A Month Without a Compass

January 2026 felt like a year crammed into one month. From geopolitics to the Epstein files: why so many simultaneous events lead to norm erosion, anomie, and unrest.

Sometimes it feels like everything in the world is moving at once, but going nowhere in particular. January 2026 was one of those months. The start of the year was brutal because so much happened it felt like twelve months had been crammed into one.

The United States hardened its approach. Under Trump's leadership, the country withdrew further from international organizations, sharpened its tone toward allies, and breathed new life into the trade war with fresh tariffs. Domestically, conflicts around immigration and enforcement escalated, with shootings many thought impossible.

"I saw a man that was retreating," GOP Sen. Rand Paul says of the video he saw of Alex Pretti, shot and killed by federal immigration officers. He has scheduled a Congressional hearing on the matter. https://t.co/5s5y5uakoi pic.twitter.com/K47kA8yngS

— 60 Minutes (@60Minutes) February 2, 2026

Meanwhile, Europe appeared rudderless. Relations with the US visibly deteriorated. Issues once taken for granted—think defense and trade—were explicitly called into question. Davos became a geopolitical battleground rather than a breeding ground for international cooperation. All the while, the war in Ukraine dragged on, with no breakthrough in sight.

A "difficult night" for Cherkasy Oblast, its head said. Russia launched 171 drones from five directions and a ballistic missile from Crimea.

— Euromaidan Press (@EuromaidanPress) February 2, 2026

Four injured, fires across the regional capital, and in Uman the heat went out at 4 a.m. while temperatures hover at minus 20°C. Air… pic.twitter.com/IqzkG0Vv4u

Amid all the turmoil, Asia faded somewhat into the background. But China made its presence felt again in January around Taiwan, with military exercises and heightened activity in the region. At the same time, familiar economic concerns persisted. Problems in the real estate sector, high debt levels, and ongoing pressure on capital flows. Politically, little changed: the trend of further power concentration around President Xi Jinping continued unabated.

The Xi Jinping purge of the 🇨🇳 highest military leadership resembles Stalin's purge of Marshal Tukhachevsky and the senior Soviet military leadership in the 1930's. It had a distinctly negative effect on the Red Army. pic.twitter.com/Oz9WG5GEsl

— Carl Bildt (@carlbildt) January 30, 2026

And then... there were the Epstein files.

A raw dump of names, fragments, and connections. Without explanation. Without timeline. Without any clear distinction between what has been investigated, what has been proven, and what is merely mentioned.

🚨 Department of Justice Publishes 3.5 Million Responsive Pages in Compliance with the Epstein Files Transparency Act

— U.S. Department of Justice (@TheJusticeDept) January 30, 2026

🔗https://t.co/eGeSO5qkVY pic.twitter.com/SRhcdg70N0

It's not just the horrifying content that makes this so destabilizing—it's the form. What does this say about institutional functioning? Why is this coming out now? Why in this manner? Why years of silence, followed by a revelation without explanation? It feeds the gut feeling that justice, media, and politics have either lost control—or never really had it.

Perhaps more important is what it does to our shared reality. For some, the documents finally confirm what they've always suspected. For others, it feels like an uncontrolled dump, without safeguards or procedures. Still others can't process the published information because it exceeds their imagination. There is no authoritative referee left to mark the boundaries of the playing field. No common framework within which this can be interpreted.

And that's precisely where this touches on something bigger than this single case. What's becoming visible here is playing out in multiple places this month. In geopolitics, in policy, in economics. Lots of information, little explanation. Many signals, little closure. Systems that keep functioning but lose their taken-for-granted authority.

The French sociologist Émile Durkheim had a word for this back in the late nineteenth century: anomie. He used it to describe a state in which existing norms lose their self-evidence while new ones have yet to form. The rules still exist, but they feel hollow. People no longer know what applies, who holds authority, and what they can hold onto.

Anomie isn't about chaos or collapse. It's about losing your bearings during transition. About a society that feels the old framework no longer fits, but can't yet see the new one. That feeling is disorienting, exhausting, and psychologically heavy. And it explains why time sometimes seems to collapse. Why a month like January can feel like a year.

