If Only I’d Bought More

From 1847’s rare Mauritius stamps to bitcoin soaring above $100K, history repeats itself. What fuels our obsession with scarcity? Are governments now eyeing bitcoin as a strategic reserve? Dive in to explore the timeless allure of rarity and the modern rush for digital gold.

In September 1847, Mauritius, then a British colony, issued its first postage stamps. Acting on a request that originated with Lady Elizabeth Gomm, wife of Governor Sir William Maynard Gomm, the local postmaster commissioned engraver Joseph Osmond Barnard. Working on a single copper plate that carried both images, Barnard produced two intaglio designs: an orange‑red one‑penny stamp for inland letters and a deep‑blue two‑pence stamp for correspondence to Britain and other overseas destinations. Exactly 500 of each value were printed. Both stamps bear the inscription “POST OFFICE” on the left frame — a wording replaced by “POST PAID” in 1848 and the reason why the 1847 pair ranks among the most celebrated rarities in world philately.

Only 500 copies of each color were printed. One day before the official launch, Lady Elizabeth, the governor’s wife, had already used a few of the red stamps to send invitations for a masquerade ball at Government House. Those invitations, now known as Ball Covers, would be worth millions more than a century later.

Initially, the stamps attracted little attention. Subsequent print runs followed, with one subtle difference: they bore “Post Paid” instead of “Post Office.” The original stamps were soon forgotten. It wasn’t until the 1860s that they were rediscovered in old correspondence. What was first assumed to be a misprint—“Post Office” being a mistake—turned out to be a deliberate engraving.

Over the ensuing decades, individual specimens occasionally resurfaced, often by chance. The “Bordeaux Letter,” sent in 1847 and only discovered in 1902 by a French schoolboy in a box of old paper, became legendary. In 1993, it was auctioned for more than 6 million Swiss francs, and in 2021, a Ball Cover sold for 8.1 million euros. Of the original thousand stamps, only 27 are known to exist today.

The Post Office stamps became the ultimate symbol of rarity. At the time, collectors embarked on a full-fledged hunt. Owning one conferred significant prestige. The Belgian philatelist Jean-Baptiste Moens even compiled a comprehensive catalog documenting the provenance of every known specimen, numbering them from I to XIX. Collectors scoured markets, bazaars, and archives, hoping to stumble upon a forgotten stamp. These stamps became a coveted item—an object of desire in the rapidly growing world of stamp collecting. Later, many would lament, “If only I had bought a few more back then.”

Anyone opening their wallet today and seeing bitcoin trading above $100,000 might feel a similar twinge. You own bitcoin, sure. But… is it enough?

I’m getting that perennial feeling again —

— Hunter Horsley (@HHorsley) May 10, 2025

I might not own enough Bitcoin.

It isn’t an irrational thought. Many only truly comprehend bitcoin when the world starts reacting to it—when prices soar, when CNBC highlights it, when your brother-in-law suddenly can’t stop talking about it. Then the doubt creeps in: Others have more. Others were smarter. Shouldn’t I jump in now?

This feeling isn’t new. Stamp collectors experienced it as early as 1864. Art collectors, gold prospectors, stock investors—everyone who has ever owned something rare and then watched its value skyrocket knows it. It isn’t the lack of ownership that stings, but the craving for more.

Recognize that feeling. It’s part of the game. In bull markets, you can feel impoverished even as your net worth grows. That vulnerability is precisely what makes it dangerous. Greed leads to foolish mistakes faster than fear.

So be cautious. Soon, financial influencers will be talking about “god candles” and setting price targets of $500,000 again, and it might be tempting to stray from your plan. But that, exactly, is the moment to hold on!

More Alpha

Are you Plus member? Then we continue with the following topics:

- Record number of payments in stablecoins

- Is Revolut putting Lightning back on the map?

- The state as a bitcoin investor

1️⃣ Record Number of Payments in Stablecoins

Erik

Stablecoins might not be as thrilling as emerging narratives like AI or cutting-edge technologies such as zero-knowledge proofs in the crypto space, but crypto dollars have been a primary use case since around 2020. The market continues to grow, as evidenced by various new figures and news stories.

