No Culprit, But Still a Crash

After early February's capitulation, investors are searching for what caused the bitcoin crash. The answer is more complex than expected. No single villain—but a clear shift in the market.

Last week, bitcoin took a hit you can't dismiss as noise. The price dropped hard, volume exploded, and the already poor sentiment turned bitter fast. This was capitulation.

The reflex is familiar. After every major move, the market searches for THE cause. A culprit. An event that explains everything. Since FTX's collapse, we've become extra sensitive to this. Back then, there was a clear villain. A name, a face, a bankruptcy. That feels comfortable. If you know where things went wrong, you also know where the danger lies.

But this time, no perpetrator emerged. Anyone still searching for "what it was" after February 5th hit a wall. No hack. No collapsed exchange. No sudden ban. And yet one of the most intense trading days in recent bitcoin history.

There must be more to it, ProCap CIO Jeff Park must have thought. He zoomed in on the crash and discovered some interesting things.

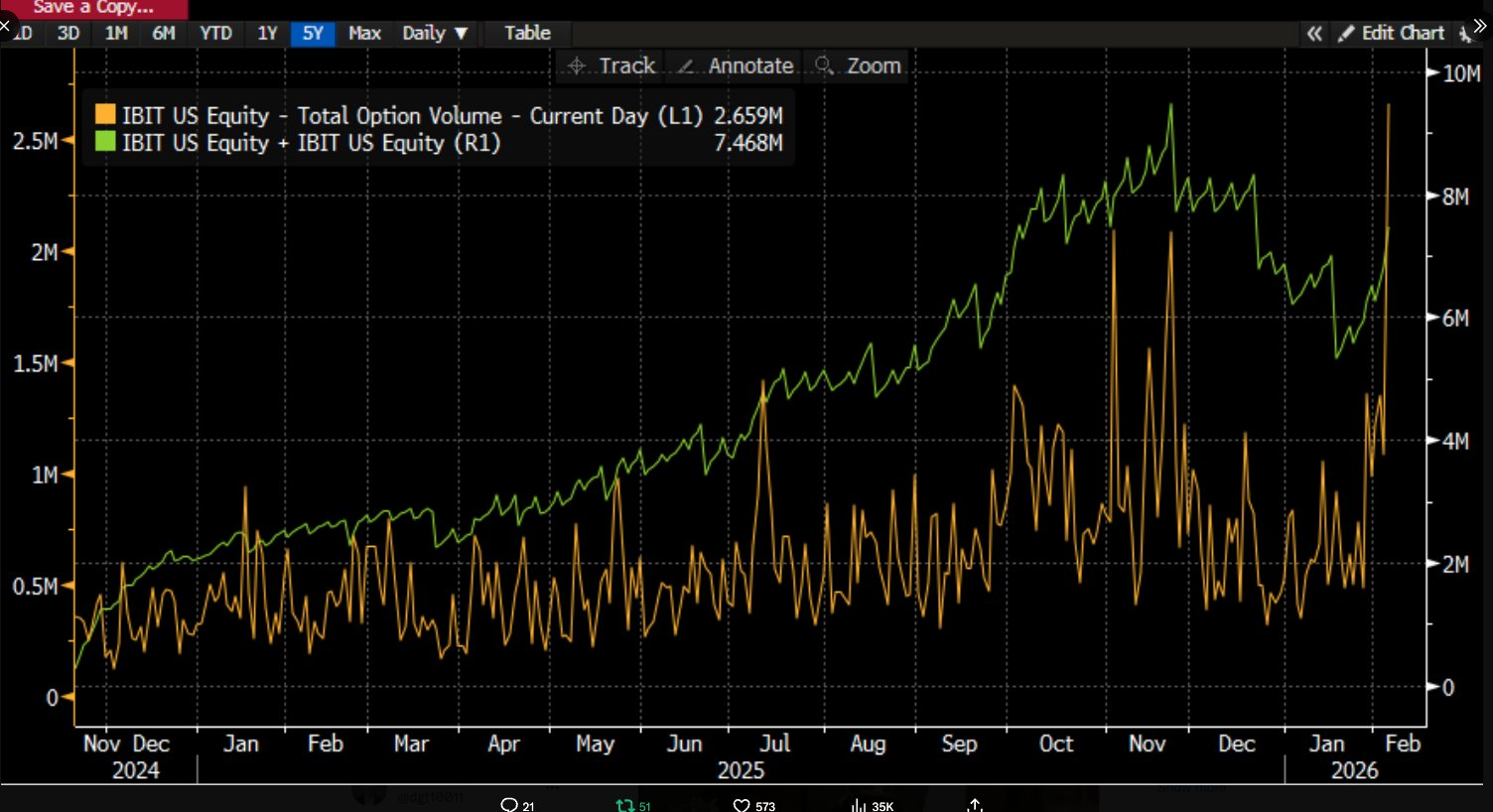

He noticed that bitcoin ETF trading hit record highs. IBIT saw higher volume than ever, and options trading spiked, with puts as the dominant instrument. At the same time, bitcoin tracked remarkably closely with software stocks and other risk assets. According to Park, this capitulation doesn't have the character of a flight from crypto, but of a shift within a broader risk-off move.

Even more striking: despite the price drop, money didn't flow out of the ETFs on balance. New shares were even created. That conflicts with the idea of investors rushing for the exits. It suggests something else, says Park. That a large part of the selling pressure didn't come from people who "wanted out of bitcoin," but from parties who had to reduce risk across their entire portfolio. Fast. Regardless of what it was.

In other words, this wasn't a classic crypto crash—it was a market event.

Bitcoin has become deeply intertwined with the financial system. It sits in multi-asset portfolios, model strategies, hedge constructions, and options books. And when something breaks there, there's no discussion. Park observes: positions get unwound. Fast, mechanically, and... without a story.

Fine, rules, models, and margin requirements can operate without narratives, but people don't. Anyone looking for more fundamental context only needs to take a small step back. Because there's a lot going on—a cluster of forces that has been eroding momentum for months.