If it feels like a ton happened in Jan, it's because a ton happened in Jan pic.twitter.com/Pym6yV7Tka

— Travis Kling (@Travis_Kling) February 1, 2026

In such a context, it's striking where people look for something to hold onto. Not just gold or silver, but also bitcoin. Not because the price is doing well—quite the opposite, it's under pressure. But because bitcoin does something that has become rare: it behaves consistently. No statements, no press conferences, no moral interpretations. Just a public ledger that records block by block what has happened.

That doesn't make bitcoin a solution for everything that chafes. But in a month full of stories, insinuations, and vanishing certainties, it is a contrast. A system that promises nothing, explains nothing, and hides nothing.

Sometimes that's remarkable enough!

More Alpha

Are you a Plus member? Then we continue with the following topics:

- Bitcoin to $74,000—now what?

- Gold buyer Tether launches new stablecoin

- Crypto lobby gearing up for midterms

- Korea: stablecoins without the circus

- Crypto works where banks fail

1️⃣ Bitcoin to $74,000—now what?

Bert

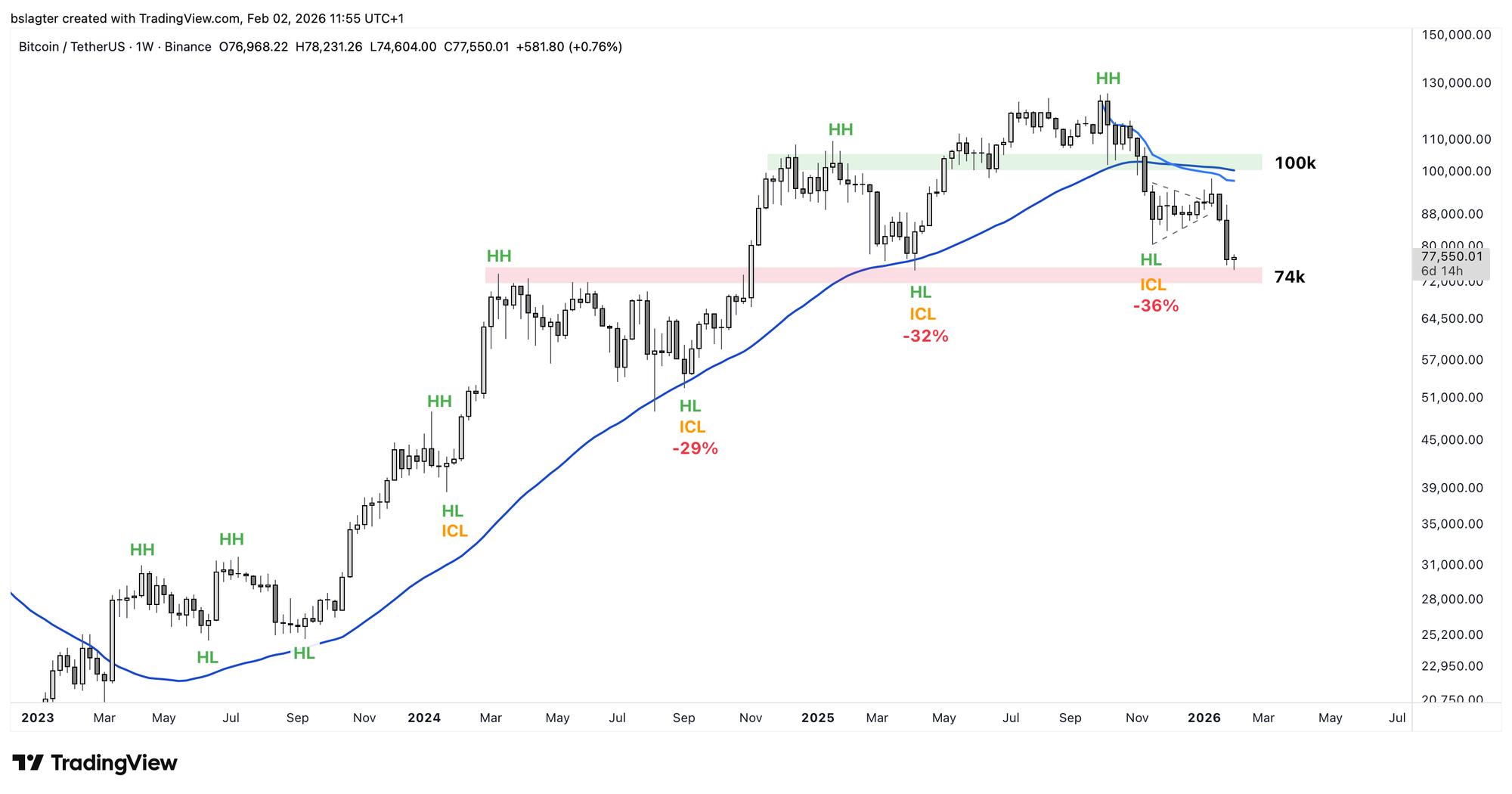

After the turbulent drop from $126,000 on October 6 to $80,500 on November 21, the price stabilized around $88,000. For weeks we hung in limbo between two key levels: $74,000 on the downside and $100,000 on the upside.

