A Stress Test from Outer Space

Former Bank of England analyst warns of financial turmoil from potential UAP disclosure. What does this say about trust, markets—and why does bitcoin keep appearing in these scenarios?

Interstellar isn't a film about aliens to me. It's a film about scale. About distances so vast we can no longer comprehend them. About time that pays no heed to our intuition. About the uncomfortable realization that there are limits to what we can know, measure, and understand.

The film makes you feel how small we are. Not in a spiritual way, but almost physically. Once you accept how large the universe is, the idea that we're the only species inhabiting it becomes strange. Almost arrogant. Trillions of planets, even more stars, spread across even greater distances; and then… nothing? That requires at least as much faith as the opposite.

Yet we often respond with dismissive laughter at words like UFOs and aliens. It feels like pulp. Like something for trashy TV shows, or an obscure conspiracy forum in some corner of the internet. "Little green men." A cultural reflex, born during the Cold War, popularized by Hollywood, and then neatly filed away in the "absurd" category.

That makes it all the more striking when this topic suddenly appears in places you don't expect it. In serious newspapers, rather than on social media. With statements attributed to people whose CVs would normally inspire trust.

Last week, The Times and The Independent covered a letter from Helen McCaw, who built a career as an economist and analyst at the Bank of England. She addressed Andrew Bailey, the current governor, with a remarkable message: governments need to consider the financial consequences of an official American statement about extraterrestrial intelligence.

According to McCaw, an official acknowledgment would shake many people's worldview. Governments would turn out to be less omniscient than often assumed. Certainties on which the system rests would come under pressure. She calls this effect an ontological shock.

Financial markets are sensitive to this. They can handle shocks, as long as they fall within known frameworks. Wars, pandemics, and recessions are unpleasant, but they still fit within existing models. What's difficult to price is a sudden shift in trust itself.

According to McCaw, such a moment could lead to severe volatility, bank runs, and uncertainty about valuations. The damage wouldn't be in the economy itself, but in the collapse of shared assumptions about how to price risks. The problem then isn't that we no longer have models. The problem is that nobody knows which model is even relevant anymore.

What's interesting is what she then mentions as possible escape routes. Of course: gold. Government bonds. The classic safe havens. But also the doubt surrounding them. What if people start speculating that new technologies could undermine the scarcity of precious metals? What if even those certainties no longer feel certain?

In The Times, bitcoin is explicitly mentioned as a potential safe haven, precisely in a scenario where people lose trust in government money and state institutions. As something that exists outside the system, and therefore comes into view when the system itself is called into question. McCaw:

"There might be a rush to digital currencies such as bitcoin, which may prove appealing if people question the legitimacy of government and lose trust in government-backed assets."

The Times

Perhaps that's the interesting part of this story. Not that aliens threaten our financial system, but that bitcoin now automatically comes up whenever trust itself becomes a topic of conversation. Even in scenarios that until recently belonged mainly in science fiction films.

More Alpha

Are you a Plus member? Then we continue with the following topics:

- US crypto legislation faces delays

- Impersonation scams on the rise

- Unlimited credit for Argentinians?

1️⃣ US crypto legislation faces delays

Erik

The consideration of the Clarity Act, a comprehensive US bill for structuring the crypto market, hit delays this week. The Senate Banking Committee had scheduled a meeting with amendments and a voting round, but postponed it at the last minute. A key catalyst was Coinbase CEO Brian Armstrong publicly withdrawing his support.

Chairman @JohnBoozman reports progress in bipartisan crypto market structure talks. Markup now set for the last week of January to ensure broad support.

— Senate Ag Committee Republicans (@SenateAgGOP) January 12, 2026

Read the chairman's statement ⬇️https://t.co/dEjZRGn9XL

The Clarity Act establishes, among other things, when a token should be considered a security or a commodity. It also explicitly divides responsibilities between regulators SEC and CFTC. In short, the law puts an end to years of uncertainty.

The EU now has MiCA: one large legal umbrella covering stablecoins, crypto assets, and crypto service providers. In the US, they're splitting it up: the Genius Act, which has already been signed, is the stablecoin law, and the Clarity Act is supposed to regulate the rest of the market structure.

