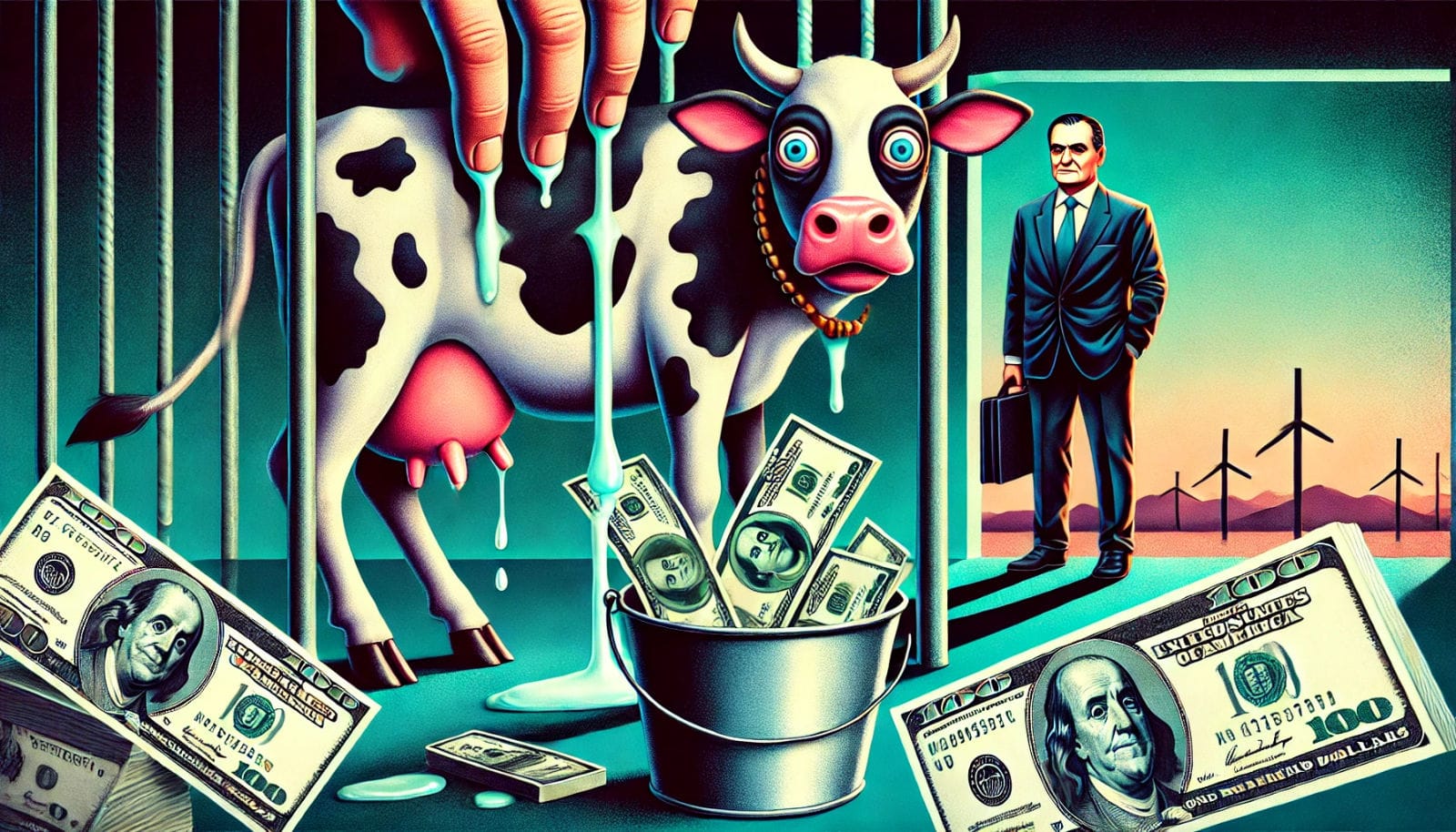

Milking the Memecoin? Milei in the Spotlight

From Nixon’s milk scandal to Argentine President Milei’s $LIBRA pump-and-dump, insiders cash in while everyday investors pay the price. Binance’s surprise sell-off stalls Bitcoin as Japan eyes a crypto revolution. Is the market rigged—or is reform finally coming?

Richard Nixon knew how to make deals. Not the “two for the price of one” offers you find in supermarkets, but high-stakes political bargains where billions were on the line. In 1971, during his re-election campaign, he faced one major problem: money. A lot of it. The American dairy industry was in trouble and demanded higher milk prices. Nixon saw an opportunity.

What happened next came to be known as the milk scandal. While the government was still officially “deliberating” what to do about milk prices, hundreds of thousands of dollars flowed from the dairy industry into Nixon’s campaign fund. Soon after, Nixon raised the minimum price for milk. Farmers were pleased, Nixon’s campaign coffers swelled, and the consumer? In the end, they picked up the tab.

