Bitcoin's Long-Term Thesis

Bitcoin drifts sideways around $68,000. We're in a bear market, and sentiment is gloomy. Bitcoin has failed, many say. But what's the actual long-term outlook?

The capitulation of February 5th was turbulent. In just a day and a half, bitcoin's price dropped 20% and hit a low of $60,000. Since then, calm has returned. Over the past two weeks, the price has been drifting sideways between $66,000 and $71,000.

The price is hovering around the average purchase price (VWAP) since the capitulation bottom. And the RSI is oscillating around the midpoint. No enthusiasm and no panic. The mood is best described as resigned and accepting, with a somber undertone.

And perhaps searching. For what bitcoin actually still is, once you let go of all the narratives from the previous bull market.

Bloomberg published this analysis last Wednesday:

The core problem is simple: the institutional thesis broke. Investors who bought Bitcoin as a hedge against inflation, currency debasement, or equity market stress have watched it fall alongside — and sometimes faster than — the risks it was supposed to offset.

The core criticism is that bitcoin has failed as digital gold and as the star player in the 'debasement trade'. And that on the other hand, bitcoin wasn't the 'hot sauce' in portfolios either, the way AI stocks were. So American money is pulling out.

Bitcoin now has the worst of both worlds. No American money, but still a strong American flavor, via the Trump family, American ETFs, and American companies. And that American association is putting off investors from outside the US.

This quickly leads us to existential questions. What is bitcoin actually still good for? What is bitcoin becoming?

These are fundamental questions. Bitcoin doesn't pay interest, dividends, or rent like bonds, stocks, and real estate. There's no industrial demand like with commodities. Bitcoin is only worth something because there's an expectation of future demand.

Where does that future demand come from?

Who wants bitcoin, and why?

Let's start with two perspectives on what bitcoin is.

First. Bitcoin has no issuing party. Nobody is in charge. Nobody can unilaterally change the rules or block transactions. Bitcoin isn't domiciled in any particular jurisdiction. This gives it a certain degree of independence and neutrality.

The strong association with America has weakened this point. Many miners are American companies, and major American players like Coinbase, Strategy, and BlackRock can exert (economic) pressure on developers and the community.

But the core remains solid. Bitcoin is an 'outside money': it's not a claim on a counterparty the way bonds are. This fits the trend of deglobalization and the emergence of a multipolar world order, in which countries trust each other less.

Second. Bitcoin has a limited supply. There are only 21 million of them, and nearly 20 million are already in circulation. That in itself means nothing, as we described in this Alpha Markets. A bitcoin clone also has a supply of 21 million, but is worthless.

The difference lies in the network effect. A worldwide consensus has emerged that you need bitcoin if you're looking for something digital that's still scarce. And so that's where the miners' hashrate is, the trading volume, the acceptance by regulators, and the interest from financial institutions.

This fits the trend where investors are looking for something the government can't simply print more of. National debts are exploding and money supplies show hockey stick charts, but there are only 21 million bitcoin.

We could look at bitcoin from ten other perspectives, but these two are the most important for answering the question of whether bitcoin has failed.

Has bitcoin failed as digital gold?

No. It's still a 'real asset' and an 'outside money', and still possesses the gold-like properties that gave rise to this metaphor.

On a 5 to 10-year horizon, there are concerns about the security budget and quantum computing, but these are solvable problems. You need to factor them into your investment thesis, but they don't write off bitcoin as digital gold.

Just like with physical gold (and other investments), during bear markets the skeptics climb onto the stage, while during bull markets you hear from the enthusiasts. That's noise. The signal is that far more players now see bitcoin as digital gold than two, five, or ten years ago.

Has bitcoin failed as a payment method?

Largely, yes. The 'freedom money' function still holds up reasonably well. In extreme circumstances, bitcoin is a lifeline. For opposition figures in a dictatorship. For refugees from a war zone. When you truly have no other alternative, there's always bitcoin.