On December 29, we ran a small poll in Discord: first to 74k or first to 100k? The result was close to 50/50.

It turned out to be a 'move around the apex' of the triangle, which then morphed into a kind of flag pattern. We've seen $98,000 and immediately dropped to $74,000. With that, we've now finally explored the entire price range between 74k and 100k.

So now what?

The zone around $74,000 has played a role at meaningful moments. It was the top of the rally after the ETF launches in the first quarter of 2024. It was the bottom after Trump's inauguration in April 2025. And now we're at that level again, with a more or less equal bottom.

Should the decline continue below $74,000, we will adjust the probabilities of our scenarios. Scenario 1 would be definitively off the table, and Scenario 2 would decrease further in probability. See last Friday's Alpha Markets for more details.

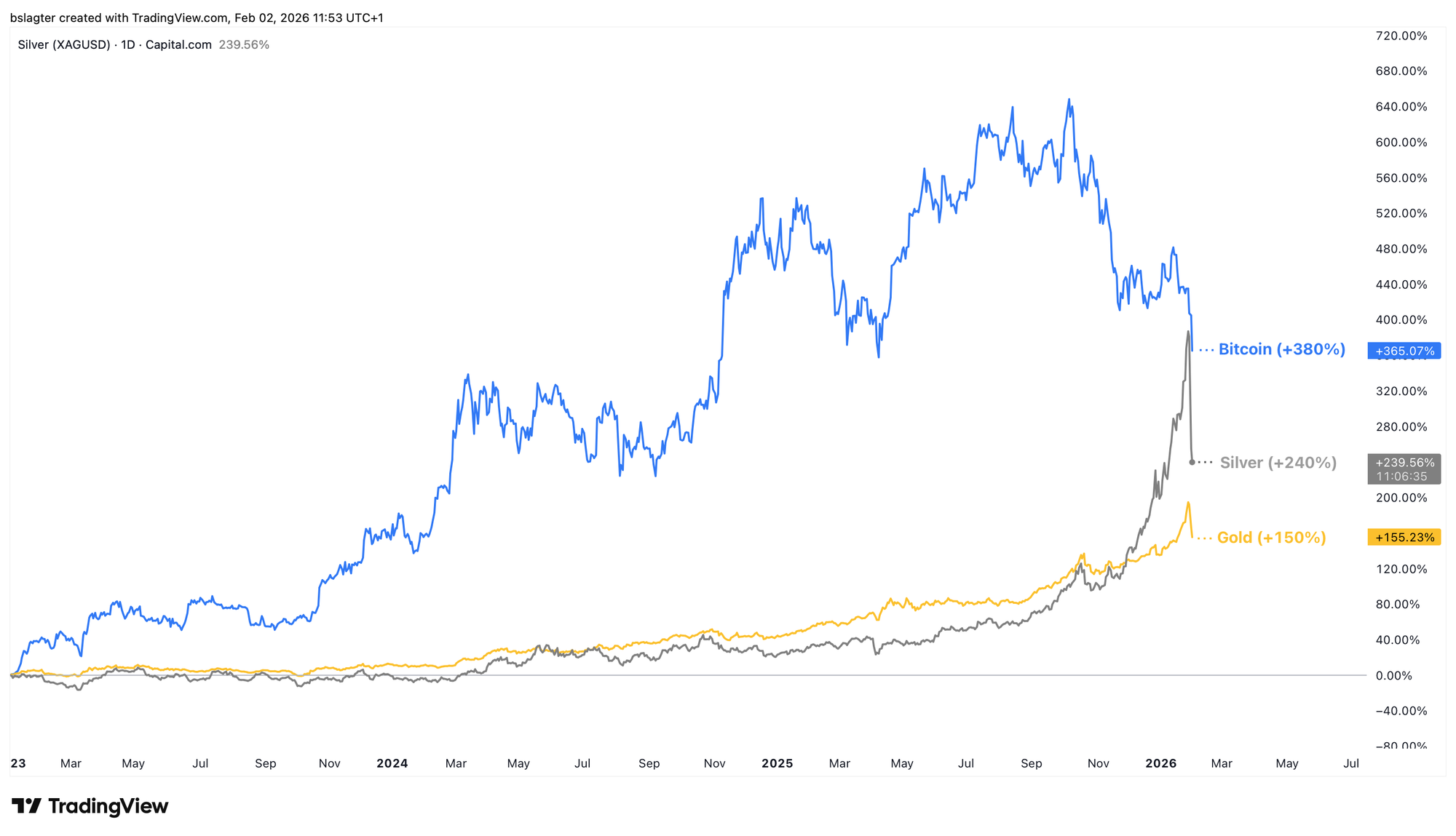

Bitcoin's decline doesn't stand alone. Stocks and precious metals also took a dive in recent days. Gold and silver made the front pages of financial media with historic drops of 20% and 40% respectively in just two days.

This price action looks like a blow-off top, the typical end of a parabolic rally. Think of a church steeple or the peak of the Matterhorn. Steep up, steep down. Whether the rally is done for now, or another floor is being added on top, will become clear in the coming weeks.

There are good arguments to expect even higher prices for gold and silver over the long term. But we're talking about a timeframe of years. Think: 2022 to 2032. Based on previous bull markets, gold could well go above $10,000 per troy ounce. But not in a straight line.

Just like with bitcoin, it pays to clearly distinguish between short and long term. You can simultaneously be in a secular bull market and a cyclical bear market. We're curious to see how this plays out!