What went wrong with crypto

— Alex Krüger (@krugermacro) February 6, 2026

1. 10/10 slaughter (will I get sued if I mention Binance?).

2. Digital Asset Treasuries (DATs) hangover.

3. Reversed flows from crime syndicates: major flows reversed after the DoJ indictment of the Cambodian Prince Group last October.

4. Quantum…

Alex Krüger, for example, points to the aftermath of the October 10th crash, which he says still hangs over the market. Treasury companies that got a harsh reality check and are sometimes underwater up to their eyeballs. Capital shifting toward AI, where the promise of growth feels more tangible. The sense that bitcoin has increasingly become an American product, driving away non-Western buyers. The endless stream of new tokens diluting real value. A lack of genuine innovation, with a glut of casino and memecoin activity as a result.

On top of that came a macro shock, Krüger writes. Kevin Warsh's appointment brought back fears of tighter monetary policy. In a market that relies on liquidity, that's no small detail.

All those factors together did something simple but deadly: they chipped away at momentum, little by little, every day.

That makes every sell order slightly heavier. Buyers wait and see. Narratives lose their power. What sounded obvious in the bull market suddenly rings hollow. Digital gold. ETFs as a safety net. Political tailwinds. In a bear market, the stories from the previous bull market are always the first to fall.

That doesn't mean they're necessarily untrue. It means they lose their explanatory power in the short term. Because in a bear market, ideology is irrelevant; liquidity rules. It's no longer about convictions, but about positioning.

That's perhaps the most uncomfortable conclusion. This capitulation had no clear cause because bitcoin is no longer a niche. It moves with the system it wants to escape but can't yet.

BREAKING: Crypto funds recorded -$1.5 billion in net outflows in the week ending Wednesday, the most since November.

— The Kobeissi Letter (@KobeissiLetter) February 7, 2026

This marks the 2nd consecutive weekly withdrawal and the 5th over the last 7 weeks.

As a result, the 4-week moving average of outflows fell to -$700 million, the… pic.twitter.com/I9U2y16SJt

So much for the crash. It prompts introspection, and therefore also: what lies ahead? What will be the story that carries bitcoin into a new bull market? Which narrative survives for the phase that comes next?

More on that after the break!