This wasn’t a coincidence—it was a classic quid pro quo: I do something for you, you do something for me. The insiders were in on it, while the rest of the country received the bill later.

Fast forward to 2025. A different president, a different scandal, yet the common thread remains the same: abuse of power and influence to manipulate the market, generating enormous profits for a select few while leaving everyone else at a loss. Except this time, it wasn’t about milk—it was about a memecoin that appeared out of nowhere and vanished just as quickly.

$LIBRA

Javier Milei, the flamboyant libertarian president of Argentina, is known for his blistering criticism of central banks. He calls them “thieves” and has repeatedly praised bitcoin as an alternative to fiat currency. But last week, he found himself caught up in something that even the most seasoned crypto traders questioned: an ordinary pump and dump. At least, that’s how it appears.

Missed the $LIBRA madness while you were being a good Valentine? Here's the recap:

— Stats (@punk9059) February 15, 2025

1) Argentinian President tweets out a token

2) Token rockets to a $4.5bn valuation in 2 hours

3) Insiders pull out $87mn

4) Token crashes 90%

5) President deletes tweet, denies involvement

6)… pic.twitter.com/3Y4gNQKCRh

On February 15, an unexpected post appeared on Milei’s official X account. He enthusiastically promoted a memecoin called $LIBRA, presenting it as a novel and innovative way to “support Argentine businesses and startups.” It sounded promising, but investors know that when a president endorses a coin, something shady is bound to happen. And sure enough, it did.

$LIBRA’s price soared. Within hours, the coin’s value almost reached $5 per token, only to plummet to under a dollar shortly after. The hype was enormous. Investors rushed in, confident that the Argentine president wouldn’t back empty promises. But as quickly as it spiked, the coin crashed, and within a day, most of its value had evaporated.

And Milei? He quietly deleted his post and claimed he was “not aware” of the project’s details.

Javier Milei now clarifies that he shared the Libra shitcoin to support a "private venture".

— BowTiedMara (@BowTiedMara) February 15, 2025

This becomes worse by the minute. pic.twitter.com/czHwOLChm4

The Smell of Insider Knowledge

Much like Nixon’s milk deal, this move raises serious questions. Was Milei genuinely naive? Or was this a calculated play, with insiders already aware that the coin’s life would be brief?

Blockchain analysis indicates that some large wallets, presumably tied to insiders, dumped massive amounts of $LIBRA just before the collapse. It’s a classic sequence:

- Insiders invest early.

- An influential figure—in this case, Milei—creates a buzz.

- The public jumps in, driving the price up.

- Insiders cash out at the peak.

- Everyone else is left holding the bag.

INTEL: Argentinian President Javier Milei retracts $LIBRA endorsement after insiders cash out $107 million

— Solid Intel 📡 (@solidintel_x) February 15, 2025

So far, there’s no direct evidence linking Milei or his close associates to the sell-off. But appearances can be deceiving. The Argentine opposition is already demanding a parliamentary inquiry into his role in the scandal.

From Financial Reformer to Pump & Dump?

What makes Milei’s blunder even more painful is that he has long portrayed himself as a reformer intent on overhauling Argentina’s monetary system. He wants to abandon the peso and sees the dollar as its natural successor. He even championed bitcoin as an alternative remedy. Now, however, he finds himself linked to a dubious crypto stunt that has left many people worse off.

The Same Game, Different Times

From Nixon’s milk deal to Milei’s crypto fiasco—the methods change, but the underlying idea remains: powerful figures manipulate markets, insiders profit handsomely, and everyone else suffers.

Perhaps Milei believed he could get away with it. Maybe he assumed that crypto is the Wild West, where no one is watching. Ironically, it’s a realm where nothing stays hidden. If connections between insiders and this pump-and-dump surface, it could explode into a major scandal—and Milei’s reputation as a reformer could be ruined before it ever truly began, much like $LIBRA itself.

BREAKING: International law firms are reportedly preparing "massive lawsuits" against Argentinian President Milei after his memecoin launch, $LIBRA.

— The Kobeissi Letter (@KobeissiLetter) February 16, 2025

The launch led to the loss of $4.4 billion of market cap in 7 hours. https://t.co/gY7AKtD77u pic.twitter.com/KAjRZ2Pq70

Nixon’s milk scandal reminds us that financial manipulation eventually comes to light. The real question isn’t whether Milei’s actions will be investigated further—it’s how many will eventually point the finger at him.

And if he’s unlucky, he might suffer the same fate as milk prices back then—a dramatic crash.

Are you Plus member? Then we’ll move on to the following topics:

- Are American states front-running the bitcoin reserve?

- Is Binance keeping the ball underwater?

- Japan is set to loosen crypto regulations