2️⃣ Gold buyer Tether launches new stablecoin

Erik

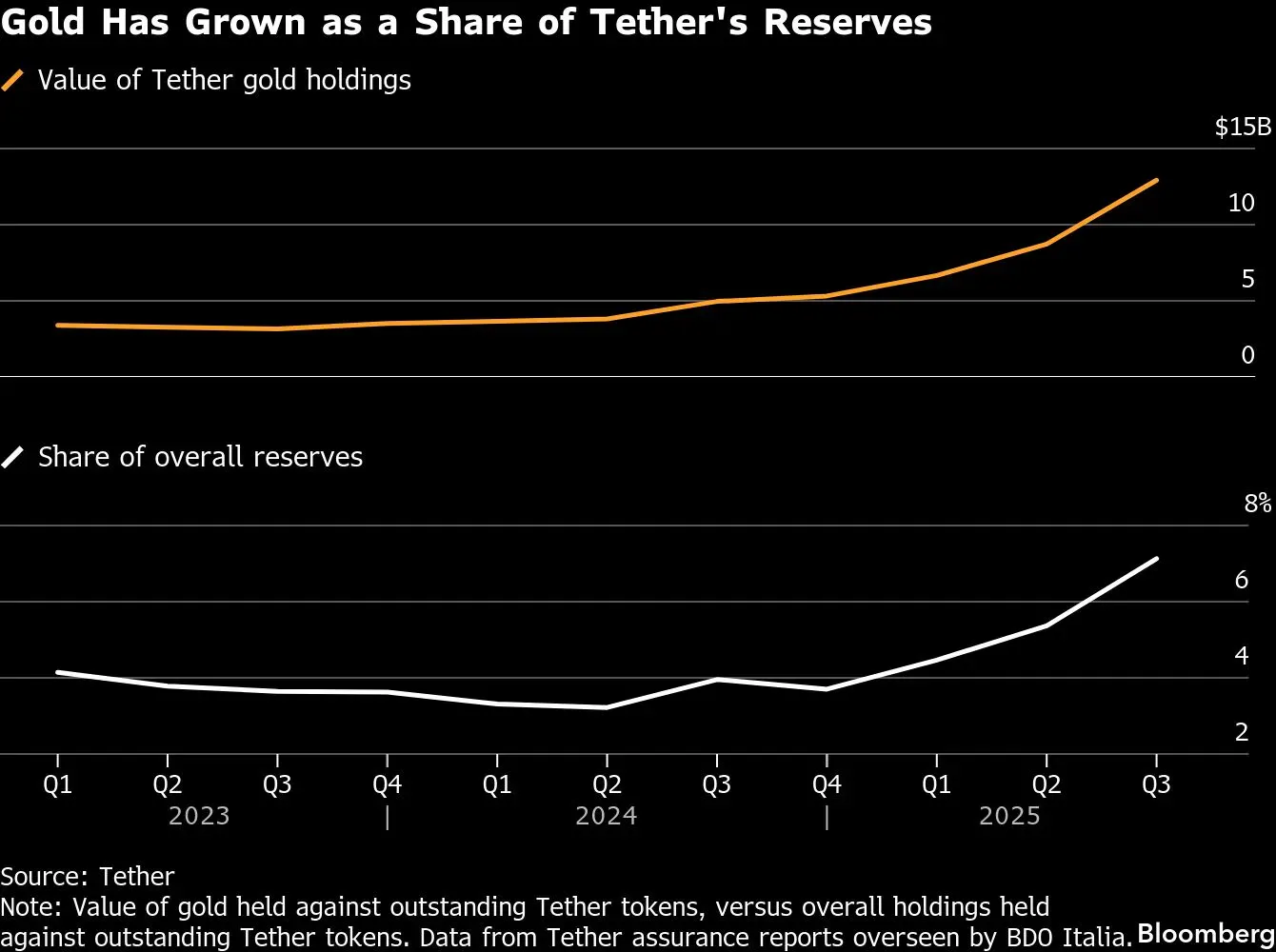

One of the most aggressive gold buyers of the past year is stablecoin issuer Tether. A recent report reveals that the issuer of stablecoin USDT is a serious player in the gold market, with reserves now reaching 140 tons—more than many countries. There's more news around Tether: it has launched a new stablecoin.

The figures Tether published last week point to an aggressive buying strategy. In the last quarter alone, the issuer of the most important stablecoin bought an additional 27 tons (27,000 kilograms) of gold.

According to CEO Paolo Ardoino, this enormous stockpile, with a market value of approximately $24 billion, is stored in a former nuclear bunker in the Swiss Alps. This backs up Ardoino's words that, although Tether has a product centered around fiat money, it wants to become less dependent on the American banking system and government bonds.

TETHER HAS QUIETLY AMASSED AROUND 140 TONS OF GOLD

— *Walter Bloomberg (@DeItaone) January 28, 2026

Tether has quietly amassed around 140 tons of gold—worth about $24 billion—making it the largest known private holder outside banks and governments. The crypto giant is buying 1–2 tons per week, storing bullion in a former Swiss…

In an interview with Bloomberg, Paolo Ardoino stated that "we will soon essentially become one of the largest gold central banks in the world." According to the CEO, Tether will keep this up for at least several more months. The reason is similar to that of many gold investors: "We believe the world is sliding toward darkness. That more and more unrest is emerging."