The Clarity Act is now stuck between two Senate committees. The Banking Committee came up with its own draft text, in which critics see too much influence from the banking lobby. Brian Armstrong says Coinbase "cannot support the bill in its current form" because according to him it amounts to an effective ban on tokenized equities, significant restrictions on DeFi, and a prohibition on passive stablecoin yield.

Coinbase CEO @brian_armstrong joins to discuss the Senate banking's new draft of the Clarity Act pic.twitter.com/BM2zFjtykA

— Mornings with Maria (@MorningsMaria) January 16, 2026

On 'Crypto Twitter/X', Armstrong's view prevails, namely that the new draft bill makes too many concessions to the status quo due to the banking lobby, rather than providing real clarity for the crypto sector. Here's a strong take from Bankless podcaster Ryan Sean Adams:

"If the bank lobby kills stablecoin yield in the Clarity act it's proof the Senate works for the banks not the people. No one benefits from this except banks. For any elected representative to support it is inexcusable.''

A milder, more politically neutral voice comes from pro-crypto Senator Cynthia Lummis, one of the architects of the bill:

"The Digital Asset Market Clarity Act will provide the clarity needed to keep innovation in the U.S. & protect consumers."

The catch-all term 'consumer protection' here likely relates to instability risks if capital flight were to occur from traditional bank accounts to yield-bearing dollar stablecoins and tokenized money market funds.

Delayed but not derailed?

Due to the clash between Coinbase, banks, and politicians, the vote on the bill has been pushed back for now, and uncertainty is growing about whether the Clarity Act will make it through the Senate in 2026.

For the crypto sector, it feels like there's a rare political momentum right now: if this opportunity for an "American MiCA" is squandered, it could take years before there's another opening for major legislation. Until then, the market remains trapped between lawsuits, lobbying, and outdated rules.

According to Armstrong, it won't come to that, and indeed it's hard to imagine the current pro-crypto administration letting this opportunity slip:

In general, love your posts, but this is not accurate. The White House has been super constructive here.

— Brian Armstrong (@brian_armstrong) January 17, 2026

They did ask us to see if we can go figure out a deal with the banks, which we're currently working on.

Actually, we've been cooking up some good ideas on how we can help… https://t.co/t1bK48oRc0

2️⃣ Impersonation scams on the rise

Erik

The frontline of crypto crime is shifting. While news about five years ago was dominated by spectacular DeFi hacks, a new Chainalysis report shows that 2025 was primarily the year of sophisticated identity fraud, with AI deployment on a rapid rise.

A month ago, we wrote about an earlier Chainalysis report focusing on hacks. In 2025, over $3 billion was stolen, with North Korea as the main culprit. In a follow-up report now published, it appears that an estimated $17 billion in scam and fraud cases should be added to that figure. That's a significant increase from approximately $12 billion in 2024. The main contributor is identity fraud, known as impersonation scams. Fraudsters posing as trusted parties, such as exchanges or government agencies. Criminals are increasingly using AI in a highly automated scam infrastructure.

Impersonation scams increased by approximately 1400% in 2025 compared to a year earlier. This can involve a seemingly perfect clone website of an exchange, or a deepfake video of an influencer, or 'helpdesk employees' who guide victims step by step through draining their own wallet.

