Bitcoin: Where It All Begins

Crypto is no bubble—it’s a mirror reflecting lost trust and shifting necessities. India leads global crypto adoption, with bitcoin as the unmistakable gateway. Are we witnessing the dawn of finance reimagined?

Crypto. A word that has come to represent many things. But if you look closely, you won't see mere hype or bubbles—you see a mirror.

A mirror that reveals where trust is missing, where money is losing its value, where young people with smartphones are looking beyond their national currency, and where institutions are finally recognizing that this may not be just a passing phase.

That feeling washes over you when you read the new Chainalysis report. Each year, they chart where crypto is most actively used—not by counting who owns the most, but by measuring who puts it to work: in stores for counter payments, through saving or investing, on centralized platforms, and via DeFi.

This year, the mirror reflects back with a surprisingly clear view.

India ranks number one—not only in overall usage but in every category: retail, institutional, DeFi, and traditional exchanges. No other country comes even close. The United States takes second place, primarily due to a massive influx of institutional investment. That wave gained momentum after BlackRock’s and Fidelity’s exchange funds were approved in January 2024.

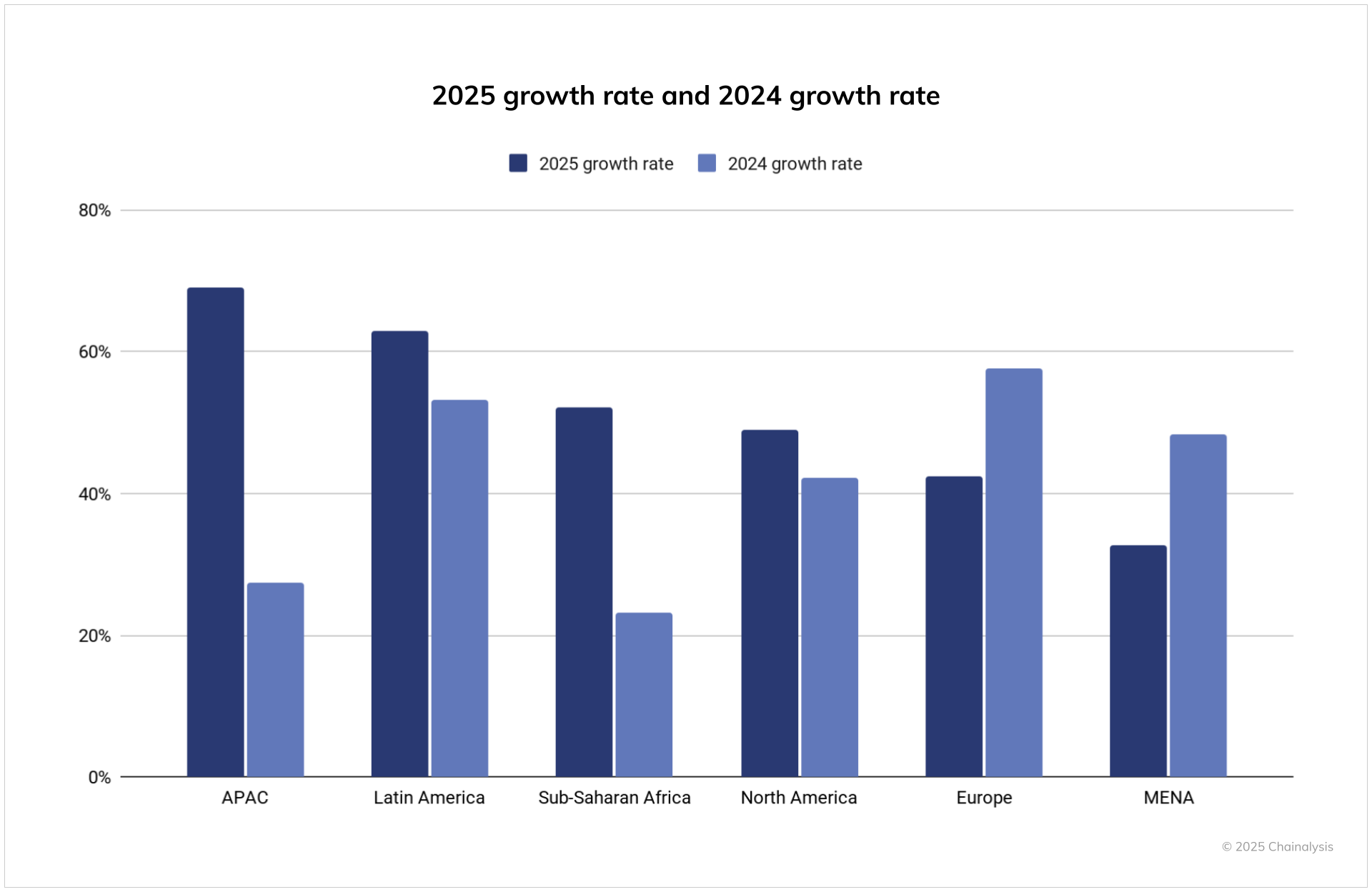

More significant than the ranking itself is the underlying trend. In Asia, crypto usage grew by 69% compared to last year. In Latin America, it increased by 63%. Sub-Saharan Africa, despite its fragile infrastructure, saw a 52% growth—not driven by speculation, but by remittances and everyday use. Although growth in Europe and the Middle East has slowed somewhat compared to the previous year, double-digit increases still persist.

