutch situation

For the Netherlands, we don't have comparable hard numbers. There are general estimates about crypto fraud damages (tens of millions per year), and there's case law in which a Dutch BTM operator was convicted of money laundering, but there's no public overview showing how much is specifically stolen via bitcoin ATMs.

It probably won't be much. There are only about 30 bitcoin ATMs in the Netherlands, which limits their usefulness for scammers. In the US, there are over 30,000 BTMs, for example in gas stations and supermarkets. There, a scammer can send a victim to the BTM around the corner.

Add to that the fact that Dutch regulations for BTM providers are stricter, for example regarding customer due diligence (KYC) and reporting unusual transactions. In the US, KYC is also required, but enforcement varies by state, and for a long time many operators got away with looser thresholds or weak controls.

That partly explains why you're seeing such large scam and money laundering cases via BTMs there now. Pressure from the FBI, FTC, and local prosecutors on that sector is likely to increase significantly. Already 17 US states have tightened regulations, and some municipalities have simply moved straight to a ban.

"Bitcoin fraud"

For bitcoiners, this news is uncomfortably familiar. It's not the first time casual news readers see "bitcoin fraud." While the core of the problem is actually classic scamming that uses new rails. These figures provide ammunition for stricter regulation or even local bans on BTMs, which also affects legitimate cash-to-self-custody users.

At the same time, you might wonder whether the current model—a machine in a supermarket corner with high fees—is really suitable as a useful way to onboard people.

2️⃣ Trump's uncomfortable relationship with crypto

Peter

The year has barely begun and Donald Trump has already set the world in motion again. Venezuela became a geopolitical pivot point in a few nighttime hours. A sitting president was removed and the international legal order was stretched until it tore. In the crypto world too, Trump's shadow looms once more.

Trump is a paradox for crypto. Under his leadership, sentiment in Washington shifted. Regulators became less hostile, entrepreneurs got breathing room, regulation became more predictable. For a sector that had been under pressure for years, it felt like a thaw after a long winter. The message was clear: innovation is allowed again, as long as it stays within the lines.

But at the same time, Trump is not a neutral actor—he has no regard for boundaries himself. He's not an outsider who happens to pursue favorable policy. He has one foot and a grabbing hand in the market.

Last week, Trump Media announced it will launch its own token in 2026. Not a speculative toy, according to the statement, but a 'reward' for shareholders. Not tradable, no ownership rights, no cash value. But access to 'rewards' within Trump's ecosystem. It sounds harmless. Almost boring.

So not a classic memecoin, but not a technical experiment either. It's political capital packaged as a token. Loyalty, brand, community—all concepts that sound familiar in crypto, but here they're directly linked to a sitting president and his company. The line between policy and interest isn't crossed, but carefully circumvented.

That discomfort grows when you look at the shadows in which markets operate.

Around the invasion of Venezuela, something remarkable happened on Polymarket. A new user placed large bets shortly beforehand on US military action and Maduro's removal. The profit: over four hundred thousand dollars. Coincidence, says the occasional voice. Insider trading, most believe.

Crypto markets and prediction markets operate on speed, incentives, and information. Politics operates on power, secrecy, and timing. When these worlds collide, friction arises.

Trump embodies that friction. He promotes a climate where crypto can grow, but simultaneously exploits the infrastructure—tokens, markets, sentiment—for his own purposes. Openly through his media company. Possibly also indirectly through networks that profit from political decisions before they become public.

Bitcoin and crypto were built to decentralize power, to make rules explicit, to distribute information more equally. But they don't exist in a vacuum. They clash with a world where power is still asymmetric, where decisions are made behind closed doors, and where timing is worth money.

The question regularly comes up whether Trump is net positive or negative for the crypto world. The answer differs per person and depends on what you weigh more heavily.

Is Trump good for crypto because he improves the business climate, tempers regulators, and gives innovation room? Or is he bad for crypto because he uses that same infrastructure for personal gain and mixes political power with markets that benefit from distance and neutrality?

🚨BREAKING: Someone in Trump's circle may have just pulled off insider trading on steroids.

— Brian Allen (@allenanalysis) October 11, 2025

A brand new crypto account was opened yesterday morning.

30 minutes before Trump announced 100% China tariffs, it opened a massive, multi-million dollar leveraged Bitcoin short.

The…

What definitely grates is that behavior that's undesirable—whether it happens openly or in the shadows—doesn't become less problematic just because it's visible. Transparency justifies nothing. It only makes clearer what's at stake.

