Bitcoin Takes Home the Nobel Prize

Nobel Peace Prize honors Venezuela's María Corina Machado—a fearless fighter using bitcoin as a lifeline against dictatorship. Could this be the dawn of a crypto-powered revolution for freedom?

The Nobel Peace Prize was awarded this year to María Corina Machado. The 58-year-old Venezuelan politician has been challenging Nicolás Maduro’s regime for over twenty years. In the jury’s report, she is described as “a courageous and determined champion of peace, igniting the flame of democracy amid growing darkness.” Previously, she received the most prestigious human rights award from the European Union.

An excellent and logical choice, considering everything she has endured. Machado has been in hiding for months, survived assassination attempts, sent her three children abroad, and yet refused to flee. She continues to advocate for a peaceful transition to democracy, even while being pursued by the secret service.

BREAKING NEWS

— The Nobel Prize (@NobelPrize) October 10, 2025

The Norwegian Nobel Committee has decided to award the 2025 #NobelPeacePrize to Maria Corina Machado for her tireless work in promoting democratic rights for the people of Venezuela and for her struggle to achieve a just and peaceful transition from dictatorship to… pic.twitter.com/Zgth8KNJk9

However, what is missing from nearly every news report is this: the Nobel Peace Prize is, indirectly, also a recognition of bitcoin.

Machado leads the Venezuelan opposition in a country that has obliterated its own currency. Since 2016, inflation has soared to eight million percent. The bolívar lost fourteen zeros. Where once one bolívar was enough, now a hundred trillion are needed. Even children know that a bag of candy retains its value better than typical savings.

This isn’t due to some economic accident, but to deliberate policy. The regime has weaponized its printing press to maintain power, silence opponents, and confiscate savings. Banks have been turned into state extensions. Accounts of opposition members have been frozen, and campaign funding cut off.

In 2024, Machado stated in an interview with the Human Rights Foundation:

“Our campaign currently has no access to the banking system. We find ourselves isolated but remain determined in our fight for change. […] With bitcoin, we can bypass the government-imposed exchange rates. This helps countless Venezuelans. It has evolved from a humanitarian tool to an essential means of resistance. We are grateful for the lifeline bitcoin provides and look forward to embracing it in a new, democratic Venezuela.”

Machado refers to bitcoin as a “vital means of resistance”. This is not just poetic exaggeration. In a country where every aspect of life is controlled—from the internet to the power grid—an open monetary system becomes a genuine instrument of freedom.

Bitcoin has enabled Venezuelans to safeguard their savings, provide for their families, and even escape the country. Moreover, it has empowered Machado’s movement, allowing a campaign without a traditional bank account to still receive and spend funds through the bitcoin network.

The Nobel Committee lauded her persistence in staying in Venezuela. What wasn’t stated outright, but can be inferred, is that her ability to remain was partly thanks to bitcoin.

It is almost ironic that Donald Trump, who once openly coveted the Nobel Prize, ended up with a different kind of honor. While he boasted about peace accords, the true prize for peace was claimed by someone who defends peace without an army, money, or conventional weapons—only conviction and perhaps a little help from Satoshi Nakamoto.

Machado accepted the award in an undisclosed safe house somewhere in Caracas. According to a Nobel Committee member, she remarked upon hearing the news: “This is an award for the entire movement.”

“Oh my god… I have no words.”

— The Nobel Prize (@NobelPrize) October 10, 2025

Watch the emotional moment when this year’s laureate, Maria Corina Machado, learns she has been awarded the Nobel Peace Prize.

Kristian Berg Harpviken, Director of the Norwegian Nobel Institute, shared the news with her directly before it was… pic.twitter.com/OCUpNz752k

Perhaps her words were spot on.

Deep down, however, this award also symbolizes the idea that money should not be in the hands of those in power. It honors technology that enables freedom and everyone who believes that true peace cannot exist without financial independence. In other words:

Bitcoin wins the Nobel Prize. The Nobel Prize for Freedom Technology.

