From Bathroom to the Stock Exchange

Prediction Market Polymarket Evolves from a Quirky Startup into a Wall Street Phenomenon as the NYSE Owner Invests Up to $2 Billion—Prediction Markets Are Coming of Age!

In 2020, Shayne Coplan found himself working from his bathroom—not for a quick visit to the toilet or a shower, but out of sheer necessity. His apartment was too cramped, his funds were depleted, and the startup he worked on day and night hadn’t earned a single cent yet. Years later, on X (formerly Twitter), he wrote:

2020, running out of money, solo founder, HQ in my makeshift bathroom office. little did I know Polymarket was going to change the world. pic.twitter.com/TktiCXQgXr

— Shayne Coplan 🦅 (@shayne_coplan) November 6, 2024

Five years later, Polymarket is valued at over $8 billion. This week, it was announced that the owner of the New York Stock Exchange—Intercontinental Exchange, or ICE for short—is investing up to $2 billion in the company. What began as an obscure crypto app for betting on elections, sports, and news has evolved into a major player in the financial world. The guy who once worked from his bathroom now holds a seat at the Wall Street table.

More importantly, the prediction market itself has matured.

When Coplan founded Polymarket, his concept wasn’t entirely new. Nearly 25 years ago, the U.S. Department of Defense attempted to predict where a war might break out through the FutureMAP project. The idea was that markets driven by financial incentives could forecast outcomes better than experts or models. Public outcry was swift—even accusations of “betting on terrorism!”—and the project was shut down within a week.

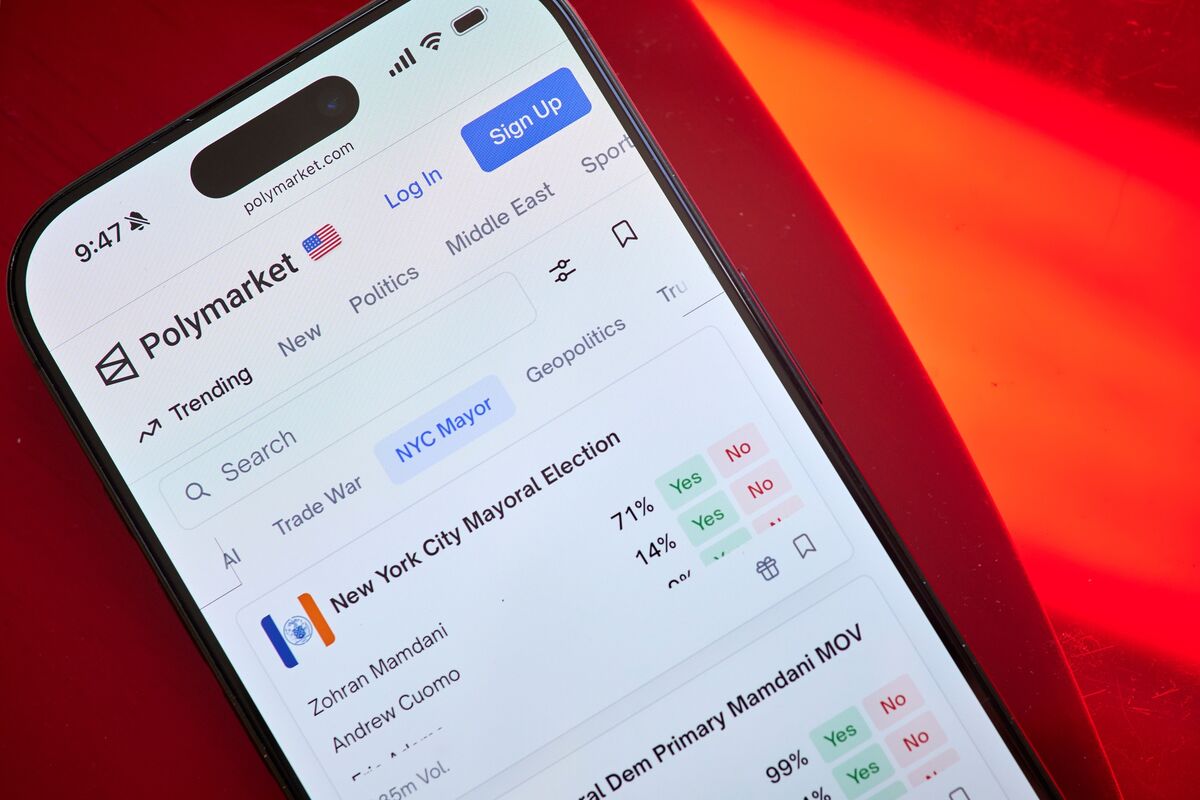

Polymarket applied that same principle, but with a modern twist. The platform runs on the Polygon blockchain network and lets users bet on the outcomes of various events—typically straightforward questions like “Will Trump win the elections?”, “Will there be an ether ETF this year?” or “Will inflation remain below 3%?” Every transaction is essentially a vote on the likelihood of an outcome, resulting in a real-time barometer of the future that is based on money rather than mere opinions.

In 2022, Polymarket was fined by the U.S. regulator, the CFTC, for offering “event contracts” without a proper license. Coplan cooperated with the investigation, reached a settlement, and subsequently halted U.S. operations. That might have been the end of the story—but instead, the platform experienced explosive growth outside the U.S., especially during the 2024 U.S. elections.

In 2025, Polymarket returned to U.S. soil by acquiring a CFTC-licensed exchange. With that legal hurdle cleared, the platform was finally allowed to operate legally. And then... ICE entered the picture.

Why would the owner of the world’s largest stock exchange invest heavily in a platform known for betting on sometimes sensitive political outcomes?

First, there’s the data. Polymarket creates a new category of market information by showing what investors currently expect, rather than what they think in hindsight. ICE plans to market that data to institutional clients worldwide. As CEO Jeffrey Sprecher put it, “There are opportunities in markets that ICE, together with Polymarket, can uniquely serve.”

A second reason is innovation. Although ICE is one of the largest data providers in the world, it recognizes that financial infrastructure is evolving. Its partnership with Polymarket is part of a broader strategy to bridge the gap to the world of real-world assets. By investing in Polymarket, ICE isn’t just acquiring a platform—it’s gaining cutting-edge expertise, technology, and access to a dynamic audience.

And third, there’s legitimacy. ICE is transforming Polymarket from a fringe crypto project into part of the financial mainstream. This endorsement paves the way for its integration into other markets—from election models to economic indicators—and could create new revenue streams for the NYSE owner.

Michael Arrington, the founder of TechCrunch and an early investor in Polymarket, responded to Coplan’s bathroom photo as follows:

It’s not just a fantastic product, it’s a public good. In the sense that it provides real utility to the public whether you place bets or not.

— Michael Arrington 🏴☠️ (@arrington) November 6, 2024

Arrington calls the platform a “public good,” which gets to the heart of the matter. Prediction markets don’t create news—they measure it. By using financial incentives to reward accuracy, those who predict correctly profit, while ideologically driven bets fall short. In doing so, they offer a rare, unfiltered signal in an era swamped by opinions but short on facts.

Of course, this model isn’t without its risks and criticisms. There are legitimate concerns about privacy and market manipulation. Still, the potential is enormous: using markets as tools to forecast the future, where efficiency matters more than an absolute claim to truth.

And Shayne Coplan? He now watches as his bathroom-born idea grows into a venture that even the New York Stock Exchange is eager to invest in.

The prediction market has truly matured.

More Alpha

Are you Plus Member? Then we’ll move on to the following topics:

- Biggest altcoin crash in years

- Morgan Stanley opens the door for bitcoin

- Tax relief for American bitcoin companies