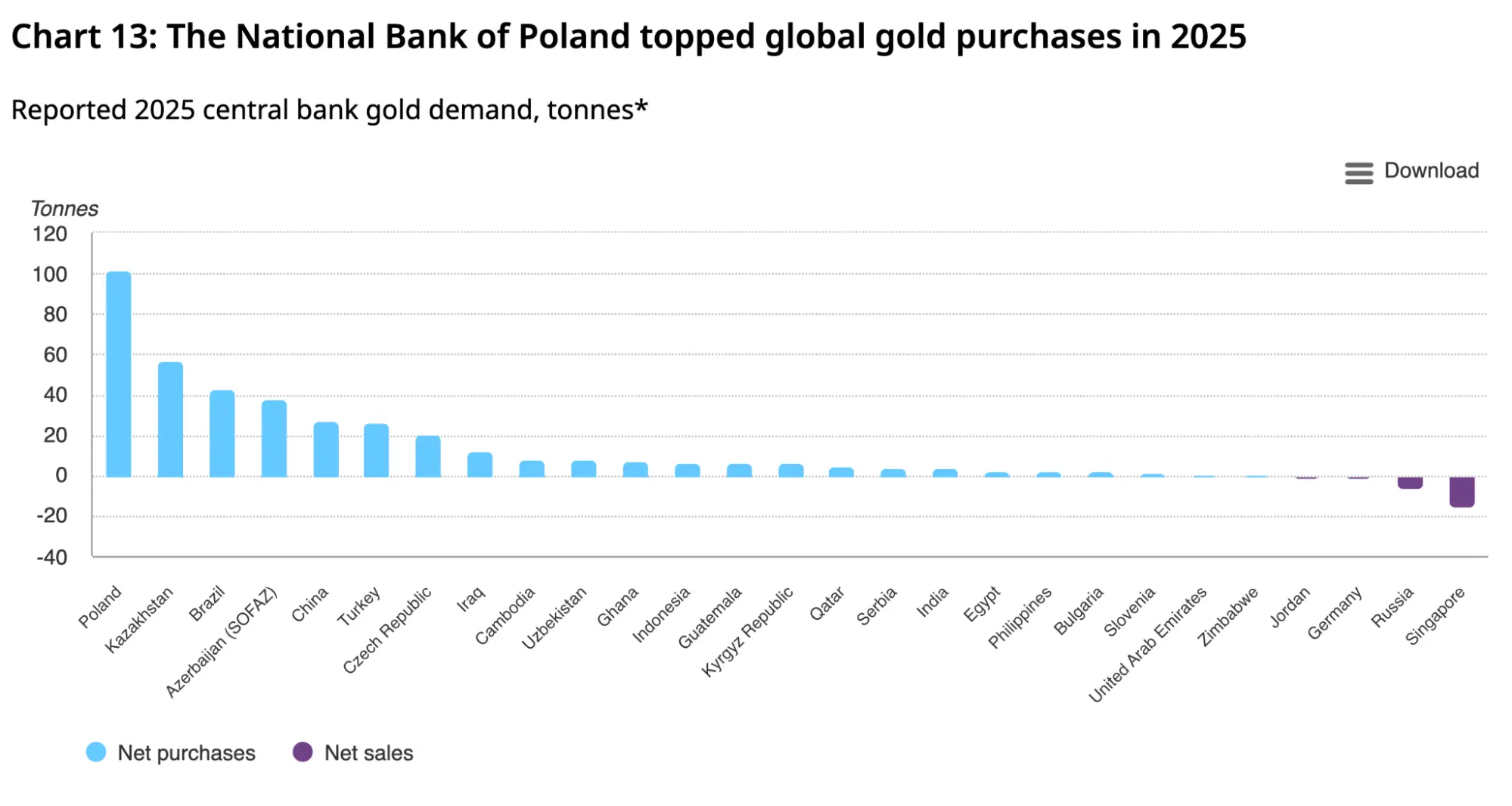

The World Gold Council publishes an annual report with a 'market update.' Central bank purchases are in a separate table, not combined with other institutions. If Tether were included in the table below, it would rank second, right next to Poland's central bank. In terms of total gold holdings among countries and institutions, Tether now ranks in the top 30 (the Netherlands has relatively large gold reserves for its population size: about 600 tons).

The two roles of gold at Tether

To avoid confusion, it's worth understanding that Tether uses gold in two different ways. A relatively small use case of Tether's gold is the one-to-one backing of stablecoin Tether Gold (XAU₮). That accounts for about $3.5 billion in gold tokens, and thus gold bars in the vault.

But the vast majority of physical gold sits in the mix as collateral for stablecoin USDT. While it's often thought that USDT is backed solely by dollars in a bank account, Tether also uses gold and BTC in that function (see the latest reserve report dated December 31, 2025). Tether: "the value of reserves as of December 31, 2025 exceeds the value of outstanding USDT by $6.3 billion."

That sounds fine, but the strategy still raises questions. There's over $25 billion in gold and BTC in the pot. If the price of gold and BTC drops by 50%, the reserve balance goes into the red.

It's a remarkable balancing act, which Ardoino implicitly acknowledges: for a company that essentially sells dollars in a different wrapper, he has little faith in the monetary system based on dollars. And that's why he backs his stablecoin with gold and BTC. In doing so, Tether reintroduces risk into what should be the most boring business model in the world: issuing dollars on a blockchain and collecting interest on the government bonds that serve as collateral.

Launch of new stablecoin USAT

As if we didn't have enough stablecoins already, Tether thought it was a great idea to issue a second stablecoin. On January 27, the company launched USAT (they brand it with a double crossbar through the T: USA₮). It's a dollar stablecoin that complies with the regulations set out in the Genius Act.