More Alpha

Are you Plus member? Then we'll move on to the following topics:

- Polymarket confirms the arrival of the POLY token

- The dollar as a lifeline

- JPMorgan deems BTC and ETH as worthy collateral

1️⃣ Polymarket confirms the arrival of the POLY token

Erik

Polymarket, the popular prediction market platform, has announced that it will launch its very own POLY token, along with an airdrop for users. CMO Matthew Modabber revealed this on the Degenz Live podcast. “A token is coming, an airdrop is coming,” Modabber said. Those hoping for an immediate launch will have to wait a bit longer: POLY will debut only after Polymarket officially returns to the U.S. market.

Focus on a regulated return to the US

As mentioned two weeks ago, the founder started developing the idea in his bathroom back in 2020—a venture that grew into Polymarket over the subsequent five years. The company is now valued at $8 billion and recently received a financial injection from the owner of the New York Stock Exchange (ICE), who plans to invest up to $2 billion.

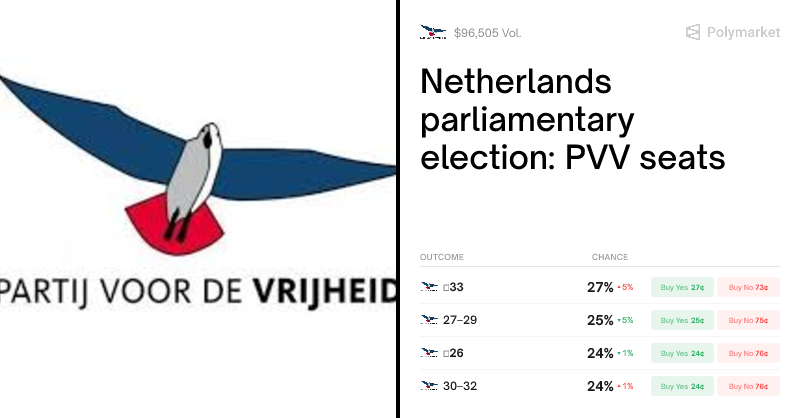

What started as an obscure crypto app for betting on elections and sports has evolved into a blockchain platform seeking regulatory approval from financial authorities. According to ICE, Polymarket is “a public good,” meaning it is valuable even for those who don't want to bet but seek insights into the likelihood of events. For example, in the Dutch parliamentary elections: how many seats will the PVV win?

After a temporary shutdown in the US, the company will officially return to American soil in 2025, armed with a license from the Commodity Futures Trading Commission (CFTC). It secured this license by acquiring QCX for $112 million. In early September, the CFTC announced that it would not take action against the acquisition—a decision that can be seen as a green light: the return to the US now appears imminent.

Airdrop for Active Users

The specifics of the POLY airdrop are still under wraps. Active users of the platform will certainly be rewarded. While the exact tokenomics and intended uses haven’t been disclosed yet, Modabber hinted at a model inspired by Hyperliquid, the perpetuals exchange that, during the launch of HYPE, tried not to overly reward large, professional “airdrop hunters.”

The Trend of ‘Mature’ Token Launches

Polymarket’s announcement comes amid a wider wave of token launches by established industry names. For example, MetaMask, the most popular Ethereum wallet, has also confirmed that it’s working on its own token and airdrop. Like Polymarket, MetaMask is choosing a cautious, regulated path for its launch. Could this signal that short-lived hype might play a smaller role than usual? Time will tell.

2️⃣ The Dollar as a Lifeline

Peter

Tether celebrated a major milestone this week: reaching 500 million USDT users, making it the world’s largest stablecoin. To commemorate this, the company released a short documentary from Kenya that highlights how ordinary people are protecting their money against inflation and currency devaluation.

The film paints a moving, sometimes heartrending picture of everyday life in Nairobi’s slums. With the Kenyan shilling losing value each year, many people have turned to storing their savings in digital dollars. One woman explains how USDT allowed her to save enough to build a small house, while others use it to send money across borders—an often expensive and slow process through traditional banks.

According to Tether, 37% of USDT holders now use the coin as a savings tool because their national currency is too unstable. CEO Paolo Ardoino called it “probably the greatest achievement in financial inclusion in history.” A bold statement, but one that is hard to dispute.

Tether USDT reached officially 500 million users!

— Paolo Ardoino 🤖 (@paoloardoino) October 21, 2025

Likely the biggest financial inclusion achievement in history. https://t.co/jbmnMDwidi

Yet there is an underlying bittersweet note to this success. The documentary celebrates the freedom that USDT brings, but it also hints at a reliance on the dollar. Millions find stability in the symbol of American authority, now digitally packaged by a private issuer.