According to VanEck, the volume of stablecoin payments in April was remarkably high, despite the overall subdued state of the crypto market. Compared to March 2025, payment volume increased by 11%, setting a new all-time high.

What are people talking about when they say blockchain has not found product market fit.

— Dan Tapiero (@DTAPCAP) May 11, 2025

Looks like $1.7T of stablecoins were transferred last month.

Can digital stables fully replace paper fiat?

Most of these are on eth too.

Data so clear here....and was 0!..just 5yrs ago. pic.twitter.com/tcnYFoGaj6

What explains the growth of stablecoins?

First, stablecoins in the U.S. have recently benefited from a more favorable regulatory climate since the Trump era. In a recent report from the U.S. Department of the Treasury, a remark was made that would have been unthinkable just four years ago:

“A combination of the rapid growth of stablecoins and market volatility could lead to a significantly higher demand for or supply of government bonds, with a potential additional demand of around $900 billion in government loans.”

One reason the U.S. government sees promise in stablecoins is that they allow for more efficient global absorption of dollars. Americans can always use additional buyers for new government debt. Companies issuing stablecoins purchase government bonds as collateral for their tokens, earning interest as part of their profit model.

USDt brings stable demand for Treasuries https://t.co/pnpvEEVHyT

— Paolo Ardoino 🤖 (@paoloardoino) May 7, 2025

Major Players Are Embracing Stablecoins

Another sign that stablecoins are breaking through is that in April and May major payment providers such as Stripe, Visa, Mastercard, and PayPal have taken steps to integrate this form of cryptocurrency. Consider the following:

- Circle, the issuer of USDC, has applied for a stock market listing. Their bold move indicates that the climate is no longer hostile and that they expect to raise a substantial sum. In collaboration with banks, Circle is also developing its own stablecoin payment network as an alternative to SWIFT.

- We recently reported that Stripe, one of the world’s largest payment providers, is expanding the possibilities for stablecoin payments to markets outside the United States and the EU.

- Meanwhile, Coinbase is introducing x402: a new standard for API and AI transactions using stablecoins. The protocol is designed for fast, automated payments outside traditional networks.

- Both Visa and Mastercard are eager not to miss out. Visa has invested in stablecoin infrastructure called BVNK, while Mastercard is set to support stablecoin payments in collaboration with Circle and Paxos.

- PayPal is offering American users a 3.7% interest rate on their PYUSD balance, its own stablecoin, starting in 2025.

Also, Coinbase—a major publicly traded crypto company in the U.S.—has good news regarding its stablecoin activities. In April 2025, revenue from stablecoins jumped 32% compared to the previous quarter, reaching $297.5 million. This isn’t surprising given that the broader market lagged a bit during that period.

The takeaway? Stablecoins are increasingly seen as an efficient, reliable, and user-friendly form of government money. This offers the U.S. a chance to gain an edge in this area without resorting to digital central bank money.

2️⃣ Is Revolut Putting Lightning Back on the Map?

Peter

Imagine this: sending a payment from London to Lagos—from euros to dollars or satoshis to satoshis—within seconds, 24/7, with virtually no transaction fees. It sounds futuristic, but Revolut appears to be betting on it.

The fintech giant, with more than 52 million customers worldwide, has announced its integration with the Lightning Network. The company is partnering with Lightspark—the venture of former PayPal executive David Marcus. In doing so, Revolut is tapping into what Lightspark calls the “Money Grid,” a new decentralized layer for real-time global payments.

Welcome to the Money Grid, @RevolutApp.

— Lightspark (@lightspark) May 7, 2025

We’re just getting started ⚡️

So it’s not just about fast bitcoin payments. At the end of 2023, Lightspark launched the Universal Money Address (UMA) protocol—an open standard that can be seen as the IBAN of the future: a simple address like peter@revolut.com that lets you receive money 24/7 in the currency of your choice, while the Lightning Network handles the transaction under the hood.

Traditional banks still cling to protocols like SWIFT and SEPA, but Revolut is building a fast, cost-effective payment network alongside them. If this network catches on, it’s a strategically smart move—the first major players to establish themselves in this open, global ecosystem will benefit from strong network effects.