Looking closely, a pattern emerges: in wealthy countries, growth is driven by regulations and investment products, whereas in poorer countries it arises out of necessity—and these two trends are now converging.

It remains unclear exactly how a country's absolute population—India being the largest with nearly 1.5 billion—is factored into the ranking. That weighting matters, because if Chainalysis adjusts the figures for population size, the picture changes dramatically. Ukraine, Moldova, and Georgia then leap to the forefront. In those regions, daily life is shaped not by tech giants or financial centers but by war, inflation, and a deep distrust of banks. Here, crypto is not a mere novelty but a vital survival mechanism; Chainalysis describes it as “real grassroots traction.”

It is also worth noting that Chainalysis has made some methodological adjustments. The “retail DeFi” subcategory has been scrapped for being too niche and not representative enough. In its place, “institutional use” has been added. Transactions exceeding $1 million now count, underscoring the ongoing shift as major players—from hedge funds to asset managers—strategically move toward the on-chain economy.

Meanwhile, the landscape surrounding stablecoins is changing rapidly. USDT and USDC remain dominant, each with over a trillion dollars in monthly volume. Smaller stablecoins like EURC have experienced rapid growth, up 89% month-over-month. And adoption isn’t coming solely from crypto platforms—Visa, Mastercard, and Stripe are integrating stablecoins into their infrastructures. Circle and Paxos are striking deals with payment providers, and traditional banks such as Citi and Bank of America are unveiling their own projects.

Yet one observation stands out above all else.