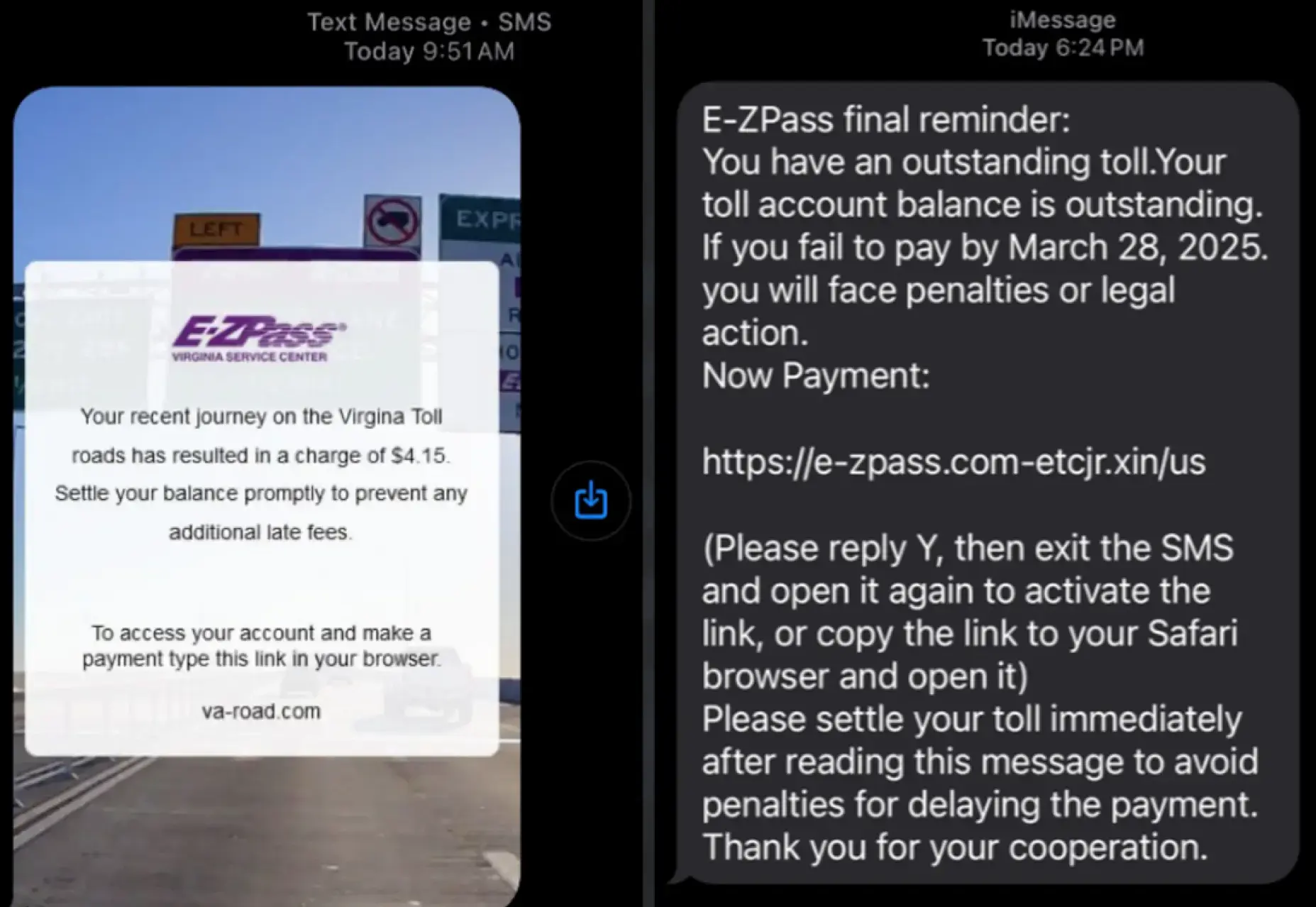

Chainalysis cites the E-ZPass toll scam as an example. This was a massive SMS phishing campaign by the Chinese gang with the ominous name Darcula. The text messages were sent in the name of the American toll collection system E-ZPass. Victims received a warning that toll fees were outstanding, with a link to a fake government website where they could "pay the balance." In reality, the money flowed to scam addresses. According to Chainalysis and other analyses, this single campaign netted hundreds of millions over several years.

The crypto element of this scam isn't in the payment by victims, but in the backend. The phishing kits ('scam as a service') are paid for in stablecoins and part of the loot is laundered via crypto rails. This shows how deeply crypto has become embedded in the infrastructure of modern fraud.

There are also impersonation scams that run entirely on crypto rails. Take the Coinbase impersonation scam of 2025. A bribed Coinbase employee was at the root of this scam, illustrating the point that the Chainalysis report makes: humans were and remain the weakest link in computer systems.

The role of AI in scams: no more bad spelling

AI makes these kinds of scams extra 'effective.' In a few clicks, scammers can create perfect text messages, emails, and fake websites that look exactly like they're from the government or bank. AI also allows the reach of scams to scale up to multiple language regions and thousands of variants per country and language. Chainalysis saw revenue from AI-assisted scams grow by a whopping 450%. As in so many domains, AI enables scaling.