Tether Announces the Launch of USA₮, the Federally Regulated, Dollar-Backed Stablecoin, Made in America 🇺🇲🚀

— Tether (@tether) January 27, 2026

Read more: https://t.co/rIMQTQ7ipX

Tether has chosen to launch a new stablecoin rather than finally making the notorious USDT compliant with American regulations. USDT remains (for now) the bad boy, doing its thing in emerging markets. Meanwhile, Tether wants to add a well-behaved newcomer to its lineup for the home market.

USAT is issued by Anchorage Digital Bank and will initially be available on exchanges including Bybit and Kraken.

3️⃣ Crypto lobby gearing up for midterms

Peter

The crypto lobby is heading into the American midterms with serious firepower. Fairshake, a political action committee focused exclusively on crypto, now has nearly $193 million in campaign funds. That amount isn't parked with one organization, but distributed across Fairshake itself and affiliated groups Protect Progress and Defend American Jobs. Together they form a war chest unlike anything seen before.

Pro-crypto super PAC Fairshake said it holds more than $193 million in the bank ahead of this year's midterm elections as it seeks to bolster industry allies running for Congress — and defeat legislative foes. https://t.co/t9bgMg73KU

— Bloomberg Government (@BGOV) January 28, 2026

To fill the coffers, Ripple and Coinbase each contributed $25 million. Andreessen Horowitz (a16z) added another $24 million. Large, mature companies and funds betting not just on visibility, but on structural influence. Fairshake is a so-called super PAC: a structure that can raise and spend unlimited money on political campaigns, as long as there's no direct coordination with candidates.

That system feels uncomfortable, and it is. Super PACs weren't created by Congress but emerged from court rulings over a decade ago. The legal reasoning is well-known: spending money on political communication falls under freedom of speech, and as long as that communication is independent, it doesn't count as a donation to a candidate. The practice is now clear. A pot of money this enormous influences the political playing field long before the first campaign posters appear.

Politicians know and feel that their voting behavior now, well before the elections, matters. Those who hesitate are forced to take a position. The message is clear: crypto has become an electoral issue. Not just during the campaign, but also in committees and behind closed doors.

The urgency created by these donations is no coincidence. There's a major dossier on the table that needs to be hammered out before summer. It concerns the Clarity Act, the law that will determine how the American crypto market is legally structured and which regulator oversees what. Stablecoins are a hot-button issue, because of the interest and reward structures surrounding them. On this point, banks and crypto companies are on a collision course.

Fairshake isn't alone. The Winklevoss twins recently launched the Digital Freedom Fund, also a super PAC, with starting capital of over twenty million dollars in BTC. Meanwhile, Stand With Crypto appears increasingly in media and debates. Officially a grassroots movement, in practice a pressure tool that makes voting behavior visible.

Cryptocurrency billionaires Tyler and Cameron Wiklevoss seed pro-crypto SuperPAC Digital Freedom Fund with $22 million in (as yet un-liquidated) bitcoins https://t.co/LlneGToO5D pic.twitter.com/UalXPMR01b

— Rob Pyers (@rpyers) January 30, 2026

Polls show political winds that have shifted slightly toward the Democrats. But the race is still open, and polls now serve mainly as directional indicators. And even if Democrats win, that doesn't mean the American government will turn against crypto. The primary battleground for this war chest isn't the composition of Congress, but the makeup of decisive committees and generating support on both sides of the political spectrum.

Anyway, the midterms are coming, and the lobby is ready!

4️⃣ Korea: stablecoins without the circus

Peter

In the United States, stablecoins have become landmines in the political arena. Banks warn of systemic risks, crypto companies want room for innovation, and politicians sway with the flavor of the day and their own wallets.

Look a bit further, and you'll see it can be done differently.

In South Korea, a Digital Asset Framework is currently being developed that explicitly gives crypto a place within the existing financial system. No endless lawsuits after the fact, no vague interpretations. First a framework, then the market.

Concretely, this means something very simple for stablecoins: anyone who wants to issue them must have at least 50 billion won in equity. That's roughly 35 to 40 million euros. That threshold wasn't chosen arbitrarily but aligned with existing requirements for electronic money. The message: this looks like money, so we'll treat it that way.

The difference with the US isn't just in the rules, but in the sequence. In Korea, politicians draw a hard line first. Only then does the sector get to weigh in on the details. In America, the opposite often happens: first a market explodes, then lobbying, then lawsuits, and only then an attempt at legislation.

That doesn't mean Korea is a lobby-free paradise. Quite the opposite. Large conglomerates traditionally play a strong role there. There's even a specific word for it: chaebol. It comes from chae (wealth) and bol (clan or lineage), and refers to powerful business networks like Samsung and Kakao.

