Investing in the Future

Just as Mercedes pivoted to EVs in 2009, Mastercard is diving into crypto—from non-custodial wallets and crypto payment cards to blockchain IBANs. Could crypto soon be as indispensable to finance as electric cars are to mobility? Bold moves may reshape the future.

Imagine working at Mercedes in 2009. At that time, diesel was still the norm, and Tesla was a wild Silicon Valley venture making cars powered by laptop batteries. You were selling millions of cars every year, and everything ran like clockwork. Then someone in management casually suggests, “Maybe we should explore electric vehicles.”

You might raise an eyebrow at that. After all, who in their right mind would buy a car that only covers 200 kilometers before leaving you stranded at a charging station for hours? The technology is expensive, profit margins are slim, and customer demand is minimal. Still, the company decided to take that step—slowly, cautiously, but irreversibly.

Now, one and a half decades later, electric driving isn’t just an inevitable future; it has become a key revenue model for Mercedes. Had you waited until it turned truly profitable in 2009, you would have missed your chance.

The same can be said for Amazon Web Services. In the beginning, hardly anyone believed an online bookstore should venture into servers and IT infrastructure. But Jeff Bezos saw it differently: if Amazon needed that infrastructure anyway, perhaps other companies did too. For years it was merely a cost center, and now AWS accounts for a significant portion of Amazon’s profits.

Or consider Apple—secretly developing its own chips for years, a move that only began paying off when the first MacBooks equipped with the M1 chip were released in 2020. The rest of the industry watched in awe as Intel, the longstanding favorite supplier, saw Apple produce laptops that were both faster and more energy-efficient.

These strategic leaps usually arise from a mix of vision and a little unease: vision because you sense the world is shifting, and unease because you fear being left behind.

This brings us to Mastercard, a stalwart in the financial world that has been at the center of global payments for decades. In an interview with the French The Big Whale, Christian Rau, Head of Crypto at Mastercard Europe, said something that echoes those earlier stories:

“If you had asked me ten years ago whether electric cars were profitable for Mercedes, the answer would have been no. But today, it’s an essential part of their business. It’s the same with crypto.”

Rau and Mastercard believe in the future of crypto and understand that its development will be gradual—marked by fits, starts, setbacks, and breakthroughs—yet ultimately unstoppable.

So, what exactly is Mastercard doing?

According to Rau, the company is active on several fronts simultaneously. First, in the most visible arena: facilitating the buying and selling of cryptocurrencies through its payment network. Their so-called on- and off-ramps make it easier for users to convert euros into tokens like USDC and back again. In Europe, with MiCA now in effect, these transactions are well regulated—a crucial factor for a company like Mastercard.

In addition, Mastercard is developing crypto payment cards in partnership with players such as MetaMask and Bitget. With these cards, users keep their crypto in their own wallets yet can still pay at supermarkets or on platforms like bol.com. At the moment of payment, a small amount of crypto is converted into fiat currency, which is then forwarded to the merchant via the Mastercard network. For the merchant, nothing changes.

Rau explains that the most technically challenging aspect is Mastercard’s work with non-custodial wallets. They have built an infrastructure where a smart contract verifies your balance at the moment of payment and then executes the transaction. He describes it as complex, yet fully in line with the principles of decentralized technology.

Moreover, the company is working to make sending crypto simpler and safer by introducing a kind of IBAN for wallets. Using their own blockchain network—the Multi-Token Network—they hope to attract financial institutions and even central banks to join the new digital economy.

Of course, this isn’t charity for Mastercard. Rau believes that these efforts will ultimately make its services better, faster, and cheaper. He acknowledges that stablecoins processed more transaction volume in 2024 than Mastercard did, but he sees this not as a threat, but as confirmation that crypto is serious business.

The Lesson

Mastercard operates in more than two hundred countries, connects with millions of businesses, and generates tens of billions in revenue. When a company of that scale dives so deeply into crypto, it speaks volumes about where the industry stands.