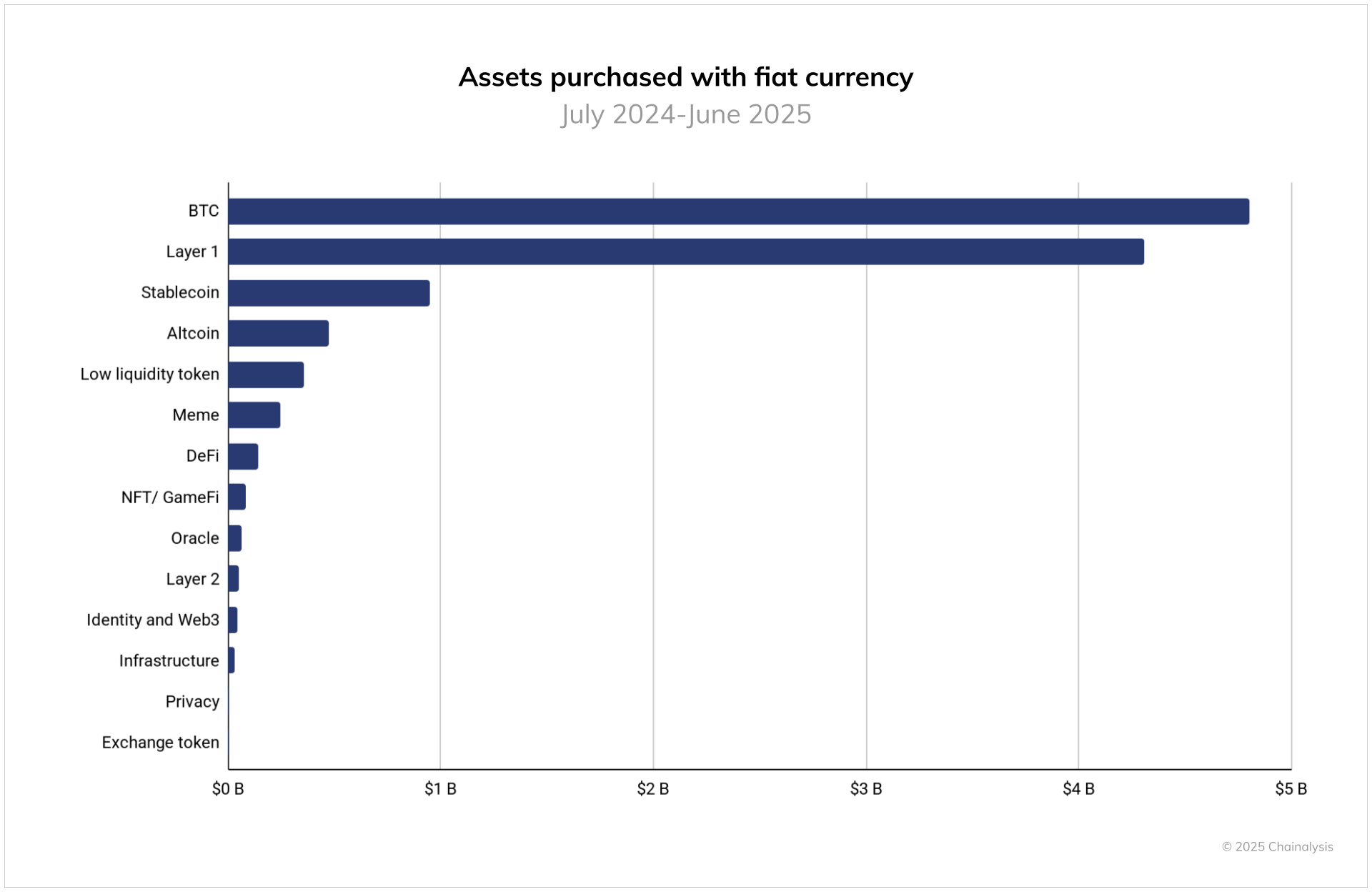

Chainalysis also looked into how people take their first step. When someone deposits euros or dollars, what is the first purchase they make?