AI can also be used to add deepfakes and voice clones to further convince and pressure victims. All in all, phishing is less detectable by poor English and strange-looking websites. The communication looks increasingly authentic.

Don't get hacked

The biggest threat from theft is therefore of a different nature than many crypto investors think. Technical bugs in protocols are still risky, but due to the higher level of technology, criminals increasingly choose the path of least resistance: deceiving people rather than hacking code. So make sure you're protected against that!

3️⃣ Unlimited credit for Argentinians?

Peter

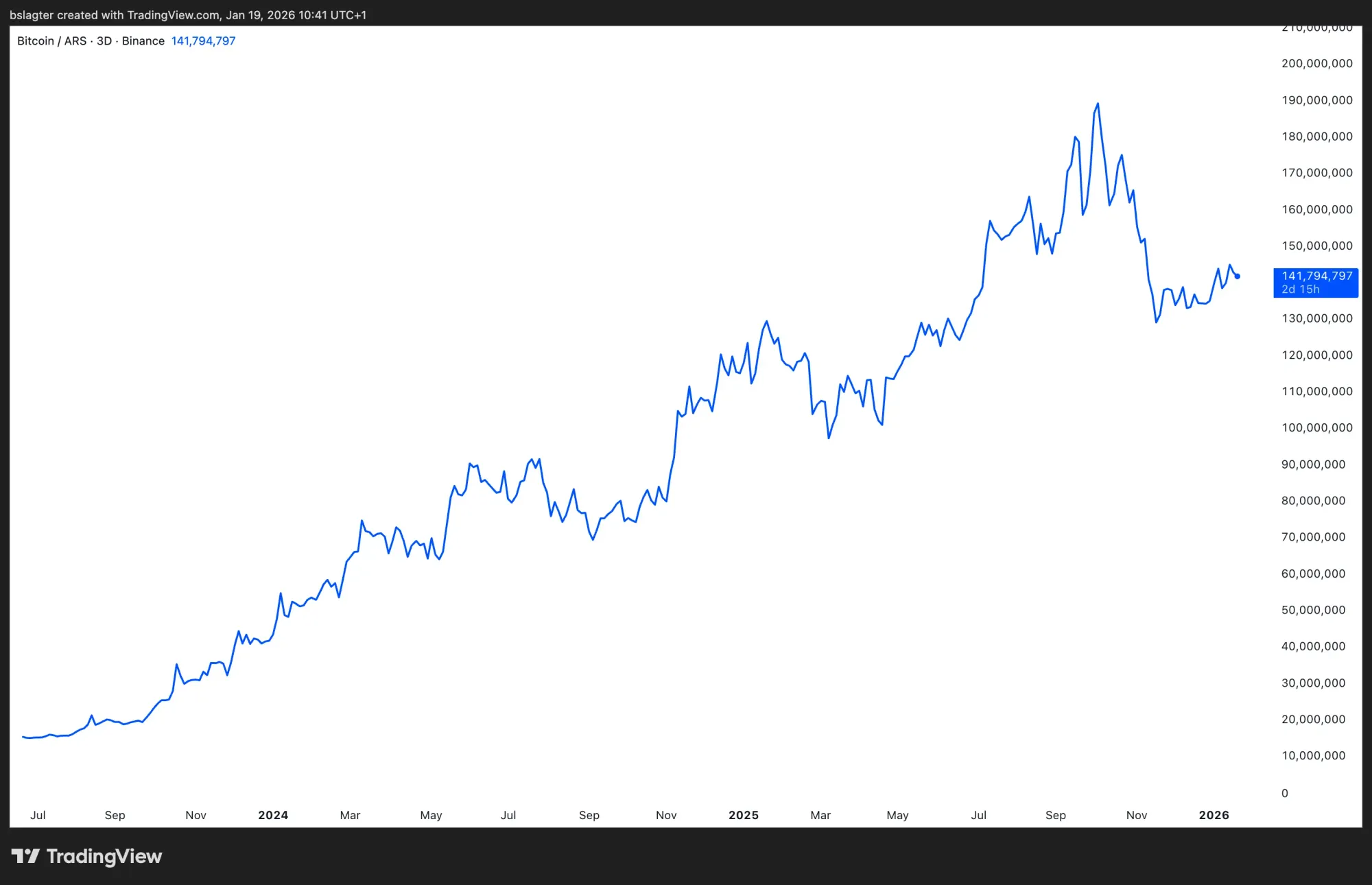

In Argentina, inflation isn't an economic topic—it's bitter reality. For the daily setback, you only need to walk into a supermarket. There you see that everything moves. Prices, wages, exchange rates. Only your savings don't move, if you leave them in pesos. That's precisely why the local bitcoin price in pesos presents such a strange, almost comforting picture: a chart shooting upward while the world around it crumbles.

In that context, Lemon, one of the largest exchanges in the country, is launching something that you'd quickly dismiss in Europe as "just another card," but that suddenly takes on a completely different meaning in Buenos Aires: a VISA credit card with bitcoin as collateral, without having to sell that bitcoin. In the first phase, it works simply. You lock up 0.01 BTC and receive a fixed credit limit in pesos. Your bitcoin stays put, but is locked as collateral.

Lemon CEO Marcelo Cavazzoli is remarkably outspoken. "We've developed a simple way to get credit in pesos with bitcoin as collateral, without needing a credit history." And he goes a step further: "Bitcoin is the best savings vehicle we've ever known." Lemon positions itself as a bank that sees bitcoin as the foundation of an emerging financial system.

Later, users will be able to set their own collateral amount and credit limit. But the most interesting thought experiment lies in the possibility of having the credit limit automatically adjust with the value of bitcoin. Then something emerges that can feel like an "infinite money glitch" for Argentinians. Your collateral rises in peso terms, your credit limit grows with it, and you can spend again without touching your savings. A kind of perpetual motion machine of purchasing power, as long as the direction is right. Of course, it works the other way too when the price moves against you, but the appeal is immediately understandable in a country where saving is always a battle against time.