This is no longer a playground or an experimental fringe of the internet. Mastercard has woven crypto into its strategy with dedicated teams, legal experts, compliance officers, and product developers working in tandem with Web3 protocols and regulators. They’re not doing it to make billions today, but because it could become indispensable tomorrow.

Just as Mercedes once bet on electric cars.

More Alpha

Are you a Plus member? Then we move on to the following topics:

- ETFs for altcoins? Only this select group stands a chance

- Growth Market: NFTs of Pokémon card packs

- Sora Ventures Launches Asia’s First Bitcoin Treasury Fund

1️⃣ ETFs for Altcoins? Only this Select Group Stands a Chance

Peter

Bitcoin and Ether now have their spot ETFs on the market. But what about the rest of the crypto market? This question is growing more urgent now that Nasdaq, Cboe and NYSE have proposed to the U.S. Securities and Exchange Commission that the approval process for such exchange-traded funds be sped up.

Instead of the current system, where each application is reviewed individually, the exchanges aim to introduce a fast track system: tokens that meet one of three strictly defined criteria would receive expedited treatment. Galaxy Digital analyzed which tokens satisfy these criteria and ended up with a surprisingly short list.

Only 12 Tokens Stand a Chance

The three criteria a token must meet are:

- ISG Spot Market: The token is traded on a regulated spot market that is a member of the Intermarket Surveillance Group (ISG).

- Regular Futures Market: The token has maintained a regulated futures market for at least six months on an exchange recognized by the CFTC (such as Coinbase Derivatives).

- ETF Exposure: There is already an exchange-traded fund holding at least 40% exposure to the token.

Based on these proposed rules, only 10 tokens would currently qualify for expedited ETF approval: DOGE, BCH, LTC, LINK, XLM, AVAX, SHIB, DOT, SOL and HBAR. Two additional tokens, ADA and XRP, could follow in September and October.

So far, no token—apart from Bitcoin and Ether—meets the first criterion. The altcoins mentioned by Galaxy satisfy criterion 2, and XRP and SOL may even meet criterion 3.

What Does This Mean?

The fast track system could open the ETF landscape to a small group of major altcoins. Institutional investors would gain regulated, transparent products offering access to tokens like Solana, Chainlink, and Dogecoin—instead of relying on expensive private funds or illiquid trusts.

For the rest of the market, nothing changes for now. Without regulated spot markets or a legal upgrade, smaller tokens remain excluded.

In other words, we won’t see an avalanche of ETFs just yet, but if the SEC adopts these proposals, the doors could be opened quite wide.