Put differently, crypto can make power visible, but cannot directly correct it. That responsibility remains with people. And with the choices they make.

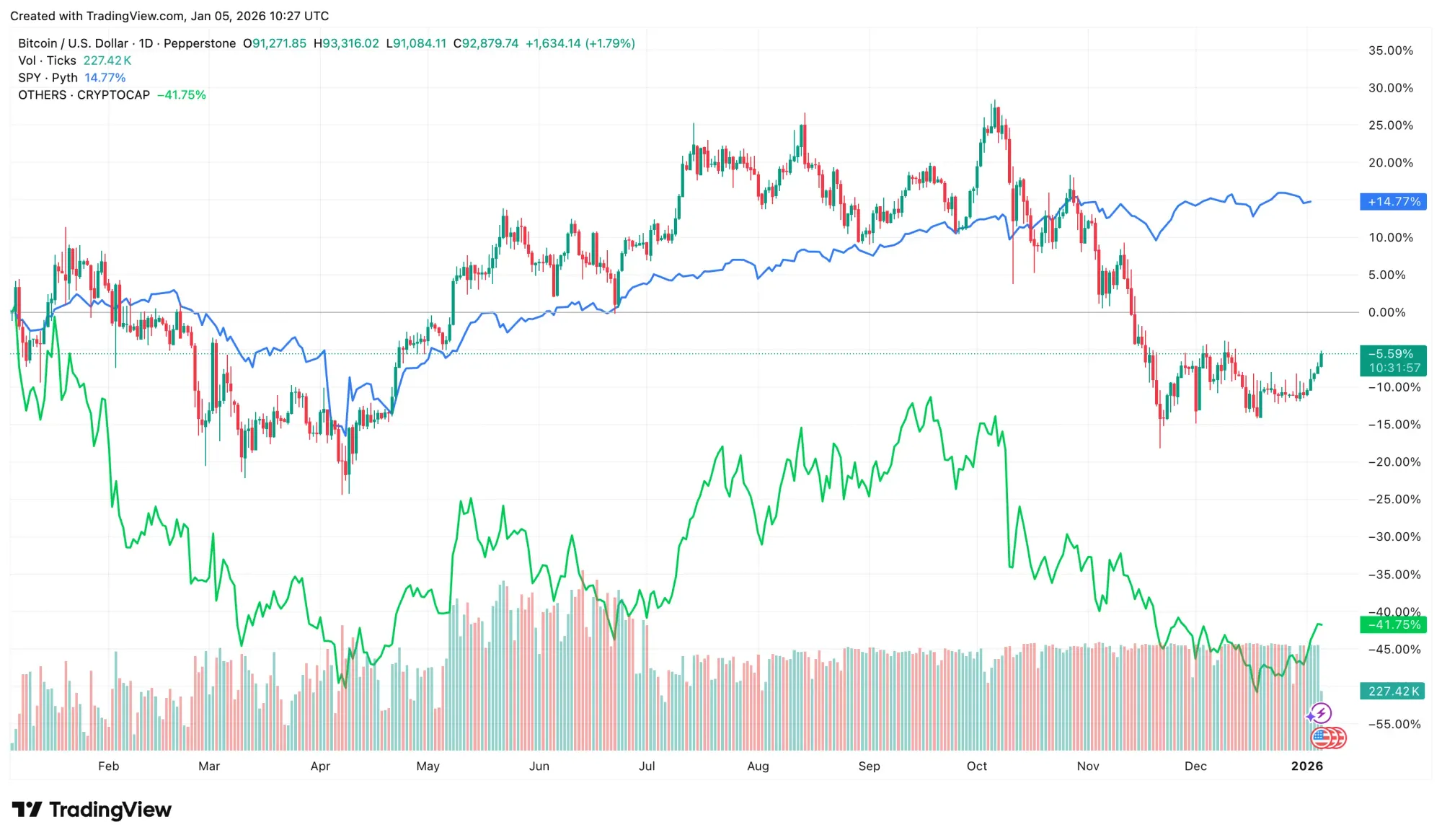

3️⃣ Altcoins: bad year, not dead

Peter

Anyone who was in altcoins in 2025 has little reason to get nostalgic. It was a year to quickly forget. Or better: a year to learn from. While the S&P 500 rose strongly and bitcoin held its ground somewhat, the altcoin segment was punished mercilessly. Not a little, but structurally, broadly, and relentlessly.