More Alpha

Are you a Plus member? Then we continue with the following topics:

- The narratives of this bear market

- The narrative of the next bull market

- Vitalik wants to reinvent Ethereum

1️⃣ The narratives of this bear market

Peter

The price crashes, and suddenly X is a campfire again. People lean forward, stare into the flames, and try to see something that offers a handhold. In a bull market, we pretend price and meaning are separate things. In a bear market, that illusion falls away. That's when the narrative machine kicks into gear.

The first narrative is the case that just won't go away: October 10th. Something hangs in the air that's hard to prove but easy to suggest. It rhymes with the usual supporting actor of every crypto drama: Binance. Then links appear, vague claims, bankruptcy rumors, new lawsuits that are "piling up," and a few familiar names pointing the finger in the same direction again. The message is simple: this wasn't a market move, this was an aftershock of a crime.

CATHIE WOOD JUST DOUBLED DOWN THAT BINANCE IS RESPONSIBLE FOR 10/10 AND IS NOW EVEN BLAMING THEM FOR THIS WEEK'S CRASH pic.twitter.com/Iw9Lcs0t4C

— Leonidas 🧡 $DOG (@LeonidasNFT) February 4, 2026

The second narrative is about big players. Someone must be getting out. Someone HAS to be getting out. Forced selling, "campaign selling," "unloading to a deadline." It sounds like a messy moving day, but it's mostly an attempt to personalize the pain. If one party is in trouble, then at least the drop makes sense. And then it can also end.

Agree with this take. Someone enormous is unloading to a deadline. Similar to when the German government did it. Coins handed over to OTC desks who simply execute.

— Alistair Milne (@alistairmilne) February 5, 2026

For me it started 14th Jan https://t.co/3Fwc1MAA3o

Then comes the moral narrative: crypto deserves this. The sector has drifted toward a memecoin casino, scams have become too easy, the shame too great. This narrative is popular because it offers a form of relief. Punishment feels much more manageable than randomness.

Crypto rebranded the past few years into a get rich quick meme casino focused on ponzi over innovation. It punished any hard working developers, rewarded those that scammed and rugged, and is now being punished appropriately as the direction it was headed was not sustainable.

— IncomeSharks (@IncomeSharks) February 3, 2026

And when morale really sinks, the old chorus returns. Roubini, Burry, Cramer. The familiar faces who resurface with every crash. Their return is a signal in itself: sentiment is SO bad that even the professional critics can smell there's applause to be had.

The Coming Crypto Apocalypse

— Nouriel Roubini (@Nouriel) February 4, 2026

By @Nouriel Roubini

The future of money and payments will feature gradual evolution, not the revolution that crypto-grifters promised. Bitcoin and other cryptocurrencies' latest plunge further underscores the highly volatile nature of this…

In the margins, the conspiracies spin along. Epstein as the lead character in a new, far-fetched creative narrative. "Paper markets" suppressing the price. Bitcoin that "wasn't supposed to act like this." These are attempts to explain the market from the outside, so you don't have to accept that the market itself simply breathes too.

.@novogratz is right - the math isn't mathing. When gold hits all-time highs and Bitcoin stalls despite the same macro tailwinds + a very friendly crypto administration - you have to look at the paper markets. We've seen this movie before with Silver - heavy shorting via futures… https://t.co/UG84LjtZuH

— John E Deaton (@JohnEDeaton1) February 4, 2026

Finally, there's the paralyzing narrative: bitcoin won't return until the pressing issues are resolved first. Quantum. Legislation. Elections. It's delay disguised as analysis, which almost always ends with the same line: that bottom is nowhere near in sight.

The Bitcoin bottom isn't in until:

— Jacob King (@JacobKinge) February 4, 2026

• Saylor goes bankrupt

• Strategy Force Sells BTC

• Binance goes bankrupt

• Coinbase goes bankrupt

• Tether gets raided by Feds

• El Salvador Sells BTC

• Maxis set new targets to $4

• Trump says BTC was Dem scam

• BlackRock…

Bear markets destroy hope, but they also reveal something honest. As soon as the price drops, you see which stories people need to stay in their seats.

Speaking of those stories... ⬇️

2️⃣ The narrative of the next bull market

Peter

Bear markets are unpleasant, but they have one beautiful quality: they force honesty. In a bull market, you can win everyone over with a few sentences and a chart. In a bear market, that doesn't work anymore. The scenery collapses, and the question that was always there remains: what is this really about?