It also puts pressure on others. Imagine if you could soon pay from a Strike wallet to a Revolut user, or vice versa, without expensive intermediaries. Traditional banks would have to compete with an infrastructure that’s faster, cheaper, and more open.

On the heels of Revolut, by end of Q3, @lightspark will welcome dozens of digital banks and wallets to the Money Grid enabling 100s of millions of users to send/receive payments 24/7 in realtime at a low cost (Bitcoin powered). Who do you want us to try adding? Name 🎯s for us!

— David Marcus (@davidmarcus) May 9, 2025

Of course, this is still in its early stages. The feature is being rolled out gradually—currently only in the UK and a few EEA countries—and the full launch date is still unknown. However, choosing Lightspark suggests this isn’t a mere test. Revolut is committed to scalability, compliance, and ease of use—no need to manage a node, open a channel, or wrestle with a complex interface. Just a fast, seamless payment, as you’re used to.

Whether Lightning will finally catch on remains to be seen, depending on who follows. But one thing’s for sure—other banks are taking notice too. The Lightning Network is definitely back on the map!

3️⃣ The State as a Bitcoin Investor

Peter

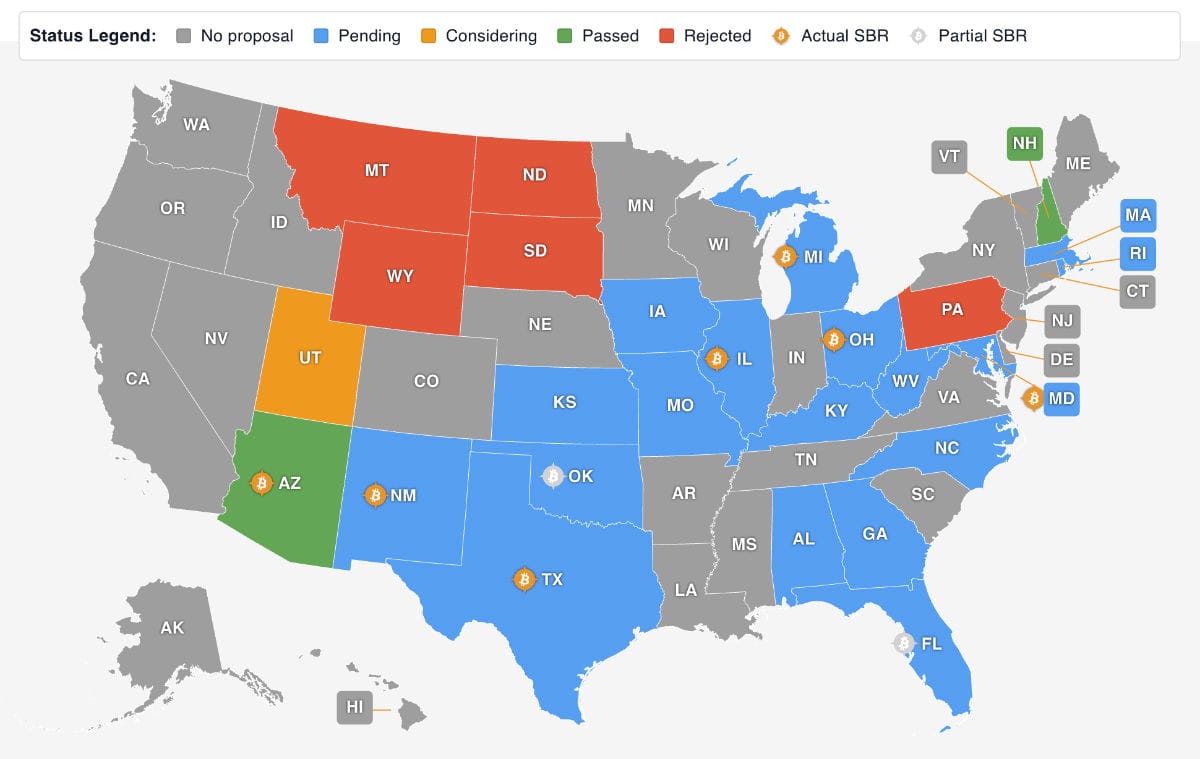

One by one, they are lining up. First New Hampshire, then Arizona. And when you add up similar proposals in other states, there are now eighteen U.S. states considering the establishment of a strategic bitcoin reserve.