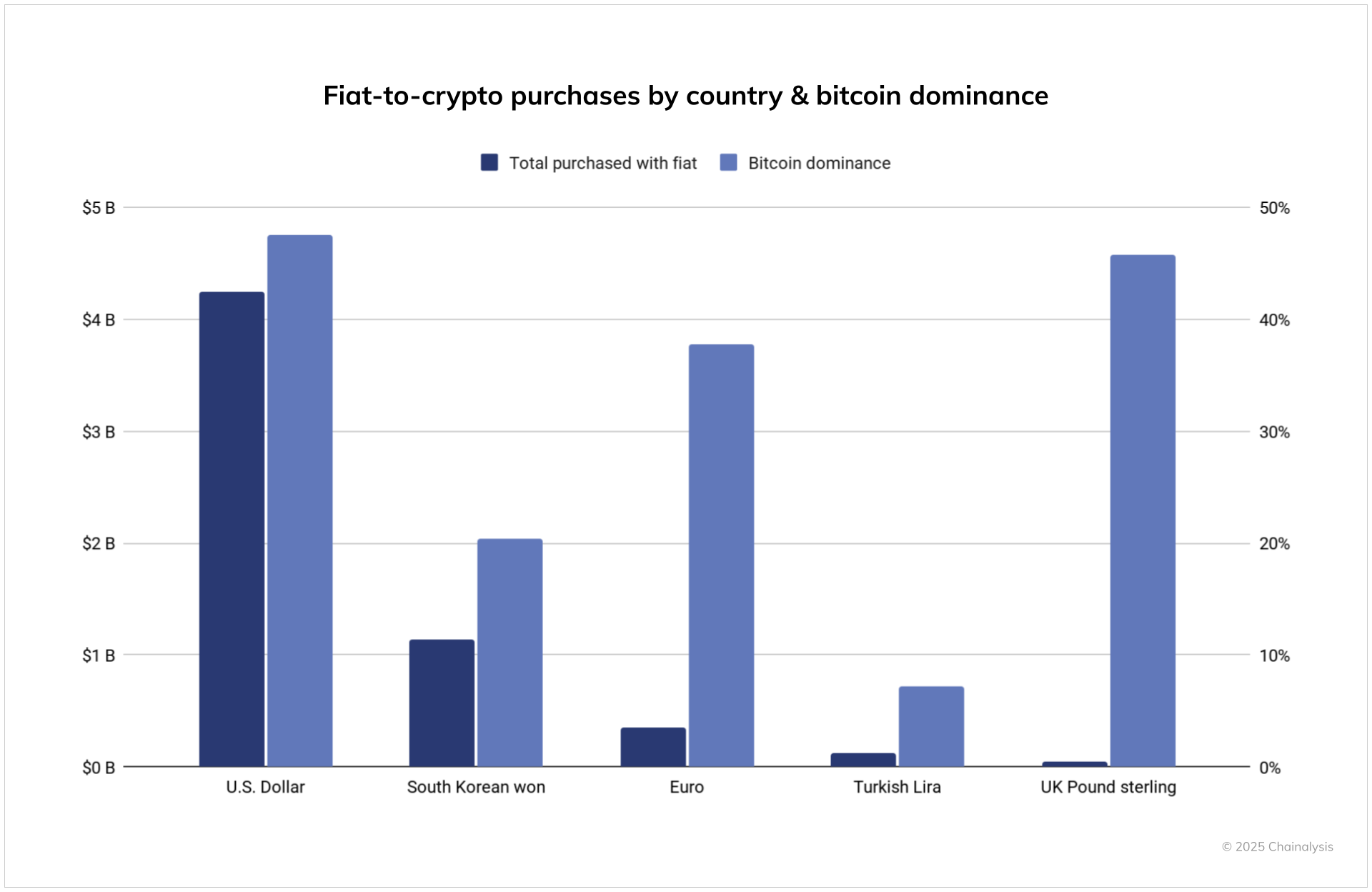

The answer is clear: bitcoin. In total, $4.6 trillion in fiat flowed directly into BTC—twice as much as what went into other network-related coins like Solana or Avalanche, and far more than into stablecoins or DeFi tokens. In Europe, nearly half of all inflows go straight to bitcoin. In South Korea, although there is significant altcoin activity, BTC remains the starting point.

You can view that either as a statistic or as a signal. Despite all the innovation, hype, and speculation, bitcoin still serves as the gateway into the crypto world for millions of people.

Not hype, just the starting point.

More Alpha

Are you Plus member? Let's dive into these topics:

- Robinhood added to the S&P 500, Strategy must wait

- Nepalese youth protesters use decentralized technology

- Tokenization gains momentum

1️⃣ Robinhood added to the S&P 500, Strategy must wait

Erik

Starting today, the renowned fintech Robinhood is being added to the American stock index S&P 500. Robinhood customers can trade stocks, options, ETFs, and crypto. The company grew famous through its commission-free trading model. Yet it continues to innovate: it recently launched a blockchain version of a stock exchange that allows customers in the EU to trade tokenized American stocks around the clock.

Robinhood’s stock soared after the announcement that it would secure a spot in this prestigious index—a move that makes sense since investors tracking the index, such as pension funds, will automatically buy the stock.

About the S&P 500

The S&P 500 is “the sun around which everything revolves” in the world of stock indices. It is the most important benchmark of the American stock market. While the Dow Jones index boasts a longer history, it includes only 30 stocks. And Nasdaq? With its focus primarily on technology companies, it represents only a limited segment of the market.

The S&P 500 isn’t just a list of the 500 largest companies, though there is significant overlap. It is compiled based on clear admission rules and the judgment of a committee of roughly eight members. The five main criteria are:

- The company must be based in the US.

- The company must be listed on a major American stock exchange.

