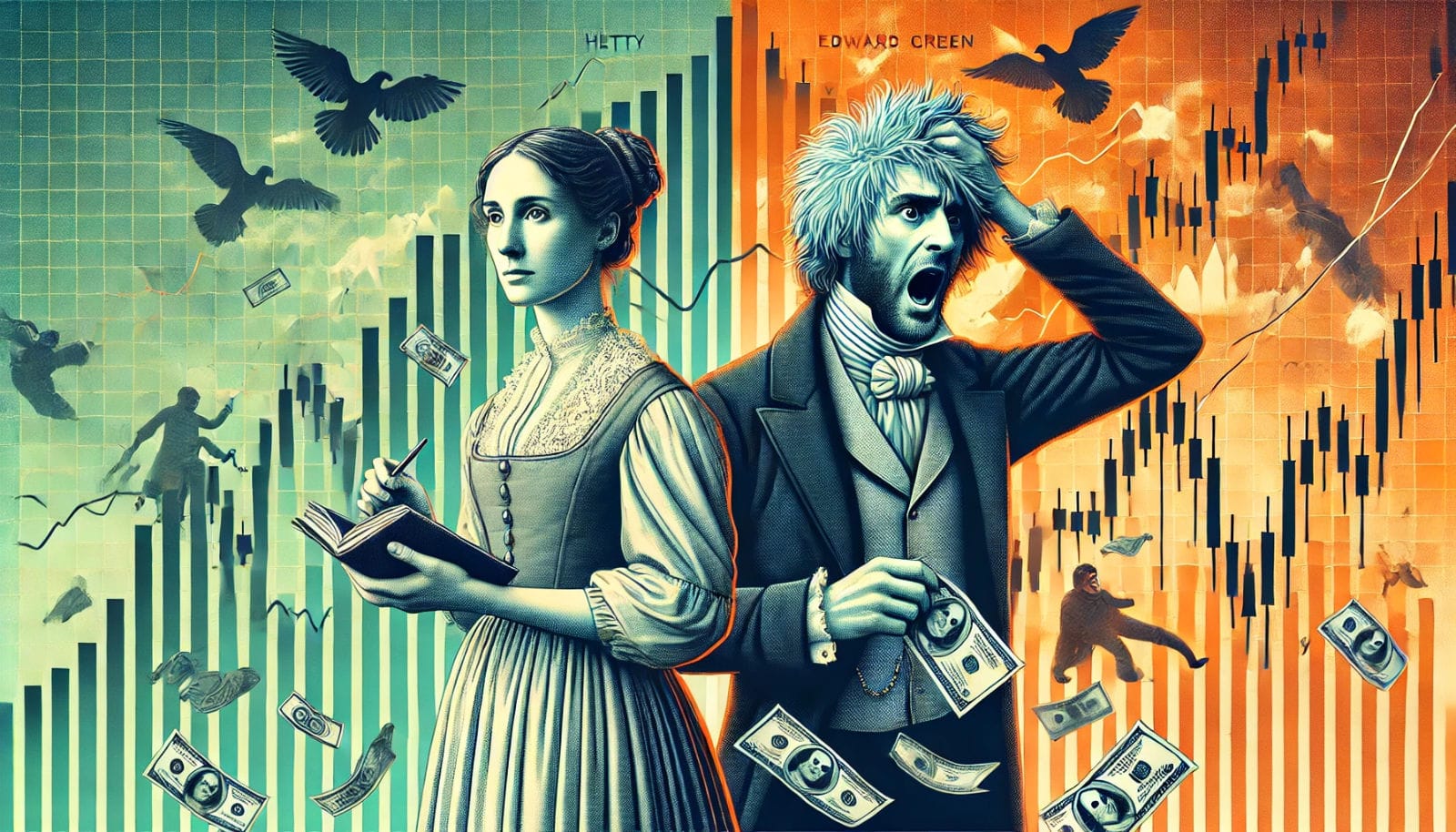

Are You More of an Edward or a Hetty?