Even projects once seen as serious building blocks of the crypto landscape couldn't escape. DeFi names from the previous cycle are still far below their old peaks. Other projects, with big promises but few lasting users, have been practically wiped out. Anyone still holding those tokens usually does so out of stubbornness, not conviction.

The dominant narrative of 2025 was simple: capital didn't want risk. Or more precisely, it only wanted to take risk where the asymmetry was crystal clear. Bitcoin benefited from that. Altcoins didn't.

And yet. As soon as the market catches its breath, altcoins come back to life too. This week it wasn't the 'fundamentally strong' altcoins that moved first. It was memecoins. PEPE, DOGE, SHIB. Surging at the first signs of recovery. Not because they've suddenly improved, but because they do what they always do.

Memecoins aren't investment stories. They promise nothing. They have no substantive roadmap, no vision, they don't pursue technological breakthroughs. They're pure sentiment and volatility. And precisely because of that, they function as a lightning rod as soon as traders dare to move again.

The irony is that the 'serious' altcoins get stuck because of this. Too risky to serve as a safe choice, too complex to function as a pure gamble. In a market battered by disappointment, that doesn't work in their favor.

Does this mean altcoins are dead? No. But it does mean 2021 is definitively over. The time when a good story, a well-known team, and a slick presentation were enough to attract capital isn't coming back.

2025 wasn't an accident. It was a selection process. Harsh, but instructive. And anyone who wants to erase that year from memory already is at risk of making exactly the same mistakes in 2026.

🍟 Snacks

To wrap up, some quick bites:

- Among major cryptocurrencies, Zcash performed best this year. Not bitcoin or ether, but ZEC tops the list with a price increase of over 800%. The privacy narrative clearly gained ground in 2025. Analysts point to stricter regulations and increasing surveillance on centralized platforms. That translates into rising volumes and prices for coins like Zcash and Monero. Institutional players are participating too: Cypherpunk Technologies recently significantly expanded its Zcash position.

- Capital continues flowing toward crypto. At the end of December, US spot bitcoin ETFs saw inflows again: $459 million net came in over one week, largely through BlackRock's IBIT. Meanwhile, $161 million flowed out of ethereum ETFs. SOL and XRP funds recorded modest inflows. Over all of 2025, $47.2 billion in capital entered the crypto market via the ETF route worldwide, just under the record year 2024.

- PwC quietly doubles down on crypto and tokenization. After years of caution, PwC is significantly scaling up its digital asset activities. According to PwC chief Paul Griggs, the strategic shift came last year, when the tone from US regulators became noticeably friendlier and Congress got to work on stablecoin and crypto legislation. PwC sees tokenization not as hype, but as a structural development. It's unclear whether this pivot is also being implemented by PwC's European division.

- Korean crypto trading moves abroad. South Korean investors moved over 160 trillion won (approximately $110 billion) in crypto from local exchanges to foreign platforms in 2025. That's according to CoinGecko and Tiger Research in a jointly written report. Strict domestic rules limit exchanges mainly to spot trading, causing active traders to seek alternatives elsewhere. That choice netted offshore exchanges about $3.4 billion in fees, primarily for Binance, Bybit, and OKX. Binance alone captured nearly 58% of the total.

- Grayscale sees 2026 as the start of the 'institutional era' for crypto. According to research head Zach Pandl, bitcoin could reach a new all-time high in the first half of 2026. The driving force: growing demand for alternative capital in an uncertain global economy, expectations of a weaker dollar, and potential Fed rate cuts. Add better US crypto regulations to that, and the playing field shifts definitively toward institutional investors, according to Grayscale.

- Iran considers crypto as payment for weapons. According to the Financial Times, Mindex, Iran's state arms export company, has proposed accepting cryptocurrency for sales of rockets, drones, and warships to foreign governments. Besides barter trade and payments in rial, crypto would help circumvent sanctions and payment restrictions.

- Tether quietly grows its bitcoin reserve. CEO Paolo Ardoino wrote that Tether purchased 8,888 bitcoin in Q4 2025. The company now owns approximately 96,000 bitcoin, worth over $8 billion. This makes Tether one of the largest bitcoin holders in the world. The purchase is part of a strategy Tether revealed earlier: it puts 15% of quarterly profits into bitcoin.

- Binance keeps growing, despite everything. The company announced it passed the 300 million user milestone in 2025. Together they accounted for trading volume of about $34 trillion. Particularly notable is retail's role in that: consumer trading increased 125% year-over-year. On many days, nearly half of all BTC and ETH trading takes place on Binance. The exchange, despite years of pressure and controversy, remains the center of gravity of the crypto market.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!