But for payments at the checkout counter, in online stores, or between two people, it's virtually never better than the alternatives. And that's not going to change (for now), because the bitcoin community doesn't broadly support expanding bitcoin with second-layer solutions. These are actively opposed because they could enable things beyond purely monetary use.

That's unfortunate, but not a disaster. For payments, digital dollars and digital euros in the form of stablecoins are much more convenient anyway.

Has bitcoin failed as an uncorrelated investment?

No. Precisely because bitcoin didn't move up alongside gold and stocks, its correlation with other asset classes has actually decreased further. When constructing a diversified portfolio, that's a plus.

Bitcoin is still part of only a small percentage of investors' diversification strategies. And therefore mainly relies on investors moving from 0% to 1%-5% allocation. It's conceivable that the negative sentiment of the bear market is holding back that step, which is why we're not seeing much of this now.

Has bitcoin failed as an option on systemic change?

The transition from one monetary order to another rarely goes smoothly. The British pound handed the baton to the US dollar during the period of the First and Second World Wars.

It strongly appears that we're in another such realignment. For now without a global physical war, but on other fronts there's plenty of fighting. With cyberattacks, (dis)information, power over commodities and supply chains, trade barriers, and currency devaluation.

You could see bitcoin as an option on a scenario in this realignment where other assets rapidly lose their value. Or as an option on an outcome of such a realignment where bitcoin gains a systemic role. Small probability, but a big payoff if it happens.

Conclusion.

In the pessimism and despondency of the bear market, it's easy to think the situation is hopeless. But that's unjustified.

The bear market settles the score with the inflated promises of the bull market. That's the cleansing effect of a bear market. But you have to be careful not to throw the baby out with the bathwater.

Of course, there's a chance bitcoin goes to zero, and every bitcoin holder must account for the possibility that bitcoin fails. But that's not our base case.