They too have a voice. As do banks, fintechs, and exchanges. But that typically happens through established consultation structures, ministries, and task forces. No wealthy super PACs or public mudslinging. The answer to the main question—can stablecoins exist and under what capital requirements—is already settled. The discussion is about the details.

Interestingly, Korea isn't leading the pack here, but it's not trailing behind either. The country waited, watched what went wrong in the US and Europe, and only now is acting. The time is ripe. The market is big enough. The risks are visible. Only then does legislation follow. The patience required for this delivers something in the short term that the US still lacks: legal certainty.

5️⃣ Crypto works where banks fail

Peter

Between the red candles and the gloomy market sentiment, it's sometimes good to zoom out. Not to macro, but to the real world. To places where price action doesn't matter.

Crypto is often seen as a toy for speculators, but it sometimes shows up where returns play no role. In Afghanistan and Syria, for example, where banks barely function and humanitarian aid gets stuck on sanctions, cash shortages, and slow intermediaries.

The New York Times described this week how Afghan-based HesabPay uses blockchain technology to get emergency aid directly to people. No bank account needed, no detours through expensive international wire transfers. In Syria, farmers and families receive aid via a simple payment card, with the underlying infrastructure running on crypto.

What started as a local initiative has now grown into a platform used by major aid organizations. The UN refugee agency supports more than 80,000 Afghan families through HesabPay and has distributed nearly $25 million since early 2025. In total, about 650,000 wallets have been created, of which around 50,000 are actively used. Approximately $60 million flows through the system monthly, mostly in stablecoins.

Why does this work there specifically? Because Afghanistan has a repressive government and a weak financial system. International banks stay away, sanctions block payment traffic, and cash is scarce. Blockchain networks offer something traditional systems cannot: direct, cheap payments that are fully traceable.

For aid organizations, that transparency isn't a side issue. Donors want to know where their money ends up. HesabPay provides real-time insight, can flag anomalous patterns, and thus reduces the risk of fraud. In fragile states, that's not a detail—it's a breakthrough.

Of course, there are risks. Stablecoins remain dependent on trust and digital balances can be frozen. Crypto is no silver bullet. But in environments where banks fail and cash doesn't work, it often simply proves to work better than the alternatives in practice.

Perhaps that's the most important lesson for a week like this: value doesn't only emerge on price charts. Sometimes precisely where the financial system stops, and technology is forced to prove its worth.

🍟 Snacks

To wrap up, some quick bites:

- Fidelity launches its own dollar stablecoin on Ethereum. The asset manager will begin issuing the Fidelity Digital Dollar (FIDD) in early February. The coin is designed to the letter of the recently passed American stablecoin law. Fidelity is targeting both institutional and retail users. The first group should be attracted by the prospect of instantly settled transactions, and the second by the convenience of frictionless, everyday payments.

- Bitcoin miners help Texas through the winter. A severe winter storm caused power outages across large parts of the US last week. To address the power shortage, bitcoin miners temporarily scaled back their consumption. This was visible on the network: hashrate dropped and block production slowed slightly. Analysts see this not as a sign of weakness, but rather of maturity: miners increasingly function as flexible consumers who scale down during peak demand and scale back up later.

- SEC provides clarity on tokenized securities. The American regulator has explained how existing rules apply to stocks and bonds issued or traded on the blockchain. The core message: tokenization changes nothing about the rules. A share is still a share, even if it's "onchain." The SEC particularly warns about tokens issued by third parties. The rights for holders may then be less clear, for example in case of bankruptcy.

- Trump nominates Kevin Warsh as new Fed chair. The presumed successor to Jerome Powell is known as a proponent of tight monetary policy and shrinking the central bank's balance sheet—not the ideal climate for risky investments. At the same time, Warsh is no crypto enemy: he has invested in crypto companies, calls bitcoin "new, cool software," and sees its growth as a signal of monetary failure. So don't expect a bitcoin hugger, but no crusade either.

- TheDAO returns with $220 million for Ethereum development. The treasury is filled with approximately 75,000 unclaimed ether from the DAO hack of 2016. These won't be liquidated, but activated: staking yields will be used to pay developers and researchers working on Ethereum network security. Vitalik Buterin is part of a group of six steering TheDAO Security Fund.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!