2️⃣ Growth Market: NFTs of Pokémon Card Packs

Erik

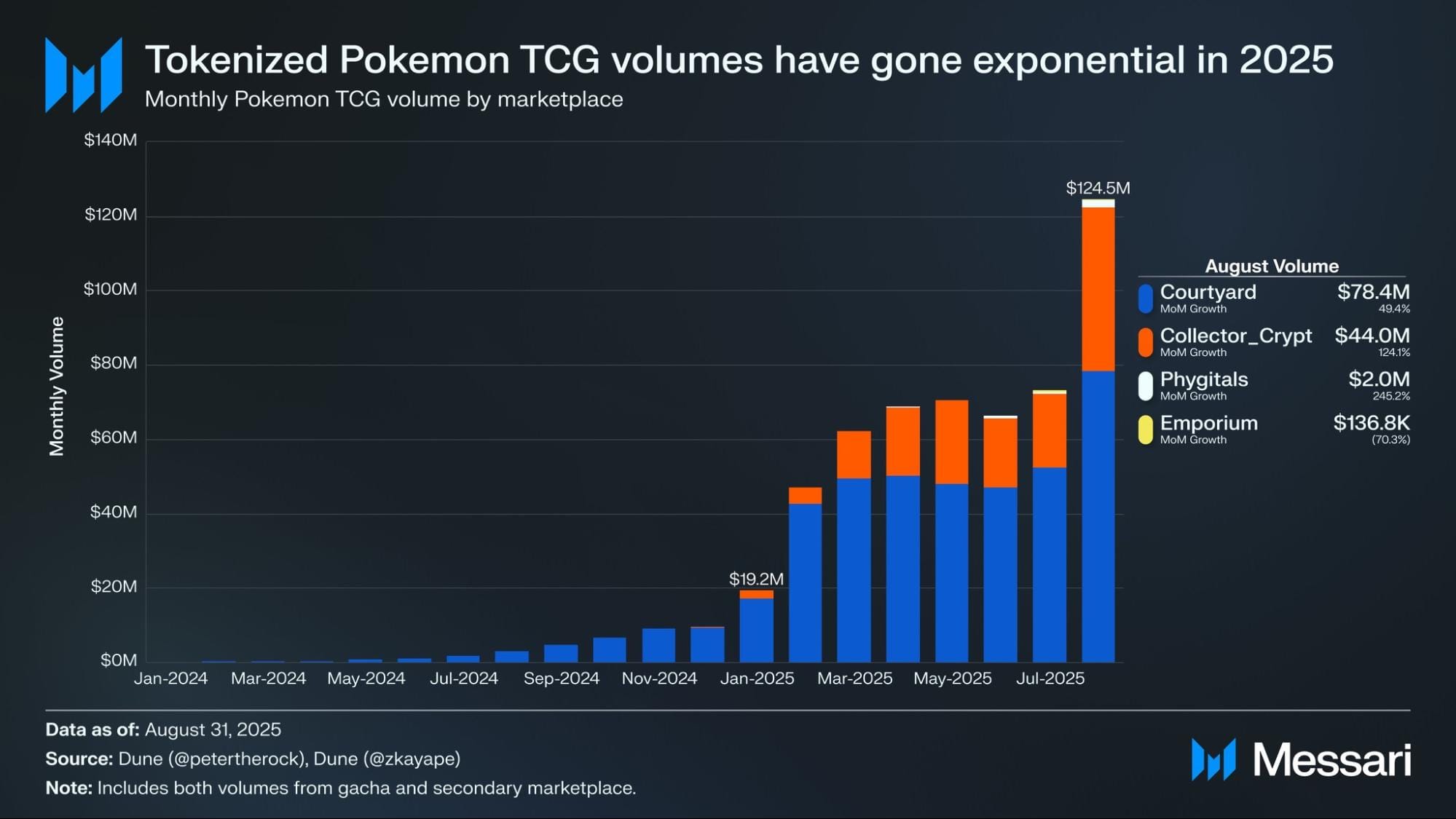

In August, the market for Pokémon trading card games (TCG) exploded. TCG platforms recorded a total volume of $125 million—a 66% monthly increase. Unlike typical NFTs, these are backed by physical items: packs of Pokémon cards. Marketplaces receive the packs from dealers, mint them as NFTs, and securely store the cards in a vault. Traders can exchange their NFTs without ever physically handling the cards, although they can have them delivered if desired.

The most popular platforms are Courtyard, built on Polygon, and Collector Crypt on Solana. The latter has grown rapidly in recent weeks, thanks in part to playful features like its “gacha machine”—a digital twist on the Japanese toy vending machines that dispense surprise capsules. You pay online, for example with USDC through your Solana wallet, and then open a virtual pack. Inside, you receive a random Pokémon card as an NFT directly in your wallet. Meanwhile, the physical card is kept securely in a vault and can be shipped to your home later.

Gotta Catch Them All?

It might sound surprising to say that Pokémon cards are now experiencing a breakthrough. After all, they were already part of a multi-billion-dollar market before becoming tradable as NFTs. However, think of the NFT angle as a move toward greater efficiency. Previously, dealers had to rely on physical exchanges or clunky, informal online marketplaces. With NFTs, the potential market has suddenly expanded.

Some analysts are even calling this the “Polymarket moment” for Pokémon TCGs. Just as Polymarket made niche prediction markets widely accessible, these platforms could revolutionize the trading of Pokémon cards—and other collectibles.