That's exactly what's becoming visible again now. After capitulation, the hunt for meaning begins. The market pauses and asks itself which stories are still worth believing in.

Tomer Strolight, podcast host and former editor-in-chief at Swan, has a fairly radical version of that. He presents bitcoin as something bigger than money, bigger than software, bigger even than a financial product. And he extends that to something that has faded into the background with Wall Street's arrival: principles. Voluntary participation. Freedom of speech. Property rights. A separation between state and economy. Fundamental characteristics of a digital state with digital citizens.

I published an article. Yay for me.

— Tomer Strolight (@TomerStrolight) February 7, 2026

NB: No AIs were involved in the writing of this article (but the image at the top is the work of an AI). https://t.co/aySXXN4CoK

He elaborates on this metaphor at length. "Those who embrace bitcoin have voluntarily opted into 'bitcoin citizenship.'" They are citizens within a system where the rules aren't enforced by people, but by software that treats everyone equally. "So it is a system of equals before its laws." And because those rules don't depend on institutions, it offers protection you can't get elsewhere, he argues. "If you have the keys, you own the coins."

You don't have to agree with his political framing to see why this could become relevant again. In a bull market, "digital gold" as a metaphor is enough. But in a bear market, the foundation comes back into view: why would anyone want to own this when it hurts?

At the same time, you can't deny that the market also needs something else. A bull market doesn't run on philosophy alone. There need to be ideas that attract money and attention. Bitwise CIO Matt Hougan therefore doesn't look at meaning, but at the next set of convictions that can draw capital back into the market. "Crypto is narrative-driven," he says, and he lists nine narratives he's tracking heading into the next cycle.

A few of those feel like old acquaintances. The story of fiat money faltering, for example. And the story of institutional adoption as a long, slow wave of capital flowing into the crypto market. But he's also placed a striking new benchmark at the top of his list: revenue. "Blockchains currently generate around $7b-$8b in annual revenue." In the next cycle, Hougan suggests, the market will pay less for promise and more for proof.

As a new category, Hougan mentions AiFi. "AI agents won't use bank accounts. They'll use crypto, stablecoins, and DeFi." If software soon trades, pays, saves, and insures itself autonomously, it needs infrastructure. A bank account is built for humans, with forms, business hours, compliance, and counters. A wallet is built for software, with APIs and 24/7 settlement. It takes little imagination to believe this narrative will resurface frequently in the coming years.

Is this... AIFI? 🦋https://t.co/wrJWhycnDG pic.twitter.com/FKRHyxjxa3

— Arlyn Culwick 🔀 (@arlynculwick) February 4, 2026

A16z partner Chris Dixon takes a different approach. He tries to dismantle the cynical conclusion that "everything except finance" is dead. "We are clearly in the financial era of blockchains." But according to Dixon, that's not a failure—it's the logical sequence. He points out that infrastructure and distribution always come first. The early internet years weren't about social media, but about TCP/IP and connectivity. Only when hundreds of millions of people were online did new applications emerge.

Crypto may manifest primarily financially right now, but that doesn't mean the rest isn't coming, Dixon argues. It means we're still in the building phase. "The order of operations matters." And he immediately exposes a sore spot: there have been many projects that produced nothing or intentionally only sought to extract value from the market. That makes the market cynical, and cynicism is deadly for adoption. That's why he calls policy the missing link. "Good policy does two things at once:" it gives builders a roadmap and brings in trust through rules and enforced transparency.

That connects to a point Hougan makes about regulation. He calls it a slow catalyst. There's been a lot of talk, concrete steps have been taken, but we've yet to feel the effects of new rules:

"Heck, the Genius Act doesn't even take effect until January 2027. When we get that and the Clarity Act in place, both investment and mainstream adoption will hockey-stick."

The funny thing about legislation is that the market can talk about it for years, and then suddenly in one quarter act as if it was always obvious. Dixon describes that effect with stablecoins: "Almost overnight, stablecoins went from suspect to legitimate." If that sentiment also shifts to other categories, it could unleash an entirely new risk appetite.