New Hampshire is kicking things off in early May. In that state, no more than 5% of the public fund may be invested in digital assets, provided those assets have a minimum market value of $500 billion. For now, that effectively means only bitcoin. The law has been signed and will take effect within sixty days.

STRATEGIC BITCOIN RESERVE IS LAW! pic.twitter.com/30zXx9srfJ

— Dennis Porter (@Dennis_Porter_) May 6, 2025

Arizona is also introducing a strategic reserve, though with a slightly different approach. An earlier proposal that would have allowed the state to actively purchase bitcoin was scrapped by governor Katie Hobbs as too risky. Instead, a milder alternative was adopted: the state may serve as an asset manager for unclaimed cryptocurrencies, using the generated profits to bolster its own bitcoin treasury.

This is a subtle yet significant trend. While former President Trump has so far been all talk and grand promises, individual states are now taking concrete steps—sometimes cautiously, sometimes boldly. According to estimates by VanEck, the proposals across these eighteen states could funnel in as much as $23 billion in inflows, which translates to roughly 220,000 bitcoin.

It’s not a done deal yet, but it’s very telling. Bitcoin was originally conceived as money independent of government control. Now, governments themselves are eager to hold bitcoin—as a reserve, a hedge, a strategic asset. Not because they studied the whitepaper, but because they’re witnessing what’s happening to their dollars.

Perhaps the greatest irony of all: bitcoin was created as an escape from state power, and now states are turning to it as protection against that very power. At this pace, it wouldn’t be surprising if the next major buyer of bitcoin isn’t a publicly traded company, but the state of Texas.

🍟 Snacks

To wrap up, here are a few quick updates:

- More and more companies are adding bitcoin to their balance sheets as a strategic reserve. From Metaplanet and Semler Scientific to the rebranded Strategy, the corporate bitcoin movement is gaining momentum. Asset manager Strive is transforming itself into a bitcoin company, David Bailey (BTC Inc.) raised $300 million for a new investment vehicle, and Bernstein analysts expect $330 billion in inflows over the coming years. Even the earnings call for Strategy drew more than 150,000 viewers—an unprecedented number. Boardrooms are sniffing out digital gold.

- Ether (ETH) shines during a week of rising prices. Ether enjoyed its best week relative to bitcoin since May 2024, with its price surging about 30% to roughly $2,500. This rally is attributed to several factors, including institutional interest, the recent Pectra upgrade, and overall positive market developments. Some analysts also suggest that thin order books—meaning a lack of liquidity—are fueling the price surge. The market is rising, but remains cautious.

- The U.S. stablecoin law is suddenly on shaky ground. What Bitwise-CIO Matt Hougan once saw as a slam dunk is now at risk. Senate Democrats are turning against the GENIUS Act, fearing overly lenient AML rules and expressing concerns over Trump’s personal involvement in crypto. The fact that Trump’s own stablecoin—launched via World Liberty Financial—is being used to invest $2 billion in Binance only adds to the skepticism. Time is of the essence, as the deadline for this proposal is in August.

- Coinbase is acquiring Deribit for $2.9 billion. This move will instantly position the company as the market leader in crypto options trading. The deal—partially in cash and partially in shares—is the largest acquisition ever in the crypto sector. With this acquisition, Coinbase brings together spot trading with futures, perpetuals, and options trading under one roof. Notably, on the same day as the announcement, Coinbase also released weak quarterly figures, showing that operational costs were up 51% compared to a year earlier.

- Fintech Superstate launches its RWA-platform, Opening Bell. Through this platform, public and private companies can issue shares on blockchain networks. Superstate aims to modernize capital markets using public networks like Ethereum and Solana. Coincidentally, on the same day, SEC Commissioner Hester Peirce hinted at an exemption for such applications, suggesting that technology and policy might finally be aligning.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!