That very success, however, also tells another story: the craving for better money is universal. If people in Nairobi can store dollars on their phones, then the leap toward truly sovereign digital money is closer than ever. In that sense, Tether is inadvertently laying the groundwork for what bitcoin promises: financial freedom without dependence on any central authority.

3️⃣ JPMorgan Deems BTC and ETH as Worthy Collateral

Erik

JPMorgan Chase, the largest bank in the US, is reportedly planning to allow its institutional clients to use their BTC and ETH as collateral for loans. The bank aims to implement this measure before the end of 2025, Bloomberg reports.

This move builds on previous steps by JPMorgan to accept shares in crypto ETFs as collateral. In the new arrangement, the deposited collateral will be managed by an external custodian, such as Coinbase. Given the high volatility of BTC and ETH, it will be interesting to see how regulators adapt banking rules to accommodate this form of collateral.

JPMorgan to allow its institutional clients to use bitcoin and ether as collateral for loans as crypto continues to get absorbed into Wall Street's plumbing. Nice scoop from @emilyjnicolle and yet another example of Life Moves Pretty Fast pic.twitter.com/ej68sOHm9J

— Eric Balchunas (@EricBalchunas) October 24, 2025

Jamie Dimon's Capitulation

This development is a positive sign for BTC and ETH, as these assets might now serve as collateral—a role traditionally reserved for US Treasuries—which could allow them to capture a small piece of that market.

It also marks a turnaround for JPMorgan CEO Jamie Dimon, who has long been dismissive of crypto. As recently as December 2023, he told a U.S. Senate hearing that if he were in charge, he would shut down the crypto market: “I’ve always been deeply opposed to bitcoin, crypto. [..] If I were the government, I’d close it down.”

Now, JPMorgan—a leading traditional financial institution—recognizes bitcoin as legitimate collateral. This step highlights the gradual blurring of lines between traditional finance and the crypto world.

🍟 Snacks

To wrap up, here are a few quick news bites:

- Crypto suddenly takes center stage in the New York mayoral election. Former governor Andrew Cuomo is running for mayor of New York and is using crypto as his trump card: he promises to transform the city into the “world capital of digital money.” His main rival, Zohran Mamdani, is critical and points to Cuomo’s ties with the OKX exchange. The elections are on November 4. They may not determine crypto’s fate, but they certainly send a signal—after all, New York is home to Wall Street.

- Trump grants clemency to Binance founder CZ. The former Binance executive, convicted of violating U.S. money laundering regulations, has been pardoned by President Trump. According to Trump, this marks the end of the “war on crypto.” Critics call it favoritism, but the symbolism is powerful: the White House is once again opening the door for Binance. It remains unclear if—and how—Binance will return to the U.S. market.

- Aave acquires neobank Stable to bring DeFi to the masses. The acquisition of the fintech company gives Aave access to the technology and talent necessary to offer savings and lending products directly to consumers. With this move, Aave aims to build on its success as a DeFi protocol by providing a user-friendly banking experience for a broader audience. The financial details of the acquisition remain undisclosed.

- a16z calls 2025 the year the world went “on-chain.” In its new State of Crypto report, the venture capitalist envisions a mature sector: over $4 trillion in market capitalization, $46 trillion in stablecoin transactions, and record growth in active wallets engaging in crypto. Major banks are stepping in, and the next wave will come from the convergence of crypto, AI, and tokenization.

- Ant Group takes a step toward crypto with “AntCoin.” The fintech company behind Alipay has registered trademarks in Hong Kong that appear to be related to stablecoins and blockchain services, including AntCoin. These filings seem to be part of preparations for future expansions in digital payments, although regulatory hurdles in China remain a significant challenge. Even Eastern tech giants are turning their attention back to crypto.

- Video platform Rumble introduces bitcoin tipping. The YouTube alternative, popular among independent creators and now boasting over 50 million monthly users, is testing a feature—together with Tether—that will reward video creators with bitcoin. The launch is scheduled for December. Earlier, Tether invested up to $775 million in Rumble, further solidifying their partnership.

Thank you for reading!

To stay informed about the latest market developments and insights, you can follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!