The market is in no-man’s land. Are you an impulsive Edward or a cool-headed Hetty? Uncertainty reigns while crypto insiders hint at a potential Bitcoin reserve and sweeping stablecoin changes. Can you weather the storm?

The market feels unsettled. There aren’t any dramatic highs or deep lows, nor is there a clear trend. Prices fluctuate like a ship tossed on turbulent seas with no fixed course. Only a few months ago, investors were celebrating prices doubling, but now the enthusiastic chatter has quieted. A lingering impatience remains. The belief that everything will naturally climb appears to have evaporated. Fear and hope oscillate, but decisive action? Not so much. This is the no-man’s land of the financial markets.

And it is precisely in this quiet uncertainty that the seeds of a new trend are often planted. But to profit later, you need to know who you are during this phase. Are you an Edward or a Hetty?

Let’s start with the story of Hetty Green. You may not have heard of her, but in the financial world of the 19th and early 20th centuries, she was a phenomenon. Her nickname? The Witch of Wall Street. Not exactly complimentary, but she didn’t mind. Hetty was an investor like few others: cool-headed, calculating, and above all, patient. She firmly believed that trading on emotion was a recipe for disaster—no impulsive buys, no panic selling. She was the one who calmly waited until everyone else was frantically offloading their assets at bargain prices. And then, she struck.

Her principles were instilled early on. Growing up in a wealthy Quaker family in New Bedford, Massachusetts, her father—who made millions in whaling—taught her the value of money from a young age. While other children were just learning to read, she was already poring over financial reports. “Panic is the enemy of wealth,” her father might have said, and Hetty listened. That simple truth guided her entire life. When banks and investors teetered on the brink during the Panic of 1907, Hetty was unfazed. She had cash, and that meant power. She lent millions to New York banks on her own terms, preventing many from sinking.

But who was Edward Green, her husband? Edward was a very different kind of investor—drawn to risk, hungry for quick profits, and making sizable investments often with borrowed money. He paid little heed to long-term strategy, and predictably, that didn’t always work out. When the market turned against him, Edward often found himself forced to sell at the worst possible moments. In the end, he too turned to Hetty for support.

Hetty and Edward were a striking contrast. While she remained calm and patient, he was impulsive and hot-headed. And here’s the key question for you as an investor: What do you do when the market turns against you?

Sometimes a crash is unmistakable. Everything plummets, panic sweeps through the market, and at least you know why. It’s extreme but straightforward. In a sideways market, however, it's different—it's like being stranded in a desert with no horizon in sight. No news, no sudden moves, no price spikes to jolt you. The silence can be overwhelming. For some, this is even worse than a crash. You keep staring at the charts, hoping for a breakthrough—up or down, it hardly matters, as long as something happens.

And here lies the danger of impatience. Do you, like Edward, act on impulse? Do you trade out of frustration or sell because you believe there’s nothing left? Or do you stick to your plan like Hetty, calmly keeping an eye on the long term?

This is the pitfall of market silence: you begin to doubt yourself. “Is that it? Is the bull market over? What if this is all there is?” The urge to act intensifies. But as Hetty knew, trading without a thoughtful reason is almost always a bad idea.

During these unsettled times, the market truly tests you. It’s not just about weathering a crash but about maintaining your mental discipline in the quiet. Do you keep your cool, or succumb to the urge to “do something”?

Now is the time to review your plan. Do you still believe in the fundamental value of your investments? Have you built a strategy that can handle periods of stagnation? If so, you know this phase is only temporary. New trends are rarely born during times of euphoria; rather, they emerge in these quiet periods when the crowd loses hope.

If you can endure the silence, you might just be more like Hetty than you realize!

Are you a Plus member? Then we’ll proceed to the following topics:

- A golden smokescreen?

- Stablecoins are brilliant

- The core values of Ethereum are being tested

- Bitcoin: Taproot Wizards want OP_CAT