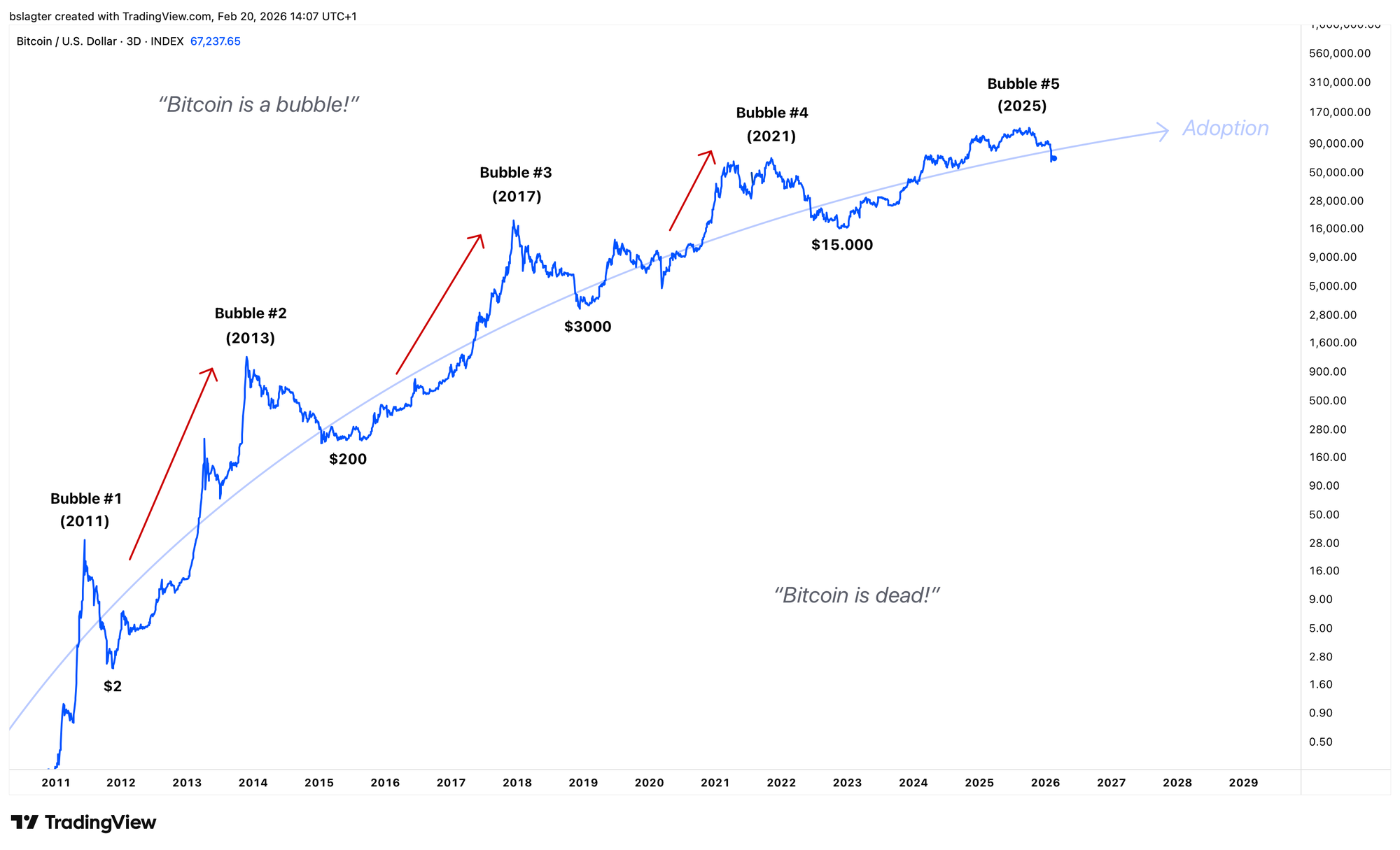

When you add it all up, there's a reasonable chance that bitcoin adoption will continue to grow in the coming years. Because it's not a claim on someone else. Because the government can't print unlimited amounts of it. Because it makes a diversified portfolio better. Because it's an option on systemic change.

And then the math is simple. The supply is fixed, demand increases, and therefore the price rises. That's a movement on a decades-long timeframe, with the price oscillating around it over the years.

You can't pin one precise price target on it. A wide range of outcomes is possible. But something in the range of 25% to 50% of gold's market cap is plausible.

At current gold prices, that puts bitcoin at between $400,000 and $800,000. And that makes it an asymmetric investment: the potential upside is much greater than the potential downside. Not a bad idea to have at least some of it in your portfolio.

We continue with the following topics:

- Will Nvidia set the direction for risk assets?

- There's a strange tension hanging over financial markets

- Warning signal for Wall Street from US Treasury bonds?

1️⃣ Will Nvidia set the direction for risk assets?

Sam

On Wednesday, February 25th, the moment arrives. That's when Nvidia releases its fourth-quarter results. These numbers could be significant for the direction of all risk assets, for the following three reasons.

First, Nvidia has grown so large in recent years that the company now carries a weighting of between 7% and 7.5% of the S&P 500 index. A major surprise in results or outlook could significantly move the index, and since the S&P 500 is only 2% below its all-time high, a positive surprise could mean an upward breakout, resulting in tailwinds for risk assets.

On the other hand, a disappointment could mean that the weakening upward momentum for stock indices continues downward to a level of 6,500 for the S&P 500. Given bitcoin's weakness in recent months, the price would then likely fall back to $60,000.

A second argument is Nvidia's own chart. The image below shows that the price has been trading between $170 and $194 since last summer, with a brief excursion above. A significant deviation from expectations could be the spark that causes a breakout from this range, either up or down. Since the sideways period has now lasted quite a few months, a breakout is likely to result in a trending move.

The final argument is that financial markets currently lack a strong narrative to drive a trend. The recently released inflation and jobs data have been digested by investors, many companies have already announced their annual results, and there's no Fed interest rate decision this month. Tariff tensions have also faded into the background.

In a few days, we'll know whether Nvidia will bring some volatility back to financial markets, and if so: which direction!