And then there's Theia CIO Felipe Montealegre, who takes the whole narrative up a level. The picture he paints: the financial system isn't an internet, it just has an internet-like interface. Under the hood, it runs on "permissioned, siloed servers." A web of closed databases and gatekeepers. His alternative is a financial layer on the internet itself, with smart contracts on shared infrastructure. He calls it the "Internet Financial System." And he compares its scale to Gutenberg: not because it sounds poetic, but because it's about what happens when costs and barriers drop by 90%. Then suddenly categories come to life that were previously unthinkable.

If you combine these four voices, an overarching narrative for the next bull market emerges.

Bitcoin as an ownership layer. Crypto as financial infrastructure that must show revenue, not just promises. Stablecoins and tokenization as rails the real world can ride on. AI and software organically moving toward wallets and on-chain systems. And underneath it all: the long wave of institutional adoption and regulatory normalization, which feels slow... until it suddenly accelerates.

I have never been more bullish on crypto.

— Balaji (@balajis) February 5, 2026

Because the rules-based order is collapsing and the code-based order is rising. So the short term price doesn't matter.

As international law breaks down, we will need not just onchain currencies, but onchain companies. As the post-war… https://t.co/iHpr3zn4dW

Is THE narrative for the next bull market in here? Probably not. But these are at least stories that don't rely on hopium alone. They rely on a movement that's already visible, even in a bear market: crypto is shifting from subculture to infrastructure.

3️⃣ Vitalik wants to reinvent Ethereum

Erik

Ethereum leader Vitalik Buterin published a striking proposal last week that deeply impacts how the network operates. In his paper Hyper-scaling state by creating new forms of state, he warns that Ethereum is hitting a hard limit if it wants to grow much larger. Not so much in processing transactions—enormous progress has been made there in recent years—but in something more fundamental: the network's 'working memory,' the so-called state. It simply isn't growing fast enough to keep up. The proposal now is to make 'premium' available state more expensive and introduce new, cheaper forms of it.

The word state comes from computer science and literally means: the current condition of a system. In classical software, it refers to everything the program "knows" at a given moment: variables, settings, user data. Not how you got there, but where you are NOW.

This same concept was later adopted in blockchains. There too, the state is the snapshot: who owns which tokens, which smart contracts are active, and what their current status is. So it's not the complete transaction history, but the end result of it.

In the context of a blockchain, that state is crucial because nodes need it to verify new transactions. The larger the state becomes, the heavier the network is to run. That tension is central to Vitalik Buterin's proposal.

The size of Ethereum's state grows by about 100 gigabytes per year. That puts heavy pressure on nodes, which ideally should be relatively easy to run. Vitalik's proposal is radical at first glance: Ethereum should stop keeping the complete state immediately available.

No longer relying on layer-2 networks

A plan, then, to make the base layer stronger and faster. But... wait a minute. Wasn't Ethereum already years into outsourcing storage and computing capacity to layer-2 networks (L2s)?

Yes, but that vision is losing popularity. Vitalik now acknowledges that the idea of L2s being responsible for scaling hasn't delivered what was hoped for. The multitude of layer-2 networks has led to fragmentation of liquidity and state. Vitalik: "We should stop thinking about L2s as literally being 'branded shards' of Ethereum."

There have recently been some discussions on the ongoing role of L2s in the Ethereum ecosystem, especially in the face of two facts:

— vitalik.eth (@VitalikButerin) February 3, 2026

* L2s' progress to stage 2 (and, secondarily, on interop) has been far slower and more difficult than originally expected

* L1 itself is scaling,…

This partly explains why Vitalik is now focusing on scaling the working memory on the base layer. Because L2s are increasingly developing into specialized networks with their own identity, rather than simple extensions of Ethereum, the base layer itself must become more powerful.

Hyper-scaling

Vitalik's proposal is first to scale up the current state as much as still possible. That makes significant headway, but not enough. Access to that state is 'premium,' so remains relatively expensive and will probably only be used for valuable, essential things like user accounts.

Additionally, the idea introduces new forms of state. Think, for example, of memory that gets wiped monthly. Ideal for "auctions, polls, elections, or individual events in games," Vitalik writes. According to the Canadian, some of the data currently stored in working memory can be transformed into a form we know from Bitcoin: as UTXOs into the archive. "Ideal for tokens and NFTs."