- The market capitalization must exceed the current threshold of $15.8 billion.

- At least 50% of the shares must be freely tradable.

- The company must be profitable for four consecutive quarters.

Only then does the committee decide—which you can glimpse in this Bloomberg podcast episode—which companies are ultimately included, taking into account factors like stability and market risk.

These more qualitative factors can result in a company being excluded even if it meets the quantitative criteria. This happened, for example, with Tesla in 2020, which was initially rejected (though it was later included). The committee may have had reservations about Tesla’s high stock volatility. In the past, there was even a one-year delay before newly listed companies were admitted—affecting Google, Amazon, and Facebook.

Strategy at the Reserve Bank

The committee is notably cautious and sometimes prefers a wait-and-see approach. For instance, if a takeover is underway, the group tends to postpone its decision—perhaps to avoid having to remove a stock shortly after its inclusion.

For Michael Saylor’s Strategy, it was a setback not to be added alongside Robinhood, even though it meets the formal criteria. While the committee did not elaborate on its decision, some analysts believe it signals that the committee remains cautious about Bitcoin treasury companies. Volatility, no doubt, will be a concern.

Why wasn't $MSTR allowed into the S&P 500 Index despite meeting all the criteria? Because the 'Committee' said no. You have to realize SPX is essentially an active fund run by a secret committee. We intv'd the dude who used to run this committee on Trillions. Check it out. pic.twitter.com/w334JrX9VO

— Eric Balchunas (@EricBalchunas) September 5, 2025

On the other hand, it’s quite possible that—just as Tesla was eventually added—Strategy could still be included in the coming months or years, provided it continues to meet the criteria. This would be positive for Strategy, as inclusion in the S&P could boost its stock price, providing a means for it to acquire more BTC.

2️⃣ Nepalese Youth Protesters Use Decentralized Technology

Erik

On Tuesday, September 9, a wave of protests in Nepal led to the resignation of Prime Minister Oli. The so-called Gen Z protests combined street demonstrations with the use of decentralized technology. During the unrest, the parliament building was set on fire, and 72 people lost their lives. Protesters utilized both decentralized chat apps and crypto to mobilize.

The protests erupted on September 8 after popular social media platforms—including Facebook, Instagram, and WhatsApp—were temporarily blocked by the government in an effort to curb the spread of anti-government rhetoric.

The resulting discontent, especially among the youth, compounded existing frustrations over corruption and limited job opportunities. It all began with a social media campaign demanding an answer to a simple question: How is it that 20% of Nepalis live in poverty while the children of parliamentarians enjoy luxury?

The Role of Crypto and Bitchat

In Nepal, crypto is completely banned. Nevertheless, protesters easily used stablecoins like USDT to bypass government restrictions. To avoid the risk of frozen bank accounts, they transferred stablecoins to each other via decentralized exchanges. One student told The Street that his cousin in Dubai had sent him bitcoin.

Alternative chat apps were also employed, including Bitchat, a peer-to-peer messaging app developed by Twitter founder Jack Dorsey.

On Bitchat, which has only been in beta since July, users don't need to create an account, allowing them to communicate anonymously without the internet. How is that possible? A local network is established via Bluetooth. Although each participant’s range is limited to 300 meters, with many users connected, the network can still cover a large area. During the protests, Bitchat downloads in Nepal skyrocketed from roughly 3,500 to nearly 49,000 in just a few days. A similar surge was observed in Indonesia—the protests there served as inspiration for those in Nepal.

Last week, we observed a sudden spike in bitchat downloads from Indonesia during nationwide protests.

— calle (@callebtc) September 10, 2025

Today we're seeing an even bigger spike from Nepal during youth protests over government corruption and a social media ban.

Freedom tech is for the people. Please share. pic.twitter.com/IqhRa8eCvw

The remarkable outcome of the uprising? Following the prime minister’s resignation, the army and president decided that the youth should choose a new interim prime minister via an online platform (Discord). A former chief justice emerged as the winner, with elections to follow in spring 2026.

3️⃣ Tokenization Gains Momentum

Peter

Imagine no longer buying a stock, bond, or fund through your bank or broker, but instead receiving it as a token directly in your own wallet via a decentralized network. That's the essence of tokenization: converting traditional financial products into digital tokens that operate on blockchain networks. The underlying value remains unchanged, but the way we manage ownership and trade does.