2️⃣ There's a strange tension hanging over financial markets

Thom

Although the S&P 500 and Nasdaq 100 are still only a few percentage points below their all-time highs, sentiment feels fragile. Investors are clearly rotating toward tangible sectors. While bitcoin and software (XSW) have been going through a deep valley since October 2025, consumer staples (XLP), industrials (XLI), materials (XLB), and energy (XLE) are showing strong performance.

True risk appetite is absent. With this sector rotation, investors are clearly choosing defensive positioning. That's understandable in itself, given the uncertain impact of AI on the global economy, the hundreds of billions of dollars that tech giants are investing in this supposed revolution, and the ongoing geopolitical unrest. Yet in my view, there are still plenty of reasons to remain optimistic.

The macroeconomic picture and other market-relevant fundamentals still look very strong:

- Economic growth in the United States is accelerating.

- Purchasing Managers' Indices (PMIs), important health indicators for American industry, are giving very strong signals.

- The labor market is proving more robust than expected.

- Inflation is declining.

- The Federal Reserve is still in a cycle of monetary easing, and with Kevin Warsh, a Trump-appointed chairman is coming soon.

- Mortgage rates in the US are at their lowest level in years.

- Corporate earnings continue to grow at an exceptional pace.

None of these are signals pointing to a classic recession scenario. Quite the opposite, in fact. It appears the American economy has entered a new phase of accelerating economic growth.

What ultimately makes the real difference is liquidity: the amount of capital available worldwide for investments. From that perspective too, the foundation appears present for bitcoin to recover.

- The Federal Reserve will probably continue easing.

- Financial conditions are still relatively loose.

- Credit spreads remain extremely tight.

Based on all these conditions, a deep and prolonged bear market for bitcoin seems unlikely. Perhaps the biggest danger is a collapse in general confidence in the AI revolution. But given the enormous investments and the first visible signs of productivity gains, that scenario also seems unlikely for now. Against that backdrop, Nvidia's results on Wednesday, February 25th carry extra weight.

3️⃣ Warning signal for Wall Street from US Treasury bonds?

Thom

The yield on 10-year US Treasury bonds has fallen to its lowest level of 2026 and is approaching October's local bottom. Long-term rates broadly reflect investors' expectations about economic growth and inflation.

Now the question is: is the bond market signaling that it foresees a weaker economy? And is that why investors are currently piling into long-dated US Treasury bonds on a large scale?

You could argue that the decline in long-term rates is primarily the result of cooling inflation (expectations). In recent weeks, the trend of declining inflation was confirmed again, which may have made it more attractive for investors to buy long-dated US Treasury bonds at current yields.

Yet that probably doesn't tell the whole story. At the same time, we're seeing broad weakness and signs of exhaustion in equity markets. Although many stock indices are still hovering around their all-time highs, convincing upward momentum is currently lacking.

Additionally, uncertainty is growing around the massive investments that tech giants are making in artificial intelligence. That Amazon wants to pour $200 billion into AI this year isn't automatically seen as positive by investors. On the contrary: the stock has actually fallen by about 17 percent so far in February.

That kind of price action also shows that the market is increasingly questioning whether these gigantic capital expenditures will ultimately translate into profit growth. All things considered, I think we can conclude that we're in a period of heightened uncertainty. Nobody knows exactly how the AI revolution will play out, and that's probably why we're seeing greater demand for US Treasury bonds.

Yet in my view, it's still too early for very gloomy conclusions. We're not yet seeing extreme movements in bond markets. These are primarily movements worth calmly speculating about in terms of possible causes.

In closing

All previous editions of Alpha Markets can be found in the archive. Questions, comments, and suggestions are always welcome in the community.

Thank you for reading!

To stay informed about the latest market developments and insights, follow our team members on X:

- Bart Mol (@Bart_Mol)

- Peter Slagter (@pesla)

- Bert Slagter (@bslagter)

- Mike Lelieveld (@mlelieveld)

We appreciate your continued support and look forward to bringing you more comprehensive analysis in our next edition.

Until then!