3️⃣ Sora Ventures Launches Asia’s First Bitcoin Treasury Fund

Erik

During Taipei Blockchain Week, Sora Ventures announced the launch of Asia’s first Bitcoin Treasury Fund. The Taiwanese investment firm, focused on the institutional adoption of Bitcoin, revealed that it had already secured commitments totaling $200 million from regional partners and investors. Their goal? To purchase $1 billion worth of Bitcoin within six months. The company made this announcement in a press release to Bitcoin Magazine.

Announcing Asia’s first $1 billion bitcoin treasury fund!! https://t.co/BZp6Buq3LX

— Jason Fang (@JasonSoraVC) September 5, 2025

The Sora Ventures fund will serve as a central pool of institutional capital meant to support existing treasury companies and help establish new ones.

Sora Ventures is quickly emerging as a major force driving institutional Bitcoin adoption in Asia. In 2024, the company invested in Metaplanet, Japan’s first Bitcoin reserve firm. In 2025, it acquired Sora Moon Inc. in Hong Kong and DV8 in Thailand, and it partnered for the acquisition of BitPlanet in South Korea.

Is Asia Catching Up?

Just as Metaplanet once did with MicroStrategy, it appears that Asia is about to follow the example set by the United States. Sora’s fund is an effort to rally institutional capital for Bitcoin in Asia—somewhat akin to what the Grayscale Bitcoin Trust achieved in the U.S.—which eventually led to American spot Bitcoin ETFs.

Jason Fang, founder and managing partner of Sora Ventures, stated, “Asia is one of the key markets for blockchain technology and Bitcoin. We observed growing interest in Bitcoin treasuries among institutions in the U.S. and the EU, while initiatives in Asia remain relatively fragmented. It’s unprecedented for institutional money to come together here [...]”

This raises the question of whether Asia is just beginning to catch up or if this is merely an isolated event.

🍟 Snacks

To wrap up, here are some quick bites:

- Longest queue for Ethereum stakers in two years. Over 860,000 ETH—approximately $3.7 billion—is waiting to be locked up for staking. Meanwhile, the queue of parties looking to exit the ecosystem is shrinking, which analysts see as an early sign of decreasing sell pressure. Institutional players are major buyers; together they now hold 4.7 million ETH, over 4% of the total supply.

- Nasdaq tightens oversight on companies raising funds to buy crypto. Public companies aiming to raise capital for this purpose must now first obtain shareholder approval. They must provide regulators with greater transparency and accountability. Companies that fail to comply risk suspension or losing their listing.

- Trump’s World Liberty Financial sidelines partner Justin Sun. The company froze Sun’s wallet after a large transfer of WLFI tokens to an exchange, possibly out of concern that the tokens would be dumped there. Earlier, Sun had invested roughly $75 million in the project—along with, as he claims, his “reputation and trust.” The incident has raised concerns about abuse of power and unreliability within this Trump initiative. There has been no response yet.

- Fireblocks launches its own network for stablecoin payments. The platform, which already processes $200 billion in transactions per month, is introducing a dedicated layer with built-in compliance. With this move, Fireblocks aims to offer a ‘blockchain’ alternative to SWIFT. This follows Circle’s similar initiative earlier this year and underscores the race to integrate stablecoins into global payment networks.

- Galaxy Digital brings its shares on-chain. In collaboration with Superstate, Mike Novogratz’s company is enabling the tokenization of its SEC-registered GLXY shares on Solana. According to Novogratz, this marks the first time a publicly traded company has put its actual shares directly on-chain, rather than derivative tokens that merely track the price. Superstate CEO Robert Leshner says the shareholder registry is automatically updated after each token transaction—an “enormous upgrade” for the stock market.

- DeFi experiences its strongest quarter in years. The total value locked in protocols surged 41% in Q3 to $160 billion—the highest level since 2022. Ethereum nearly doubled its TVL to $96.5 billion, and Solana grew 30% to $13 billion. The surge is not surprising. During the same period, the value of Ether, which often serves as collateral, increased by more than 80%, fueling even more trading and lending activity. Some analysts view clearer regulations in the U.S. as a supporting factor.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!