Why is this so disruptive? Because tokenization removes barriers. Securities can soon be traded 24/7, divided into fractions, and transferred directly between investors—without the delays imposed by traditional clearinghouses. Just as email revolutionized the postal system and Spotify transformed CDs, tokenization could revolutionize financial markets. The core value stays the same, but the process becomes faster, more flexible, and far more accessible.

Until recently, this field was in an experimental phase. Banks and asset managers were cautiously testing its viability. In fact, experiments were even conducted in the Netherlands. For example, ABN AMRO issued a few bonds as tokens on public networks in recent years. These tests were necessary to explore both the technology and the regulatory framework.

Meanwhile, tokenization has emerged as one of the key topics. Just look at what the first two weeks of September brought.

Ondo Finance announced that it will tokenize more than a hundred American stocks and ETFs on Ethereum, allowing investors outside the US to participate as well. Fidelity launched a money market fund on Ethereum totaling over $200 million. Nasdaq has requested permission from US regulators to list tokenized securities directly on its main market. And as if that weren't enough, leaked reports suggest that BlackRock is exploring how to offer its popular ETFs as tokens. This follows the success of their tokenized money market fund, BUIDL, which has already attracted billions.

*BlackRock* is exploring ways to tokenize ETFs...

— Nate Geraci (@NateGeraci) September 11, 2025

World's largest ETF issuer.

via @olgakharif pic.twitter.com/DqaafsmjRc

You see—the momentum is building. In just two weeks, major names from across the financial sector have shown they are taking tokenization seriously. The amounts involved matter, the proposals are concrete, and the ambitions are clearly stated. The pilot phase is over, and the shift toward scalable implementation is unmistakable.

Bank of America reinforces this conclusion. The traditional giant described tokenization this week as “mutual fund 3.0.” It represents the next step in evolution after classic mutual funds and ETFs. Essentially, the bank is saying: this is not a toy, but the future of investing.

Of course, there are still hurdles—regulation, interoperability, trust—but the outlook remains bright!

🍟 Snacks

To wrap up, here are a few quick bites:

- Vietnam launches a five-year crypto pilot with strict conditions. Only domestic companies can offer trading platforms, and all transactions, issuances, and payments must be conducted in Vietnamese dong. Participants must have at least 10 trillion dong in capital (approximately $380 million), with at least 65% coming from institutional investors. Foreign shareholders may own no more than 49%.

- The CFTC is investigating whether foreign crypto exchanges operating under MiCA can access American customers. If Europe’s new regulations are deemed “sufficiently robust,” a company like Bitvavo could, in theory, serve U.S. clients without establishing a separate U.S. entity. This could significantly narrow the gap between global liquidity and American investors—provided the CFTC truly opens the door.

- Kazakhstan’s head of state is fully embracing crypto. President Tokayev is proposing the creation of a strategic crypto reserve through the central bank. Additionally, a “CryptoCity” is planned for Alatau—a fully digital city where residents can pay using crypto. Legislation for digital assets is expected by 2026 at the latest.

- Ledger warns of a supply-chain attack via NPM. Malicious code in popular JavaScript packages stealthily replaced crypto addresses, causing funds to be inadvertently sent to hackers. Although the compromised versions were quickly taken offline, some applications might still be vulnerable. Always verify the address on your hardware wallet before signing a transaction to keep yourself safe.

- Nasdaq wants to trade tokenized securities alongside regular stocks. The exchange has asked the SEC for permission to list stocks and ETFs as on-chain tokens on its main market. If approved, it would be the first time regulated tokenized securities stand side by side with traditional ones in the U.S. However, this potential breakthrough may still be some time away, with a launch possibly coming as early as Q3 2026.

- Tether is launching an American stablecoin called USAT. Unlike USDT, this coin must comply with stricter regulations, including transparent reserves and oversight. Its issuance is being managed through Anchorage Digital Bank. Tether is taking a cautious approach and intends to continue operating under U.S. law. With a Captain America–esque flair, it plans to break into the American market at an as-yet undisclosed time.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!