In short: instead of cramming everything into one expensive, universal database, you split up storage. The premium portion stays small and decentralized, the rest flows to places optimized for it. This allows Ethereum as a whole to become MUCH larger—hyper-scaling—without nodes being extremely heavily burdened as a result.

Ethereum is transitioning from the rollup centric roadmap to the ZK centric roadmap.

— RYAN SΞAN ADAMS - rsa.eth 🦄 (@RyanSAdams) February 7, 2026

New era.

Strong L1, Strong ETH.

Vitalik's statements did stir up some dust. Particularly the idea that layer-2 networks play a smaller role drew responses. But the initial criticism quickly quieted and was translated into a new characterization: L2s need to do something difficult and earn their own identity. The era of "Ethereum, but faster" is thus over.

Vitalik's thoughts on Ethereum's continued development have been largely positively received, both among developers and in the hallways on X.

Vitalik's fifteenth year

Speaking of Ethereum: we're approaching Vitalik Buterin's fifteenth year in the crypto world. This year marks fifteen years of activity. His relentless work testifies to an endurance, integrity, and stoicism that are unprecedented in crypto, a world where turnover is quick and many OGs have long since burned out.

Vitalik became active at seventeen, when he was paid 5 BTC per article at Bitcoin Weekly magazine, worth a few dollars at the time. At nineteen, he wrote Ethereum's whitepaper entirely alone. He survived the snake pit of the network's early days and still writes dozens of articles per year for and about Ethereum; even though he could obviously retire long ago on his staked ether!

🍟 Snacks

To wrap up, some quick bites:

- Tether scales back mega-plans behind new funding round. The stablecoin issuer wanted to raise up to $20 billion, but appears to be backing away from that after pushback from investors. Tether CEO Paolo Ardoino states that Tether doesn't need the money and is also "happy" if "zero dollars are invested." The reluctance among investors mainly revolves around the company's high valuation. There are also concerns about oversight and reserves, despite the high profits and well-filled coffers.

- Emirati sheikh quietly took large stake in Trump's crypto company. Shortly before Trump's inauguration, representatives of Sheikh Tahnoon bin Zayed bought 49% of World Liberty Financial, a crypto and stablecoin company linked to the Trump family, for $500 million. Months later, the UAE gained access to advanced American AI chips. According to the Wall Street Journal, these events are connected. The timing fuels concerns about conflicts of interest, though all parties deny political influence or deals.

- Gemini withdraws from Europe and Australia and cuts staff significantly. The crypto exchange is leaving the British, European, and Australian markets and laying off about 25% of its employees to focus entirely on the US. According to Gemini, AI tools make smaller teams more productive and international expansion has become too complex and too expensive. The focus shifts to America, with prediction markets as a new growth pillar and hopes for a quick path to profitability.

- CME flirts with its own 'CME Coin' as part of the move toward tokenized collateral. CEO Terry Duffy said that the exchange is exploring whether it can issue its own token on a (partially) decentralized network, alongside a separate 'tokenized cash' solution it's building in collaboration with Google. The idea: more efficient collateral and faster settlement, but only with tokens from highly creditworthy parties. This is the first time CME has explicitly considered launching its own on-chain asset.

- Bitcoin shouldn't expect a 'bailout' from the Americans. Treasury Secretary Scott Bessent said in Congress that the government doesn't have the authority to rescue bitcoin, force banks to buy, or put taxpayer money into crypto. The only BTC on the balance sheet comes from seizures, not investment policy. That bitcoin is held in the Strategic Bitcoin Reserve. According to Bessent, that shows the state tolerates exposure but doesn't want to be a safety net.

- Family offices remain notably absent from crypto. According to JPMorgan's Global Family Office Report 2026, 89% of wealthy families have zero exposure to digital assets. Gold is also avoided. Only 17% name crypto as a future theme; AI gets the priority by far. Volatility and unclear correlations are keeping crypto out of the core portfolio for now.

- White House seeks reconciliation between banks and crypto around interest on stablecoins. Tuesday brings a second meeting between policy staff from major banks and industry organizations about whether crypto companies may pay interest on stablecoins. Banks fear capital flight from deposits; crypto thinks banks are unfairly protecting their monopoly. The outcome is crucial for further handling of the Clarity Act and thus the continued development of American crypto rules.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!