Lemon backs up that appeal with a claim that says a lot about current Argentine behavior: according to the company, bitcoin is the most held savings asset among their users, ahead of crypto dollars and pesos. That clashes with the cliché that Argentinians are primarily dollar savers. Maybe they are. But for a growing group, bitcoin has apparently become the better piggy bank. And then such a card suddenly isn't a payment product, but a bridge: bitcoin as savings, pesos as spending money, and credit as the lubricant in between.

🍟 Snacks

To wrap up, some quick snacks:

- Traders skipped altcoins in 2025, says Wintermute. According to the market maker, new capital flowed primarily into bitcoin and ether. Altcoin narratives that existed faded relatively quickly into the background. The reason? Consumers preferred stocks over cryptocurrencies, the company states. AI, robotics, and quantum computers captured attention in that context. Capital that did flow into the crypto market came primarily through ETFs and digital asset treasuries (DATs).

- Pakistan to use USD1 stablecoin for cross-border payments. World Liberty Financial (WLF), part of the Trump business empire, is reportedly in discussions with the central bank about this, according to Reuters. The talks concern the integration of USD1 into Pakistan's new digital payments framework. This currently largely relates to international payments but could be expanded in the future.

- Seized bitcoin from Samourai Wallet won't be sold. The US Department of Justice has confirmed they haven't been liquidated and won't be sold either. The coins remain on the US government's balance sheet. Formally, according to the White House, they fall under Executive Order 14233 and as such are part of the Strategic Bitcoin Reserve.

- Moldova working on MiCA-like crypto law. It's set to be signed in 2026. It concerns a new regulatory framework for crypto that aligns with MiCA. Citizens of the EU candidate country will be allowed to own and trade crypto, but digital currencies won't receive legal tender status. According to Finance Minister Andrian Gavriliță, high volatility and money laundering risk play a decisive role.

- Goldman Sachs exploring deeper move into the crypto world. CEO David Solomon said during the quarterly earnings presentation that Goldman is ramping up its research into tokenization, stablecoins, and regulated prediction markets. The bank is examining how these technologies can be integrated into its own infrastructure and product offerings in trading and investment banking. It underscores once again: Wall Street no longer sees this market as niche.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!